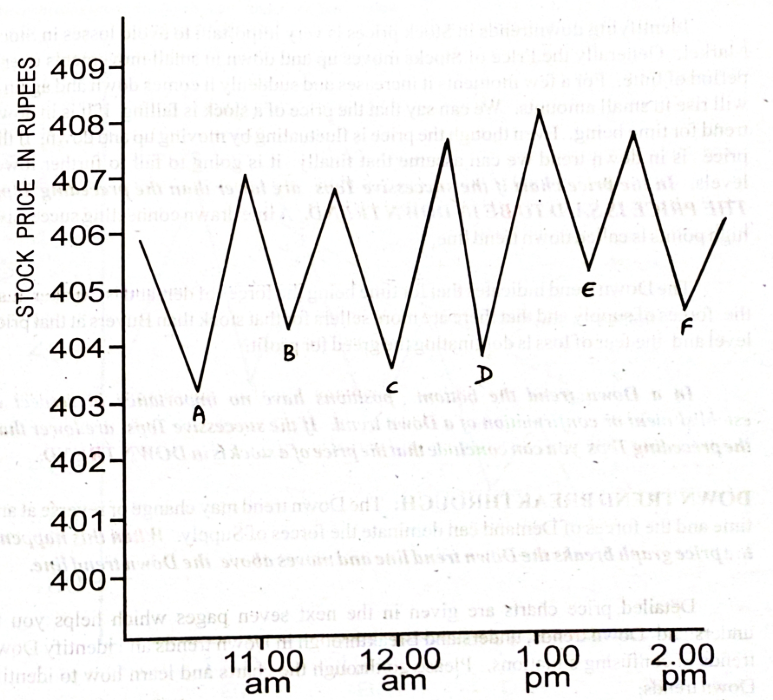

Thread on Options in Low Vix High Vol. Environment

At times when Vix is ultra low, premiums are less. As a seller it gets difficult to sell less premiums. If there is a fake move against your direction, it hits the stoploss or forces you to liquidate the position 1/n

At times when Vix is ultra low, premiums are less. As a seller it gets difficult to sell less premiums. If there is a fake move against your direction, it hits the stoploss or forces you to liquidate the position 1/n

only to see market going in your direction. Being a Positional Option Strategist on weekly option then becomes a challenge. How I am coping up with this change....? A thread...

I do not sell cheap options even if its positional 2/n

I do not sell cheap options even if its positional 2/n

i.e. bear call spread of 20 point benefit against a max loss of 180 etc in #Nifty or 40 point gain for a 260 point loss in #BankNifty.

Any strategy I create, my priority is to make a strategy with Max_Loss:Max_Profit ratio of 1:1. 3/n

Any strategy I create, my priority is to make a strategy with Max_Loss:Max_Profit ratio of 1:1. 3/n

Secondly, I decide a quantity with which even if I face my worst case scenario, my loss will not be more than 2% of the capital. 2% here is highly improbable as it happens only if I let positions expire. Else my loss in adverse scenario is capped at 0.03% or 0.04% practically.4/n

Thirdly, you need to have clear understanding of three factors:

1. Max Profit

2. Max Loss

3. Actual Profit that you can extract from this max profit in points. For eg. if net credit is 100 in a strategy, will you be able to get 70 points in theta decay? 5/n

1. Max Profit

2. Max Loss

3. Actual Profit that you can extract from this max profit in points. For eg. if net credit is 100 in a strategy, will you be able to get 70 points in theta decay? 5/n

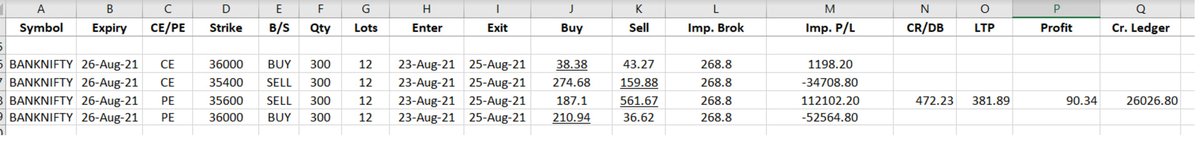

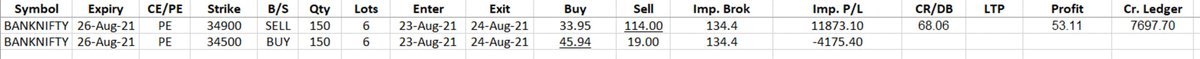

For eg. this is the strategy I created on Bank Nifty in last week of August 2021.

