In part 2, we covered:

- Quant Tokenomics

- The importance of token velocity

In this thread we will cover:

- ODAP

- Partners

- CBDC’s

- more on Overledger

Let’s begin.

- Quant Tokenomics

- The importance of token velocity

In this thread we will cover:

- ODAP

- Partners

- CBDC’s

- more on Overledger

Let’s begin.

ODAP (Open Digital Asset Protocol)

In October of 2020, MIT & Quant announced a collaboration to push #crypto one step closer towards mainstream adoption.

ODAP.

*(Intel also plays a role in ODAP)*

In October of 2020, MIT & Quant announced a collaboration to push #crypto one step closer towards mainstream adoption.

ODAP.

*(Intel also plays a role in ODAP)*

For those that don’t know

The Massachusetts Institute of Technology is one of the leading institutions in the development of technology & science in the world.

MIT was also one of the first colleges to operate on ARPANET (covered in part one).

The Massachusetts Institute of Technology is one of the leading institutions in the development of technology & science in the world.

MIT was also one of the first colleges to operate on ARPANET (covered in part one).

Side note:

Lawrence G Roberts from MIT was selected as the first project manager of ARPANET

And a MIT telecommunication line was used in the testing environment for ARPANET, leading to the foundation of the packet-switching network.

Lawrence G Roberts from MIT was selected as the first project manager of ARPANET

And a MIT telecommunication line was used in the testing environment for ARPANET, leading to the foundation of the packet-switching network.

Quant & MIT submitted a proposal to the IETF that would allow

-Distributed ledgers in an open & interoperable format

- Session negotiation & message passing between gateways connection DLT systems

- Oracle Functionality

- KYC/AML/FATF compliance

The first of its nature.

-Distributed ledgers in an open & interoperable format

- Session negotiation & message passing between gateways connection DLT systems

- Oracle Functionality

- KYC/AML/FATF compliance

The first of its nature.

What does this mean?

Blockchains will be able to seamlessly interoperate through a single programmatic interface.

Legacy systems will also be able to communicate with this blockchain-agnostic protocol.

Financial institutions will be confident in a fully-compliant protocol.

Blockchains will be able to seamlessly interoperate through a single programmatic interface.

Legacy systems will also be able to communicate with this blockchain-agnostic protocol.

Financial institutions will be confident in a fully-compliant protocol.

IETF: Why are they important?

The Internet Engineering Task Force is a standards body that helped TCP/IP become the global standard for the internet

The Internet Engineering Task Force is a standards body that helped TCP/IP become the global standard for the internet

The US government, Intel, and other large institutions have already expressed interest in backing the proposal.

ARPANET, TCP/IP & the internet started out of the USA.

Has London with $QNT become the next great enabler of the #digital age and Web 3.0?

Time will tell.

ARPANET, TCP/IP & the internet started out of the USA.

Has London with $QNT become the next great enabler of the #digital age and Web 3.0?

Time will tell.

PARTNERS

Big names:

- SIA (HUGE)

- Oracle

- AWS

- Hyperledger Foundation

*SIA is apart of multiple DLT solutions: Spunta & Blockchain surety

(Italian Central Bank project)

Big names:

- SIA (HUGE)

- Oracle

- AWS

- Hyperledger Foundation

*SIA is apart of multiple DLT solutions: Spunta & Blockchain surety

(Italian Central Bank project)

Haw Hamburg university played a role in helping solve smart contract interoperability for Overledger

Overledger supports interoperability between these 5 large permissioned blockchain systems:

$ETH $JPM $XRP Corda ( $XDC ) & Hyperledger fabric

(Side note: In another thread I’ve done, the founders of $KDA created the $JPM Quorum project)

$ETH $JPM $XRP Corda ( $XDC ) & Hyperledger fabric

(Side note: In another thread I’ve done, the founders of $KDA created the $JPM Quorum project)

Interoperating these ecosystems indirectly gives them access to these potential clients to enable mass adoption:

Quant is also a guarantor of Pay.uk

The leading retail payments provider of the UK.

They move 6.7 TRILLION in GBP a year.

The leading retail payments provider of the UK.

They move 6.7 TRILLION in GBP a year.

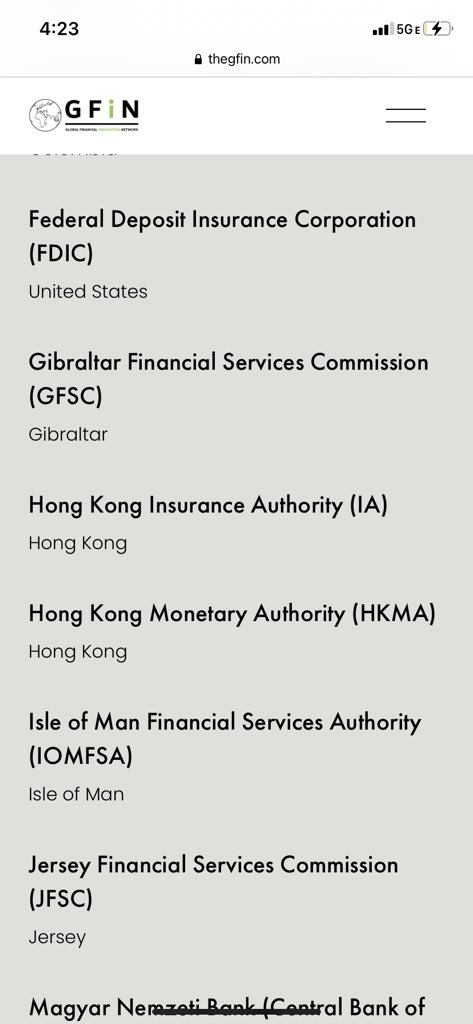

GLOBAL FINANCIAL INNOVATION NETWORK & $QNT

Quant partnered with Data 61 to run cross border trials with GFIN.

Members include:

- Central banks

- Regulators

- Consortiums

All around the world.

Quant partnered with Data 61 to run cross border trials with GFIN.

Members include:

- Central banks

- Regulators

- Consortiums

All around the world.

Next: CBDC’s.

Central Bank Digital Currencies are virtual fiat money issued by its countries central bank.

Purpose: financial inclusion & simplifying fiscal policy

What is $QNT ‘s role ?

Central Bank Digital Currencies are virtual fiat money issued by its countries central bank.

Purpose: financial inclusion & simplifying fiscal policy

What is $QNT ‘s role ?

CBDC’s

#Quant is officially part of the Digital Pound Foundation

Pushing for a UK #CBDC alongside some of the largest financial organizations in the UK & Europe

As well as $LCX for CBDC settlement implementation

#Quant is officially part of the Digital Pound Foundation

Pushing for a UK #CBDC alongside some of the largest financial organizations in the UK & Europe

As well as $LCX for CBDC settlement implementation

Here is a link from the Bank of International settlements (the central bank of central banks) on how CBDC’s can simplify cross border payments:

submitted to the G20:

bis.org/publ/othp38.pdf

submitted to the G20:

bis.org/publ/othp38.pdf

CONCLUSION:

Once again, I didn’t cover everything in detail that I wanted

But the info I provided here should be a good start to understanding the scope of $QNT

Achieving real world adoption

That has not been seen since

TCP/IP

🚀

Thanks for reading.

Once again, I didn’t cover everything in detail that I wanted

But the info I provided here should be a good start to understanding the scope of $QNT

Achieving real world adoption

That has not been seen since

TCP/IP

🚀

Thanks for reading.

• • •

Missing some Tweet in this thread? You can try to

force a refresh