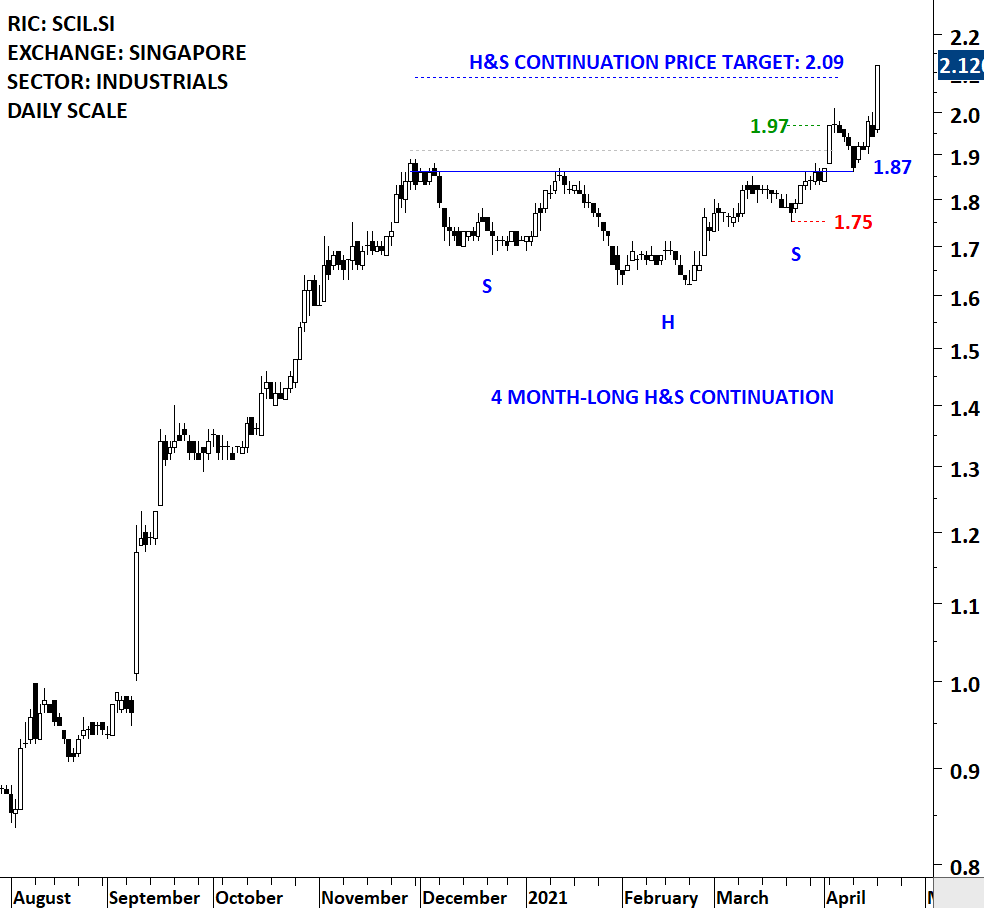

Waiting for a daily close above the resistance by 3% margin is a trading tactic Edwards & Magee discussed in their book Technical Analysis of Stock Trends.

For some of you this might be a too late entry. Remember that trading tactics can be different for each trader/investor.

For some of you this might be a too late entry. Remember that trading tactics can be different for each trader/investor.

As there is no perfect stop-loss placement, there is also no perfect entry condition. Sometimes you can miss the breakouts due to gap openings. I'm sure many of you managed to position well into this H&S continuation breakout.

There are several ways to trade a chart pattern. From anticipatory positions before the breakout to buying during re-test after a breakout...

However, there is only one way to identify a text-book classical chart pattern. This one was a H&S continuation.

However, there is only one way to identify a text-book classical chart pattern. This one was a H&S continuation.

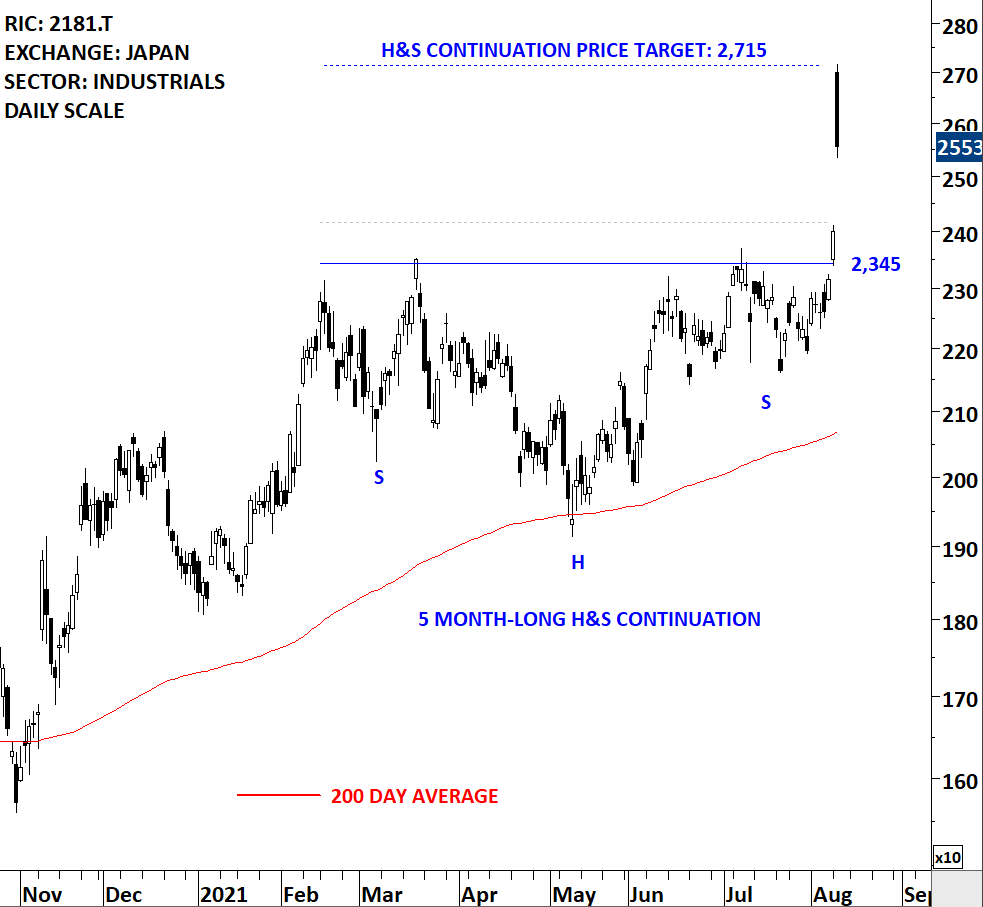

Similar H&S continuation chart patterns in play. #EUROPE

Interested in learning more about #classical #charting #principles? Check out more than 40 #educational #videos & #webinars discussing different patterns and how to utilize them in your trading >> blog.techcharts.net

• • •

Missing some Tweet in this thread? You can try to

force a refresh