The #BTC 200D MA (200-day moving average of price) is an important level for understanding #Bitcoin.

I think the $BTC 2Y MA and its 5x multiple are more valuable long-term, but mid-term the 200MA is worth paying attention to.

Here's my perspective 👇[THREAD]👇

I think the $BTC 2Y MA and its 5x multiple are more valuable long-term, but mid-term the 200MA is worth paying attention to.

Here's my perspective 👇[THREAD]👇

https://twitter.com/misconfig_exe/status/1471253592891793416

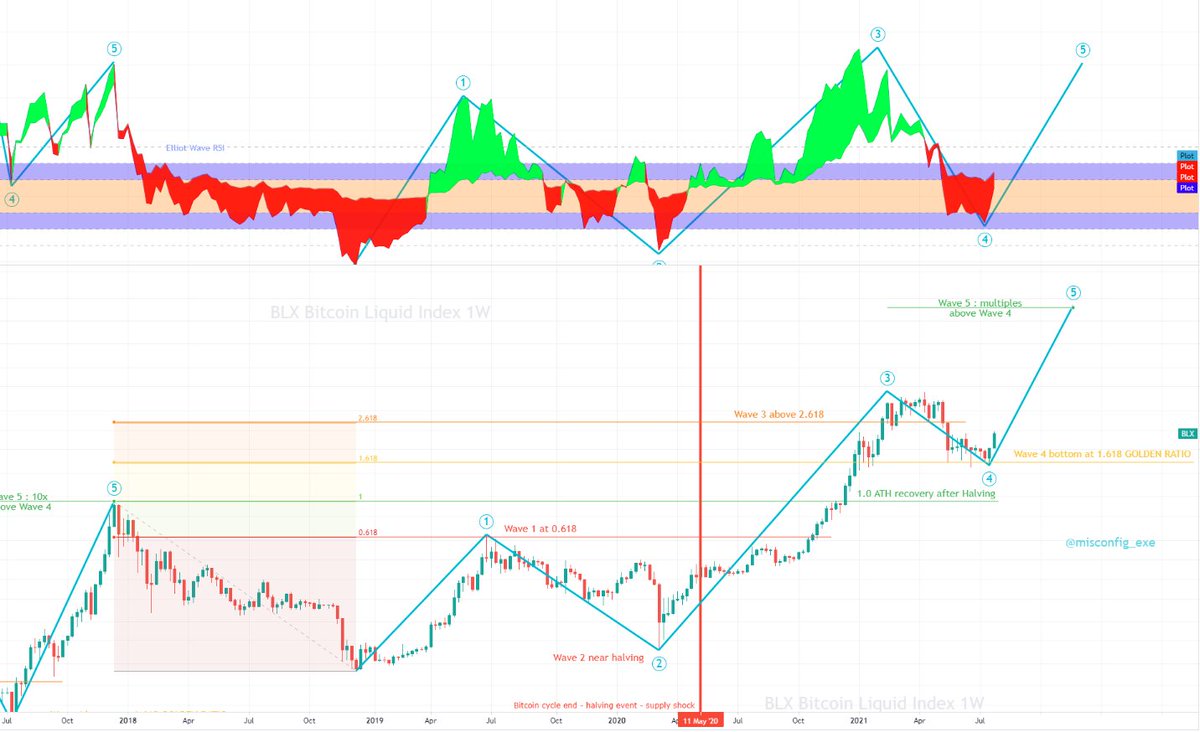

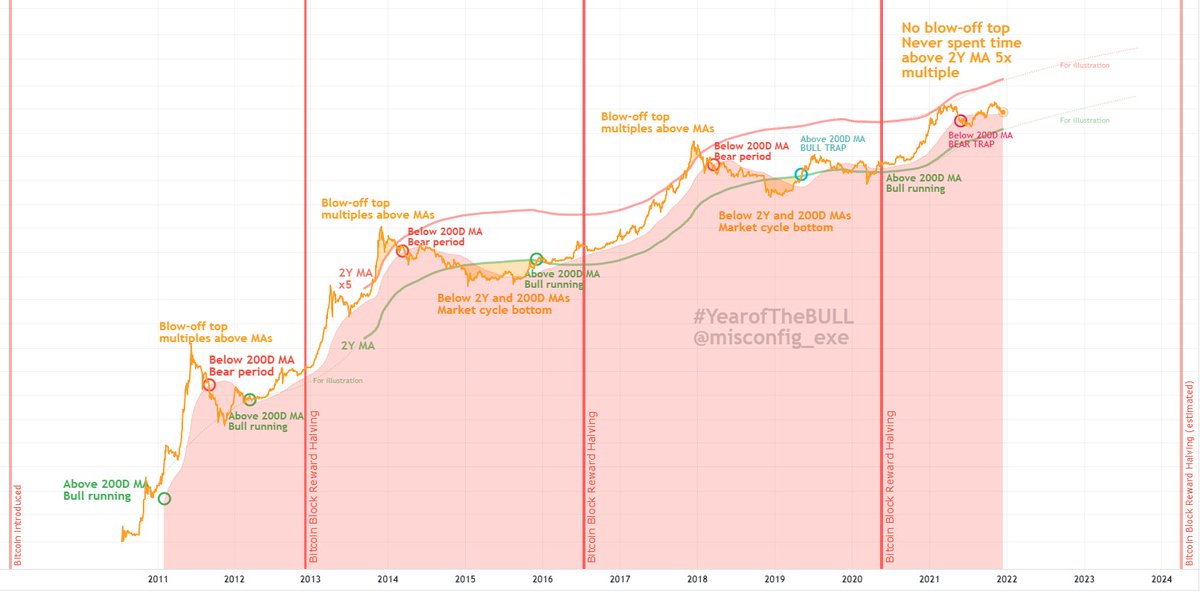

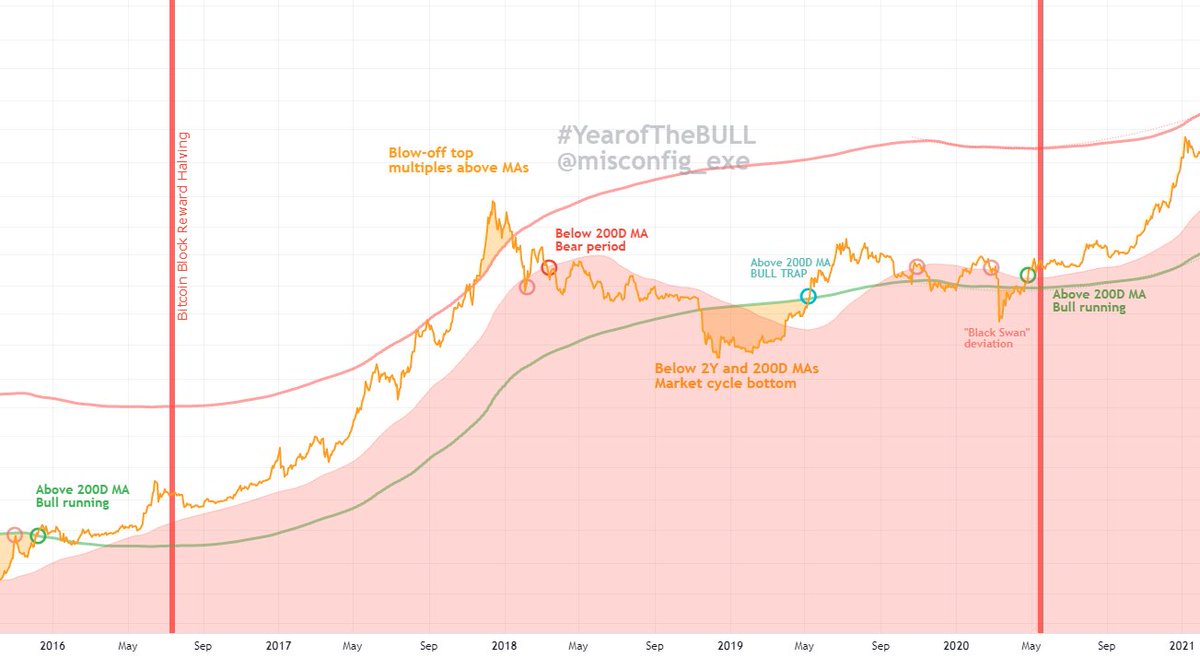

From #Bitcoin's introduction in 2009 until its first halving, $BTC stayed above the 200D MA period until its first bear market period. The 200D MA served as resistance, but breaking above it led to prices higher than the 200D MA breakdown the previous year, signaling new 🆙trend

