Among many #fintech #stocks, we studied and feel #UGroCapital can surprise many in coming years.

Why? Will try to cover their biz. transformation, strategy, financials and future prospect in below #Thread 🧵

Do read and let us know you view😊

Here we start..

1/n

#Investment

Why? Will try to cover their biz. transformation, strategy, financials and future prospect in below #Thread 🧵

Do read and let us know you view😊

Here we start..

1/n

#Investment

2/

#UGroCapital

⭐️Incorporated in 1994 as Chokhani Securities Private Limited then later become public and listed at BSE in 2003

⭐️Earlier mainly focused on securities biz., then tried for other biz. like merchant banker, exp. to Info.& Tech. etc. But without any big success.

#UGroCapital

⭐️Incorporated in 1994 as Chokhani Securities Private Limited then later become public and listed at BSE in 2003

⭐️Earlier mainly focused on securities biz., then tried for other biz. like merchant banker, exp. to Info.& Tech. etc. But without any big success.

3/

#UGroCapital

⭐️Its transformation journey start from 2017 when current CMD (Mr. Shachindra Nath) took-over & renamed it to 'U GRO Capital'.

⭐️This followed stopping all previous biz and re-capitalization & rebranding with a Tech-enabled MSME Lending Biz. model.

#Investment

#UGroCapital

⭐️Its transformation journey start from 2017 when current CMD (Mr. Shachindra Nath) took-over & renamed it to 'U GRO Capital'.

⭐️This followed stopping all previous biz and re-capitalization & rebranding with a Tech-enabled MSME Lending Biz. model.

#Investment

4/

#UGroCapital

⭐️Introduced very impressive mangmnt & BoD members & started expanding the biz by leap & bound

⭐️This model of acquiring a small, listed comp. & raising significant capital to build a #fintech was an industry 1st conceptualization

⭐️Listed on NSE also in Aug-2021

#UGroCapital

⭐️Introduced very impressive mangmnt & BoD members & started expanding the biz by leap & bound

⭐️This model of acquiring a small, listed comp. & raising significant capital to build a #fintech was an industry 1st conceptualization

⭐️Listed on NSE also in Aug-2021

5/

U Gro Capital

⭐️Best part is their focused approached. Among many available lending options within MSME, they funneled down the 8 key sectors due to ample opportunities and designed very robust Digital model for efficient & effective lending.

#stocks #StockMarket #Investment

U Gro Capital

⭐️Best part is their focused approached. Among many available lending options within MSME, they funneled down the 8 key sectors due to ample opportunities and designed very robust Digital model for efficient & effective lending.

#stocks #StockMarket #Investment

6/

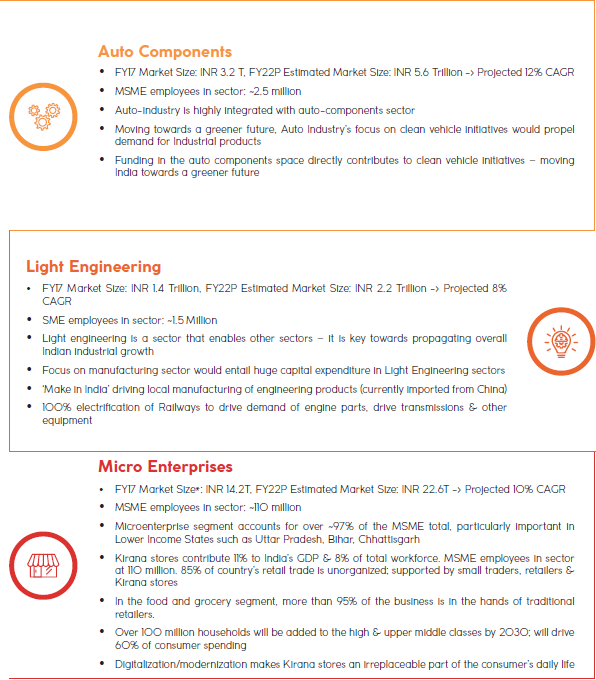

#UGroCapital

⭐️8 Sectors: healthcare, education, chemicals, food processing, hospitality, electrical equipment, auto components & engineering

