🚨🚨 Update: Today a quick market update as nothing have changed since yesterday. We still detect more incoming inflows from whales. The whales ratio maintains its level between 0.7 - 1.0. As soon we register bigger outflows, more inflows follows. Today we have

#BTC #ETH #XRP

#BTC #ETH #XRP

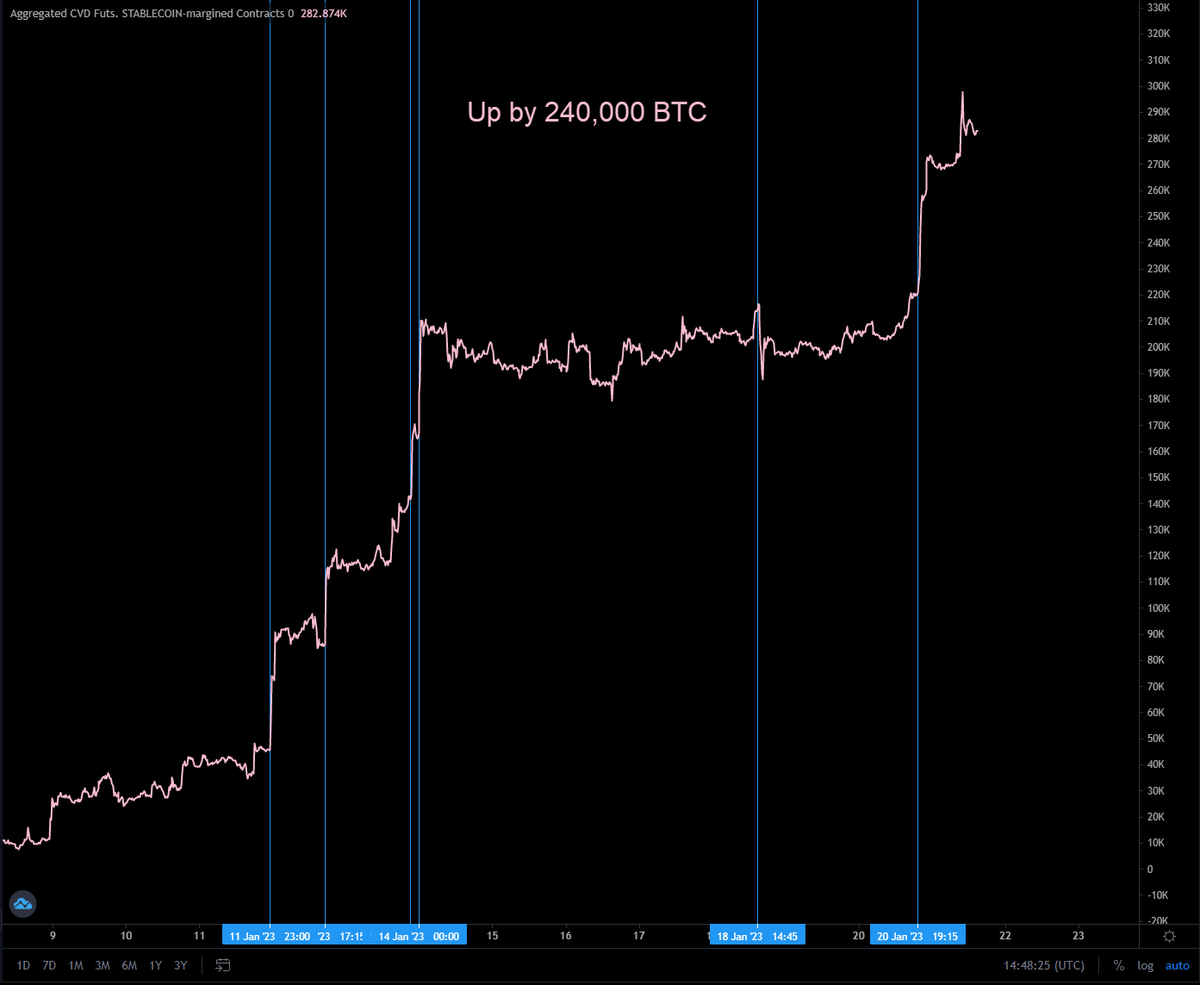

registered more inflows than outflows. The stablecoin reserves on exchanges has rised a bit. I have received some whale alerts related to new stablecoin inflows to exchanges, but we have more outflows coming from #Binance again. Almost $510m stablecoin withdraw registered from

