#PayTmIPO – Long Thread:

There is a new game in town. The rules are “well laid out” by VCs – Report just 3 yr financials, blame flat sales since 2019 on covid, pick consultants to project fancy story, price IPO at 45 times sales, create scarcity of “limited offer” of 12% shares”

There is a new game in town. The rules are “well laid out” by VCs – Report just 3 yr financials, blame flat sales since 2019 on covid, pick consultants to project fancy story, price IPO at 45 times sales, create scarcity of “limited offer” of 12% shares”

12% stake sale ~matches the “principal investment” by VCs. Oh, by the way, get some tranches of funding just before IPO that values your company closer to issue price. It’s like you buying your own house again for 2x price. May not work for you but somehow seems to work for VCs.

Now rope in mutual funds with 75% of this scarce offering (SIP money will go somewhere after all) & leave retail scrambling for 2.5% stake of a brand that is now a “household name”. Get brokerage firms & YouTube advisors to keep pumping story with same broken records from DRHP.

Vola ! You have launched a successful IPO. With principle off the table, you still have 88% ownership to be gradually transferred overtime to domestic mutual funds, riding on retail (other peoples) money.

They say “a fool & his money will always be parted”.

They say “a fool & his money will always be parted”.

Everyone rewards excellence & those are rare. Internet is about winner takes all, where one or 2 players dominate the entire industry.

But who rewards mediocrity? Well, enter #PaytmIPO. If Infosys & TCS were a bet on excellence, Paytm is a bet on mediocrity. We’ll see how.

But who rewards mediocrity? Well, enter #PaytmIPO. If Infosys & TCS were a bet on excellence, Paytm is a bet on mediocrity. We’ll see how.

