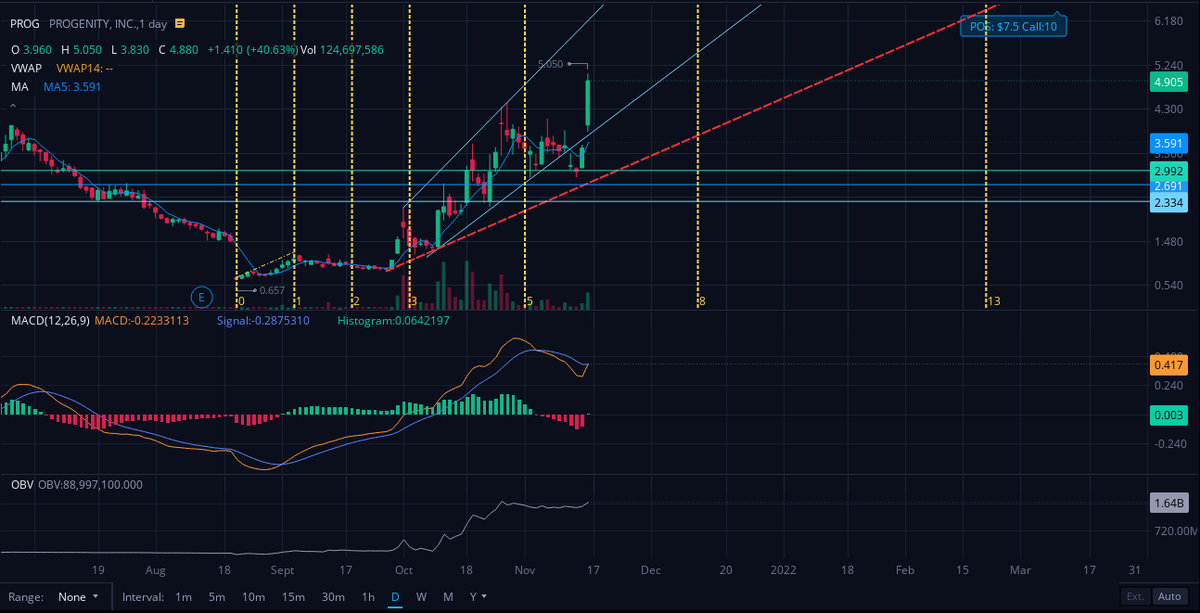

$PROG Take a look at the difference in the OI on the ITM strikes.

Do you see the lack of volume, and yet the OI dropped dramatically?

That means people exercised their options in massive numbers.

T+2 days from now (Wed), those shares will be forced to deliver. This is bullish.

Do you see the lack of volume, and yet the OI dropped dramatically?

That means people exercised their options in massive numbers.

T+2 days from now (Wed), those shares will be forced to deliver. This is bullish.

Image on the left is from last week.

Image on the right is from today.

The FUD factory at InvestorPlace is working overtime.

We are going to #SQUEEZEPROG

Be patient and hold. We got this.

I'm buying shares and OTM calls.

Image on the right is from today.

The FUD factory at InvestorPlace is working overtime.

We are going to #SQUEEZEPROG

Be patient and hold. We got this.

I'm buying shares and OTM calls.

The reason why this matters is because naked calls that get exercised early force the seller to buy stock at market price before T+2 to cover those calls. The more ITM calls exercised before close on Wed, the more shares that have to be bought before Friday.

Just saying.

Just saying.

The stock market is a magical place where degenerates can become millionaires overnight if they have the right strategy and share a common sentiment for a stock.

Short HFs and market makers are powerless against the tidal wave of retail investors in the world.

Short HFs and market makers are powerless against the tidal wave of retail investors in the world.

Every share matters. Every transaction matters. Every tick matters.

Retail has more power than the entire Street when it comes together.

I'm looking forward to seeing what today's price action brings tomorrow and Wednesday.

It's a beautiful day to be a $PROG investor.

Retail has more power than the entire Street when it comes together.

I'm looking forward to seeing what today's price action brings tomorrow and Wednesday.

It's a beautiful day to be a $PROG investor.

• • •

Missing some Tweet in this thread? You can try to

force a refresh