Max profit was 277 points. Max loss was 130 points. My expectation was expiry around 35400-35600 points and from this strategy expected around 80 points in profit. 6/n

Max profit was 277 points. Max loss was 130 points. My expectation was expiry around 35400-35600 points and from this strategy expected around 80 points in profit. 6/n

In three days, I was able to easily get a theta decay of 90 points. Trade is attached in image. Before going into clean profit, even during volatility, trade went into a minor loss of 10 points itself. In worst case scenario, I have seen the trade go to minus of 40 points. 7/n

40 points can be easily covered if I have to take a stoploss. In worst case scenario, even adjusting for a max loss of 130 point is easy. One can write some spreads or shift the whole spread to new expected expiry point. Most importantly, it saves against FREAK TRADES. 8/n

During the course of waiting for theta decay, I also extract extra opportunities to write directional spreads with lets say half the quantity to extract some extra points if I am clear about the direction. Or lets say if the existing strategy is brushing at breakeven. 9/n

Another Example?

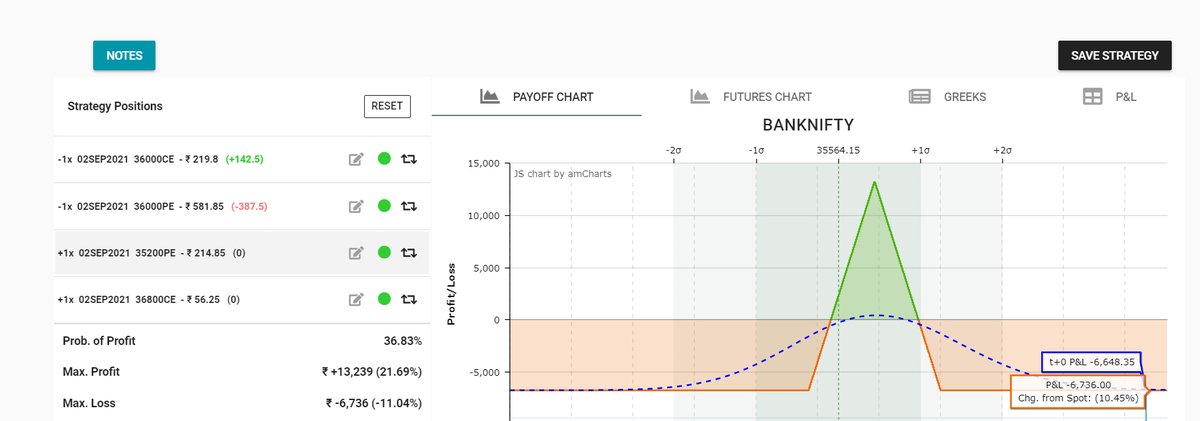

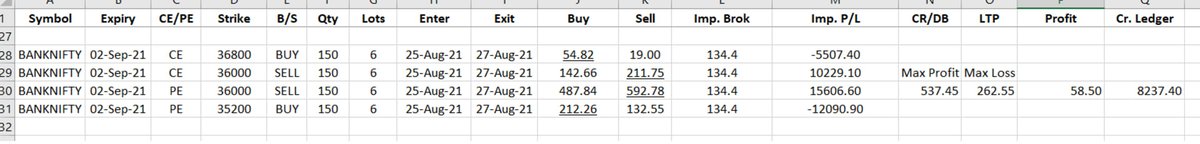

I recommended this Iron Fly. Max Profit is 537 points. Max loss is 262 points. Now loss was double my recommended loss of 130 points, based on max profit of 537 point, I could extract 100+ points in Theta decay. I executed this strategy with half qty. 10/n

I recommended this Iron Fly. Max Profit is 537 points. Max loss is 262 points. Now loss was double my recommended loss of 130 points, based on max profit of 537 point, I could extract 100+ points in Theta decay. I executed this strategy with half qty. 10/n

Market opened against me and then rallied towards 36000 and by end of day through all the volatility, account never turned red. I did not want to carry anything overnight, so closed this position at 60 point profits. 11/n

