MobiKwik DRHP Takeaways!

KYI - Know Your IPO ✅

Let's understand everything about this fintech company in the thread below 🧵👇

Do Retweet and help us educate more investors :)

KYI - Know Your IPO ✅

Let's understand everything about this fintech company in the thread below 🧵👇

Do Retweet and help us educate more investors :)

1/n

About MobiKwik -

- Fintech company

- one of the largest mobile wallets and BNPL (buy Now pay later) players in India

- Also offers microinsurance (life, health & general) products, mutual fund investments, and trading of digital gold

About MobiKwik -

- Fintech company

- one of the largest mobile wallets and BNPL (buy Now pay later) players in India

- Also offers microinsurance (life, health & general) products, mutual fund investments, and trading of digital gold

2/n

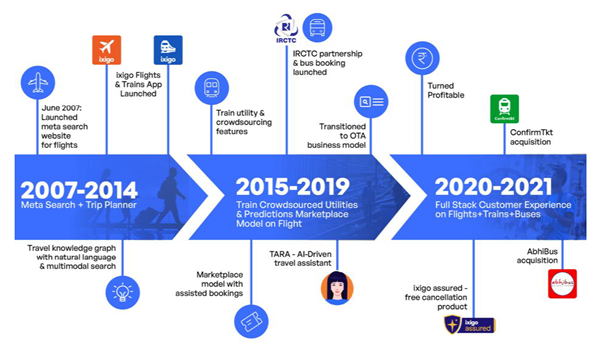

- Commenced operations in 2009 with MobiKwik Wallet for users to add money and use it to pay utility bills

- Over time, moved to Ecomm shopping, food delivery, petrol pumps, large retail chains etc

- FY21- 101.37 mn Registered Users and 3.44 mn+ online/offline merchants

- Commenced operations in 2009 with MobiKwik Wallet for users to add money and use it to pay utility bills

- Over time, moved to Ecomm shopping, food delivery, petrol pumps, large retail chains etc

- FY21- 101.37 mn Registered Users and 3.44 mn+ online/offline merchants

3/n

Dhandha (Business Model) -

- Consumer payments segment is the foundation stone for BNPL. It acts as the top of the funnel through which they acquire new users

- 3 Business Segments - BNPL, Consumer Payments (MobiKwik Wallet), and Payment Gateway (Zaakpay).

Dhandha (Business Model) -

- Consumer payments segment is the foundation stone for BNPL. It acts as the top of the funnel through which they acquire new users

- 3 Business Segments - BNPL, Consumer Payments (MobiKwik Wallet), and Payment Gateway (Zaakpay).

4/n

Revenue and Cost Drivers for each of the 3 main verticals -

- Kindly go through image 1 properly as it will help you understand the business in a simple way.

Segmental Gross Merchandise Value (GMV) figures

- Self-explanatory. BNPL scaled back due to COVID

Revenue and Cost Drivers for each of the 3 main verticals -

- Kindly go through image 1 properly as it will help you understand the business in a simple way.

Segmental Gross Merchandise Value (GMV) figures

- Self-explanatory. BNPL scaled back due to COVID

5/n

Let’s look at each of the businesses individually now -

#1 - BNPL – (2 products)

Buy Now Pay Later (BNPL) is just a fancy term for lending at the higher risk bands with the risk not being priced in

Let’s look at each of the businesses individually now -

#1 - BNPL – (2 products)

Buy Now Pay Later (BNPL) is just a fancy term for lending at the higher risk bands with the risk not being priced in

6/n

Product #1 in BNPL - MobiKwik Zip

- Launched May 2019 - flagship BNPL product

- Interest-free, ₹500 -₹30000 credit limit in the user’s MobiKwik Wallet. one-tap activation in 15-day cycles

- Focus on Indian middle-class

Product #1 in BNPL - MobiKwik Zip

- Launched May 2019 - flagship BNPL product

- Interest-free, ₹500 -₹30000 credit limit in the user’s MobiKwik Wallet. one-tap activation in 15-day cycles

- Focus on Indian middle-class

7/n

- FY21 - 22.25 mn users have been pre-approved for MobiKwik Zip. MobiKwik Zip users' repeat rate was 79.19%.

Product #2 in BNPL - Zip EMI

- Good re-payment history Users pre-approved for this

- Focused on users wanting high-value products between ₹ 25000 to ₹ 100000

- FY21 - 22.25 mn users have been pre-approved for MobiKwik Zip. MobiKwik Zip users' repeat rate was 79.19%.

Product #2 in BNPL - Zip EMI

- Good re-payment history Users pre-approved for this

- Focused on users wanting high-value products between ₹ 25000 to ₹ 100000

8/n

- An Interest bearing product

- Types - 6,12, 18 Month EMIs

Basically, BNPL product #1 directs users towards product #2.

