#PayTmIPO #Paytm This will be a long tweet but worth your time it will help your investment decisions.

Before comments on #paytm I will rewind to 2008 I was heading institutional broking of large broking house with half a million clients and over 2000 offices across India,

Before comments on #paytm I will rewind to 2008 I was heading institutional broking of large broking house with half a million clients and over 2000 offices across India,

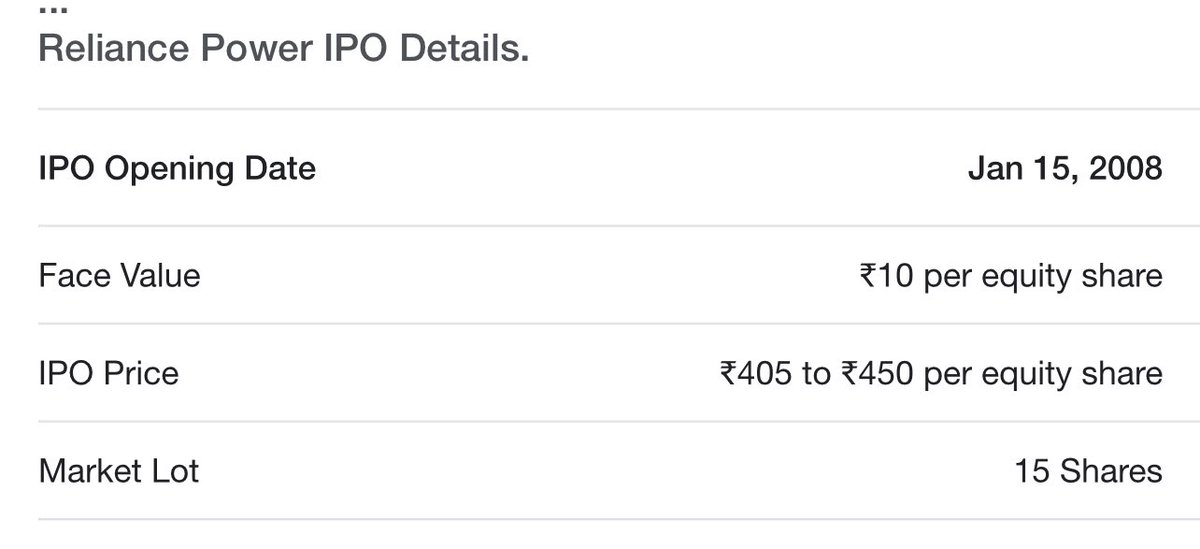

Largest public issue #Rpower #reliance brand untill that point most trusted company among retail investors, IPO band was between ₹400-450 company wanted me to promote this issue, my answer was clear NO, I did not see any fundamentals matching I simply said #rpower has no fuse

Close to 14 years period of vanavas of lord ram still the share is trading around ₹14.

“The more you want something to be true, the more likely you are to believe a story that overestimates the odds of it being true” ~M Housel

Markets were at the peak when issue came and by end

“The more you want something to be true, the more likely you are to believe a story that overestimates the odds of it being true” ~M Housel

Markets were at the peak when issue came and by end

Of 2008 housing bubble in the US markets busted and had lost over $8.2 trillion it was $6 trillion in 2000 dot com bubble across the world equity markets were shattered, Shares of #DLF with face value of ₹1 where #motilaloswal gave a target of ₹900 still trading below IPO price

So many stories I have experienced from close quarters along with deep pain of retail investors being carried away by the cyclone of greed always resulting in financial catastrophe. As a psychologist & having studied eastern philosophy I keep my self above profits or losses.

Coming to 2021 Markets are at all time high & #paytm has come out with India’s largest public issue with face value of ₹1, there is nothing to talk about numbers as the company is in a deep loss only fuel is investor money so why investors are putting money it’s a separate story

But prima face Paytm offers payment services, financial services,commerce & cloud services. Some 360 million consumers, over 21 million merchants they acquired this simply because of #jio launch which reduced the price of per GB of Internet from ₹300 & demonetisation a big leap

Ji’s ₹300 to ₹10 GB making internet lowest cost in the world #rcom & #vodafoneidea went out of business one is on lifeline by govt quoting just > ₹10 so change in technology which helped #pytm to grow will also fasten its collapse these users are not sticky No USP anymore.

So retail users as one category will not help most of them are already using #Googlepay & paytm cannot fight #google in there area of expertise with > $2 trillion market cap & there collaboration with #reliance in India will spearheaded it. Most important they own the ecosystem.

Followed by #Amazon which is again over trillion market cap and has a very big platform and ecosystem in India same with #phonepay supported by #wallmart the USP they had in the beginning is diminishing at faster rate so now there strength is 21 million Merchants which they claim

Now for them even a beggar is a merchant they haven’t defined the category yet

But as per various banks reports There are >2 crore merchants in India with approx $ 780 billion in value of transactions in 2020. They are expected to grow rapidly in the coming years

Game starts now.

But as per various banks reports There are >2 crore merchants in India with approx $ 780 billion in value of transactions in 2020. They are expected to grow rapidly in the coming years

Game starts now.

If I am a merchant doing a monthly turnover of over 1 lakh I would prefer a bank rather than #pytm for them most important is short term credit at reasonable interest paytm will loose big time in this and I will put more money into #ICICIbank which will be a clear winner

Merchant stack will certainly help power #ICICi bank it will over power #hdfcbank refer to my initial buy call in #ICICI at ₹540 levels & comparison all other banks plus #Reliance #Jio #airtel #anazon #PhonePe will benefit but the big winner will be #icicibank

Then why is #paytm attracting so much money from institutional investors, as I know there game and have been at top there play is different and retailers should never copy institutional players, they are handling big money and can afford to loose, even #rcom had top investors

If #Paytm gives good ipo returns ? It might give even 100% but is that safe, #banknifty options might give 500% returns in day but it will also destroy your entire capital in matter of seconds. So try to be reasonable & you will create wealth

Is paytm an investment idea not now.

Is paytm an investment idea not now.

Will it be in future, yes it might be if the acquire any #PSUBanks there hurry in ipo also shows that they are keen and getting ready even to bid for #IDBI bank even in that case the bank will give better returns because there will be a bidding race and now there is a big player

A combination of #icicibank and #idbi one for safety and power of compounding other as a strategic reason that can power your portfolio by 3X over long term. In the era of technology, AI and Machine learning investment will become tough one should be smart about safety of capital

Having said that #paytm is big success it’s a dream come true for Indian startup’s i wish them success ahead, my view is only for safety of retail investors and there capital for a different class of investors it might work well for different reasons.

Disclaimer: All the above tweets especially and all my tweets are for knowledge &education purposes only it’s not a recommendation to buy or not to buy please consult authorised financial advisor before investing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh