Now onto usual programming :)

Review

Astro - focusing on recent changes & a few interesting data studies

TA - selected charts

Sum

Will post the threadreader app after each

Read what sections interest you

Review

Astro - focusing on recent changes & a few interesting data studies

TA - selected charts

Sum

Will post the threadreader app after each

Read what sections interest you

From the sheet:

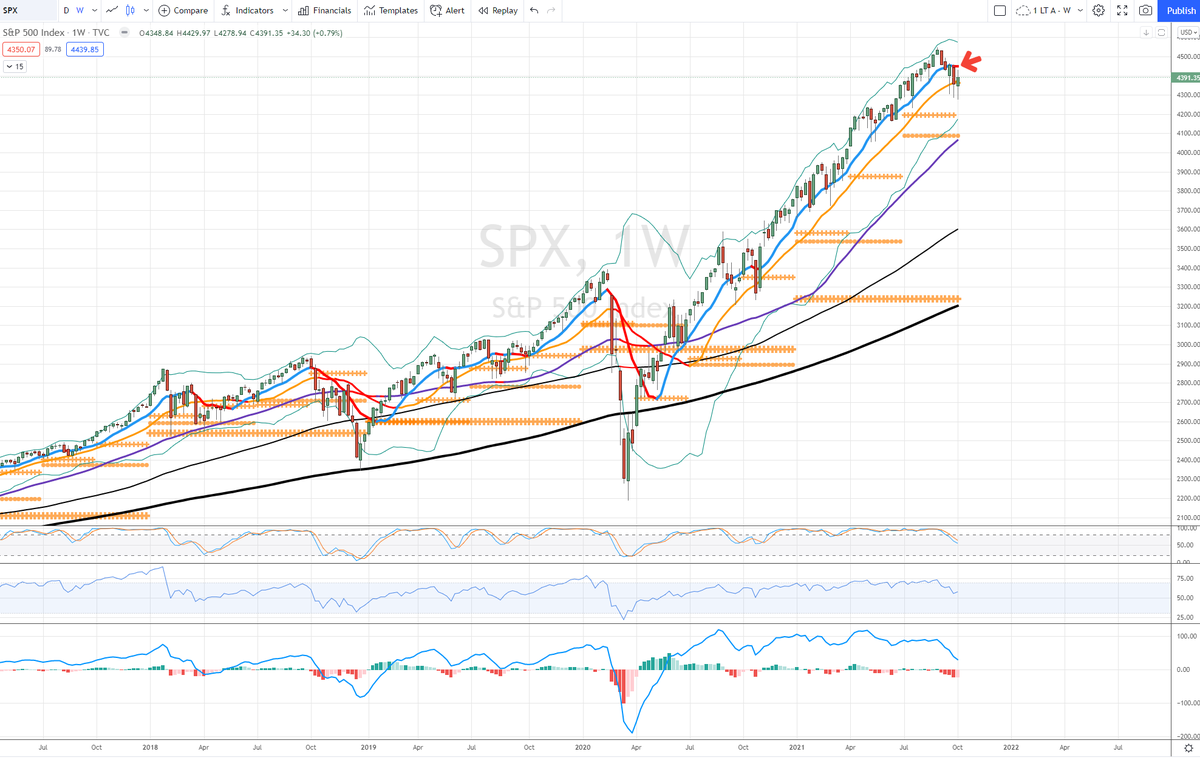

Indexes: "Prefer down to 10/10 area, but not high confidence - FXI / China most likely"

Not correct so far, but did call an audible and thought key low might be in per 10/6 close

Indexes: "Prefer down to 10/10 area, but not high confidence - FXI / China most likely"

Not correct so far, but did call an audible and thought key low might be in per 10/6 close

https://twitter.com/MarsiliosMM/status/1445847723190546432

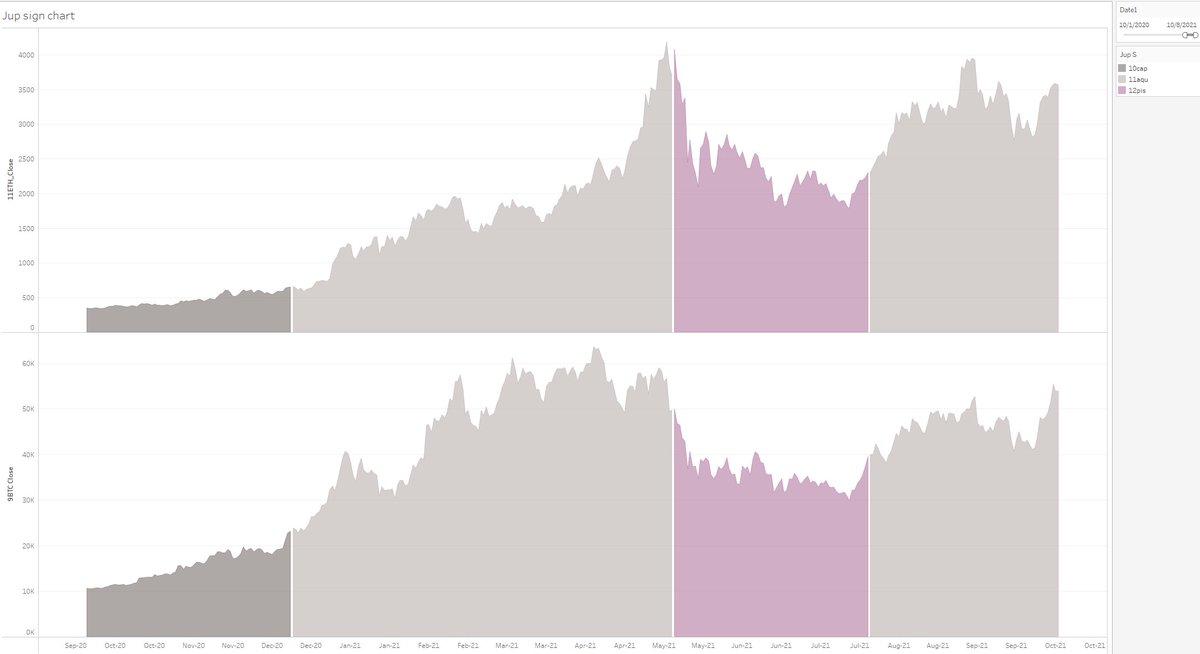

Cryptos: "Looking more bullish, esp 10/5-7"

