Active addresses don't tell the entire story, but there are still sub-plots to every story.

#LTC active addresses went over 700k for the 1st time ever on Oct 14, 2021

#Ethereum active addresses have been on a decline since May 2021

Some potentials reasons?

A thread...

#LTC active addresses went over 700k for the 1st time ever on Oct 14, 2021

#Ethereum active addresses have been on a decline since May 2021

Some potentials reasons?

A thread...

2/ Over the past 12 months, tech & adoption breakthroughs have occurred for both #Litecoin & #Ethereum:

ETH: #NFTs, institutional investing, @Grayscale, PoS

LTC: @litebringergame @BitPay @PayPal @Venmo, institutional investing, Grayscale, OmniLite, etc.

Cont.

ETH: #NFTs, institutional investing, @Grayscale, PoS

LTC: @litebringergame @BitPay @PayPal @Venmo, institutional investing, Grayscale, OmniLite, etc.

Cont.

3/ Is the fact one (#LTC) is trending up in active addresses & one (#ETH) is trending down attributed to one becoming more used than the other?

It depends on what your definition of 'used' is. Ethereum is staked more prominently than Litecoin, causing less to circulate.

Cont.

It depends on what your definition of 'used' is. Ethereum is staked more prominently than Litecoin, causing less to circulate.

Cont.

4/ Active addresses data for both show #ETH dominance over #LTC for almost the entirety of their co-existence. Much different use cases to this point, much different user experience and investor as well.

ETH catching the imagination of Gen Z'ers with cute kitties & NFTs.

Cont.

ETH catching the imagination of Gen Z'ers with cute kitties & NFTs.

Cont.

5/ #LTC putting people to sleep with simply doing what it was programmed to do.

So what happened since May when #ETH was at 3.5 mln active addresses & LTC was at 340k?

ETH is a behemoth in this space, the mother that has given birth to more babies than Octamom.

Cont.

So what happened since May when #ETH was at 3.5 mln active addresses & LTC was at 340k?

ETH is a behemoth in this space, the mother that has given birth to more babies than Octamom.

Cont.

6/ Again, not one specific thing can be attributed with the falling daily active addresses for #ETH

But perhaps, just maybe, ETH's competitors have finally put a dent in it's armor & stolen market share (both in utility & investment) in respect to what ETH has to offer.

Cont.

But perhaps, just maybe, ETH's competitors have finally put a dent in it's armor & stolen market share (both in utility & investment) in respect to what ETH has to offer.

Cont.

7/ This steal of market share on all fronts is something #LTC & #BTC have gone through in multiple cycles. This is #ETH's first with real competition.

#LTC has weathered that storm & is coming out the other side. It's use case strengthened, its investor base resilient.

Cont.

#LTC has weathered that storm & is coming out the other side. It's use case strengthened, its investor base resilient.

Cont.

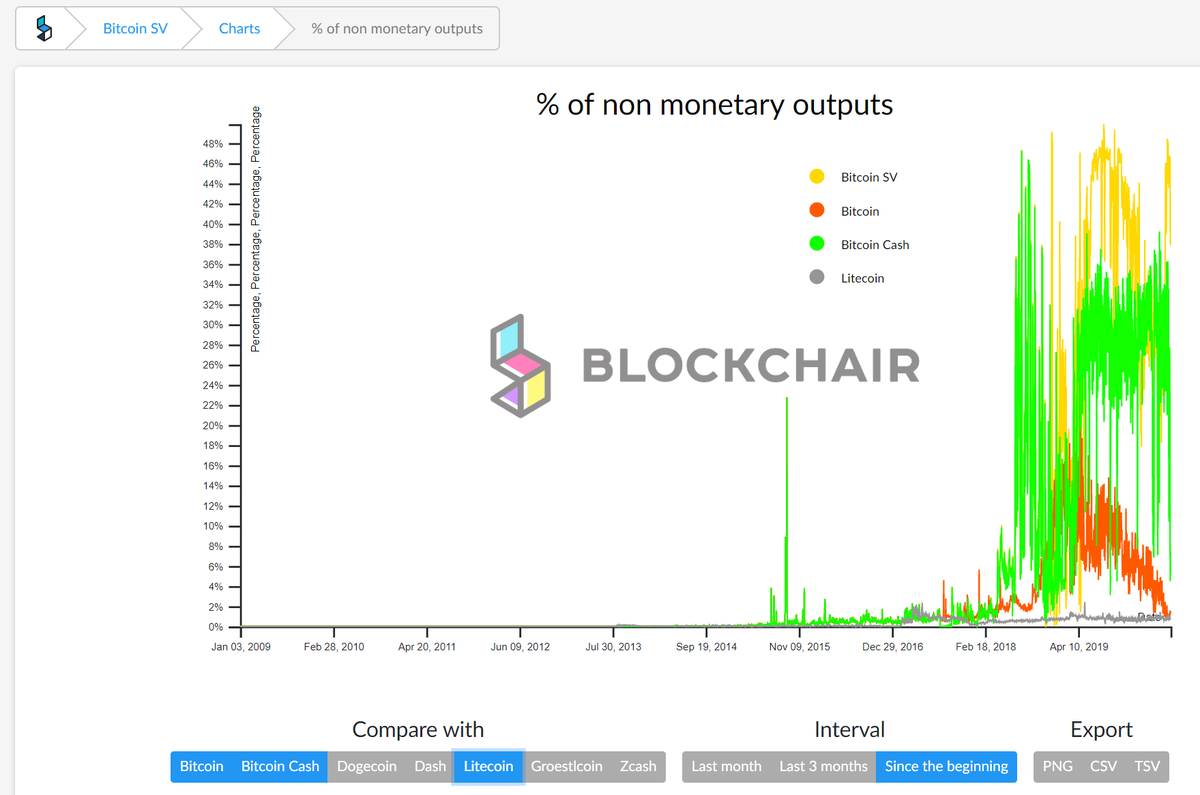

8/ 13,500 tokens, coins, etc. are in the #cryptocurrency market place. Yet, only 4 are normally adopted on large platforms first.