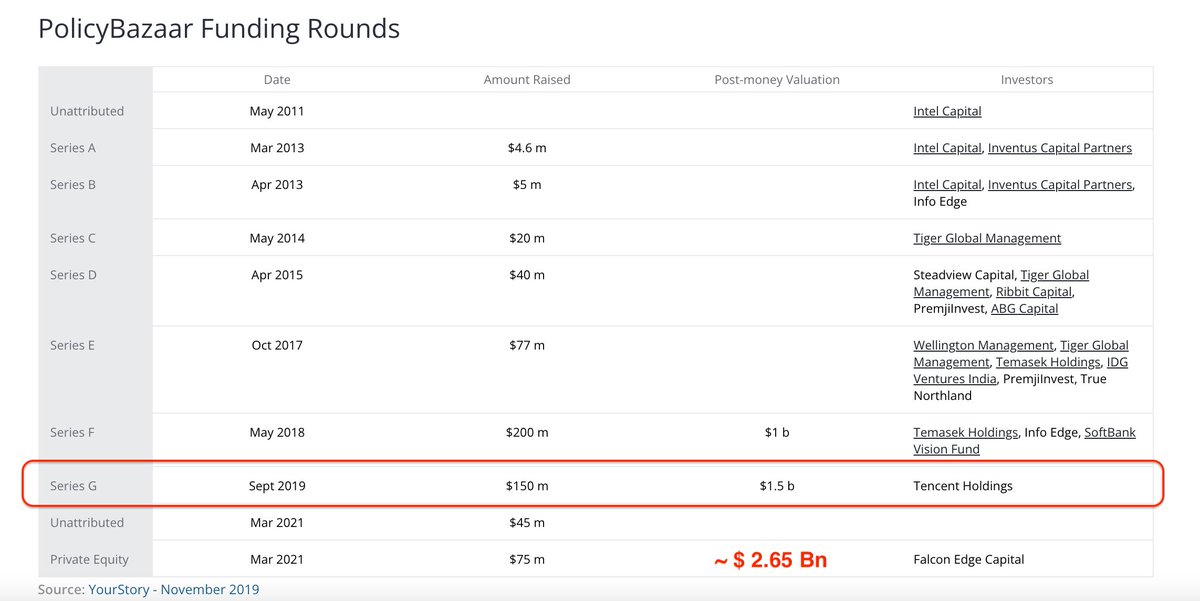

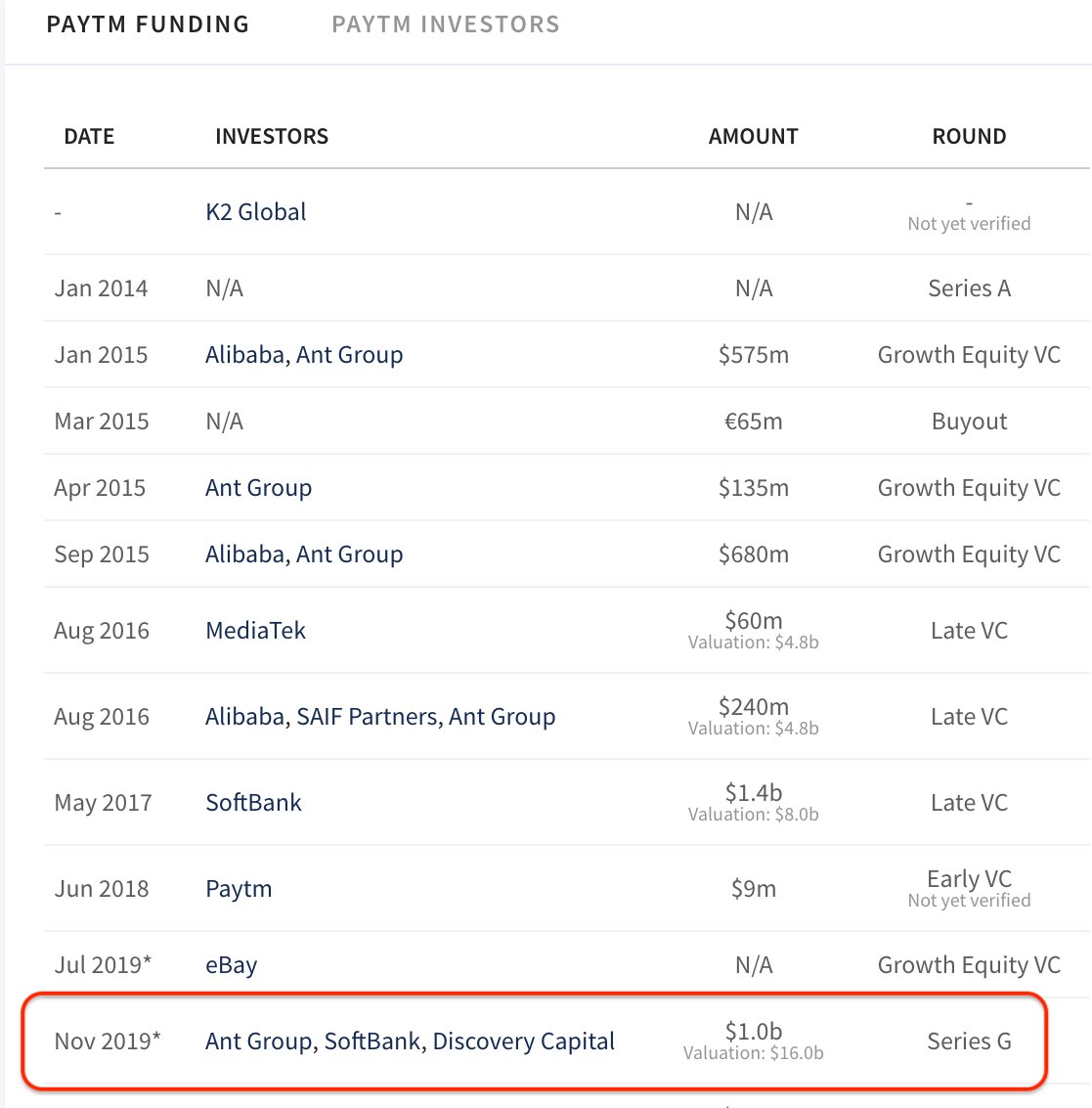

Before we get to business model, see the valuation ladder where owners keep valuing their own property & higher rates.

But there is a catch here – Paytm seems to have got the last funding in 2019 at $ 16 Bn valuation. On that, the current pricing at $ 20 Bn seems fair, isn’t it?

But there is a catch here – Paytm seems to have got the last funding in 2019 at $ 16 Bn valuation. On that, the current pricing at $ 20 Bn seems fair, isn’t it?

Hmm….it’s easy to draw this conclusion unless you notice that this funding came in Nov 2019. Why is this critical? The world didn’t know about Covid.

Something tells me that the IPO was planned for 2020. But then Covid stuck in March 2020. No IPO happens in a bear market. Oops!

Something tells me that the IPO was planned for 2020. But then Covid stuck in March 2020. No IPO happens in a bear market. Oops!

So here we are. #PaytmIPO asking Rs 18,300 Cr ($ 2.5 Bn) valuing the company at 1.5 lac Cr ($ 20 Bn). That puts Paytm in the league of top 25 cos, well almost.

If Paytm doubles from here, it will be bigger than Axis bank & close to Kotak bank.“Super app” bigger than these banks?

If Paytm doubles from here, it will be bigger than Axis bank & close to Kotak bank.“Super app” bigger than these banks?