#Binance indicating whales selling their assets and withdrawn their stablecoins. If we don't detect some big inflows to treasury soon its almost confirmed that these whales want to stay to stablecoins to buy the dip afterwards. We have also detected $400m stablecoin inflows

arriving #Okex and #Huobi. Those $200m from #Huobi are coming from #Bitfinex and fresh minted from (thin air) #tether treasury. Maybe pump ammo or just to hold the line ($45.5k) as they expect a rising sell pressure. However, our whales ratio 30d average has declined today. Even

if we still detect more whales inflows, it has subsided a little. Since yesterday we have more positive netflows than negative, confirming the high whales ratio and indicating more inflows than outflows.

Today option traders are trading more bearish than yesterday based on their recent transactions. The volume for options with expiry 07Jan22 and 14Jan22 has rised a lot. Both showing more Puts than Calls. Some traders bought almost $35m in puts for our 14Jan22 expiry expecting a

#BTC price below $44k. That let explain our decline in max pain again from 54k to 52k after it declined from 55k to 54k just few days ago indicating, option traders are adjusting their option portfolio now. Anyway, the biggest trade activity for all expiry right now is for puts

at $44k and for calls at $60k. It looks like option traders are expecting a dump below $44k until 01-14-2022, while they expect 52k end of the month.

Futures are looking very bearish atm. Leverage ratio maintains its high level, funding rates rising a bit, but not a big deal atm

Futures are looking very bearish atm. Leverage ratio maintains its high level, funding rates rising a bit, but not a big deal atm

It seems, at least thats showing me the chart, in futures we had a flash crash to 44.9k to retrace quick afterwards one hour ago. Anyway, no big liquidations happend since yesterday.

In the last hour we have received more shorts than longs, except on #Bitfinex, #Huobi and

In the last hour we have received more shorts than longs, except on #Bitfinex, #Huobi and

#Deribit. You remember the indirect stablecoin inflow from #Bitfinex to #Huobi I've mentioned above? 🧐 Do they know something? We will see.

If we check the longs/shorts ratio of the last 24h its almost neutral and that matches to the funding rates. Also here #Bitfinex traders

If we check the longs/shorts ratio of the last 24h its almost neutral and that matches to the funding rates. Also here #Bitfinex traders

very bullish, with #Kraken and #Deribit traders as they traded more longs than shorts.

Total exchange reserves has risen since yesterday by 800 #BTC. #Okex has received more tokens too, a total of 550 #BTC since yesterdays update. #Bitfinex is surprising me with 1,550 more #BTC

Total exchange reserves has risen since yesterday by 800 #BTC. #Okex has received more tokens too, a total of 550 #BTC since yesterdays update. #Bitfinex is surprising me with 1,550 more #BTC

in their reserves. #Gemini also showing a rising reserve by almost 450 #BTC. #Binance maintains its reserve level and has just reduced its reserve by almost 350 #BTC since yesterday.

Looks like we are heading the last final dump weeks imo. But we are still missing the big dump. Since our last big inflows we have detected certain outflows and we have reduced the reserves a bit, but we still have too many tokens remaining and instead of just selling, more

inflows are arriving. So, imo we are not done yet, even if we lift up heading upper 40s, we will dump again afterwards. High leverage futures and a lot of dump ammo still on the table. Bullish looks different. As soon we will dump hard we will rise in volatility. So, no high

leverage folks! It doesn't matter of longs or shorts, but please no high leverage.

Stick to your plan and don't let you guide by price action, influencers or fear! 🙏 Good luck all of you!

Stick to your plan and don't let you guide by price action, influencers or fear! 🙏 Good luck all of you!

• • •

Missing some Tweet in this thread? You can try to

force a refresh