Unfortunately this involves banks, turnarounds and LendingClub $LC but I think something potentially quite interesting may be happening here, due to this acquisition:

When I mentioned to Munger and Buffett the other day that I was reading up on LendingClub this was the reaction - and they're not too wrong: LC is crap

However, the business model is a little different these days and if my guess is right, it may all end up becoming little more than a vestigial artifact, like Chamath's legs

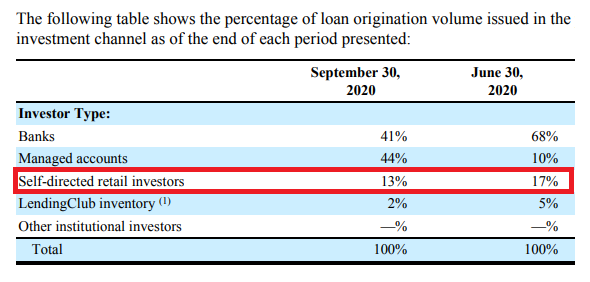

Where things stand now is that it's no longer so much a P2P lender.

Where things stand now is that it's no longer so much a P2P lender.

Anyway, a year ago last week LC announced they'd be acquiring a chartered neobank called Radius and without going into the details, the big idea behind this is to capture the economics that LC currently lose to their bank partners, to lower their funding costs and gain stable NIM

That's all fine as far as it goes but my guess is that what may happen here is that the tail will end up wagging the dog.

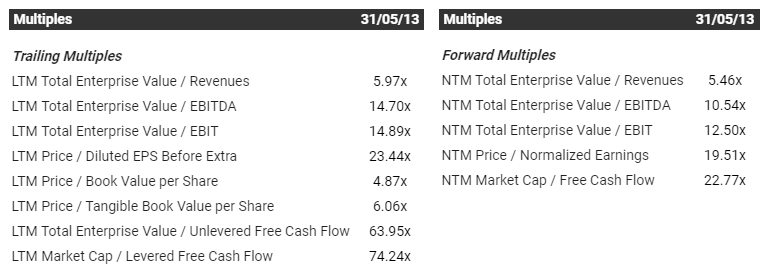

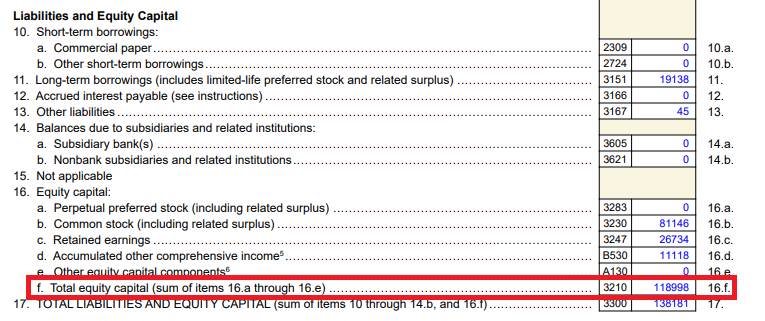

At the time of purchase Radius had $1.4B in assets and agreed to a sale at 1.72x book, or $185M and this tallies with the holdco's numbers on their Y-9

At the time of purchase Radius had $1.4B in assets and agreed to a sale at 1.72x book, or $185M and this tallies with the holdco's numbers on their Y-9

A year later this stood at $2.6B in assets. How much of this is PPP I can't say but given the kind of bank they are and looking back, it seems fair enough to say Radius is a high growth bank

If we naively glom the two sides together we see two things: Radius is probably around ⅔ of the assets and that resulting LC+R bankco may be quite overcapitalised.

Radius brings a bank charter and their management are staying on

Radius brings a bank charter and their management are staying on

And as the merged company becomes a bank, my sense is that the bankers will end up steering the ship despite the talk of the benefits here for core LC. If anything, this feels to me more like a SPAC or reverse merger situation; Radius' business is where the action is, LC's isn't.