⭐️All are emerging, basic need & growing seg. which themselves need huge capital

#Investment #StockMarkets #fintech #Finance #Share

#UGroCapital

⭐️8 Sectors: healthcare, education, chemicals, food processing, hospitality, electrical equipment, auto components & engineering

⭐️All are emerging, basic need & growing seg. which themselves need huge capital

#Investment #StockMarkets #fintech #Finance #Share

7/

#UGroCapital

⭐️'Data Tripod', on this lending model is designed & customized heavily for each sectors & even for sub-sectors within that so within hospitals, different model for dental hospital and IVF clinic etc.

⭐️This means understanding the needs of every SME!

#Investment

#UGroCapital

⭐️'Data Tripod', on this lending model is designed & customized heavily for each sectors & even for sub-sectors within that so within hospitals, different model for dental hospital and IVF clinic etc.

⭐️This means understanding the needs of every SME!

#Investment

8/

#UGroCapital

⭐️They set-up a four-pronged asset engine to capture market:

1. Branch-led channel (Prime & Micro Branches)

2. Eco-system Channel (Supply Chain & Machinery Loan Financing)

3.Partnership & Alliances channel (NBFC/ FinTech cos)

4. Direct Digital Channel

#Investment

#UGroCapital

⭐️They set-up a four-pronged asset engine to capture market:

1. Branch-led channel (Prime & Micro Branches)

2. Eco-system Channel (Supply Chain & Machinery Loan Financing)

3.Partnership & Alliances channel (NBFC/ FinTech cos)

4. Direct Digital Channel

#Investment

9/

#UGroCapital

⭐️AUM trend as shown in attached pics:

- Sector wise

- Channel wise

- Sectoral mix (secure/un-secured)

⭐️Revenue: Good geographical coverage

⭐️Borrowing Break-up: Banks remain primary source

#Investment #StockMarkets #fintech #Finance #MSME #Share #NiftyBank

#UGroCapital

⭐️AUM trend as shown in attached pics:

- Sector wise

- Channel wise

- Sectoral mix (secure/un-secured)

⭐️Revenue: Good geographical coverage

⭐️Borrowing Break-up: Banks remain primary source

#Investment #StockMarkets #fintech #Finance #MSME #Share #NiftyBank

10/

⭐️Since transformation (2017), huge growth in Sales on QoQ

⭐️Improved OPM

⭐️Profit is turning +ve & improving

⭐️Recently tied-up with BoB & SBI

⭐️Q2FY22: Disbursements Q-o-Q growth of 139%

⭐️Highest ever monthly disbursements in Oct’21 @ Rs. 300Cr.

#Investment #StockMarkets

⭐️Since transformation (2017), huge growth in Sales on QoQ

⭐️Improved OPM

⭐️Profit is turning +ve & improving

⭐️Recently tied-up with BoB & SBI

⭐️Q2FY22: Disbursements Q-o-Q growth of 139%

⭐️Highest ever monthly disbursements in Oct’21 @ Rs. 300Cr.

#Investment #StockMarkets

11/

#UGroCapital

⭐️Set out a target to capture 1% of the MSME lending market in next 5 years. This would translate to an AUM of roughly Rs. 20,000 Cr.

⭐️So based on the target, we can expect the #stock price can be 10X from here (CMP ~190)

#Investment #StockMarket #Nifty #Share

#UGroCapital

⭐️Set out a target to capture 1% of the MSME lending market in next 5 years. This would translate to an AUM of roughly Rs. 20,000 Cr.

⭐️So based on the target, we can expect the #stock price can be 10X from here (CMP ~190)

#Investment #StockMarket #Nifty #Share

• • •

Missing some Tweet in this thread? You can try to

force a refresh