The top 10 stocks in #Nifty50 contributes more than 55% weight-age, the remaining 45% comes from other 40 stocks. This weight-age changes yearly twice based on stock performance. What if I choose to do SIP of Rs.10,000 every month only with Top 1 stock from this list?

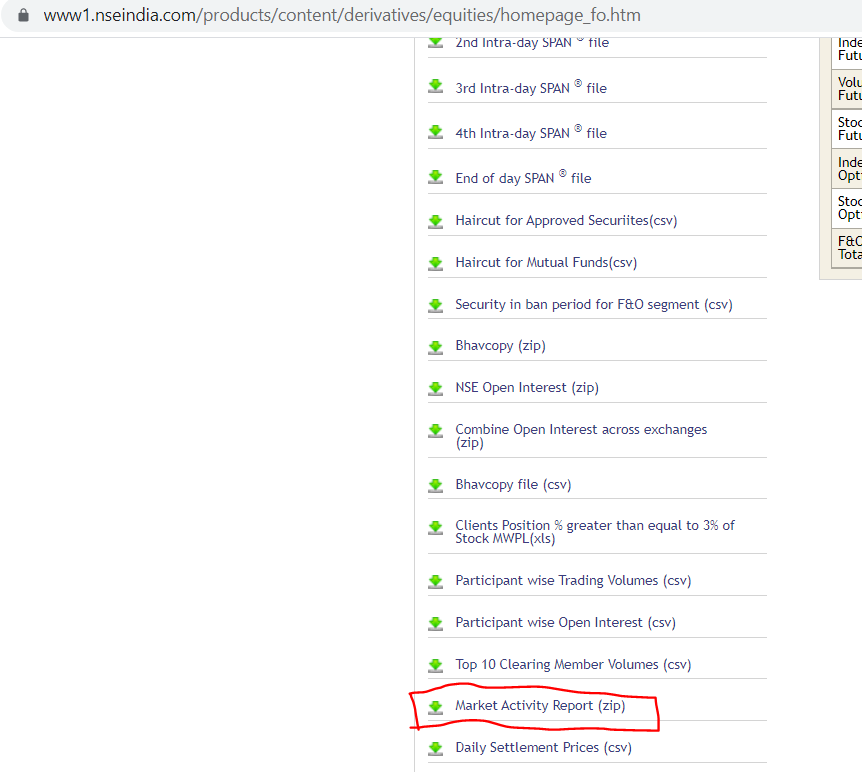

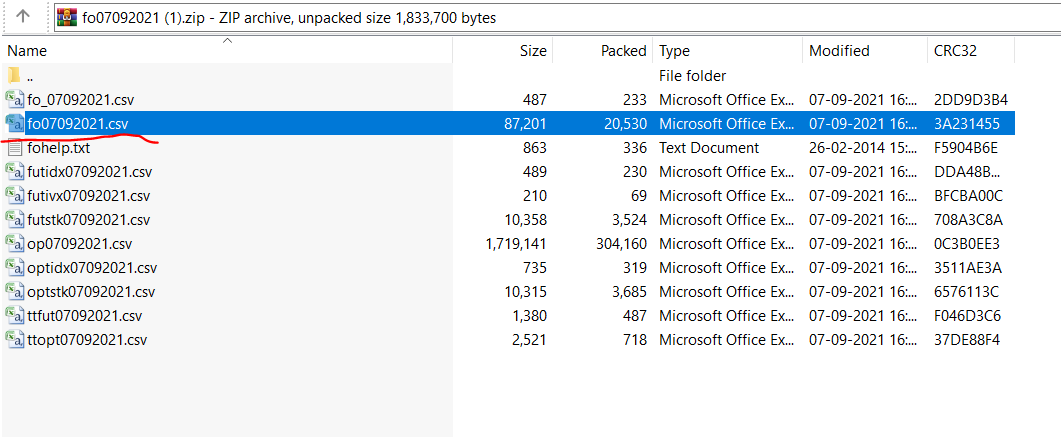

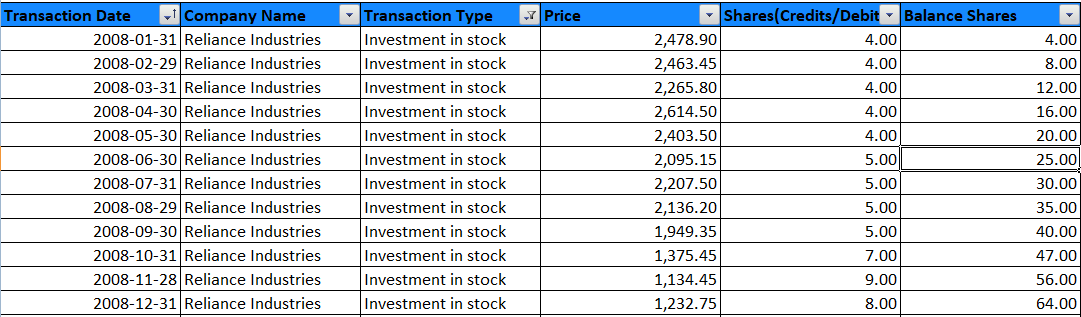

I downloaded last 13 years historical Nifty50 constituents from niftyindices.com and grabbed the top stock based on weight-age. Allocated Rs.10,000 every month into that stock.

Used @ValueResearch portal to upload the transaction to compute the final results inclusive of Bonus, Splits, Dividends etc. In last 13 years, these 