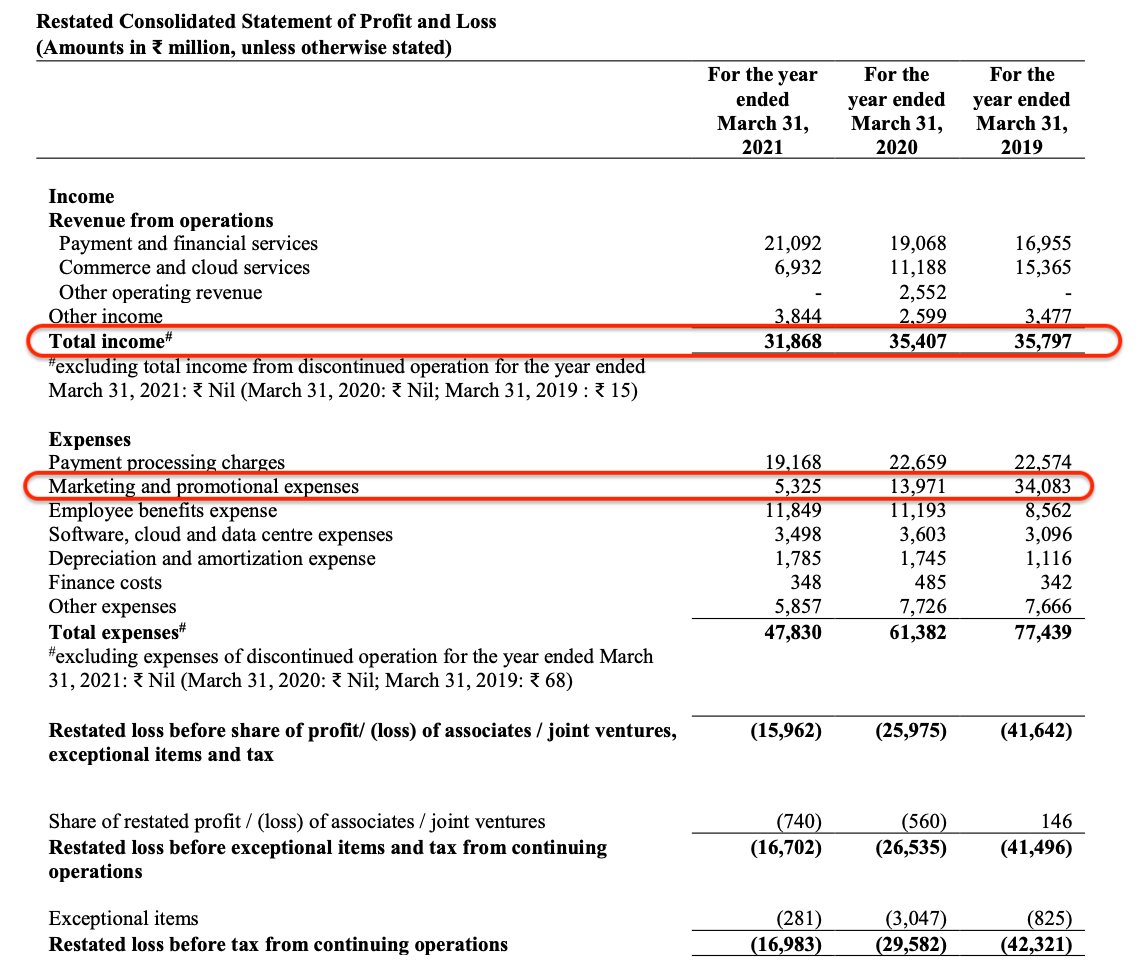

You’ll say, well #Paytm has potential…..right ? Well, the revenue is all of Rs ~3200 Cr & has stayed stagnant since FY19. Also almost entire loss reduction (Rs 1500 Cr loss in FY’21) comes from reducing promotional expenses. (Remember 2020 planned listing)

