SJS Enterprises IPO Review

Know your IPO ✅

I know I was supposed to do this yesterday but there are just too many IPOs :')

Do retweet and help me educate more investors!

#IPOwithJST

Know your IPO ✅

I know I was supposed to do this yesterday but there are just too many IPOs :')

Do retweet and help me educate more investors!

#IPOwithJST

1/n

About SJS -

- A design-to-delivery aesthetics solutions provider

- Designs, develop and manufactures products for a wide range of customers on auto and consumer appliance side

- Supplied 115 mn+ parts, 6,000 SKUs in FY21 to 170 customers in 90 cities across 20 countries

About SJS -

- A design-to-delivery aesthetics solutions provider

- Designs, develop and manufactures products for a wide range of customers on auto and consumer appliance side

- Supplied 115 mn+ parts, 6,000 SKUs in FY21 to 170 customers in 90 cities across 20 countries

2/n

Customer base -

- OEMs - Suzuki, M&M, John Deere, VW, etc

- Tier-1 automotive component suppliers such as Marelli, Visteon, Brembo and Mindarika

- Consumer durables/appliances manufacturers such as Whirlpool, Panasonic, Samsung, Eureka Forbes, Godrej and Liebherr;

Customer base -

- OEMs - Suzuki, M&M, John Deere, VW, etc

- Tier-1 automotive component suppliers such as Marelli, Visteon, Brembo and Mindarika

- Consumer durables/appliances manufacturers such as Whirlpool, Panasonic, Samsung, Eureka Forbes, Godrej and Liebherr;

3/n

- medical devices manufacturers such as Sensa Core

- sanitary ware manufacturers such as Geberit

Long-standing relationships -

- With several customers.

- Q1FY22 - Relationship with 10 largest customers in terms of revenue averaged approximately 15 years

- medical devices manufacturers such as Sensa Core

- sanitary ware manufacturers such as Geberit

Long-standing relationships -

- With several customers.

- Q1FY22 - Relationship with 10 largest customers in terms of revenue averaged approximately 15 years

4/n

Principal raw materials and components -

- plastics, copper, nickel, aluminum, paints, inks, chemicals, adhesives, PVC, metalized polyester, polyethylene terephthalate, polycarbonate in the form of films, sheets, and resins

Principal raw materials and components -

- plastics, copper, nickel, aluminum, paints, inks, chemicals, adhesives, PVC, metalized polyester, polyethylene terephthalate, polycarbonate in the form of films, sheets, and resins

5/n

SJS recently completed the Exotech Acquisition pursuant to which Exotech became their Subsidiary on April 5, 2021.

SJS recently completed the Exotech Acquisition pursuant to which Exotech became their Subsidiary on April 5, 2021.

6/n

Issue Details -

Complete offer for sale of 800 Cr, so 1.47 cr shares being sold

Promoters own 3 cr shares that amount to 98.86% of the company

Promoters selling 50% of the company in an IPO!

Amusing!

Issue Details -

Complete offer for sale of 800 Cr, so 1.47 cr shares being sold

Promoters own 3 cr shares that amount to 98.86% of the company

Promoters selling 50% of the company in an IPO!

Amusing!

https://twitter.com/aditya_kondawar/status/1453956032393191429

7/n

Risks -

- Top 5 customer revenue - 63% of total revenue

- Top 10 customer revenue - 87.3% of total revenue

- Aesthetics markets in which they operate are undergoing significant changes, with an increasing focus on new products

Risks -

- Top 5 customer revenue - 63% of total revenue

- Top 10 customer revenue - 87.3% of total revenue

- Aesthetics markets in which they operate are undergoing significant changes, with an increasing focus on new products

8/n

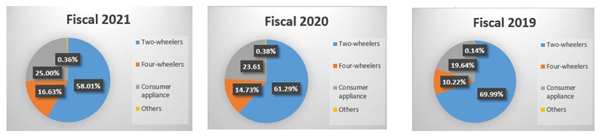

Financials -

Financials seem ok, CFO and FCF present (Growth or operational efficiency going ahead key monitorable)

Geographical and segment-wise Revenue breakups given

Financials -

Financials seem ok, CFO and FCF present (Growth or operational efficiency going ahead key monitorable)

Geographical and segment-wise Revenue breakups given

9/n

Peers -

- It does seem from this chart that SJS is doing the best amongst the peer set (They are the 3rd largest but they are doing the best, so why is that? This does need further digging)

- Competition is high

Peers -

- It does seem from this chart that SJS is doing the best amongst the peer set (They are the 3rd largest but they are doing the best, so why is that? This does need further digging)

- Competition is high

10/n

Valuation & Conclusion -

FY21 – EPS Rs 15.69 | RoE – 15.15% | BV – 105.05 (as of June 2021)

At Rs 542 upper band, PE 34.5x, 7.45x Price to sales, and 5.15x times P/BV

Total Market cap post listing –1648 Cr

Valuation & Conclusion -

FY21 – EPS Rs 15.69 | RoE – 15.15% | BV – 105.05 (as of June 2021)

At Rs 542 upper band, PE 34.5x, 7.45x Price to sales, and 5.15x times P/BV

Total Market cap post listing –1648 Cr

11/n

An aesthetic designer demanding a 7.45x price to sales that has not grown and is selling 50% of themselves seems like a risky proposition to us. (If they are making such super normal margins and doing the best, then why sell 50% as OFS?)

The conclusion is clear :)

An aesthetic designer demanding a 7.45x price to sales that has not grown and is selling 50% of themselves seems like a risky proposition to us. (If they are making such super normal margins and doing the best, then why sell 50% as OFS?)

The conclusion is clear :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh