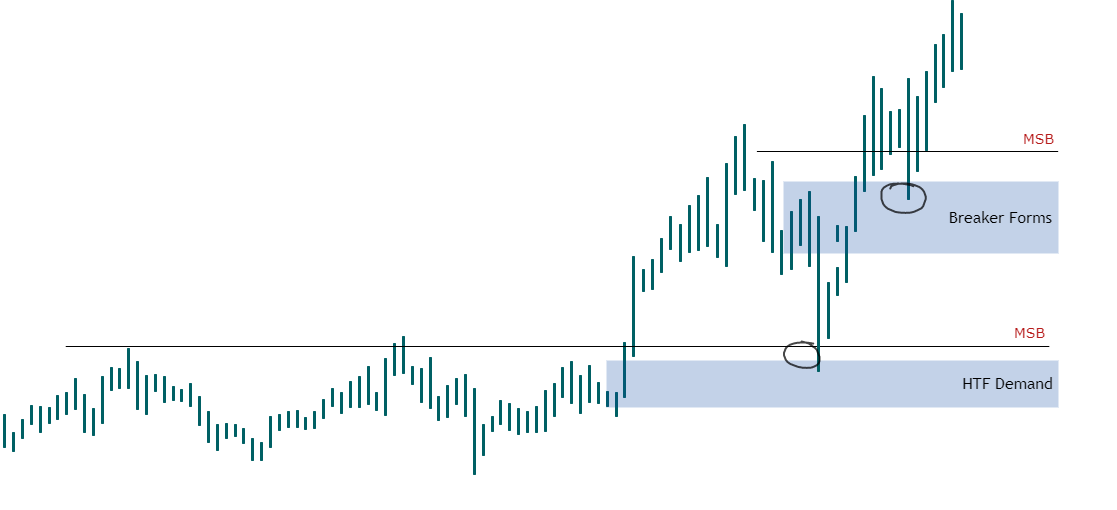

$LINK / $USD

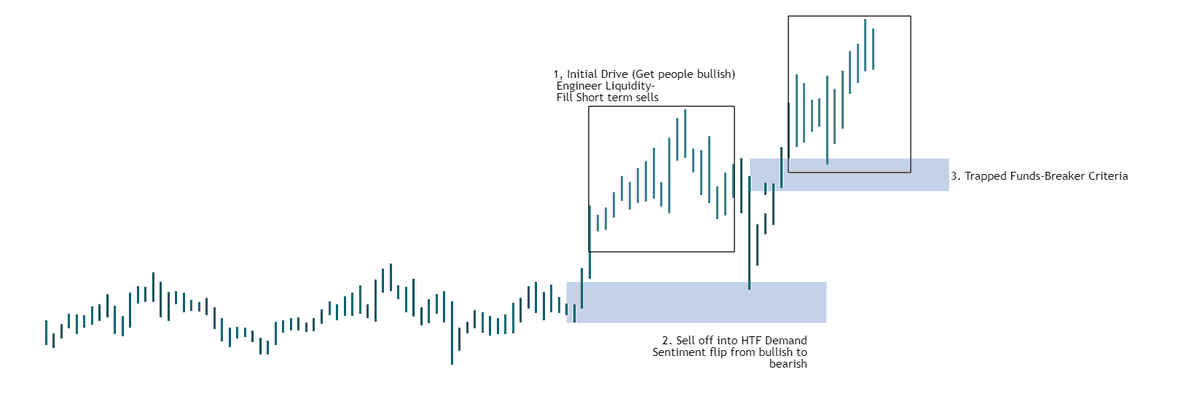

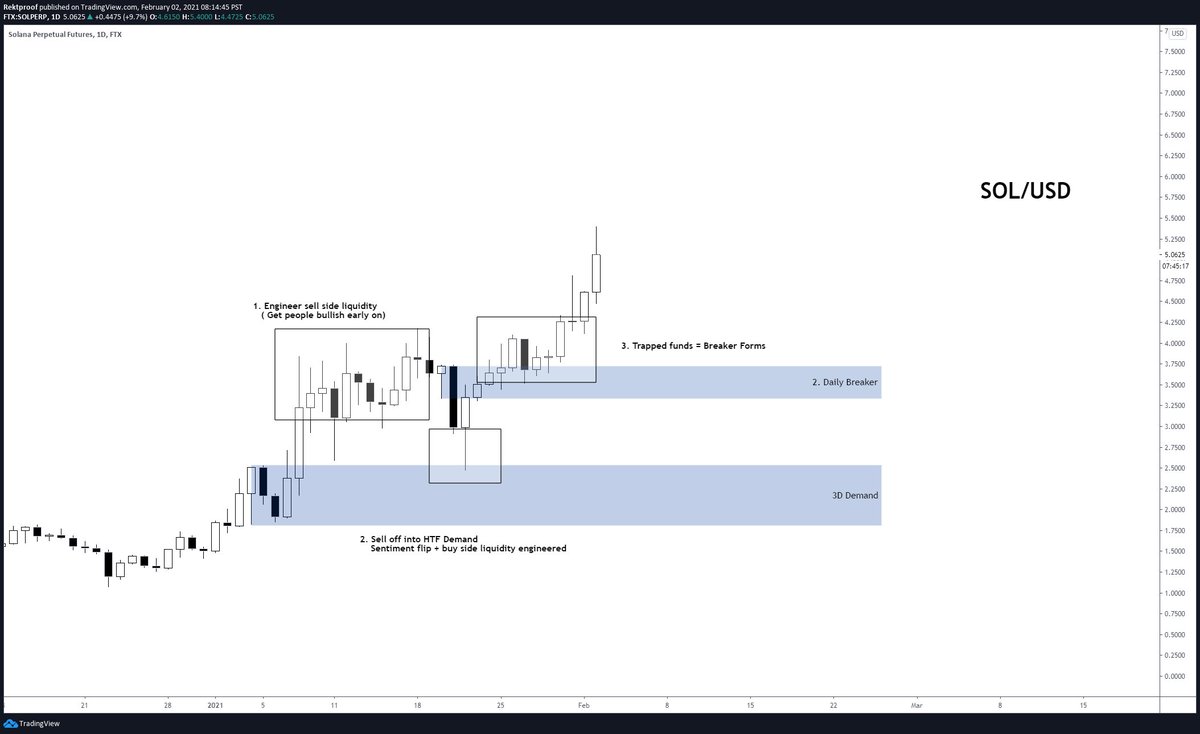

Another PO3.

Price broke the low and gave us a H12 breaker.

Looking to see if we run the high into the daily supply above.

#LINK

Another PO3.

Price broke the low and gave us a H12 breaker.

Looking to see if we run the high into the daily supply above.

