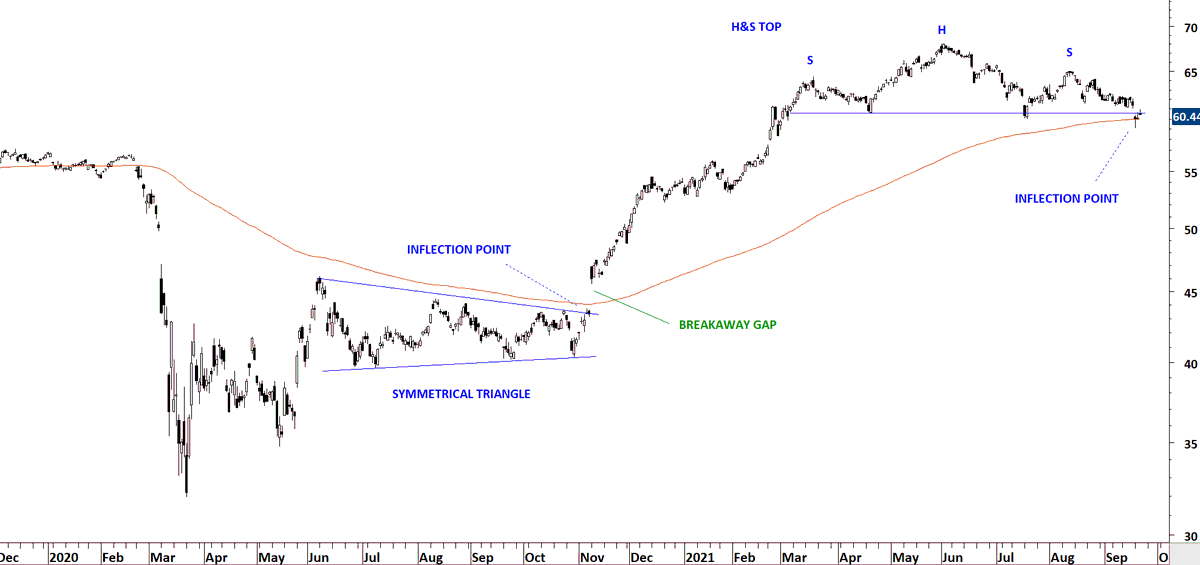

This is considered Type 2 breakout. (Explained in following videos).

Irrespective of time frame (note I don't analyze intraday price action), price dynamics are the same. Breakouts can be followed by pullbacks and those would ideally find support at the previous resistance.

Irrespective of time frame (note I don't analyze intraday price action), price dynamics are the same. Breakouts can be followed by pullbacks and those would ideally find support at the previous resistance.

Piyasada birileri..., dis gucler, soros, vs. gibi inanclari olan arkadaslar icin Isvec borsasinda islem goren bir hissenin grafigini paylasiyorum.

Piyasadaki o "birileri" ne atfedilen hareketler aslinda kolletif olarak toplu suru piskolojisi/insan davranislarindan kaynaklaniyor

Piyasadaki o "birileri" ne atfedilen hareketler aslinda kolletif olarak toplu suru piskolojisi/insan davranislarindan kaynaklaniyor

Reference to earlier tweet on the price dynamics of a Type 2 breakout.

Type 2 breakout: Breakout followed by a pullback that doesn't challenge the upper boundary of the pattern. These type of price action will not challenge the possible stop-loss you have placed below the pattern boundary.

• • •

Missing some Tweet in this thread? You can try to

force a refresh