In the next #Bitcoin era, the first after the halving at the end of 2012, $BTC rose rapidly and parabolically, blowing off early and testing the 200D MA for support to continue the bull run. (cont)

(cont from above) At this stage in 2014, a 5x multiple of #Bitcoin's new 2Y MA coincides with the recent #BTC blow-off top, and serves as short-term resistance before breaking well above that $BTC 5x 2Y MA multiple with a final blow-off top leads to ...

(cont)

(cont)

(cont from above) March 2014 when $BTC breaks down below the 200DMA, and then finds it as resistance, confirming the new 🔻bear trend for #BTC for most of 2015.

When #Bitcoin breaks down below the 2Y MA, it signals the market cycle bottom at the beginning of 2015, but ... (cont)

When #Bitcoin breaks down below the 2Y MA, it signals the market cycle bottom at the beginning of 2015, but ... (cont)

(cont from above) even after #BTC breaks above the 2Y MA, it still finds the 200D MA as resistance before breaking out just before the beginning of 2016, and #Bitcoin holds above both 2Y MA and 200D MA leading into the halving, which is followed by higher $BTC prices.

In the following era after the second #BTC halving beginning in mid 2016, $BTC rose steadily and found resistance at the 5x 2Y MA multiple times before breaking through and blowing off above the 5x 2Y MA, leading to ... (cont)

(cont from above) a "dead cat" bounce off the 200D MA, following which #Bitcoin fell below then found resistance underneath the 200D MA. After collapsing below the 2Y MA, #BTC found a market cycle bottom, and rose above the 200D MA and the 2Y MA, earlier than in prior era. (cont)

(cont from above) This over-eager early rise above #BTC's 2Y and 200D MAs was short-lived, and $BTC formed a BULL TRAP. #Bitcoin's cycle trend change is confirmed closer to the halving, after multiple attempts to hold above the 2Y and break above the 200D. ... (cont)

(cont from above) #Bitcoin's trend finally held above the 2Y MA and the 200D MA just before the 2020 halving, after a "black swan" deviation took the whole market down temporarily. Then the current era begins ...

