#mirza #International

#MIRZAINT

So, finally MIRZA has outlined the scheme of demerger of its biz. verticals in to 'Redtape' & 'Mirza'.

In this #Thread 🧵we will share:

1. About Mirza Int.

2. Merger/De-merger proposal

3. Redtape-valuation & comparison w/ peer

Let's start

1/

#MIRZAINT

So, finally MIRZA has outlined the scheme of demerger of its biz. verticals in to 'Redtape' & 'Mirza'.

In this #Thread 🧵we will share:

1. About Mirza Int.

2. Merger/De-merger proposal

3. Redtape-valuation & comparison w/ peer

Let's start

1/

2/🧵

#MIRZAINT

⭐️Founded in 1979, Mirza is India’s leading leather footwear manufacturer

⭐️ It is preferred supplier of leather footwear to international brands.

⭐️One of the largest Indian suppliers of finished leather to overseas markets.

⭐️Own 'Red Tape' brand

#stockmarkets

#MIRZAINT

⭐️Founded in 1979, Mirza is India’s leading leather footwear manufacturer

⭐️ It is preferred supplier of leather footwear to international brands.

⭐️One of the largest Indian suppliers of finished leather to overseas markets.

⭐️Own 'Red Tape' brand

#stockmarkets

3/🧵

#mirzaint

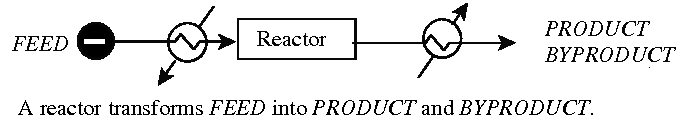

Mirza has integrated operation through vast infra:

Raw materials from their own tannery ➡️Inhouse design ➡️Manufacturing the footwear in-house ➡️Brands are marketed through a pan-India network of company-owned outlets/E-comm.

#investing #stockmarkets #stocks

#mirzaint

Mirza has integrated operation through vast infra:

Raw materials from their own tannery ➡️Inhouse design ➡️Manufacturing the footwear in-house ➡️Brands are marketed through a pan-India network of company-owned outlets/E-comm.

#investing #stockmarkets #stocks

4/🧵

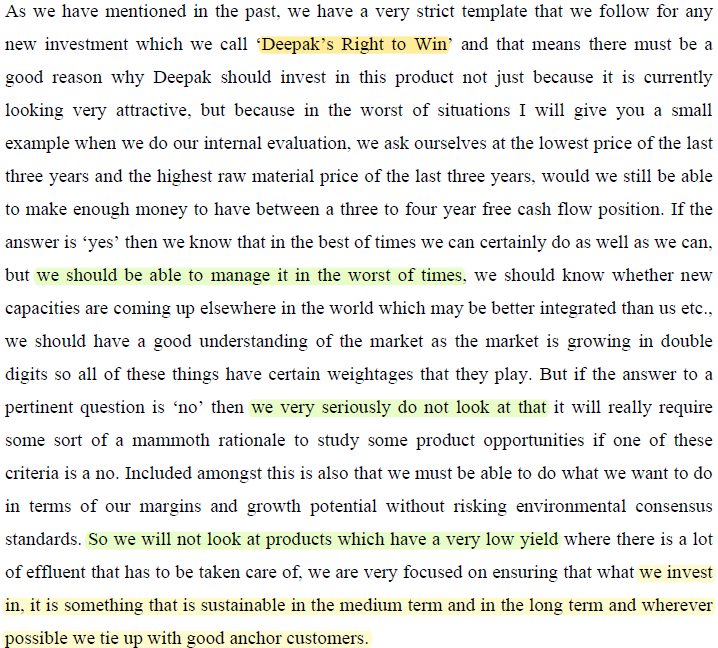

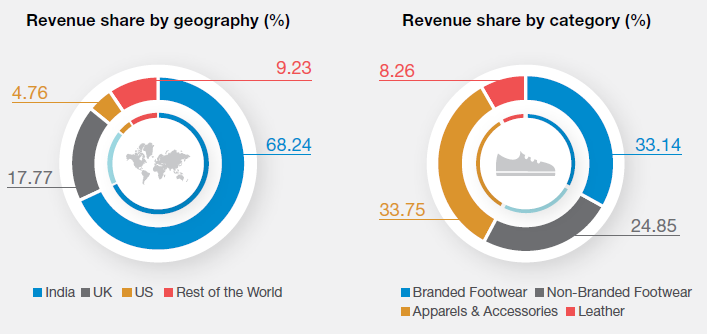

#MIRZAINT

Robust production capacity:

