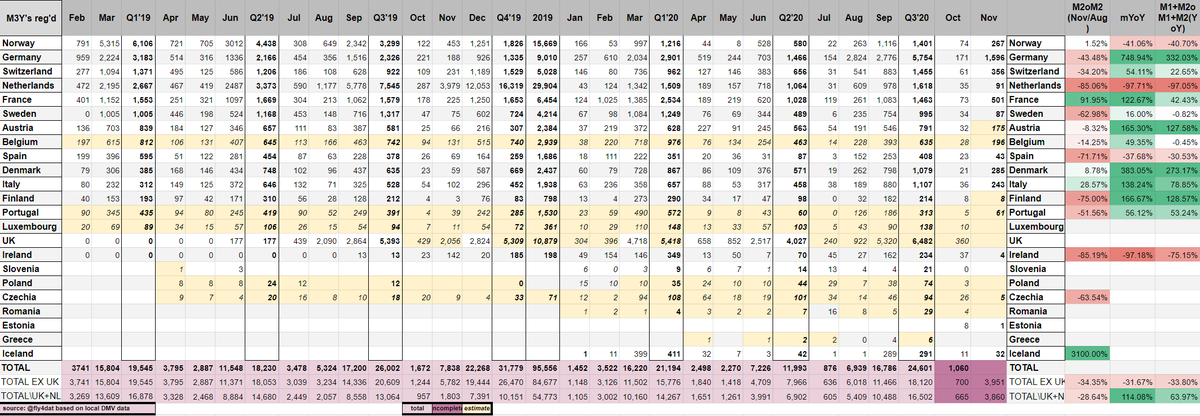

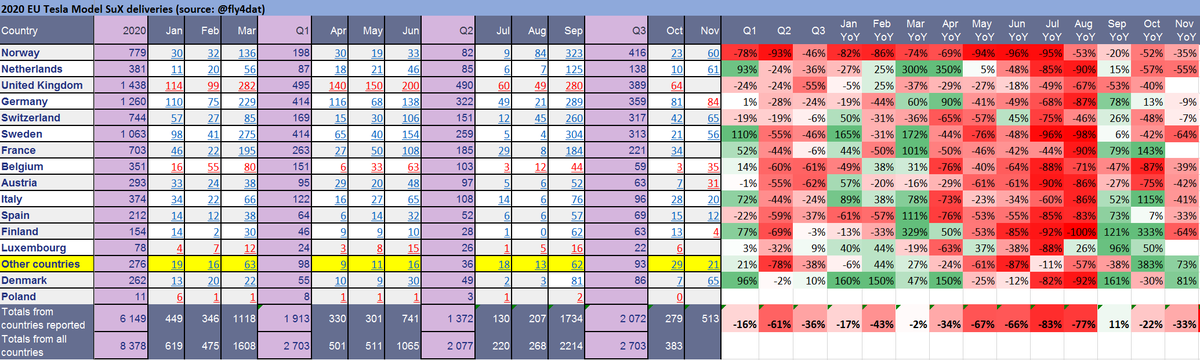

1/ Many bulls were surprised about the relatively low # of Teslas delivered in Q3 in Europe🇪🇺

I believe most all shipped have been delivered, and the # wasn't low at all.

$TSLA $TSLAQ

I believe most all shipped have been delivered, and the # wasn't low at all.

$TSLA $TSLAQ

2/ However, it's always a question how many unfilled orders have slipped to Q4. According to my *channel checks*, there have been a few from even early Q3 slipping into Q4, especially M3LR. We can say that Q3 demand was strong.

3/ But Q4 orders have been slow so far. Maybe the ~€2k price hike was too much for many. If you order a car today, you'll likely get it in November.

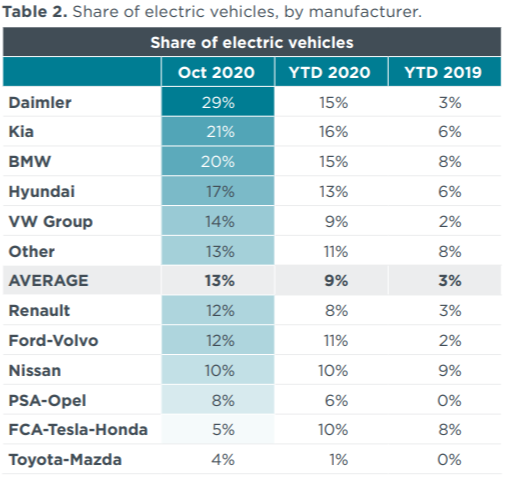

4/ Note that I'm currently not in the #nodemand camp. Most all other BEVs have wait times of 3-15 months, only Tesla delivers within a few weeks. That should drive a lot of extra demand in Tesla's way. Let's see how many they ship.

5/ Also, many might want to wait for "cheaper" MIG MY. Although I don't think costs would be lower, Tesla should decrease pricing to boost demand.

This doesn't apply to M3 though so M3 demand should not be impacted.

This doesn't apply to M3 though so M3 demand should not be impacted.

• • •

Missing some Tweet in this thread? You can try to

force a refresh