Some notes on TFF Pharmaceuticals $TFFP from the HC Wainwright call

20 mins long, link to call below

sessions.ct.events/tplayer.aspx?s…

20 mins long, link to call below

sessions.ct.events/tplayer.aspx?s…

This previous thread about TFF was conjecture and I think the Wainwright call gave some grounds to think it may not totally off the mark.

https://twitter.com/hareng_rouge/status/1326895581462208513?s=20

This is again the idea: Pfizer wants to get a powder version of the Covid vaccine in order to avoid the cold-chain issues and expenses associated with the first-gen vaccine

This is it with my emphasis - again, this is conjecture and just a personal interpretation but "vaccines that are currently on the market", "conversations, very exciting conversations" and "companies" - plural, all suggest to me that something may indeed be happening here.

It's worth listening to that call. Both this thread and the vaccine issue, should it come to pass, both overshadow what is really the longer-term opportunity here; one which comes in part because it's impossible to see past the name "pharmaceuticals" without thinking biotech

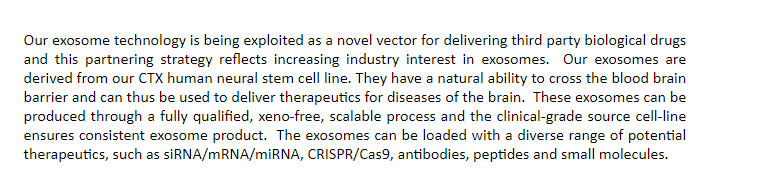

TFF isn't about a molecule, rather it's about engineering: freezing molecules so they can be turned into powder and inhaled, applied topically or even rubbed into the eyes. It seems clear they've cracked it: it works with everything tried so far and things are starting to happen

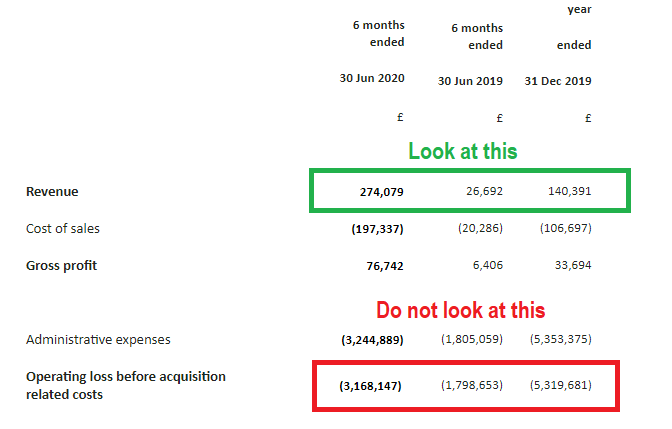

More from that call, again with my emphasis.

Whilst I think TFF stands a fair chance of becoming a licenced platform for various drugs, for the here and now it's about Covid - and after that call, it might not come as a complete shock if they announce something here. We'll see

Whilst I think TFF stands a fair chance of becoming a licenced platform for various drugs, for the here and now it's about Covid - and after that call, it might not come as a complete shock if they announce something here. We'll see

• • •

Missing some Tweet in this thread? You can try to

force a refresh