1/n

About Sigachi -

- Incorporated in 1989 to manufacture chlorinated - paraffin and hydrochloric acid in Hyderabad

- in 1990- diversified to microcrystalline cellulose (“MCC”).

- 1996 - commenced exports - first order of MCC to Bangkok

About Sigachi -

- Incorporated in 1989 to manufacture chlorinated - paraffin and hydrochloric acid in Hyderabad

- in 1990- diversified to microcrystalline cellulose (“MCC”).

- 1996 - commenced exports - first order of MCC to Bangkok

2/n

- Engaged in manufacturing, marketing, and supplying of microcrystalline cellulose (“MCC”) that is widely used as an excipient for finished dosages in the pharmaceutical industry.

- 3 manufacturing units one at Hyderabad and one each at Jhagadia and Dahej in Gujarat

- Engaged in manufacturing, marketing, and supplying of microcrystalline cellulose (“MCC”) that is widely used as an excipient for finished dosages in the pharmaceutical industry.

- 3 manufacturing units one at Hyderabad and one each at Jhagadia and Dahej in Gujarat

3/n

- Due to the inert non-reactive and versatile nature of MCC, the product has varied applications in the pharma, food, nutraceuticals, and the cosmetic industries

- They make MCC of various grades - 15 to 250 microns, all of which are marketed by them under various brands

- Due to the inert non-reactive and versatile nature of MCC, the product has varied applications in the pharma, food, nutraceuticals, and the cosmetic industries

- They make MCC of various grades - 15 to 250 microns, all of which are marketed by them under various brands

4/n

- For instance, HiCel DG, a grade of MCC is used in pharma products to provide superior compatibility and robustness with low bulk density to the end-use dosage

- HiCel CE 15 another grade of MCC is used as raw material in the food industry to provide a creamier texture

- For instance, HiCel DG, a grade of MCC is used in pharma products to provide superior compatibility and robustness with low bulk density to the end-use dosage

- HiCel CE 15 another grade of MCC is used as raw material in the food industry to provide a creamier texture

5/n

Issue Details -

- Fresh issue of 125 cr

- Rs 500 cr total market cap post listing

- Very Small company and very small IPO

Objects of Issue -

Issue Details -

- Fresh issue of 125 cr

- Rs 500 cr total market cap post listing

- Very Small company and very small IPO

Objects of Issue -

6/n

Risks -

- MCC products accounted for 75% of their revenues

- Top 5 customer revenue was 47.93%

- Contingent liability of Rs 6 Cr

Risks -

- MCC products accounted for 75% of their revenues

- Top 5 customer revenue was 47.93%

- Contingent liability of Rs 6 Cr

7/n

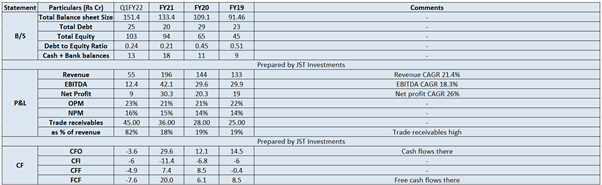

Financials –

Good Growth + Margins Maintained

Valuation & Conclusion -

FY21 EPS – 13.13 | RoE – 32.12% | NAV Q1FY22 – 44.8

At upper price of Rs 163, P/E 12.4x, P/BV 3.64x,P/S 2.5x.

We want to sit this out/wait and watch as this is a small company worth Rs 500 Cr

Financials –

Good Growth + Margins Maintained

Valuation & Conclusion -

FY21 EPS – 13.13 | RoE – 32.12% | NAV Q1FY22 – 44.8

At upper price of Rs 163, P/E 12.4x, P/BV 3.64x,P/S 2.5x.

We want to sit this out/wait and watch as this is a small company worth Rs 500 Cr

• • •

Missing some Tweet in this thread? You can try to

force a refresh