It is all about targetting a big user funnel and converting a part of them into interest payers by creating a habit :)

- An Interest bearing product

- Types - 6,12, 18 Month EMIs

Basically, BNPL product #1 directs users towards product #2.

It is all about targetting a big user funnel and converting a part of them into interest payers by creating a habit :)

9/n

#2 Business Segment - Consumer Payments Segment (MobiKwik Wallet)

MobiKwik Wallet is a mobile payments app, which provides 101.37 million Registered Users (FY21) a simple, fast, safe, and reliable way to pay.

#2 Business Segment - Consumer Payments Segment (MobiKwik Wallet)

MobiKwik Wallet is a mobile payments app, which provides 101.37 million Registered Users (FY21) a simple, fast, safe, and reliable way to pay.

10/n

#3 Business Segment - Payment Gateway (Zaakpay)

- Introduced in 2012.

- A payment gateway aggregator and offers end-to-end payment processing solutions to online merchants through an extensive choice of payment modes (UPI, cc, debit card, etc)

#3 Business Segment - Payment Gateway (Zaakpay)

- Introduced in 2012.

- A payment gateway aggregator and offers end-to-end payment processing solutions to online merchants through an extensive choice of payment modes (UPI, cc, debit card, etc)

11/n

"From a focus perspective, we will be focusing on all of our three businesses — the consumer business (wallet), BNPL, and payment gateway — and not venturing into anything new." (Company management on their business direction. Src – Moneycontrol)

"From a focus perspective, we will be focusing on all of our three businesses — the consumer business (wallet), BNPL, and payment gateway — and not venturing into anything new." (Company management on their business direction. Src – Moneycontrol)

12/n

Wealthtech and Insuretech cross-sell to users -

- Acquired Clearfunds, an online mutual fund platform in 2018

- As of FY21, partnered with 36 asset management companies

- The AUM of Wealthtech offerings was Rs 397 Cr in FY21 (288 cr in FY20 and 165 cr in FY19)

Wealthtech and Insuretech cross-sell to users -

- Acquired Clearfunds, an online mutual fund platform in 2018

- As of FY21, partnered with 36 asset management companies

- The AUM of Wealthtech offerings was Rs 397 Cr in FY21 (288 cr in FY20 and 165 cr in FY19)

13/n

User acquisition-

- Acquired 77% of Users organically without any cost

- Primary sources: SEO, Mobile ASO initiatives, User referrals, Checkout and POS placement in merchant network and Bharat Bill platform

- Other modes – Bill payments, co-branded apps

User acquisition-

- Acquired 77% of Users organically without any cost

- Primary sources: SEO, Mobile ASO initiatives, User referrals, Checkout and POS placement in merchant network and Bharat Bill platform

- Other modes – Bill payments, co-branded apps

14/n

Merchants -

- FY21 - 3.44+ mn merchants accepted payments through the MobiKwik Wallet, including 3.37 mn+ physical stores + 73281 online merchants

- Consists of websites, apps, where MobiKwik Wallet is a payment option in the checkout

Merchants -

- FY21 - 3.44+ mn merchants accepted payments through the MobiKwik Wallet, including 3.37 mn+ physical stores + 73281 online merchants

- Consists of websites, apps, where MobiKwik Wallet is a payment option in the checkout

15/n

- Physical retail stores - MobiKwik Wallet is a QR code payment option at the POS/ cashier.

- Platform also enables P2P payments via UPI, MobiKwik Wallet as well as MobiKwik Wallet to bank payments.

Segment use Cases - Img 1

Network Effects Fly Wheel - Img 2

- Physical retail stores - MobiKwik Wallet is a QR code payment option at the POS/ cashier.

- Platform also enables P2P payments via UPI, MobiKwik Wallet as well as MobiKwik Wallet to bank payments.

Segment use Cases - Img 1

Network Effects Fly Wheel - Img 2

17/n

Risks -

- Increasing Intense competition

- BNPL competitors are large financial institutions backed by low-cost insured deposits

- low entry barriers of BNPL

- Cost of switching to another BNPL offering are very low and users keep shifting to lowest cost BNPL provider

Risks -

- Increasing Intense competition

- BNPL competitors are large financial institutions backed by low-cost insured deposits

- low entry barriers of BNPL

- Cost of switching to another BNPL offering are very low and users keep shifting to lowest cost BNPL provider

18/n

Key Performance Indicators -

- Users and GMV has grown well

- CAC coming down

Financials Overview -

- Numbers of the 3 businesses

- Unit Economics show User incentives scaled back & credit costs increased (Good Underwriting is essential)

(Img 1 and 2 Credit @os7borne)

Key Performance Indicators -

- Users and GMV has grown well

- CAC coming down

Financials Overview -

- Numbers of the 3 businesses

- Unit Economics show User incentives scaled back & credit costs increased (Good Underwriting is essential)

(Img 1 and 2 Credit @os7borne)

