0/ For the past few months, the Alpha Launchpad has been quietly providing immense value to $ALPHA stakers. Just because you don't see immediate high APYs, doesn't mean your capital is idle.

Quick thread on why numba go up is not the only way to win in crypto.

👇

Quick thread on why numba go up is not the only way to win in crypto.

👇

https://twitter.com/AlphaFinanceLab/status/1447921543355506697

1/ Alpha Staking

Quick recap, $ALPHA staking automatically makes you eligible for all airdrops from protocols being incubated in the Alpha Launchpad.

On top of that, stakers are paid a portion of all the fees ever earnt from Alpha products.

Staking: tokenomics.alphafinance.io/staking

Quick recap, $ALPHA staking automatically makes you eligible for all airdrops from protocols being incubated in the Alpha Launchpad.

On top of that, stakers are paid a portion of all the fees ever earnt from Alpha products.

Staking: tokenomics.alphafinance.io/staking

2/ Beta Finance

The first Alpha Launchpad incubated project @beta_finance has just gone live and at current vals,

every $1000 of ALPHA staked will earn you ~$640, for a 64% yield on the FIRST project being launched.

All you have to do is stake ALPHA until Feb 2022.

The first Alpha Launchpad incubated project @beta_finance has just gone live and at current vals,

every $1000 of ALPHA staked will earn you ~$640, for a 64% yield on the FIRST project being launched.

All you have to do is stake ALPHA until Feb 2022.

3/ Why is yield so high?

Bc Beta Finance will airdrop 5% of all tokens to ALPHA stakers. At current mkt vals,

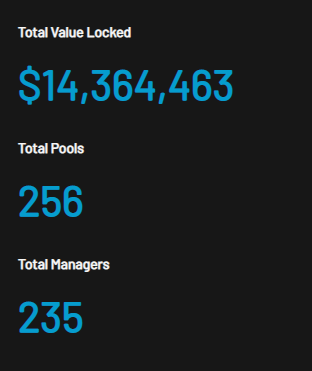

5% FDV of Beta = $138m

Total value staked in Alpha = $215m

Net return for Beta = 138/215 = 64%

Bc Beta Finance will airdrop 5% of all tokens to ALPHA stakers. At current mkt vals,

5% FDV of Beta = $138m

Total value staked in Alpha = $215m

Net return for Beta = 138/215 = 64%

4/ Now you may think, well 64% ain't super fancy. But hang on - this is Alpha's first project. @pStakeFinance has already been launched with 2% of their tokens to be airdropped, and a very stacked list of protocols to come after.

5/ As an ALPHA staker, I think of my stake as a claim on all current & future projects going through the Alpha Launchpad.

Given Tascha & team's track record + quality selection process, I'm sitting comfortable knowing my tokens will be compounding in multiple ways.

Given Tascha & team's track record + quality selection process, I'm sitting comfortable knowing my tokens will be compounding in multiple ways.

6/ Now the easiest thing to do is sit on my hands and HODL.

• • •

Missing some Tweet in this thread? You can try to

force a refresh