1/15 Welcome To Olympus

Though @OlympusDAO's team is mostly anonymous, it is the brainchild of Zeus, who ideals for it to become the #decentralized reserve currency of the #cryptocurrency space.

Though @OlympusDAO's team is mostly anonymous, it is the brainchild of Zeus, who ideals for it to become the #decentralized reserve currency of the #cryptocurrency space.

https://twitter.com/ohmzeus/status/1351614840771641350?s=20

2/15 Instead of pegging their value to a #FIAT currency, @OlympusDAO seeks to back each of their native tokens $OHM through a basket of #cryptocurrency assets much like a centralized bank.

3/15 However, unlike a centralized bank, decisions would have to be made via voting on proposals in the #DAO (Decentralized Autonomous Organisation), preserving the spirit of decentralization and democracy.

4/15 What’s up with the #APY?

One of the reasons that @OlympusDAO gained so much traction early on was the more than 7,000% APY offered, which it claimed was sustainable for an extended period of time.

One of the reasons that @OlympusDAO gained so much traction early on was the more than 7,000% APY offered, which it claimed was sustainable for an extended period of time.

5/15 @OlympusDAO's success in maintaining those #APYs while not having giant red candles over and over is thanks to its bonding mechanism.

6/15 This allows @OlympusDAO to accrue value for its treasury and #POL (Protocol-Owned Liquidity) over time.

7/15 Is it just another #Ponzi scheme?

As you can see from the project’s runway, it can continue to pay out its current #APYs of over 7,000% for more than a year, even without any new participants.

As you can see from the project’s runway, it can continue to pay out its current #APYs of over 7,000% for more than a year, even without any new participants.

8/15 Furthermore, the protocol owns almost 100% of its own #liquidity, which means that if people want to buy or sell $OHM, @OlympusDAO will accrue #trading fees.

9/15 However, this does not mean that @OlympusDAO is a fool-proof way to riches, and this is where the infamous (3,3) meme comes into play.

10/15 This concept actually leverages game theory, more specifically, the #PrisonersDilemma. Basically, assuming only two parties are involved, they can:

11/15

1. Both Stake (3, 3) — achieving the best for both themselves and the protocol

2. One Stakes and One Bonds (3, 1) — 3+1 =4 and is still overall good for liquidity and taking $OHM off the open market

3. One sells (1, -1)– where the seller diminishes the other’s effort

1. Both Stake (3, 3) — achieving the best for both themselves and the protocol

2. One Stakes and One Bonds (3, 1) — 3+1 =4 and is still overall good for liquidity and taking $OHM off the open market

3. One sells (1, -1)– where the seller diminishes the other’s effort

12/15 4. Both sell (-3, -3) — creates the worst outcome for both the user, and the protocol.

So, what if everyone sells?

So, what if everyone sells?

13/15 Well, the short answer is that those who stay staked long enough will not only break even but eventually run a profit.

14/15 Liquidity-as-a-service

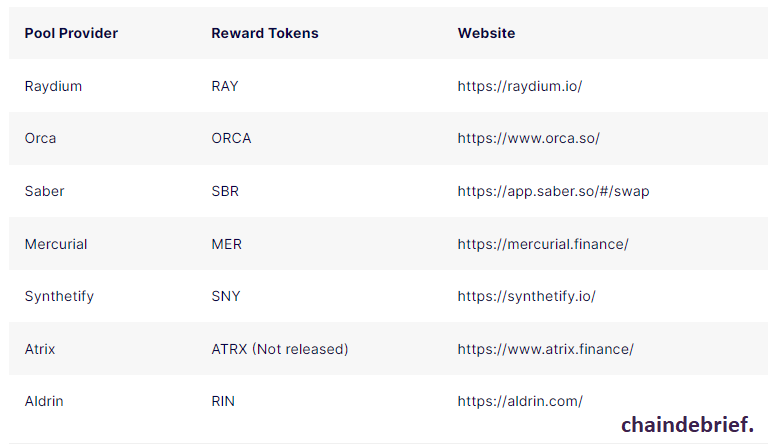

With @OlympusDAO success, it has started to accumulate more assets and revenue-generating platforms. Olympus Pro, which provides liquidity-as-a-service, allows other platforms to acquire their own #liquidity as well.

With @OlympusDAO success, it has started to accumulate more assets and revenue-generating platforms. Olympus Pro, which provides liquidity-as-a-service, allows other platforms to acquire their own #liquidity as well.

15/15 They’ve also been looking to expand to other chains such as @FantomFDN, and recently started providing their #liquidity as a service feature on the @avalancheavax Chain, which includes notable projects such as @pangolindex and @BenqiFinance.

Read more about @OlympusDAO at: chaindebrief.com/what-is-olympu…

• • •

Missing some Tweet in this thread? You can try to

force a refresh