"lengthening cycles" is a contradiction in terms.

If the peak takes longer to occur then in previous cycles, that does not mean that the cycle is longer.

Just as if the last snow of winter occurs later in the year, that does not make the year longer!

If the peak takes longer to occur then in previous cycles, that does not mean that the cycle is longer.

Just as if the last snow of winter occurs later in the year, that does not make the year longer!

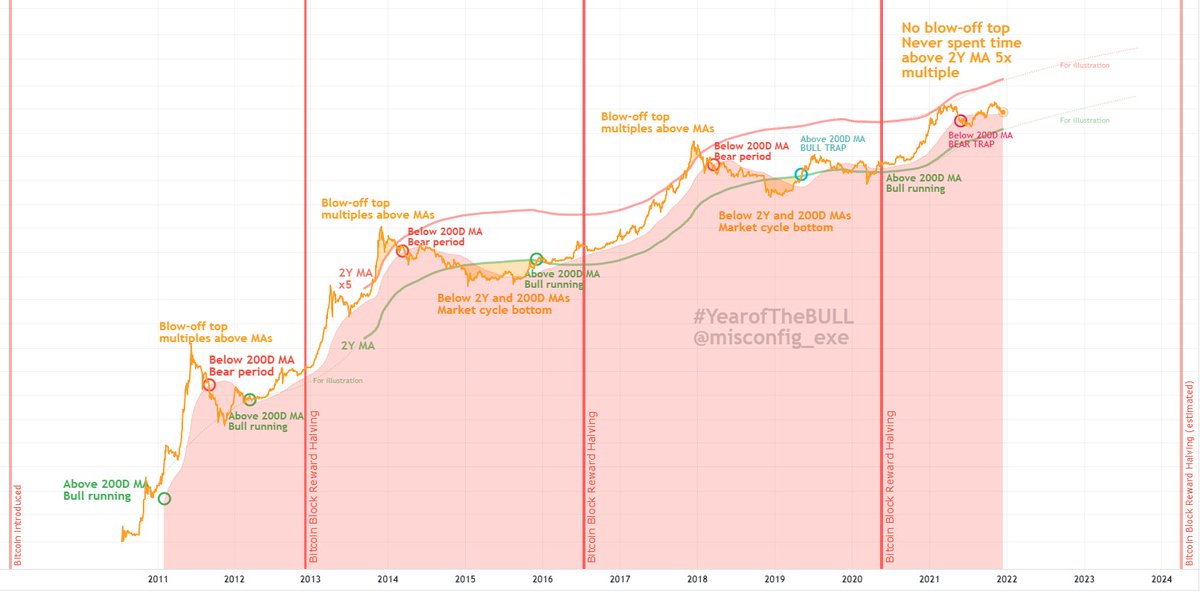

Some people would have you believe that "The first cycle was from 2009 to 2011" (3 years) and "The second cycle was from 2011 to 2013" (4 years) and "The fourth cycle was from 2013 to 2017" (5 years) and therefore this cycle should be longer.

These people are bastardizing the word cycle and they should remove it from their mouth.

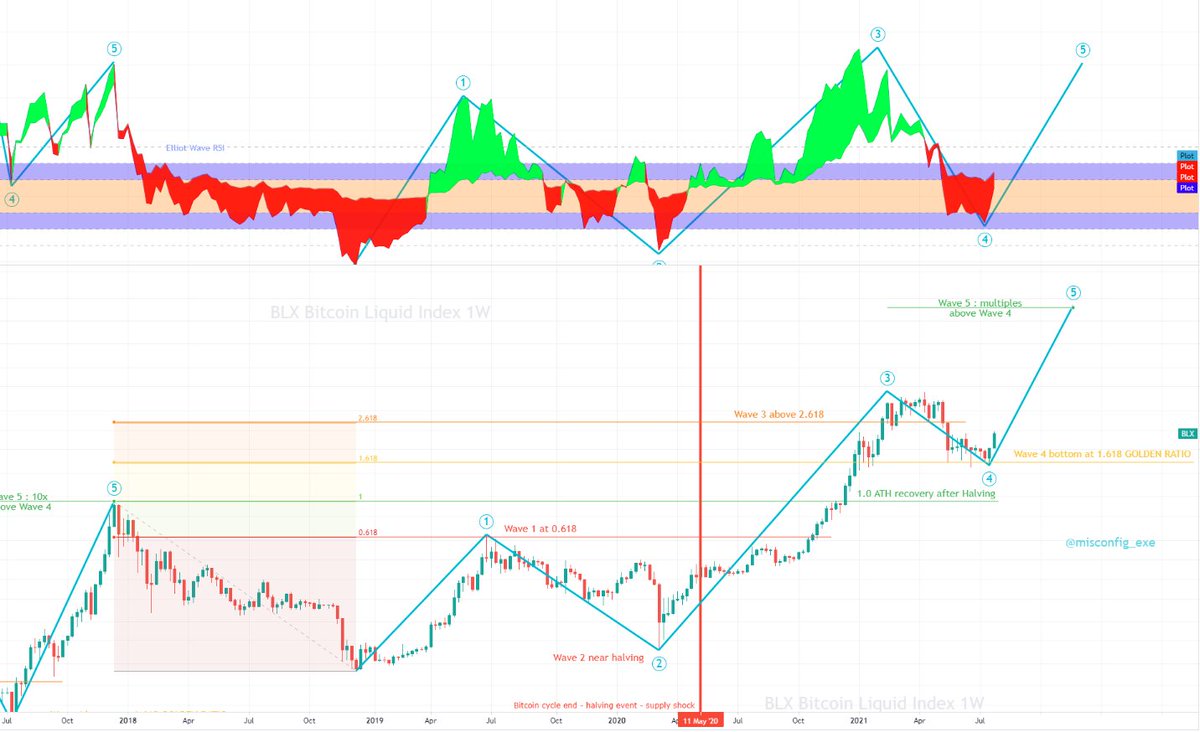

The cycle is consistent, it is pre-programmed. It does not change.

It takes 210,000 blocks for each cycle.

It takes 210,000 blocks for each cycle.

Does this cycle have an impact on the price? Yes, it has in the past.

And as we have all been saying, the impact of this cycle on the price will diminish over time.

But that doesn't change the cycle.

Blockchain keeps on making blocks.

The cycle renews at each halving

And as we have all been saying, the impact of this cycle on the price will diminish over time.

But that doesn't change the cycle.

Blockchain keeps on making blocks.

The cycle renews at each halving

• • •

Missing some Tweet in this thread? You can try to

force a refresh