⭐️54 Million pairs of footwear/annum

⭐️38.91% capacity utilization in FY21

Widespread presence

⭐️EBO in ~120 Cities in India

⭐️Globally in 24 countries

Revenue:

⭐️Shoe division account for ~60%

⭐️India account for ~70%

#stockmarkets

#MIRZAINT

Robust production capacity:

⭐️54 Million pairs of footwear/annum

⭐️38.91% capacity utilization in FY21

Widespread presence

⭐️EBO in ~120 Cities in India

⭐️Globally in 24 countries

Revenue:

⭐️Shoe division account for ~60%

⭐️India account for ~70%

#stockmarkets

5/🧵

#MIRZAINT

Restructuring proposal:

✔️Merger of RTS Fashion Pvt. Ltd. with Mirza Int. Ltd.

✔️Demerger of 'Redtape' & 'Mirza'

Biz. verticals of Mirza (Pic-1):

1. Private/White Label

2. Branded Biz./Redtape

3. Leather Tannery

Biz. vertical of RTS (Pic-2):

1. Mirza (UK) Ltd.

#MIRZAINT

Restructuring proposal:

✔️Merger of RTS Fashion Pvt. Ltd. with Mirza Int. Ltd.

✔️Demerger of 'Redtape' & 'Mirza'

Biz. verticals of Mirza (Pic-1):

1. Private/White Label

2. Branded Biz./Redtape

3. Leather Tannery

Biz. vertical of RTS (Pic-2):

1. Mirza (UK) Ltd.

6/🧵

#MIRZAINT

Scheme:

⭐️Mirza Int. will issue 22 #Shares of Rs.2/- to the Shareholders of RTS for every 10 Shares of Rs.10/-

⭐️Redtape Ltd. will issue 1 Share of Rs.2/- to the Shareholders of Mirza for every 1 Share of Rs.2/-

#stockmarkets #investing #stocks #sharemarket

#MIRZAINT

Scheme:

⭐️Mirza Int. will issue 22 #Shares of Rs.2/- to the Shareholders of RTS for every 10 Shares of Rs.10/-

⭐️Redtape Ltd. will issue 1 Share of Rs.2/- to the Shareholders of Mirza for every 1 Share of Rs.2/-

#stockmarkets #investing #stocks #sharemarket

7/🧵

#MIRZAINT

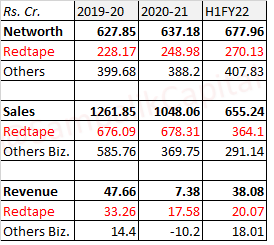

Demerged entity, 'Redtape Ltd.' account for:

⭐️ ~40% of total net worth, i.e. Rs.275 Cr.

⭐️~55% of total Sales, i.e. Rs.675 Cr.

⭐️~50% of total Profit, i.e. Rs.20 Cr.

Current #share price of Mirza is ~Rs. 130. Same will be price of 'Redtape' also.

#stockmarkets

#MIRZAINT

Demerged entity, 'Redtape Ltd.' account for:

⭐️ ~40% of total net worth, i.e. Rs.275 Cr.

⭐️~55% of total Sales, i.e. Rs.675 Cr.

⭐️~50% of total Profit, i.e. Rs.20 Cr.

Current #share price of Mirza is ~Rs. 130. Same will be price of 'Redtape' also.

#stockmarkets

8/🧵

#mirzaint

#MirzaInternational

#chart update

🚀 Mirza price up-move supported by huge volume. Can expect min. 2X from here 👍

P.S.: Go through the #Thread for de-merger details

#stockmarkets #investing #sharemarket #StocksToBuy #stocks #stocks

#mirzaint

#MirzaInternational

#chart update

🚀 Mirza price up-move supported by huge volume. Can expect min. 2X from here 👍

P.S.: Go through the #Thread for de-merger details

#stockmarkets #investing #sharemarket #StocksToBuy #stocks #stocks

• • •

Missing some Tweet in this thread? You can try to

force a refresh