#LINK

$LINK / $USD

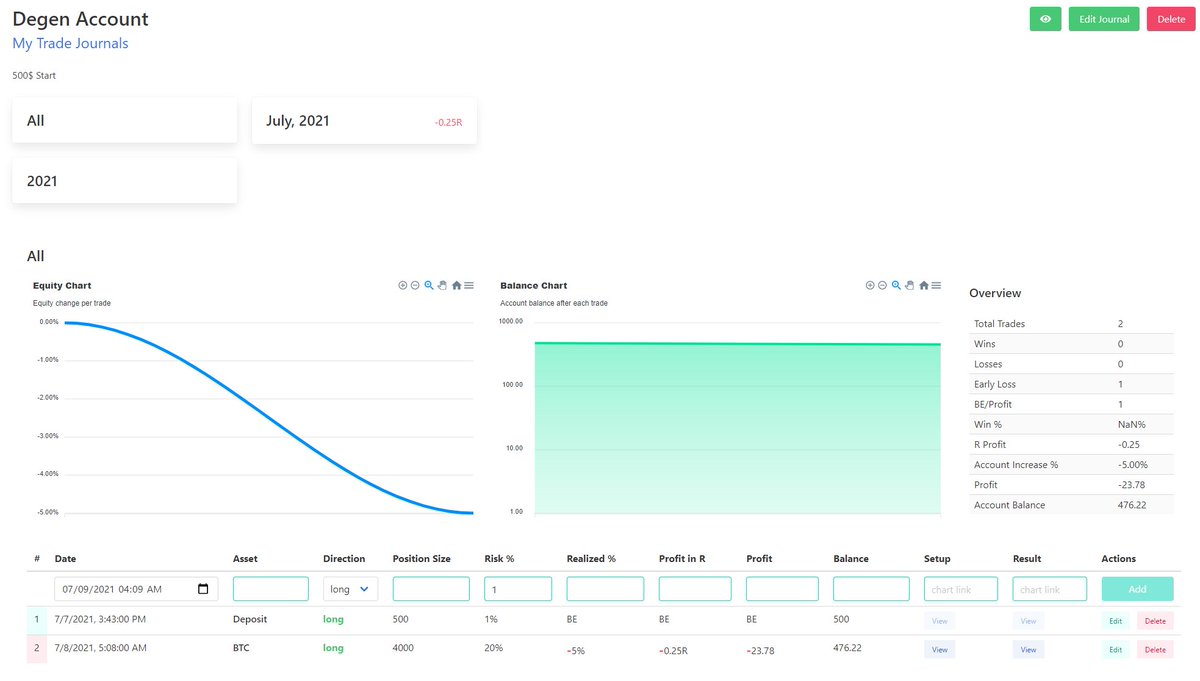

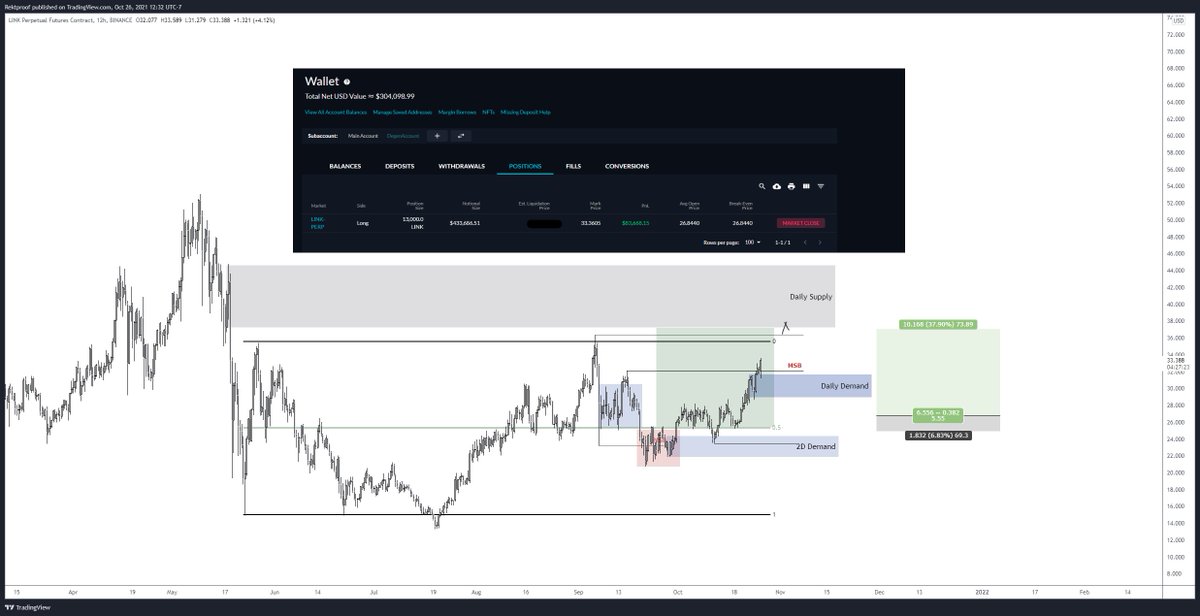

Patience paid off.