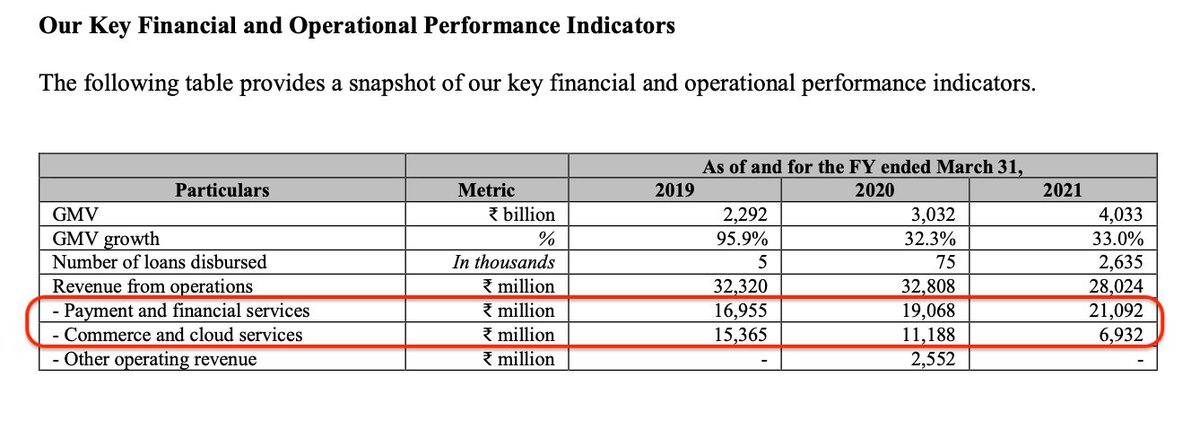

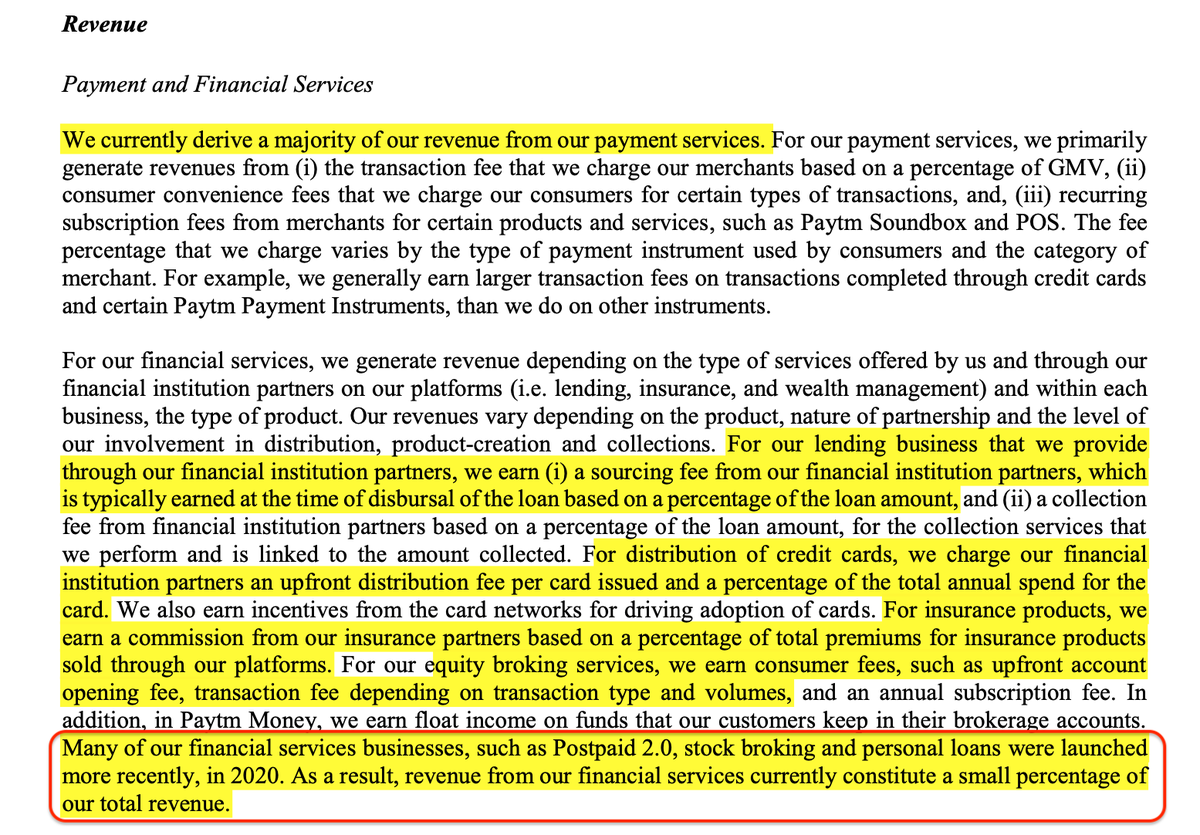

But we need to dig more on revenue sources. #Paytm is largely in 2 clusters – Financial services & eCommerce. Revenues from payments (& fin svcs) grew, albeit at 33% for last 2 yrs whereas “eCommerce & cloud” biz is falling substantially, indicating that this segment is declining

What was “eCommerce & cloud” biz? Remember Paytm Mall eCommerce biz which was to take on Flipkart & Amazon?

Then there is ticketing biz, again trying to compete with the biggies already established in ticketing. We see new segments tried & folded without significant leadership

Then there is ticketing biz, again trying to compete with the biggies already established in ticketing. We see new segments tried & folded without significant leadership

Sometime in 2020, Paytm decided to be a financial super app v/s competing on eCommerce. It earns brokerage fee from banks/NBFC/Insurers for loans, cards, insurance, etc. In a captured space, it is just new entrant. As quoted “financial svcs revenue is small % of our revenue”

Do you want to pay for yet another shot at diversification in spaces that are crowded, given failed experiments ? How much can an app cross-sell?

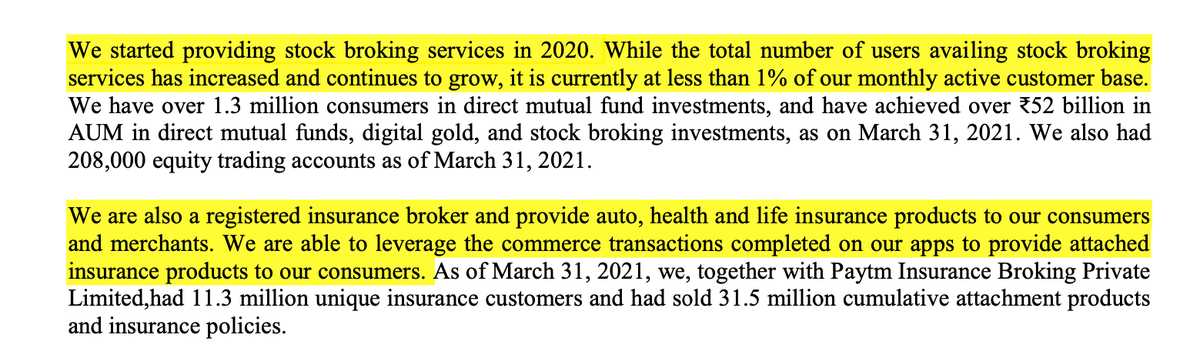

While industry is worried with too many stocks trading accounts, Paytm has barely started.What leadership execution do we value here?

While industry is worried with too many stocks trading accounts, Paytm has barely started.What leadership execution do we value here?

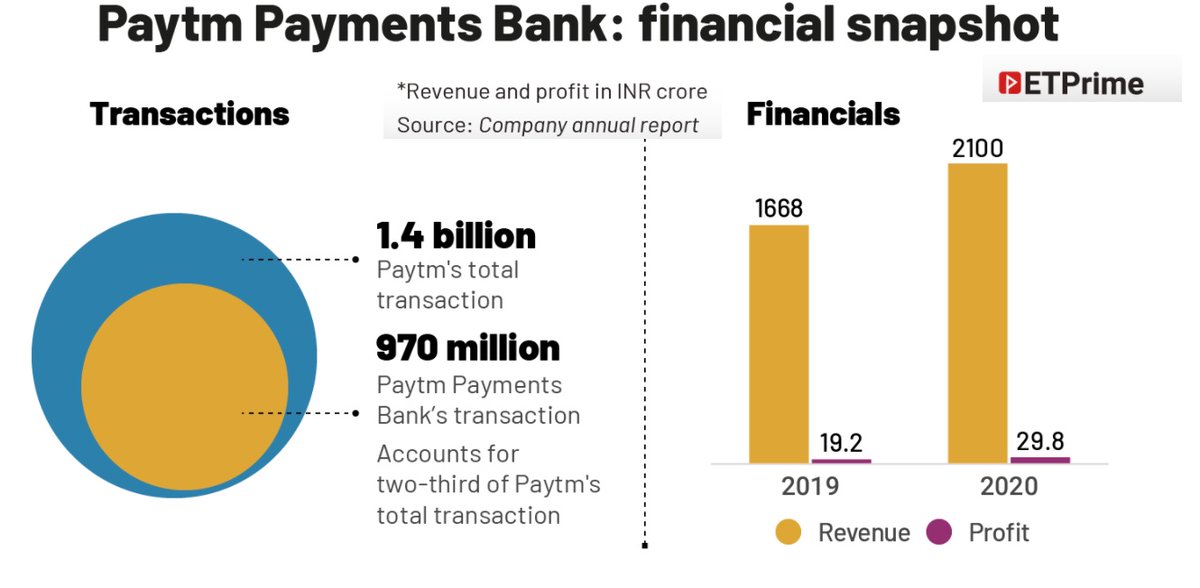

Brings us to the much talked about payments bank. Banks make money largely by lending, but these banks can’t lend. So how strong is this entity? Co says ~6 crore accounts. With “deposits” of Rs 3200 Cr that works to Rs 500 per account! Is this where money will be made?

