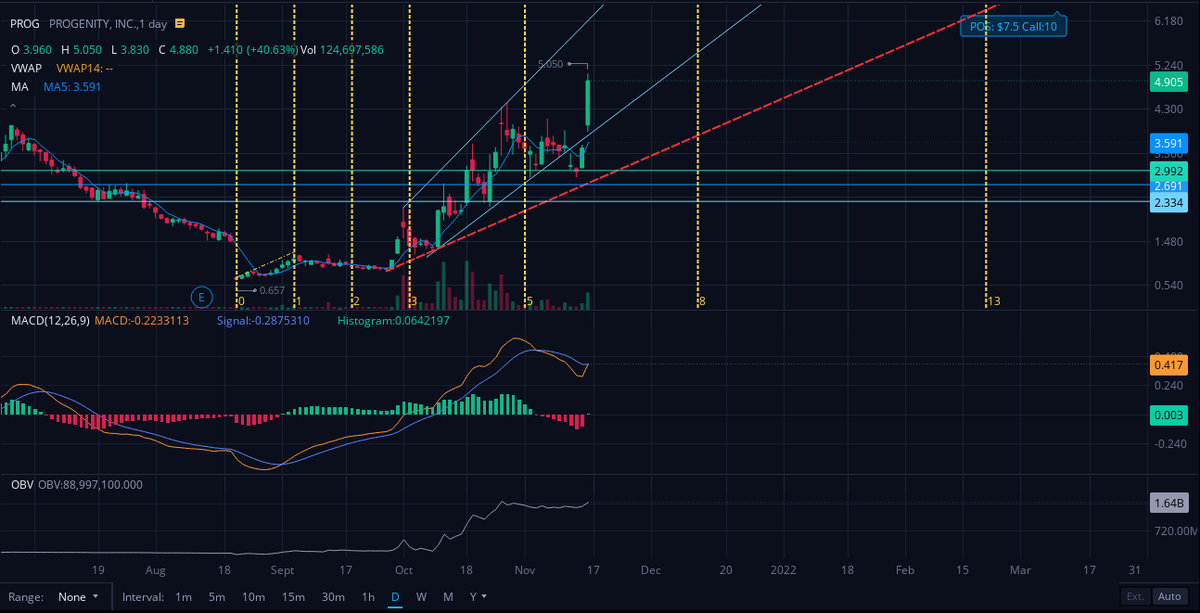

$PROG MEGA DD Thread part 1

Posted this back on October 20 after recent options expiration. The details of the charting and price movements should help inform #PROGGERS in order to give conviction to #SqueezePROG

Retweet to help spread the info.

threadreaderapp.com/thread/1450660…

Posted this back on October 20 after recent options expiration. The details of the charting and price movements should help inform #PROGGERS in order to give conviction to #SqueezePROG

Retweet to help spread the info.

threadreaderapp.com/thread/1450660…

$PROG MEGA DD Threed part 2

This is when #PROG officially hit all of my squeeze triggers, according to my Short Exempt Squeeze Signal Theory.

threadreaderapp.com/thread/1451687…

Short Exempt squeeze signal Theory explained: reddit.com/r/Wallstreetbe…

This is when #PROG officially hit all of my squeeze triggers, according to my Short Exempt Squeeze Signal Theory.

threadreaderapp.com/thread/1451687…

Short Exempt squeeze signal Theory explained: reddit.com/r/Wallstreetbe…

Not really DD, but just some pay observations I made that prove I'm not a complete dimwitted degenerate who only pretend to understand the stock market.

I predicted two of $PROG's major moves before they happened, not to mention the $AMC June sneeze

threadreaderapp.com/thread/1448305…

I predicted two of $PROG's major moves before they happened, not to mention the $AMC June sneeze

threadreaderapp.com/thread/1448305…

Another thread in response to the FUD being churned out by investor place in order to dissuade retail from buying the stock.

These guys are paid to shill and hate on $PROG in order to let their benefactors profit from the run up

threadreaderapp.com/thread/1459707…

These guys are paid to shill and hate on $PROG in order to let their benefactors profit from the run up

threadreaderapp.com/thread/1459707…

And my attempt to call out investor place author @Tsiash1 who published a stock basing article on $PROG last week in order to convince retail that it's worthless.

I still have not gotten a response to my challenge against his shit research.

threadreaderapp.com/thread/1459389…

I still have not gotten a response to my challenge against his shit research.

threadreaderapp.com/thread/1459389…

New DD for 11/15, week of 11/19 options expiration. $PROG #SqueezePROG

threadreaderapp.com/thread/1460387…

threadreaderapp.com/thread/1460387…

• • •

Missing some Tweet in this thread? You can try to

force a refresh