🧵/1-Due to the innovative approach towards #BTC price valuation based on #Scarcity, the #S2F model by @100trillionUSD has attracted a lot of attention in the community since 2019. After the recent market's 50% drop, the S2F_price deflection from Market_price caused a huge debate

🧵/2- I have two theories for this descending behaviour in the #S2F deflection graph.

A- The #S2F model is only a function of Scarcity. However, Scarcity can be exaggerated/neutralized by other factors such as wealth distribution's equality in the network; Gini Coeff

A- The #S2F model is only a function of Scarcity. However, Scarcity can be exaggerated/neutralized by other factors such as wealth distribution's equality in the network; Gini Coeff

🧵/3- Therefore, if we redefine the S2F model to include the Gini Index, we can improve the price prediction performance (lower deflection). Gini Coeff calculation requires T3 data offered by @glassnode (I don't have them)

news.earn.com/quantifying-de…

news.earn.com/quantifying-de…

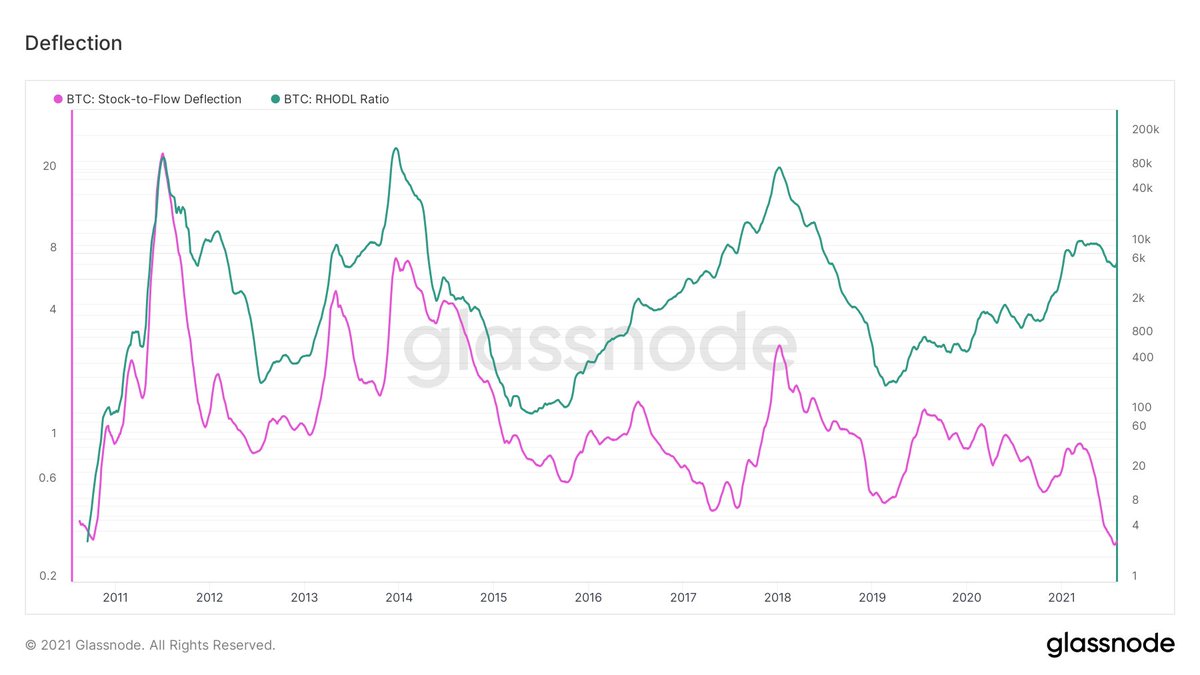

🧵/4- An alternative for the Gini index to gauge the distribution dynamic in the market, we can employ #RHODLRatio by @glassnode. If we compare the RHODL Ratio and S2F deflection ratio, you would see an obvious correlation there.

🧵/5- This correlation shows that #S2F deflection (so do S2F price) is a function of wealth distribution equality as well as wealth scarcity.