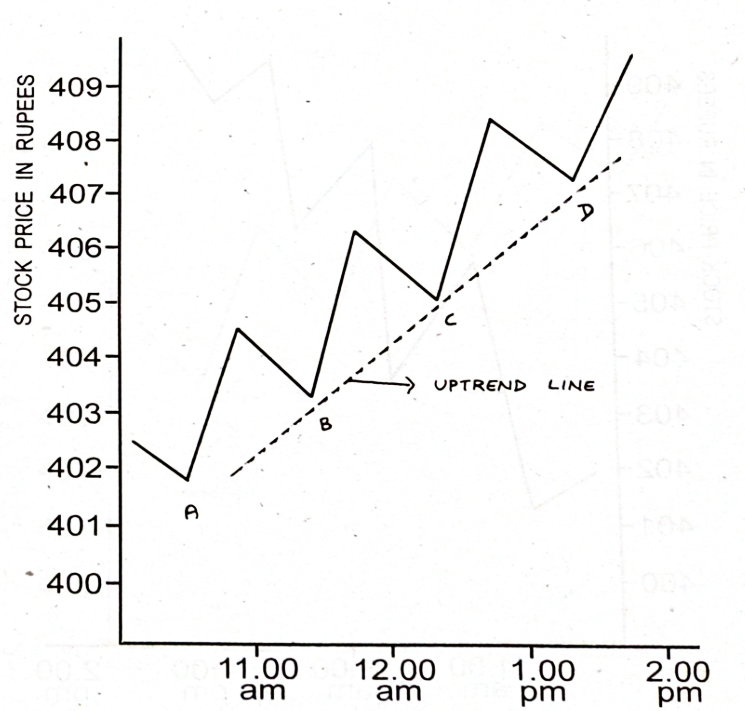

In nutshell when trading in low vix environment:

1. Execute strategy with good RR and net credit greater than max loss. Delta Neutral, Theta Positive strategy.

2. Keep an optimal position size.

3. Trade practical probable actual theta decay and not max loss vs max profit. 12/n

1. Execute strategy with good RR and net credit greater than max loss. Delta Neutral, Theta Positive strategy.

2. Keep an optimal position size.

3. Trade practical probable actual theta decay and not max loss vs max profit. 12/n

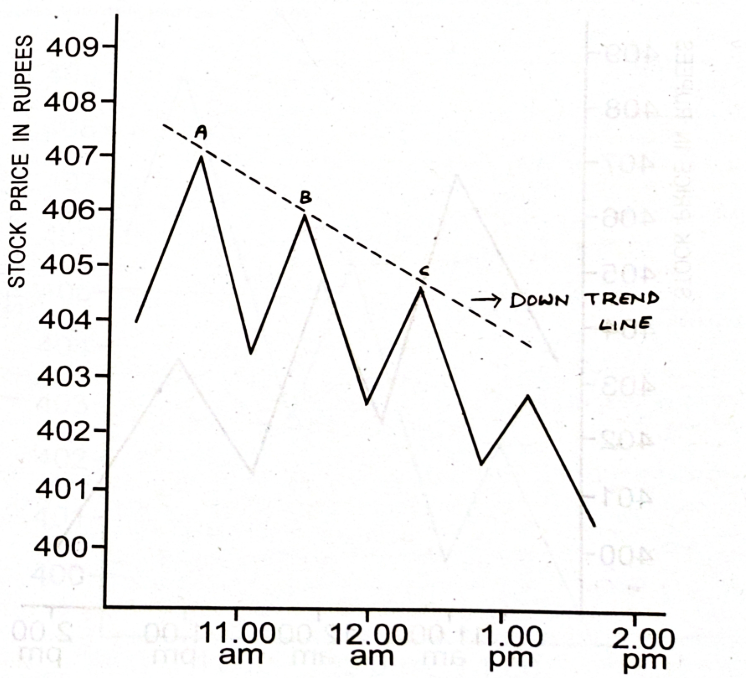

As the expiry gets close, option premiums reduce. In the garb of adjustments do not get seduced by writing low premiums out of desperation. Instead, create a strategy where if you are wrong, you can close quickly with minimal damage and create new strategy.

Hope this helps.

Hope this helps.

• • •

Missing some Tweet in this thread? You can try to

force a refresh