I have a sad announcement for all of my #fintwit friends who post frequently about real yields and the market's long term #inflation expectations

It's fake, and its staring us right in the face

The @federalreserve

is in near full control of this "market based" signal

Proof

1/

It's fake, and its staring us right in the face

The @federalreserve

is in near full control of this "market based" signal

Proof

1/

Anyone who needs a reminder, the breakeven rate is the yield on a nominal treasury bond less the yield on treasury inflation protected securities

It's an approximation of the market's expectation of future inflation over the duration of the bond

Yield and price move inverse

It's an approximation of the market's expectation of future inflation over the duration of the bond

Yield and price move inverse

More buying of nominal bonds pushes nominal yields lower

Same for TIPS

When more buying power comes in, the price of any asset moves up

Powell continually says that he's only concerned about inflation if long term inflation expectations become "untethered"

Same for TIPS

When more buying power comes in, the price of any asset moves up

Powell continually says that he's only concerned about inflation if long term inflation expectations become "untethered"

The way we measure those expectations is by looking at long term breakeven rates

If the market thinks that future inflation will be higher, they will buy more TIPS and less nominal bonds, driving the TIPS price up, bond prices lower, and the breakeven rate higher

If the market thinks that future inflation will be higher, they will buy more TIPS and less nominal bonds, driving the TIPS price up, bond prices lower, and the breakeven rate higher

Tons of algos and models utilize these breakeven, real rate, expectations

But what happens when the signal that Powell is looking at is captured by the fed? How is it a market signal if it's not a free market?

Lets look at 20-year breakeven rates

But what happens when the signal that Powell is looking at is captured by the fed? How is it a market signal if it's not a free market?

Lets look at 20-year breakeven rates

Using bonds with maturities 18-22 years out, at the end of October the fed owned:

57.5% of the 18-22 year treasury bond market

53.0% of the 18-22 year TIPS market

The controls over half the market at the 20yr maturity

And why is there a gap in ownership of bonds vs TIPS?

57.5% of the 18-22 year treasury bond market

53.0% of the 18-22 year TIPS market

The controls over half the market at the 20yr maturity

And why is there a gap in ownership of bonds vs TIPS?

If they dont intervene equally, then they are impacting the signal of breakeven rates

Breakeven inflation rates would be higher if the fed had to either sell some of these normal bonds or buy more TIPS to equalize holdings

But here's comes the best part:

Breakeven inflation rates would be higher if the fed had to either sell some of these normal bonds or buy more TIPS to equalize holdings

But here's comes the best part:

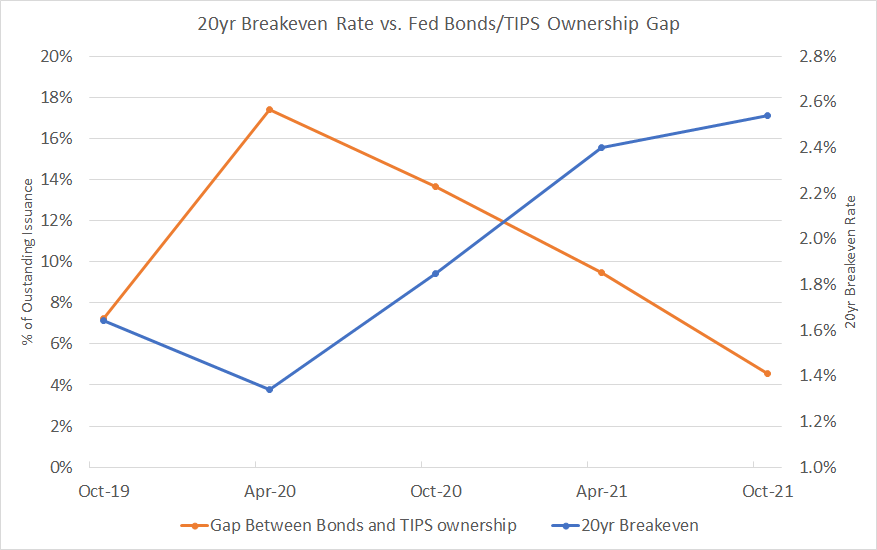

Walking backwards in 6-month intervals just a few steps, the impact of this intervention becomes clear

Here is the percentage of each market the fed has controlled over the past 2 years:

Here is the percentage of each market the fed has controlled over the past 2 years:

If you subtract fed ownership of 20-year TIPS from that of 20-year bonds, you get the orange line shown below

You can plot this next to the 20-year breakeven rate in blue,

Then you see this is a fed controlled and captured market

The fed controls the #inflation signal

You can plot this next to the 20-year breakeven rate in blue,

Then you see this is a fed controlled and captured market

The fed controls the #inflation signal

• • •

Missing some Tweet in this thread? You can try to

force a refresh