19/n

Valuation & Conclusion -

EPS, BV everything negative, and anyway it's a fintech so who cares about valuations 😅😅

On Oct 12, Mobikwik entered the unicorn club (33rd Indian startup to hit a $1 billion valuation this year)

Valuation & Conclusion -

EPS, BV everything negative, and anyway it's a fintech so who cares about valuations 😅😅

On Oct 12, Mobikwik entered the unicorn club (33rd Indian startup to hit a $1 billion valuation this year)

20/n

A secondary sale of shares took place at a $1 billion valuation under the ESOP plan recently

After Preference shares conversion - Total 5.56 Cr shares

at 1 bn $ valuation – per share price – ₹1349

at 1.5bn$ – ₹2023

at 1.7bn$ – ₹2293

In unlisted – ₹1350

A secondary sale of shares took place at a $1 billion valuation under the ESOP plan recently

After Preference shares conversion - Total 5.56 Cr shares

at 1 bn $ valuation – per share price – ₹1349

at 1.5bn$ – ₹2023

at 1.7bn$ – ₹2293

In unlisted – ₹1350

21/n

1.5 and 1.7 bn $ valuation because they are said to target that in the IPO.

1 bn $ because that's the reference rate since the secondary market deal of ESOPs took place at that valuations.

1.5 and 1.7 bn $ valuation because they are said to target that in the IPO.

1 bn $ because that's the reference rate since the secondary market deal of ESOPs took place at that valuations.

22/n

Competition -

- A lot of players competing with them in their business segments and that too well-funded ones that are bigger in size.

- Definitely, one should wait and watch how the competitive intensity plays out.

Competition -

- A lot of players competing with them in their business segments and that too well-funded ones that are bigger in size.

- Definitely, one should wait and watch how the competitive intensity plays out.

23/n

The company was started by husband-wife duo Upasana Taku and Bipin Preet Singh back in 2009 when digital payments were at a nascent stage in India.

Taku, in fact, said she had to fight with her parents to leave her comfortable job at PayPal in the US

The company was started by husband-wife duo Upasana Taku and Bipin Preet Singh back in 2009 when digital payments were at a nascent stage in India.

Taku, in fact, said she had to fight with her parents to leave her comfortable job at PayPal in the US

24/n

to start the company from her home in New Delhi. Over the years, Mobikwik has survived multiple upheavals, while fending off larger and deeply funded rivals such as Paytm, Google, and PhonePe.

Src – moneycontrol

to start the company from her home in New Delhi. Over the years, Mobikwik has survived multiple upheavals, while fending off larger and deeply funded rivals such as Paytm, Google, and PhonePe.

Src – moneycontrol

25/n

Sectoral information –

India’s online transacting users has rapidly grown at a CAGR of approximately 15% from 180 mn

in FY18 to 250 mn+ in FY21.

However, India had only 30-35 million unique credit card users resulting in a low credit card penetration of 3.5%

Sectoral information –

India’s online transacting users has rapidly grown at a CAGR of approximately 15% from 180 mn

in FY18 to 250 mn+ in FY21.

However, India had only 30-35 million unique credit card users resulting in a low credit card penetration of 3.5%

26/n

India ranks as the second-largest mobile payment market in the world in terms of user base

Within mobile payments, mobile wallet payments are expected to grow (by value) by 3x by FY26.

India has low credit card penetration

BNPL in India is expected to grow 15x

India ranks as the second-largest mobile payment market in the world in terms of user base

Within mobile payments, mobile wallet payments are expected to grow (by value) by 3x by FY26.

India has low credit card penetration

BNPL in India is expected to grow 15x

27/n

India has reached one of the highest smartphone and internet penetration in the world

Favorable Demographics

Online transactors and shoppers have been both growing in India rapidly and this is driving the consumer internet economy

BNPL Global Map

India has reached one of the highest smartphone and internet penetration in the world

Favorable Demographics

Online transactors and shoppers have been both growing in India rapidly and this is driving the consumer internet economy

BNPL Global Map

28/n

I had done a survey on Mobikwik (link here -

I have used 5 images from the substack of @os7borne. he has written a really nice article on Mobikwik here -

fintechinside.substack.com/p/fortyone

I had done a survey on Mobikwik (link here -

https://twitter.com/aditya_kondawar/status/1450097643917492229)

I have used 5 images from the substack of @os7borne. he has written a really nice article on Mobikwik here -

fintechinside.substack.com/p/fortyone

Also, a good interview by @chandrarsrikant Ji and @priyankasahay Ji here -

moneycontrol.com/news/business/…

End of thread! Thanks for reading :)

Hit the follow button to make sure you don't miss out on any IPO threads from me!

moneycontrol.com/news/business/…

End of thread! Thanks for reading :)

Hit the follow button to make sure you don't miss out on any IPO threads from me!

• • •

Missing some Tweet in this thread? You can try to

force a refresh