Thread🧵 : Stock Market Resources

Few DM’s on how to get started in the stock market. So creating a detailed thread on some resources/books that have helped me

1) zerodha.com/varsity/

One can start with @ZerodhaVarsity

The content is really good & explained in detail.

Few DM’s on how to get started in the stock market. So creating a detailed thread on some resources/books that have helped me

1) zerodha.com/varsity/

One can start with @ZerodhaVarsity

The content is really good & explained in detail.

2) Position Sizing & Risk Management

Van Tharp Guide to Position Sizing

An amazing book that explains importance of risk management in a simple manner.

One of the best books I have read on risk management

P.S : It costs around 200 $.. I’ll make a detailed summary on this soon

Van Tharp Guide to Position Sizing

An amazing book that explains importance of risk management in a simple manner.

One of the best books I have read on risk management

P.S : It costs around 200 $.. I’ll make a detailed summary on this soon

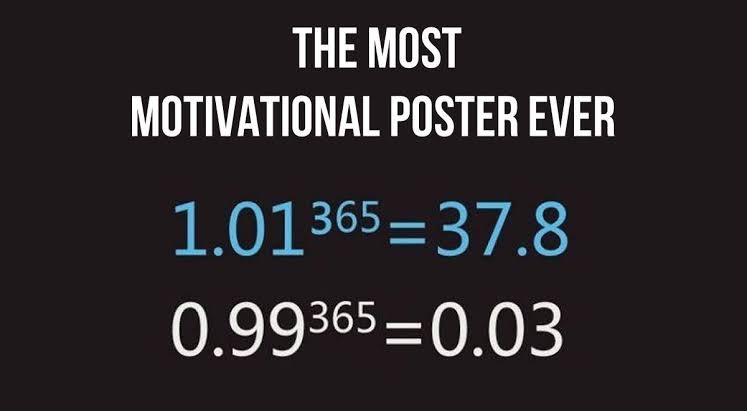

3) Trading Pyschology

Trading in the zone

The Disciplined Trader

The Market Wizards

3 best books that explains why discipline & trading psychology is the important aspect in trading

Trading in the zone

The Disciplined Trader

The Market Wizards

3 best books that explains why discipline & trading psychology is the important aspect in trading

4) System Building & Backtesting

Trading Systems by Emilio Tomasini

A good book on how to build a trading system & things to consider while backtesting a trading system

A must read if you want to get started with system driven trading & how to build backtested systems

Trading Systems by Emilio Tomasini

A good book on how to build a trading system & things to consider while backtesting a trading system

A must read if you want to get started with system driven trading & how to build backtested systems

6) Intraday Trading

a) How to make money in intraday trading by @AshwaniGujral6

A great book on intraday trading & good perspective on how to analyse & trade intraday patterns

a) How to make money in intraday trading by @AshwaniGujral6

A great book on intraday trading & good perspective on how to analyse & trade intraday patterns

6 b ) Intraday

Secrets of Pivot Boss by Frank Ochoa

A great book on understanding intraday price patterns & how to get an overall sense of markets

Must read if you want to become great at intraday trading📈

Secrets of Pivot Boss by Frank Ochoa

A great book on understanding intraday price patterns & how to get an overall sense of markets

Must read if you want to become great at intraday trading📈

7) Option Trading

The Bible of Option Strategies by Guy Cohen

A good book that cover various option strategies that can be implemented in different market conditions & also discusses pro & cons of each

The Bible of Option Strategies by Guy Cohen

A good book that cover various option strategies that can be implemented in different market conditions & also discusses pro & cons of each

8) Python

udemy.com/course/algorit…

A udemy course on Python for Trading. A good starting point to learn how python can be applied on financial data sets

udemy.com/course/algorit…

A udemy course on Python for Trading. A good starting point to learn how python can be applied on financial data sets

9) Quantitative Resources

epchan.blogspot.com/?m=1

Dr. E.P Chan’s Blog where he talks about quantitative strategies and trading ideas

quantstart.com

QuantStart discusses Algorithmic Trading strategy research, development, backtesting and implementation

epchan.blogspot.com/?m=1

Dr. E.P Chan’s Blog where he talks about quantitative strategies and trading ideas

quantstart.com

QuantStart discusses Algorithmic Trading strategy research, development, backtesting and implementation

10) Fundamentals

drvijaymalik.com

Great blog on fundamental trading with extensive deep research on various companies. A must read if you are a fundamental investor

@drvijaymalik is undoubtedly one of the best fundamental investor in India.

A big fan of his analysis !

drvijaymalik.com

Great blog on fundamental trading with extensive deep research on various companies. A must read if you are a fundamental investor

@drvijaymalik is undoubtedly one of the best fundamental investor in India.

A big fan of his analysis !

11) The above resources have helped me immensely & may help you as well!

I hope you the find the resources insightful & useful !

Happy Learning :)

-End

I hope you the find the resources insightful & useful !

Happy Learning :)

-End

• • •

Missing some Tweet in this thread? You can try to

force a refresh