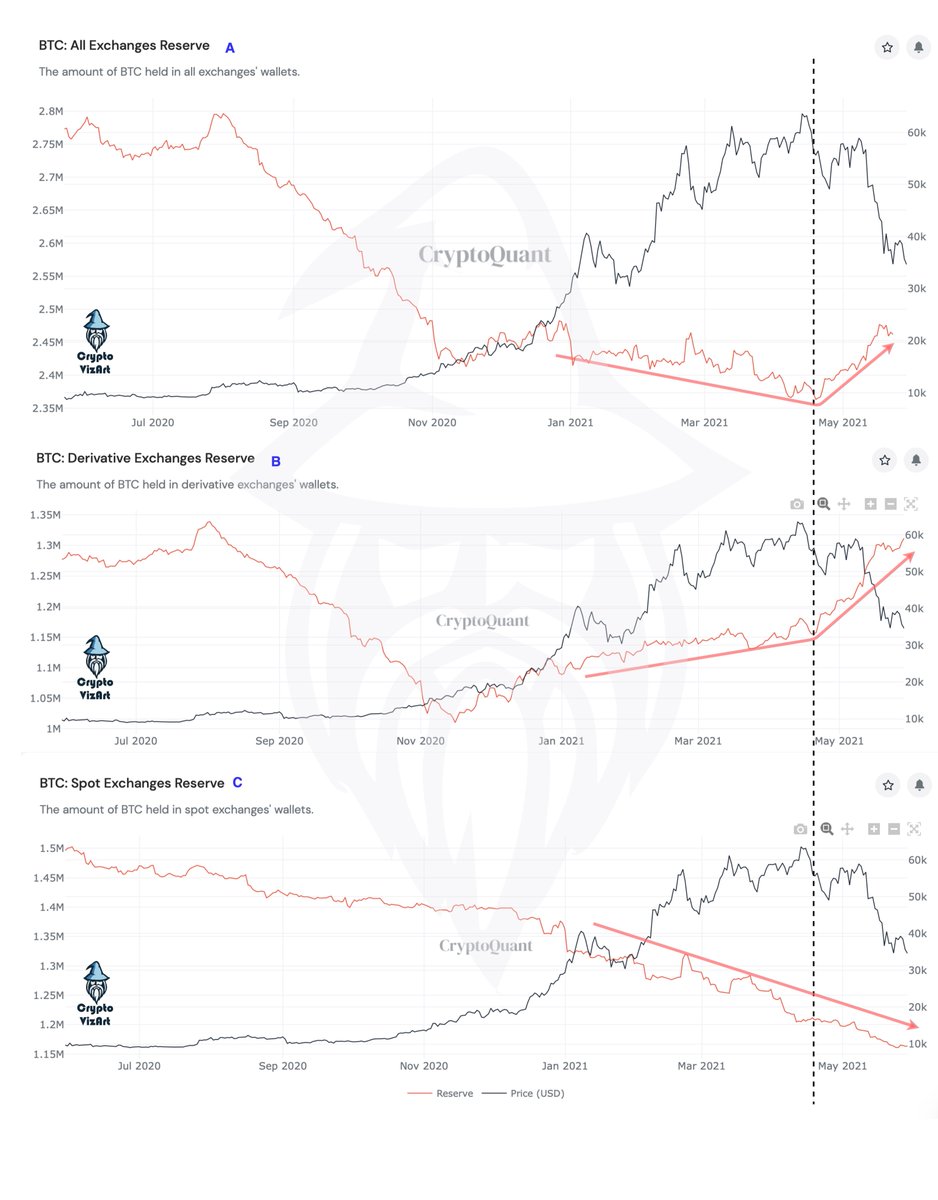

B- The second explanation could be the error in Scarcity calculation.

B- The second explanation could be the error in Scarcity calculation.

🧵/6- @100trillionUSD defined Scarcity as Stock (circulating supply)/Flow (issuance rate) in his article. Where the Issuance rate is perfectly administrated/set by the network. However, the circulating supply in PlanB’s model is only adjusted by 1 Million Satoshi’s coins.

🧵/7- The lost coins are not considered in Scarcity calculation. The best source for lost supply is the #AdjustedSupply offered by @Glassnode (Coins that were active +7 years ago are subtracted from the total supply). Here you can see the total supply( ⚫️) vs AdjustedSupply (🔵).

🧵/8- Recalculating the Scarcity = Stock/Flow by #AdjustedSupply (instead of Total Supply - Saoshi's #BTC) can lead to some improvements in #S2F model price prediction as well.

@n3ocortex thanks to @glassnode for workbench !

• • •

Missing some Tweet in this thread? You can try to

force a refresh