Paytm payment bank makes Rs 2100 Cr topline. 70% transactions in payment bank come from not the bank customers but via Paytm itself.

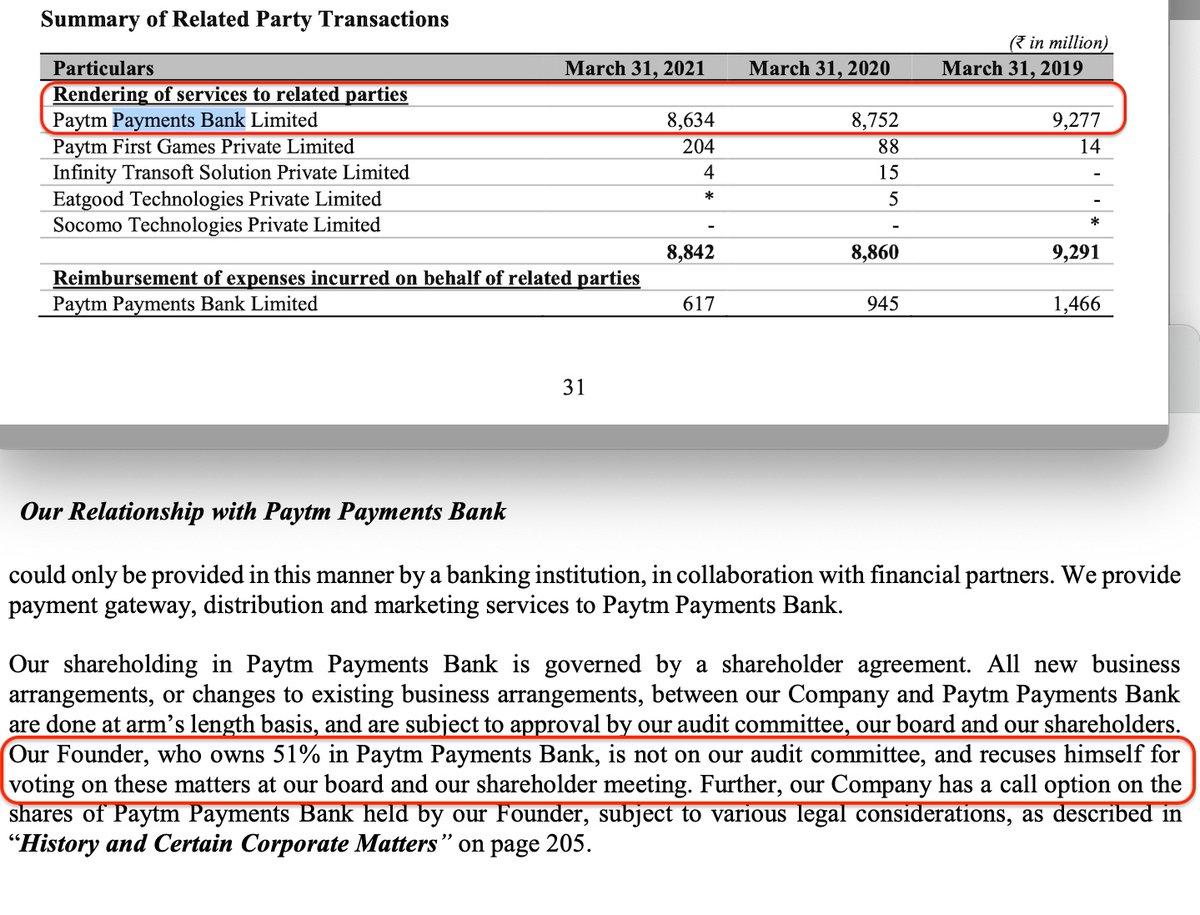

Look at related party tranx disclosed in DRHP: Paytm pays Rs ~900 Cr revenue to its payment bank, which is owned 51% by promotor VSS. Hmm…okay!

Look at related party tranx disclosed in DRHP: Paytm pays Rs ~900 Cr revenue to its payment bank, which is owned 51% by promotor VSS. Hmm…okay!

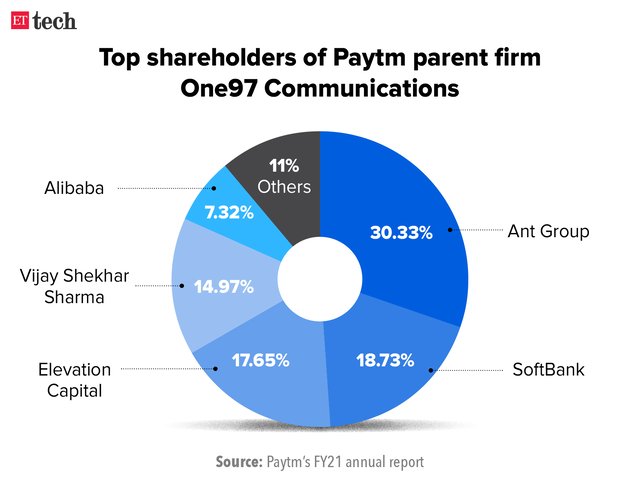

You see why such maze of cross ownership & 38% direct Chinese stake doesn’t inspire confidence for banking biz.