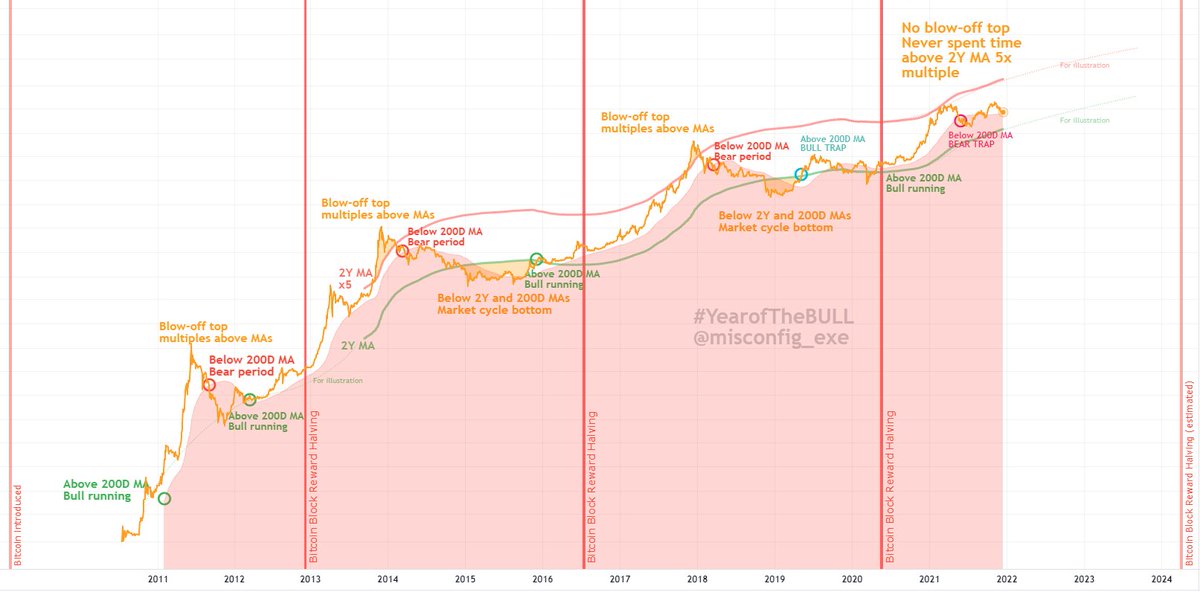

In the current #Bitcoin era beginning with the 2020 halving $BTC rose rapidly parabolically, rounding off early as it found resistance at the 5x 2Y MA like prior cycle. This time though ... (cont)

(cont from above) ... #BTC price corrected below the 200D MA during a bullish period. Like 2020's early breakout was a BULL TRAP, I identified this as a BEAR TRAP in #Bitcoin's bull run.

$BTC broke above the 200D MA for a bit, oscilated around it briefly, then ... (cont)

$BTC broke above the 200D MA for a bit, oscilated around it briefly, then ... (cont)

(cont from above) ... #BTC rose above the 200D MA to form a NEW ALL-TIME HIGH immediately after forming a higher low, confirming the continuation of the #Bitcoin bull trend.

Now ... (cont)

Now ... (cont)

(cont from above) ... Now #Bitcoin is again testing the 200D MA at $47k, and looks set to continue the rest of the bullish period in this #BTC era until the final blow-off top above the 5x 2Y MA ($141,890 as of today) some time next year, before the next halving in 2024...

(cont)

(cont)

(cont from above) ... #Bitcoin's 2Y MA is currently sitting just below the 2021 yearly open (confluent with the 1.618 #GoldenRatio of the 2018 bear market period) at about $28,400 and rising. How high will it go in 2022? This will indicate the potential bear market bottom.

Flirting with the 200D MA is not comfortable, but a recovery here will be a big indicator that the bull run is not over. Zoom out. #Bitcoin is not done. #Inflation is not over. #MoneyPrinter gonna #BRRR. And the #DigitalEconomy and #CryptoCurrency adoption is inevitable. STACK!

If you found this #Bitcoin thread interesting or valuable, please retweet and consider sharing it with a friend outside of Twitter.

If you'd like to support me in my analysis and content, please consider a tip or join our community on Discord!

Details at ko-fi.com/misconfig

If you'd like to support me in my analysis and content, please consider a tip or join our community on Discord!

Details at ko-fi.com/misconfig

A reminder: I'm not a financial advisor, let alone YOUR financial advisor. I believe in Bitcoin but I'm just a dude fascinated by patterns. Do your own research, enjoy your gains and learn from your losses.

Better yet, just dollar-cost average monthly + HODL long-term✌️

Better yet, just dollar-cost average monthly + HODL long-term✌️

If you've read this far, thank you!

Please offer your vote and retweet the poll for visibility:

Do you think #bitcoin will see another blow-off top?

Please offer your vote and retweet the poll for visibility:

Do you think #bitcoin will see another blow-off top?

https://twitter.com/misconfig_exe/status/1471260236379918338

I'd like to highlight @venturefounder's 200D MA analysis which includes on-chain indication of peak "Fear" at this time.

Remember, everything is cyclical

Remember, everything is cyclical

https://twitter.com/venturefounder/status/1471706438129131522

@venturefounder Another analyst, Steve @ btcfeen highlights a large cluster of bid order sitting below the 200D MA, suggesting that the loss of the MA may lead to selloffs, enabling smarter players to pick up cheaper bids

https://twitter.com/btcfeen/status/1471930358899765255

@threadreaderapp I command thee to unroll this thread

• • •

Missing some Tweet in this thread? You can try to

force a refresh