Price off the 2D demand as the PO3 is heading into the daily supply. Daily MSB and currently reacting off the newly formed daily demand.

4R+ Running but looking for higher. The degen Link trade is absolutely smashing it.

LFG!

#Chainlink

Patience paid off.

Price off the 2D demand as the PO3 is heading into the daily supply. Daily MSB and currently reacting off the newly formed daily demand.

4R+ Running but looking for higher. The degen Link trade is absolutely smashing it.

LFG!

#Chainlink

$LINK / $USD

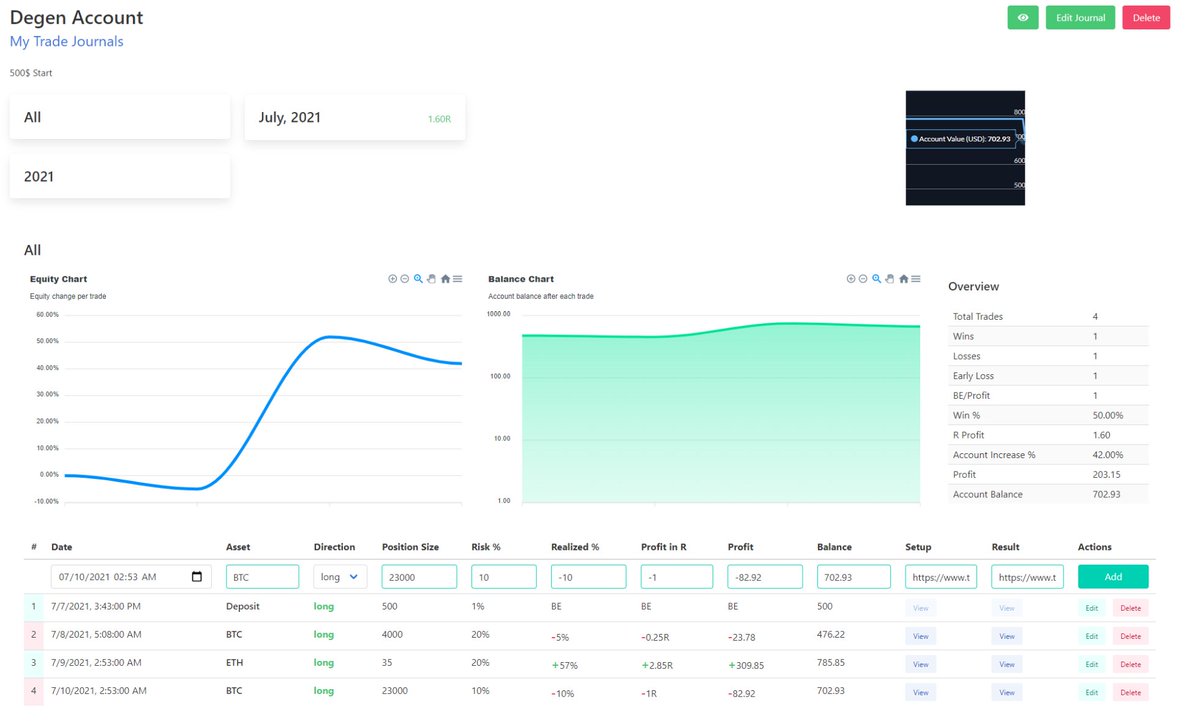

Never updated the close on here.

Chopped out for the majority of Link as I was looking for the daily supply to TP.

Exited before full TP was hit but regardless decent return as price retraced to my original entry

2.93R+ booked

Thread closed..//

Never updated the close on here.

Chopped out for the majority of Link as I was looking for the daily supply to TP.

Exited before full TP was hit but regardless decent return as price retraced to my original entry

2.93R+ booked

Thread closed..//

• • •

Missing some Tweet in this thread? You can try to

force a refresh