5 stocks #HDFCBANK #ICICIBANK #ITC #RELIANCE & #INFY had the highest weight-age at different periods.

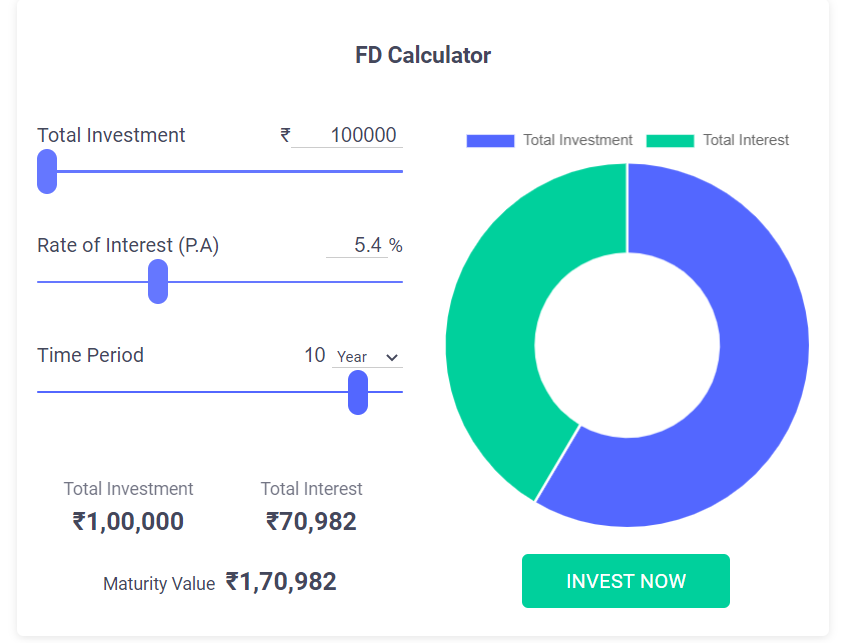

Total #SIP investment was around Rs.15 lacs in last 13 years and the fund value now is Rs.49 lacs, annualized return was 16%. If I had did the same SIP with #Niftybees my returns would have been around 12% to 14%.

But using the same index stocks, we are able to beat the index returns by using the simple rule of focusing on the top stock. Usually 20% of index stocks is responsible for the 80% of movement in index, but this test shows just top 1 stock can outperform index in the long run.

• • •

Missing some Tweet in this thread? You can try to

force a refresh