Good observations by @EtraAlex

Two further points to bear in mind are (1) counterparty sector (official or private financial, private non-financial) and (2) the distinction between location and nationality

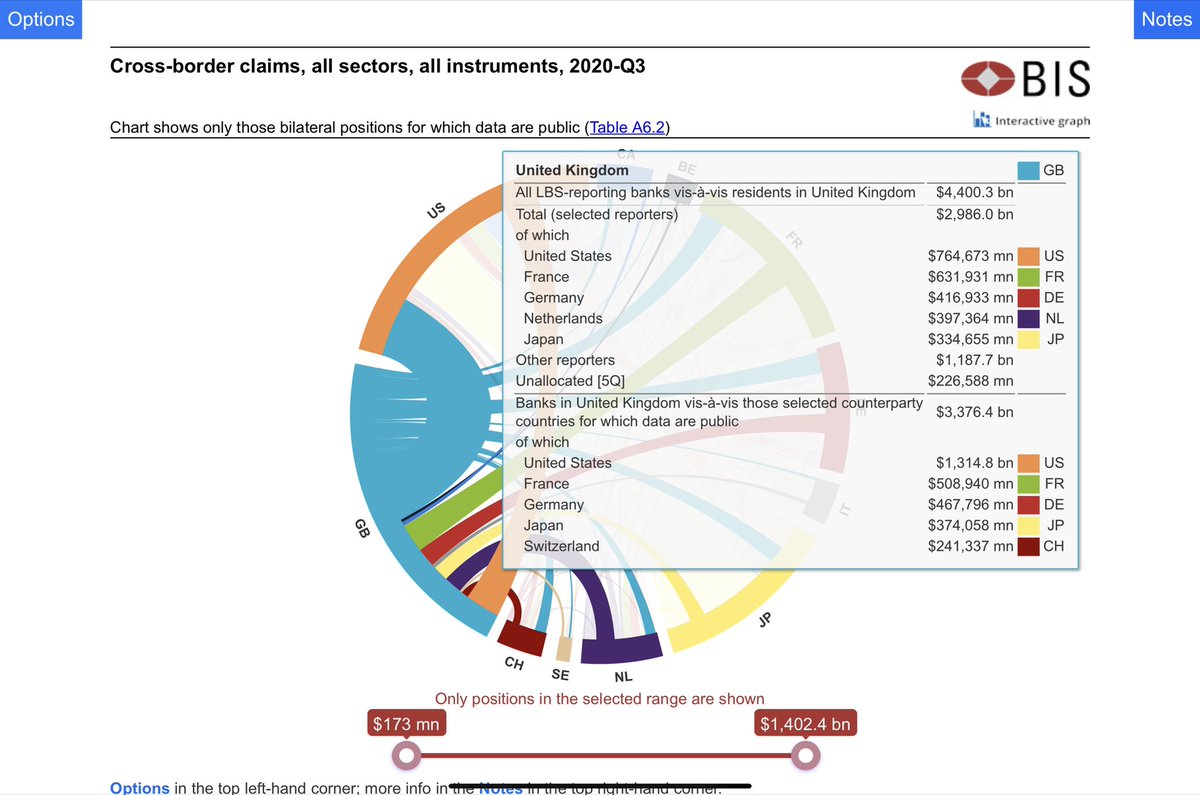

For this, the following BIS data would shed more light

(continued)

Two further points to bear in mind are (1) counterparty sector (official or private financial, private non-financial) and (2) the distinction between location and nationality

For this, the following BIS data would shed more light

(continued)

https://twitter.com/EtraAlex/status/1462173607883382785

First, regarding the counterparty sector, the 2020:Q1 surge in cross-border banking flows stands out

Normally, we would expect a sharp retrenchment during stress episodes, but there was instead a surge, as discussed in this #BIS_Bulletin

bis.org/publ/bisbull34…

Normally, we would expect a sharp retrenchment during stress episodes, but there was instead a surge, as discussed in this #BIS_Bulletin

bis.org/publ/bisbull34…

A closer look reveals that most of the flows were the recycling of dollar funding through interoffice flows as part of a "Grand Overdraft"; this explains the surge and the subsequent unwinding

To get at these issues, one needs to go beyond the balance of payment data that @EtraAlex uses

Check out our Dreamcatcher data visualisation tool for our locational banking statistics, which makes everything very easy and intuitive

bis.org/statistics/sta…

Check out our Dreamcatcher data visualisation tool for our locational banking statistics, which makes everything very easy and intuitive

bis.org/statistics/sta…

Second, it's important to distinguish cross-border flows (about the location of the activity) from the *nationality* of the flows (whether they're within the same firm)

The previous bulge in 2014-15 is mostly about latter. This is a useful primer:

bis.org/publ/work524.h…

The previous bulge in 2014-15 is mostly about latter. This is a useful primer:

bis.org/publ/work524.h…

Perhaps @EtraAlex has in mind the chart below (page 20 in the primer linked above), where gross flows mask the net balances

But the analogy is perhaps not that good for the case he mentions - the business model is very different for the banks concerned

But the analogy is perhaps not that good for the case he mentions - the business model is very different for the banks concerned

My press briefing remarks for the March 2016 BIS Quarterly Review might be more relevant

bis.org/publ/qtrpdf/r_…

bis.org/publ/qtrpdf/r_…

See also this BIS Quarterly Review piece from September 2020 that maps the flows in the early stages of the pandemic

bis.org/publ/qtrpdf/r_…

bis.org/publ/qtrpdf/r_…

In any case, do check out the BIS statistics resources here, where everything is laid out in very intuitive terms:

bis.org/statistics/abo…

bis.org/statistics/abo…

If you haven't seen it already, this introductory video takes you through our banking statistics step by step

• • •

Missing some Tweet in this thread? You can try to

force a refresh