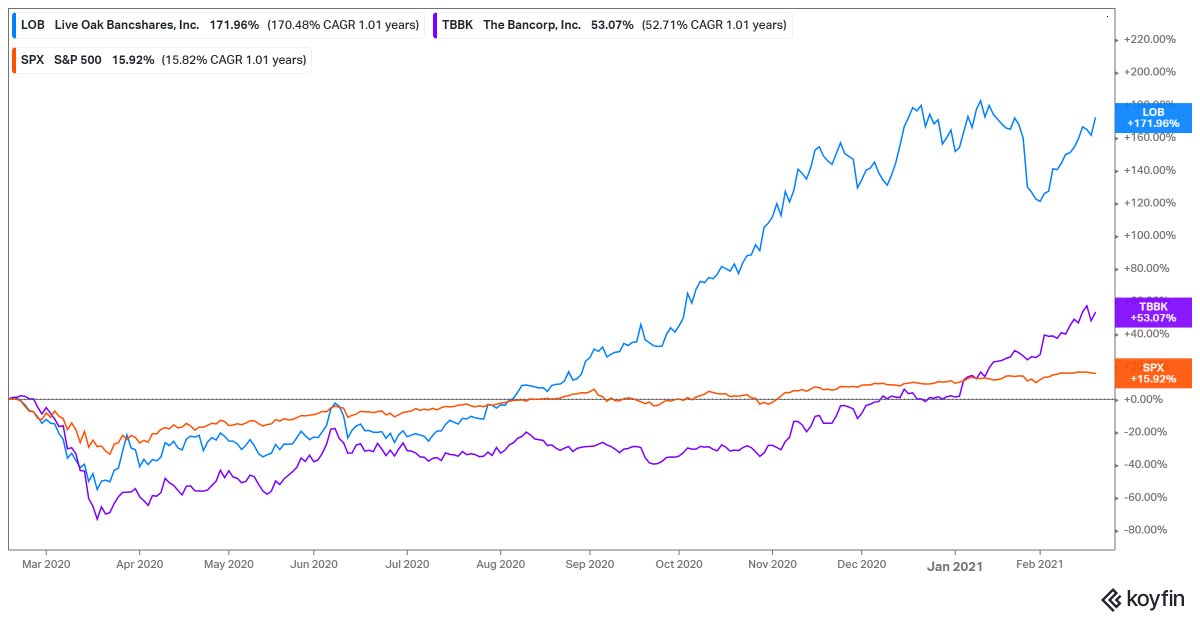

Neobanks are generally either one of two things: glorified apps renting out a balance sheet such as Chime ($14.5B) or Affirm ($27B) or they're the banks whose balance sheet is being rented, in the case of the above it's $TBBK ($1.2B) and Cross River. APIs connect the two.

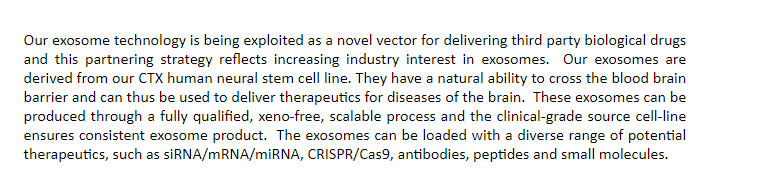

Radius is quite special because it's on both sides - both the go-go front end and the FDIC-chartered back end, which in my thinking - thanks to LC - just got a lot bigger

pv.glenbrook.com/creative-tensi…

pv.glenbrook.com/creative-tensi…

And it is in what is, for me, one of the most interesting areas of banking: APIs. These are what connect the two sides together. $7B $QTWO or $9B Temenos are a couple of companies here.

pv.glenbrook.com/creative-tensi…

pv.glenbrook.com/creative-tensi…

There are issues: LC and the FTC are wrangling at the SC over whether the FTC is allowed to fine them over past issues; the judge earlier encouraged them to settle and avoid wasting everyone's time but it seems they're going to establish that before the actual trial starts.

And whilst APIs are certainly for real, it doesn't take much imagination to see this all ending in tears one day - but in the meantime you have the tech and payment bros bidding up the app side of things and subsidising balance sheet growth at banks.

forbes.com/sites/antoineg…

forbes.com/sites/antoineg…

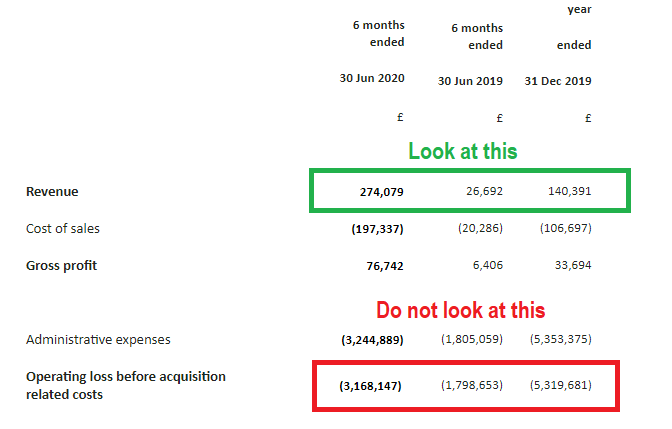

But because it's not such an immediately interesting sector, at the smaller end you can put out obviously good results..

https://twitter.com/hareng_rouge/status/1362649689489887232?s=20

..and only open up 2% - which is to say that whilst there are plenty of interesting approaches to banks, it's a sector where GARP or mispricings can sometimes still be found. At a bit under 1.5x book when it closes, LC might be an interesting back door into neobanking and APIs.

• • •

Missing some Tweet in this thread? You can try to

force a refresh