SELL PRESSURE IN ALL EXCHANGES

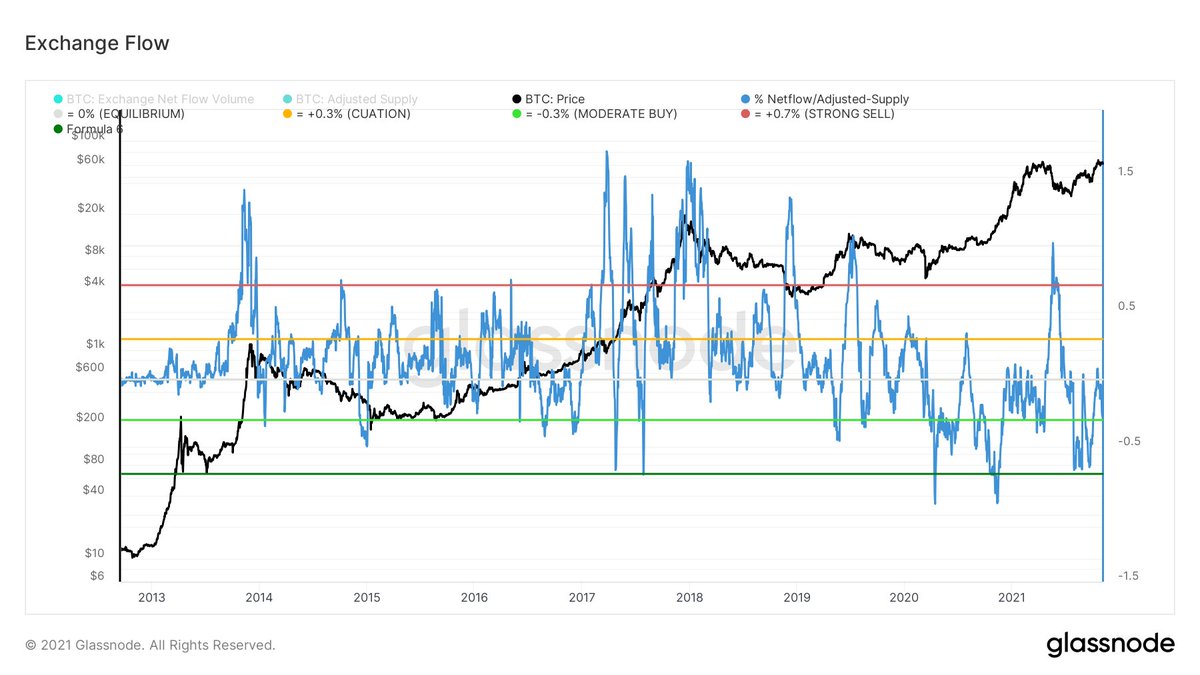

🧵/1.To estimate the intensity of in/outflows to/from all exchanges, we can measure the #NetFlow magnitude as % of adjusted supply (excluding lost & +7 year dormant). Here, I calculated the (30D-aggregated #NetFLow to all exchanges/adjusted supply)

🧵/1.To estimate the intensity of in/outflows to/from all exchanges, we can measure the #NetFlow magnitude as % of adjusted supply (excluding lost & +7 year dormant). Here, I calculated the (30D-aggregated #NetFLow to all exchanges/adjusted supply)

🧵/2. At the market's 2013-14 & 2017-18 tops, we can see the monthly aggregated #NetFlow to all exchanges reached levels above > + 0.75% of adjusted supply.

🧵/3. Reversely, during the bearish periods, we had #NetFlow (withdrawal); - 0.5% to - 0.75%.

Comparing the current market structure with YTD historical data, we can see the #NetFlow levels is similar to Dec 2020 (#BTC ~ 20K); < 0.0%.

Comparing the current market structure with YTD historical data, we can see the #NetFlow levels is similar to Dec 2020 (#BTC ~ 20K); < 0.0%.

🧵/4. Last time we were at 60-64K, this metric was showing massive inflows (on a monthly base); >+0.75%. However, recent ATH was achieved while the #NetFlow was in equilibrium-outflow range !!!

دوستان امشب یک تحلیل جامع ضبط خواهد شد. کانال یوتیوب رو دنبال کنید، چرا که حجم ویدیوها سنگین خواهد بود و در یوتیوب با کیفیت کمتر هم قابل دیدن است.

لینک مستقیم به کانال یوتیوب

youtube.com/channel/UCTSU6…

لینک مستقیم به کانال یوتیوب

youtube.com/channel/UCTSU6…

• • •

Missing some Tweet in this thread? You can try to

force a refresh