No wonder the small bank & insurance licenses are lying with RBI & IRDA for over a year. Post IPO, “Ant fin” stake will fall <25% but is that good to inspire trust?

No wonder the small bank & insurance licenses are lying with RBI & IRDA for over a year. Post IPO, “Ant fin” stake will fall <25% but is that good to inspire trust?

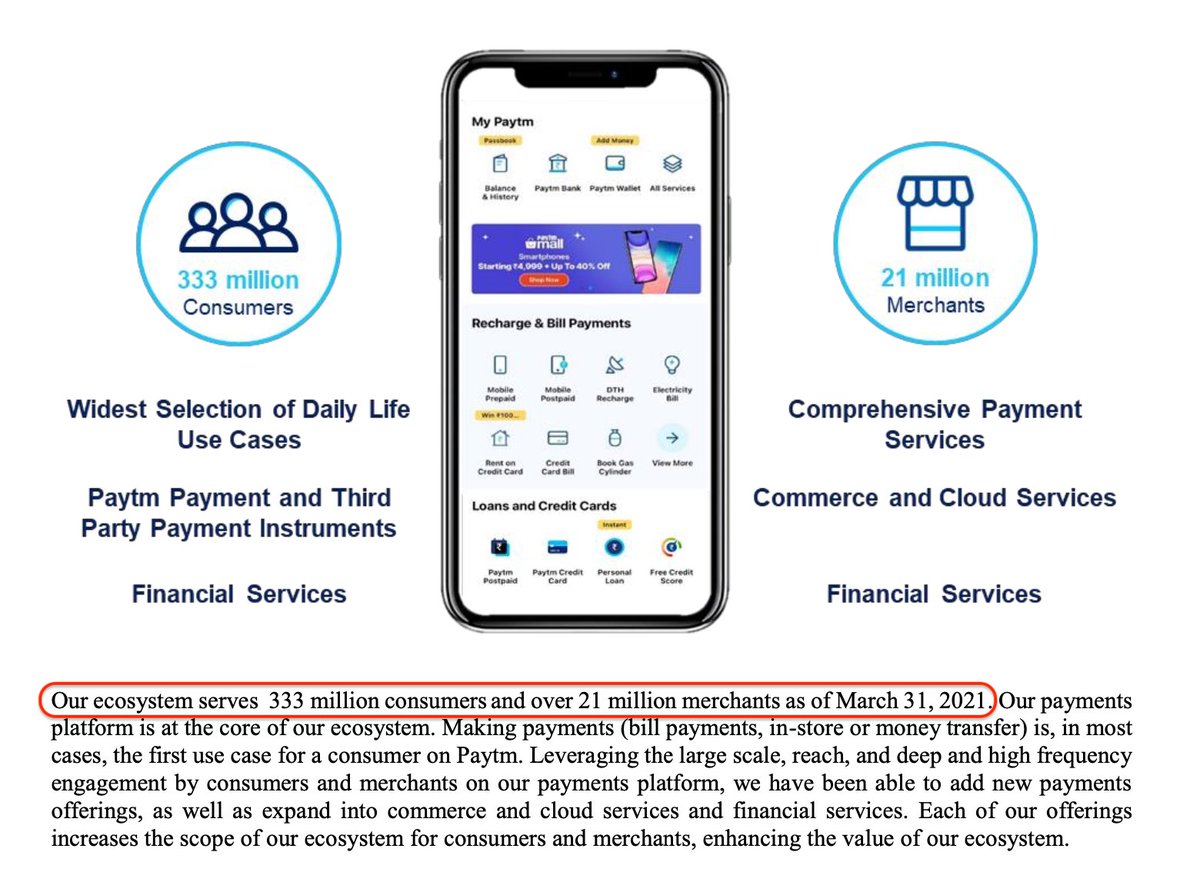

Finally, let’s examine the core of #Paytm on which the super app is built. The payments business that claims 330 Mn “users”. However active user number drops to ~50 Mn that has been stagnant.

330 Mn “users” means 33 Cr people have tried Paytm at some point but haven’t adopted it

330 Mn “users” means 33 Cr people have tried Paytm at some point but haven’t adopted it

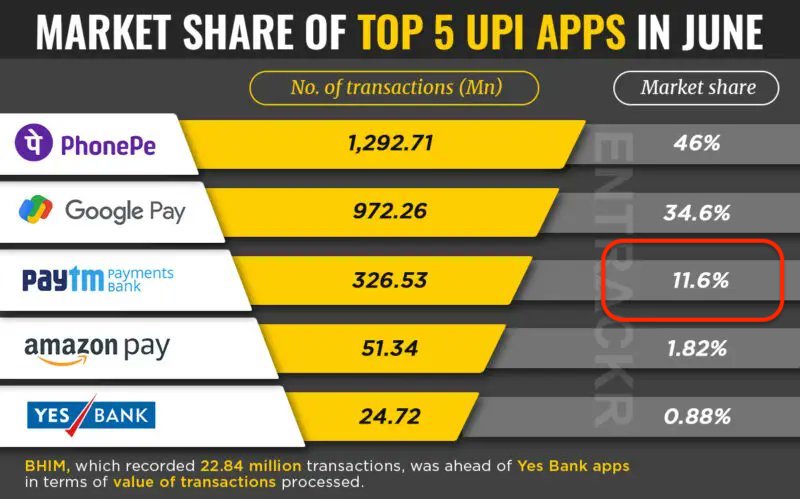

Is Paytm a household name – yes, of course. When you have 33 Cr users in a country of ~25 Cr households, almost everyone knows you. But only 15% of those are real users. There is no more adoption now. You know what killed it? See graphic – Paytm has just 12% share on UPI tranx.

