I will be posting a #BTC Cycle Peak Dash Board which contains information about:

1. On-chain peaking indicator

2. Countdown to projected cycle peak

3. Projected cycle peak prices & price gauges for:

a. Top Cap Model Rebuild

b. Fib Multipliers

c. BLX Model

1. On-chain peaking indicator

2. Countdown to projected cycle peak

3. Projected cycle peak prices & price gauges for:

a. Top Cap Model Rebuild

b. Fib Multipliers

c. BLX Model

Notes:

1. On-chain peaking indicators

Peaking indicator shows whether #BTC is peaking but doesn't give the timing. The closer the gauge is to 100%, the more likely BTC is peaking;

In ref. to 2017 Peak & In ref. to 2013 Peak shows how BTC performs in relation to past cycles.

1. On-chain peaking indicators

Peaking indicator shows whether #BTC is peaking but doesn't give the timing. The closer the gauge is to 100%, the more likely BTC is peaking;

In ref. to 2017 Peak & In ref. to 2013 Peak shows how BTC performs in relation to past cycles.

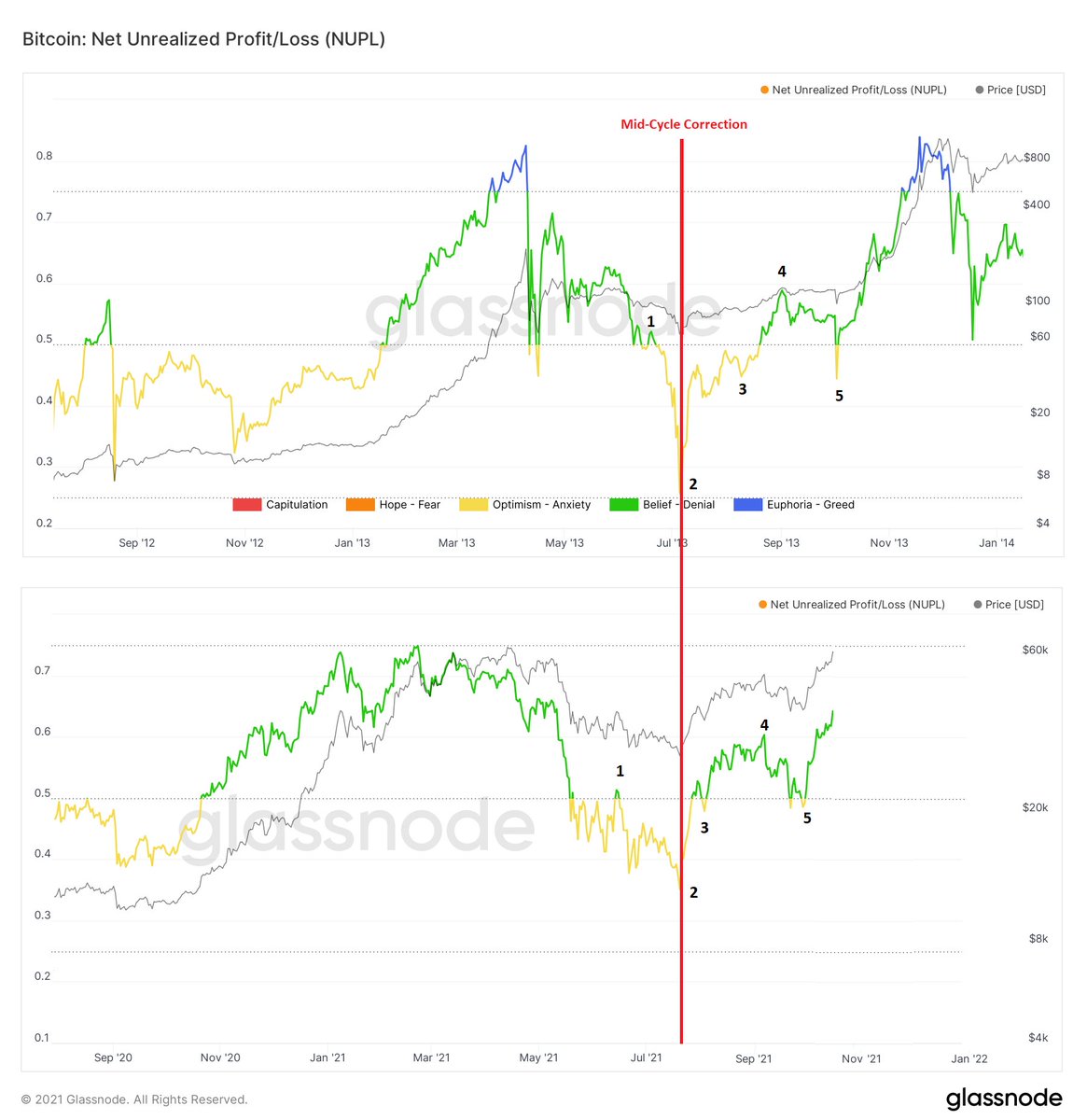

2. Countdown to projected cycle peak

Top Cap Model Date: This is based on the no. of days elapsed between #BTC's mid-cycle correction & its cycle peak in past cycles. Est.: 12/20/21

60D VVOL Date: This is based on BTC's 60-Day Volatility. Est.: 12/29/21

Top Cap Model Date: This is based on the no. of days elapsed between #BTC's mid-cycle correction & its cycle peak in past cycles. Est.: 12/20/21

60D VVOL Date: This is based on BTC's 60-Day Volatility. Est.: 12/29/21

https://twitter.com/AllenAu11/status/1455115142606114822

3. Projected #BTC Cycle Peak

For model information, please read:

a. Top Cap Model Rebuild: Pinned tweet 1a

b. BLX Model: Pinned tweet 1b

c. Fib Multipliers Model:

The price gauges show how close BTC's price is to that of the various models on a given day.

For model information, please read:

a. Top Cap Model Rebuild: Pinned tweet 1a

b. BLX Model: Pinned tweet 1b

c. Fib Multipliers Model:

https://twitter.com/AllenAu11/status/1447583326068379661

The price gauges show how close BTC's price is to that of the various models on a given day.

• • •

Missing some Tweet in this thread? You can try to

force a refresh