#BTC #ETH #LTC & #BCH

BTC & ETH are the darlings, but #LTC's growth & trx's grow as strong, if not more strong, than both by ratio.

Cont.

#BTC #ETH #LTC & #BCH

BTC & ETH are the darlings, but #LTC's growth & trx's grow as strong, if not more strong, than both by ratio.

Cont.

9/ The unfortunate aspect to all of this is agendas. #BTC & #ETH have strong financial backing by many sources.

#LTC? Not so much. It relies on a cash strapped non-profit and 10's of thousands of individuals globally to push it's utility, etc. It's like a mom & pop shop

Cont.

#LTC? Not so much. It relies on a cash strapped non-profit and 10's of thousands of individuals globally to push it's utility, etc. It's like a mom & pop shop

Cont.

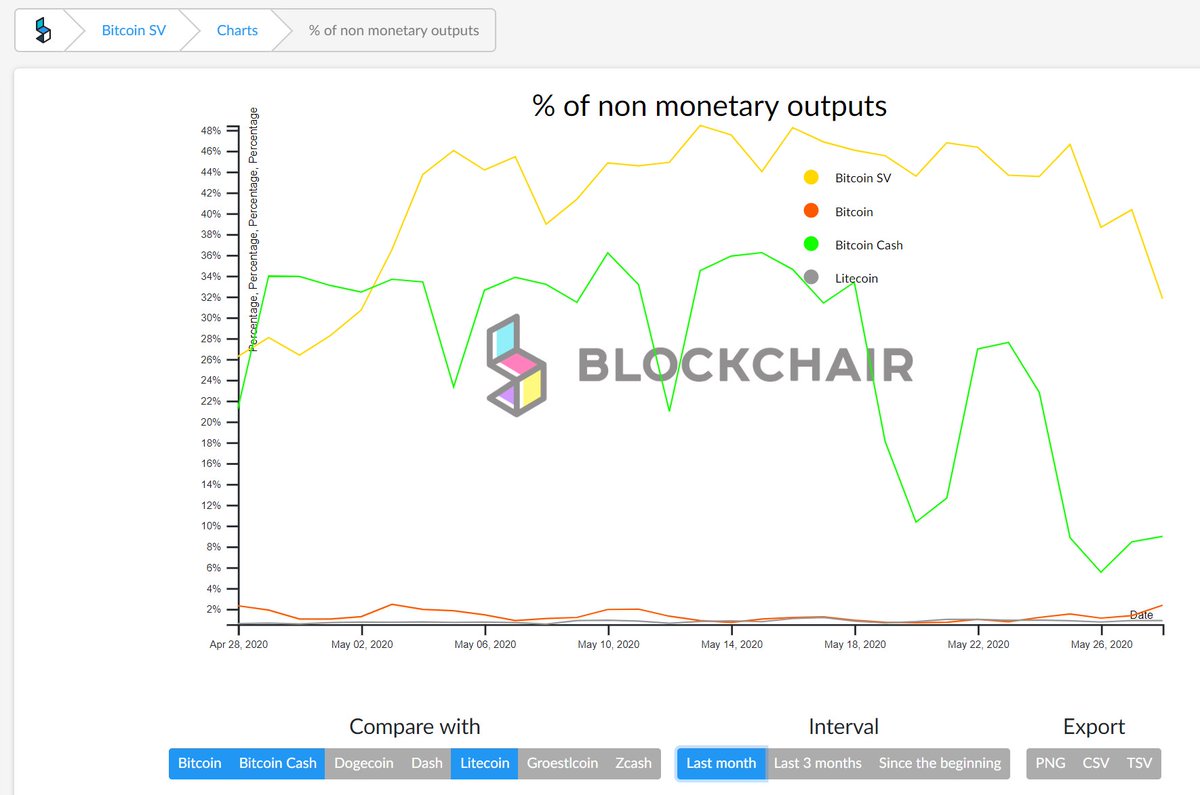

10/ But mom & pop #LTC have built a loyal following of investors & users the past 10 yrs. & now that following is arguably growing at a faster rate than #ETH in terms of actual on chain usage.

Gas fees for ETH? That too can be a catalyst. It's why people love to use LTC.

Cont.

Gas fees for ETH? That too can be a catalyst. It's why people love to use LTC.

Cont.

11/ No singular catalyst can be identified for the current flipping of active addresses between #LTC & #ETH as of late, but with enough enough time, it is becoming easier to ascertain the potential future trajectory, on chain utility-wise, of both if this trend continues.

Fin

Fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh