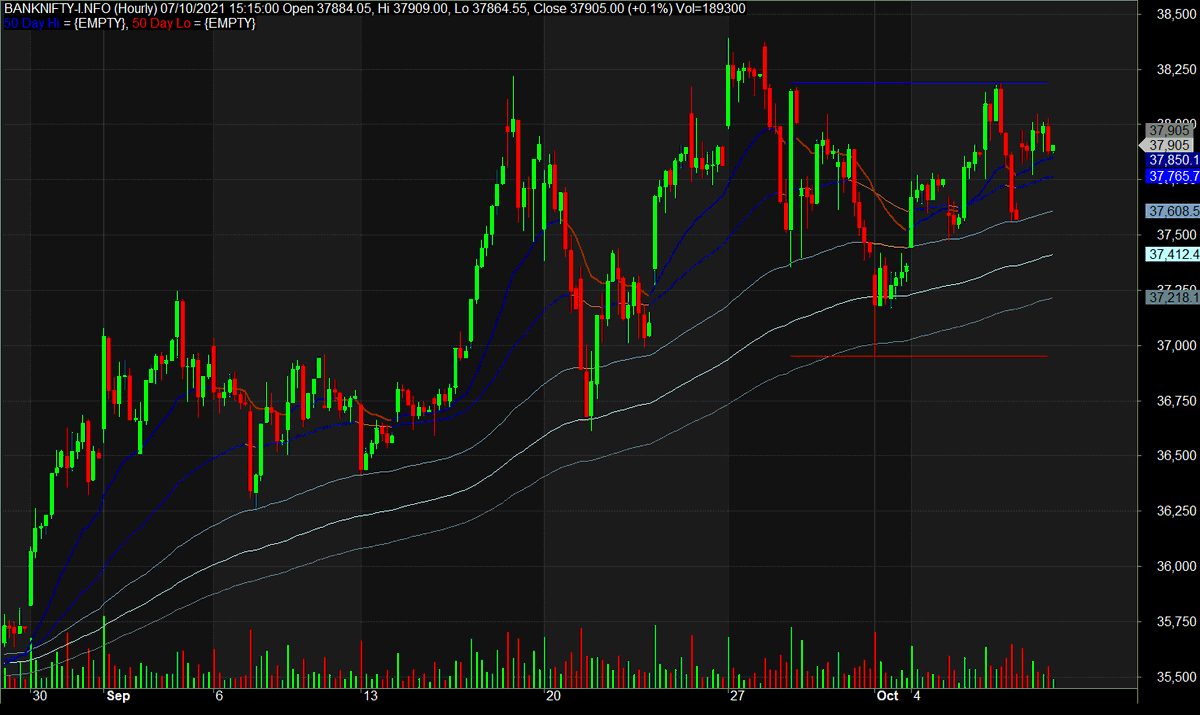

The next 2 days i.e. Friday and Monday are going to be tough decision making on #BANKNIFTY.

We are brushing at an all-time high and forming a narrow triangle. COI going down can go for short covering at high to force sellers to liquidate and go higher. Or long buildup might..

We are brushing at an all-time high and forming a narrow triangle. COI going down can go for short covering at high to force sellers to liquidate and go higher. Or long buildup might..

start with a fresh breakout. Whatever happens, Monday will be a gamble as far as positional trading is concerned. The way Wednesday sell-off was negated today, I am expecting a range from 37500 to 3900 for the 2nd week of October.

Right now I am trading for a range of 37000 -38500. If we cross 38200, will shift to the 37500 to 39000 range. Definitely going to be interesting and not simple at all. Given that #Nifty is now sideways, bias may remain bullish sideways for some time overall.

Even if we break an all-time high, not expecting too much bullishness on #BANKNIFTY. Volatility? Yes.

• • •

Missing some Tweet in this thread? You can try to

force a refresh