Someone else has also since mentioned $JAKK to me - it's a (shitco) toy maker, similar to Character Group #CCT in the UK. CC's tweet mentions the refi, he has a point - I think there may be something here to play for, perhaps towards a double or so before the end of the year.

https://twitter.com/CasinoCapital/status/1400510479328595974

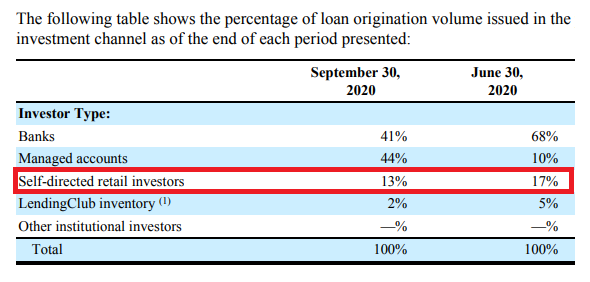

Company has cash of $80M + new debt of $99M (pink) repays difference on prior debt of $129M with cash on hand (green) so $50M cash + debt $99M

6,395 shares at $10.6, converts at $5.65 (purple) into $18.9M (blue) so + 3,345 shares = 9,740 / $103 cap & $20M prefs (grey) $172M EV

6,395 shares at $10.6, converts at $5.65 (purple) into $18.9M (blue) so + 3,345 shares = 9,740 / $103 cap & $20M prefs (grey) $172M EV

As you can see it's highly seasonal into Q3. Mgmt mentioned in the last (Q1) call that inventories are low. Typically they would be about $20M higher than here in Q2, so if we penalise the cash in the EV by that amount to account for inventory build we're at $192M

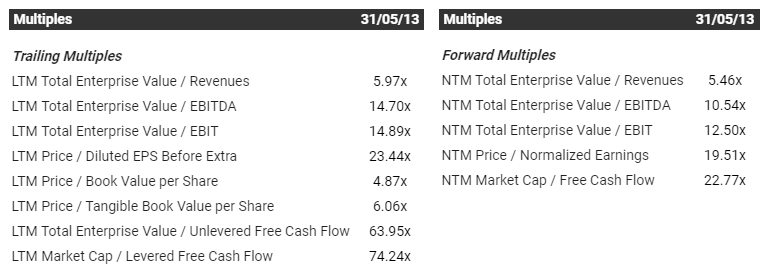

Giving a trailing EV/LTM EBITDA of x4.8 and looking for significantly increased profitability this year - and that against some easier comps

If you assume they increase their revenues in line with the overall toy industry growth figure of +27% and do $51M (vs $40) in EBITDA then their current valuation comes out at 3.75x - even for a shitco, this is quite cheap. Hold the multiple at 4.8x and the shares are $16, up 50%

The measly rise in the shares since the refi announcement implies these savings being capitalised at 2-3x - again, that's perhaps on the low side. Half a turn more on the multiple and $51M EBITDA has shares at $18.6 vs today's mid $10

Estimates suggest $39M EBITDA for FY21, my guess would be that they're perhaps on the low side given the comments on the call and this point from the toynews article

Q1/21 revenues were up 26% but the estimates for the money making quarter are down 5%, seems a little incongruous to me.

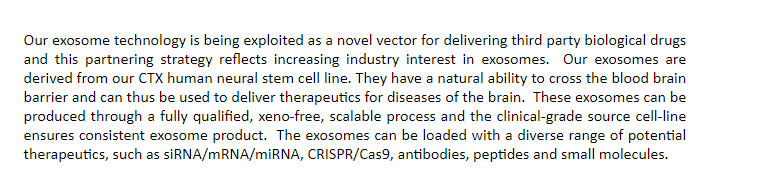

#CCT in the UK at end April reported revs up 44% in the HY to Feb and already had this to say about the H2. UK isn't the US but with a refi barely priced in and a fair environment for toy sales, some sales growth and multiple expansion for $JAKK don't seem too unreasonable to me

• • •

Missing some Tweet in this thread? You can try to

force a refresh