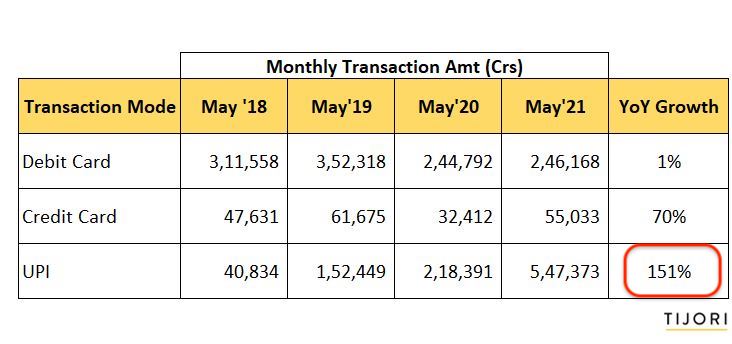

See the trend below (data by @Tijori1 ) which clearly indicates that digital payments market which was actually “disrupted” by Paytm is going the UPI way while elite segment is always grabbed by credit cards. A comeback in any of these categories by #Paytm looks very difficult.

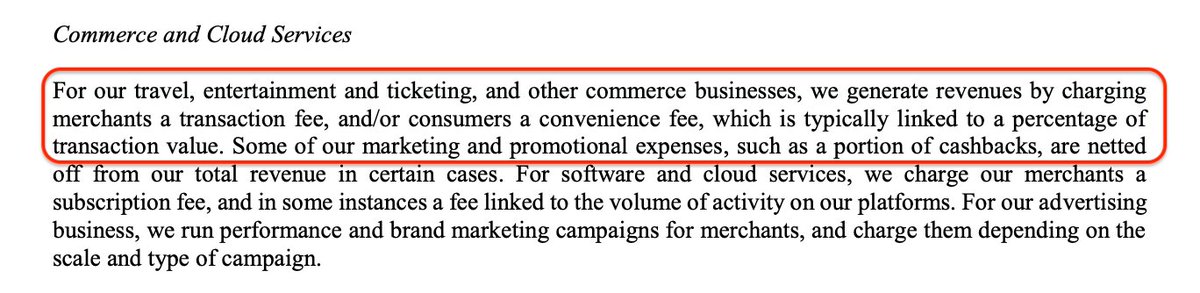

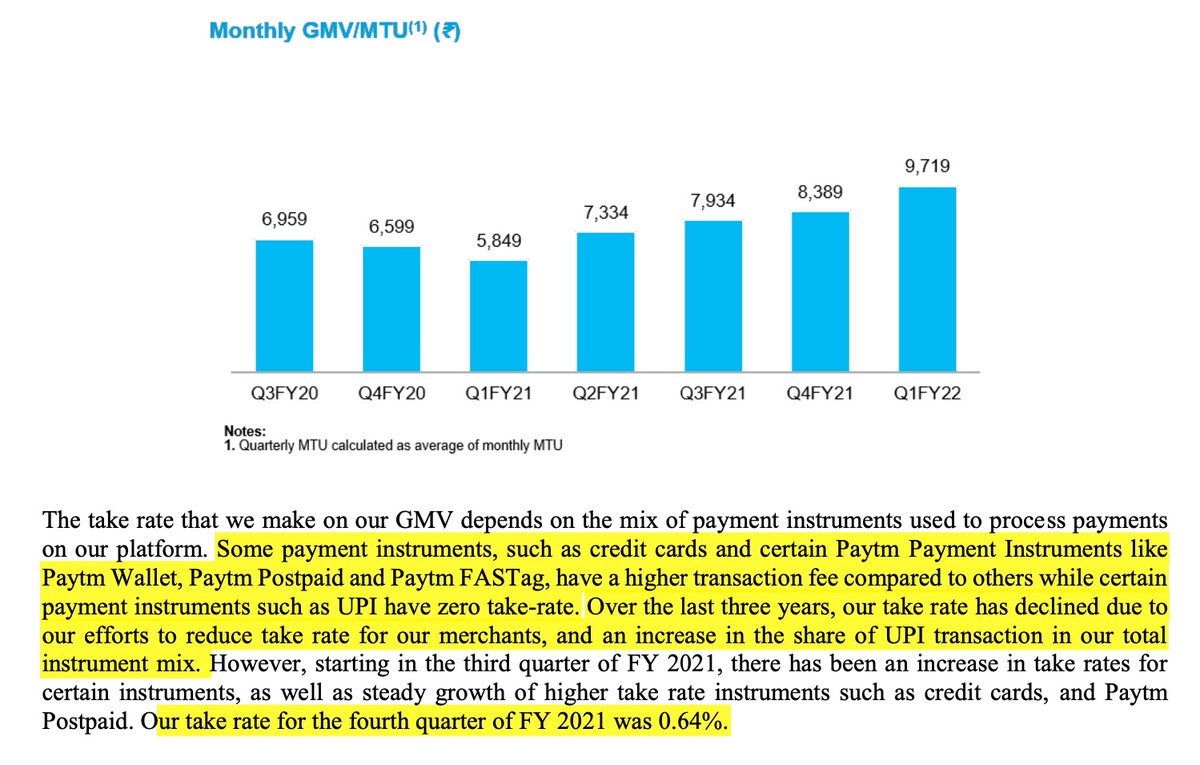

You know what it does to #Paytm business? While DRHP displays some near term rise in spends, real issue is lost in the text below.

Since UPI dominance increased, Paytm is forced to reduce “take rate” it charges merchants (0.64%). Paytm revenues are falling despite rising spends!

Since UPI dominance increased, Paytm is forced to reduce “take rate” it charges merchants (0.64%). Paytm revenues are falling despite rising spends!

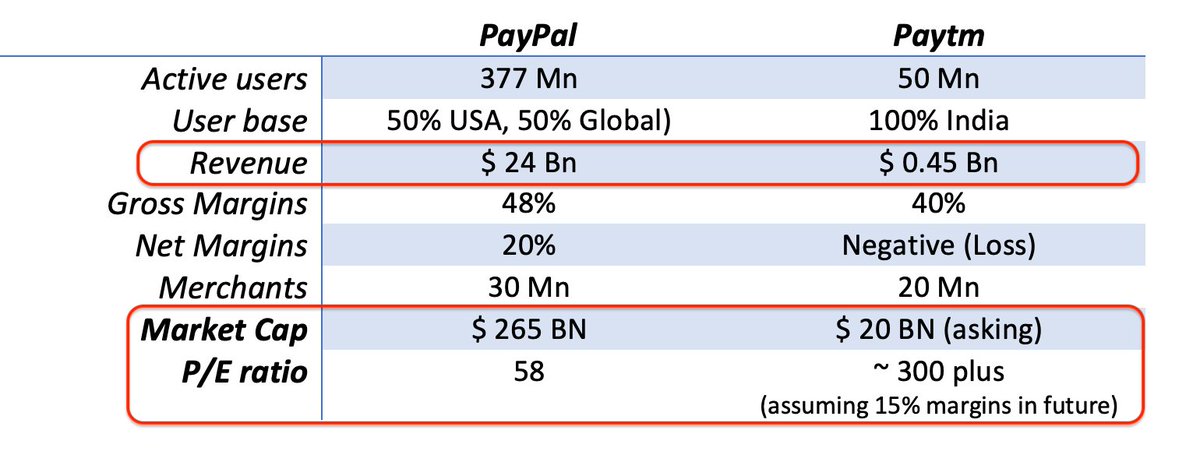

Want to value the company with all this context? Let’s give it a shot. If #PayTmIPO is trying to be #PayPal of India (inspired, to say the least), the comparison is imminent. I’ve tried some high-level metrics below:

They say, when you buy something, look at "who is selling". TCS listed in 2004 at 24 P/E & yielded returns of 28% CAGR for next 15 yrs. The sellers for #PayTmIPO are Ant Financial (Alibaba) & Softbank (of We Work IPO fiasco), not best known for their financial integrity.

Conclusion: Digital businesses are about 1 or 2 winners taking all mkt. I see Paytm losing fast to UPI, GPay, Amazon & WhatsApp pay (likely). I also see an effort to be a super app for other financial brokerage areas where it has no moat & there are leading incumbents already.

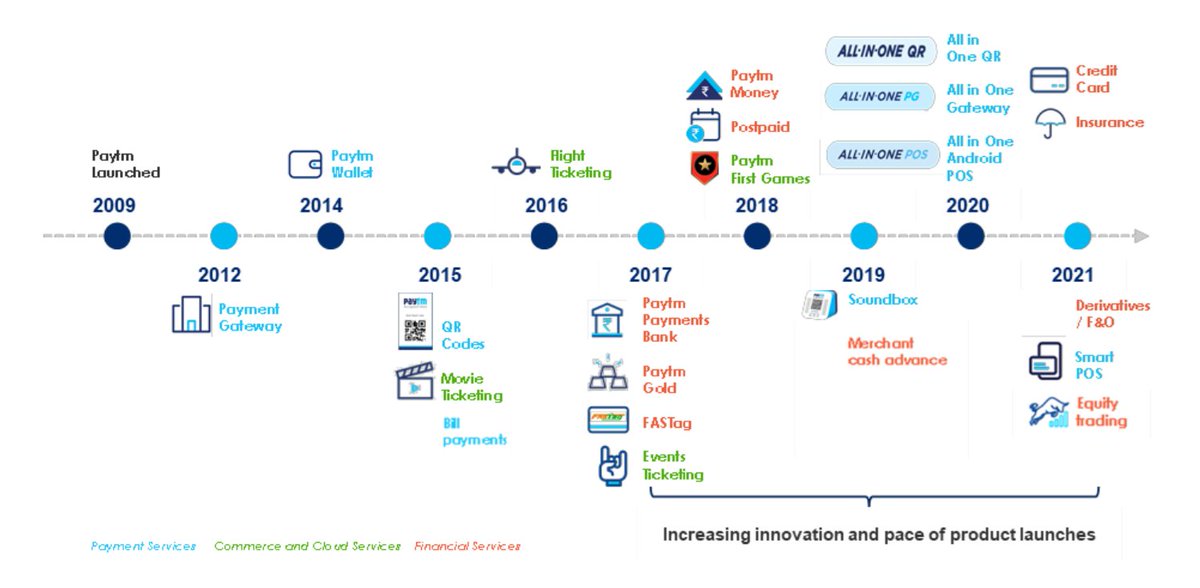

Paytm folded fast against Flipkart & Amazon in marketplace. We don’t see those buried ventures in the timeline below. Its competence in financial svcs is limited & banking is not easy to disrupt, yet. Financial svcs are all about trust. Would you make a fixed deposit with Paytm?

Amazon & Flipkart inspire excellence,Paytm looks like mediocre also ran in a space dominated by giants. With dreams bigger than its financials, #PaytmIPO is asking valuation at ~65% of Axis bank, ~40% of Kotak & 20% of HDFC bank. If your mutual fund buys this IPO, stop that #SIP

• • •

Missing some Tweet in this thread? You can try to

force a refresh