Nailed

Nailed

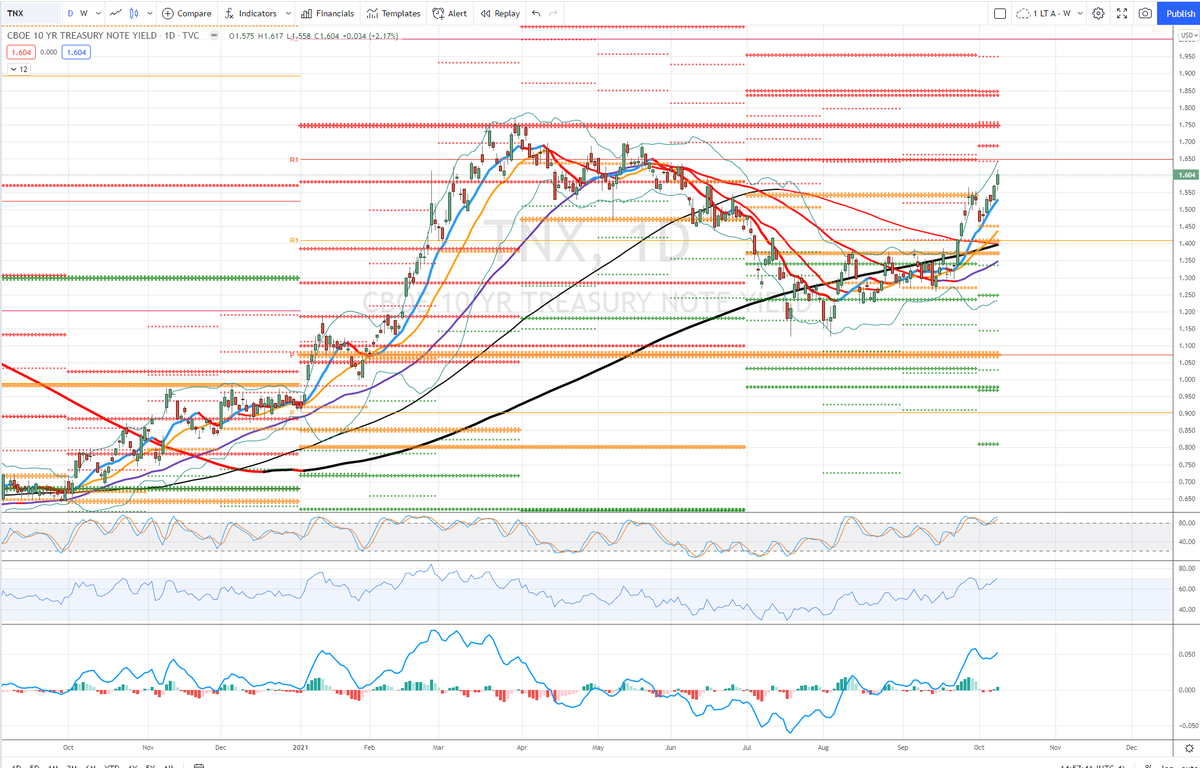

Safe Havens: "Bonds mixed, VIX supporting stocks, needs to rally > 22.5 to put bears back in play"

Bonds weaker, but did hold up through 10/6 which was the event thought would help lift

VIX supported stocks, 1 day above 22.5 (10/4 index key low) then sharply down

Mixed

Bonds weaker, but did hold up through 10/6 which was the event thought would help lift

VIX supported stocks, 1 day above 22.5 (10/4 index key low) then sharply down

Mixed

Tweet Sum: "Opposite energies at work same time, tug of war, who wins?"

Schwab after the fact -

"The first full week of Oct...on pace to finish with a solid weekly gain but in choppy fashion with multiple large swings above & below the unchanged mark."

Check!

NDX & RUT flat

Schwab after the fact -

"The first full week of Oct...on pace to finish with a solid weekly gain but in choppy fashion with multiple large swings above & below the unchanged mark."

Check!

NDX & RUT flat

"Cryptos happy to be back long, may hedge a bit midweek"

☑️☑️☑️

"Indexes may have to cover shorts again if indexes clear those Q4 pivots..."

☑️☑️☑️

☑️☑️☑️

"Indexes may have to cover shorts again if indexes clear those Q4 pivots..."

☑️☑️☑️

On scale of 1 to 5 where

5 amazing all correct or nearly so

4 excellent most right

3 mixed, some right some not

2 not totally wrong, but more misses than hits

1 off

*

Where are we, 4 of 5, right? Guess depends if allow for midweek adjust call, otherwise stocks off lows.

5 amazing all correct or nearly so

4 excellent most right

3 mixed, some right some not

2 not totally wrong, but more misses than hits

1 off

*

Where are we, 4 of 5, right? Guess depends if allow for midweek adjust call, otherwise stocks off lows.

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh