Alright guys, a head spinner from Module 4, Ranges & Targets:

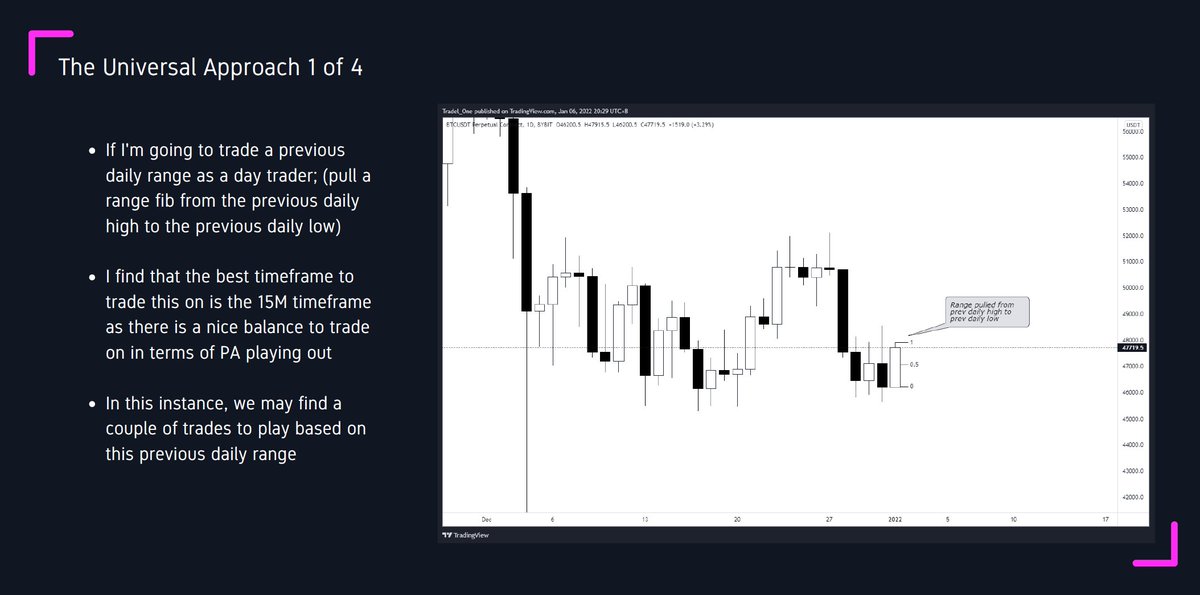

As price is fractal in nature, we can work out a ratio from our Timeframe Based Range setup, to a workable timeframe to manage a $BTC #bitcoin trade on

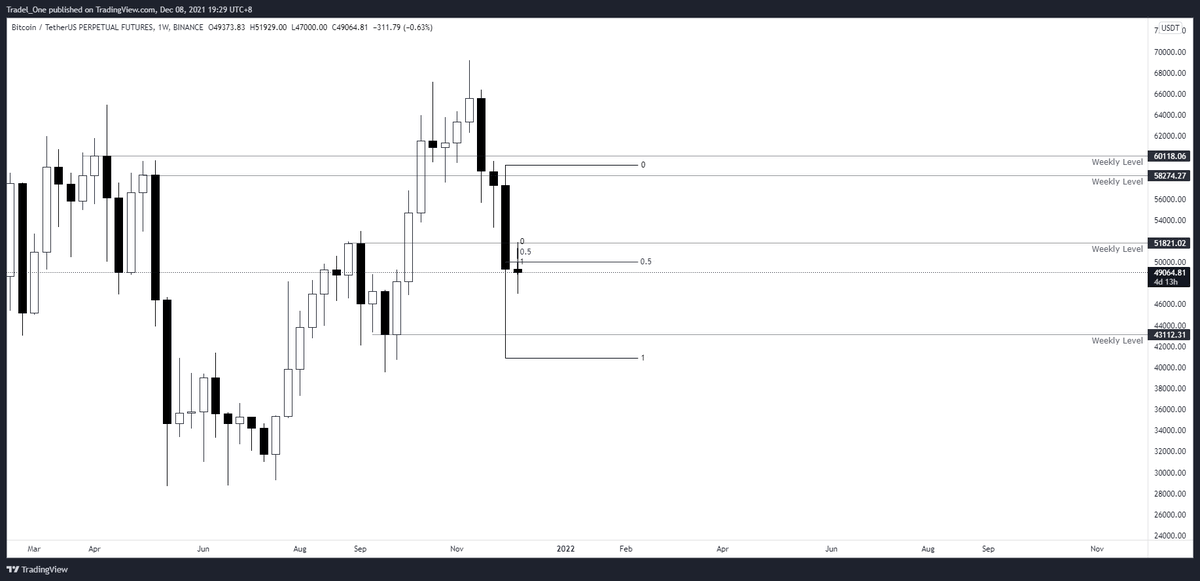

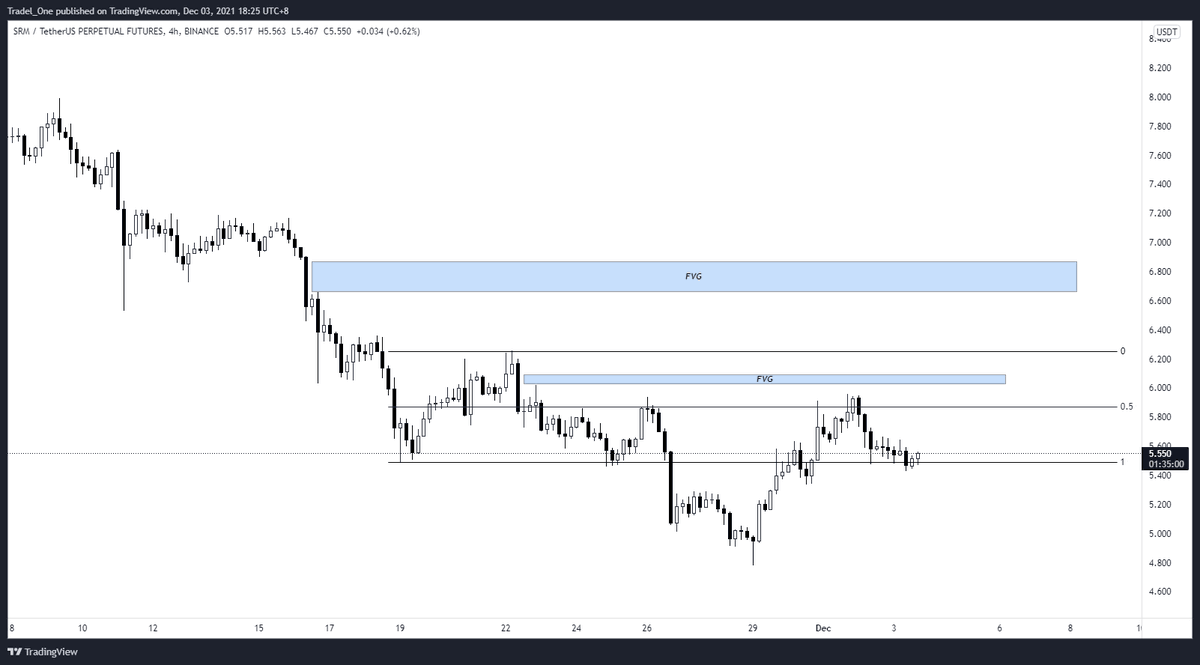

Here we set up a range on the 1D, but manage on the 15M

As price is fractal in nature, we can work out a ratio from our Timeframe Based Range setup, to a workable timeframe to manage a $BTC #bitcoin trade on

Here we set up a range on the 1D, but manage on the 15M

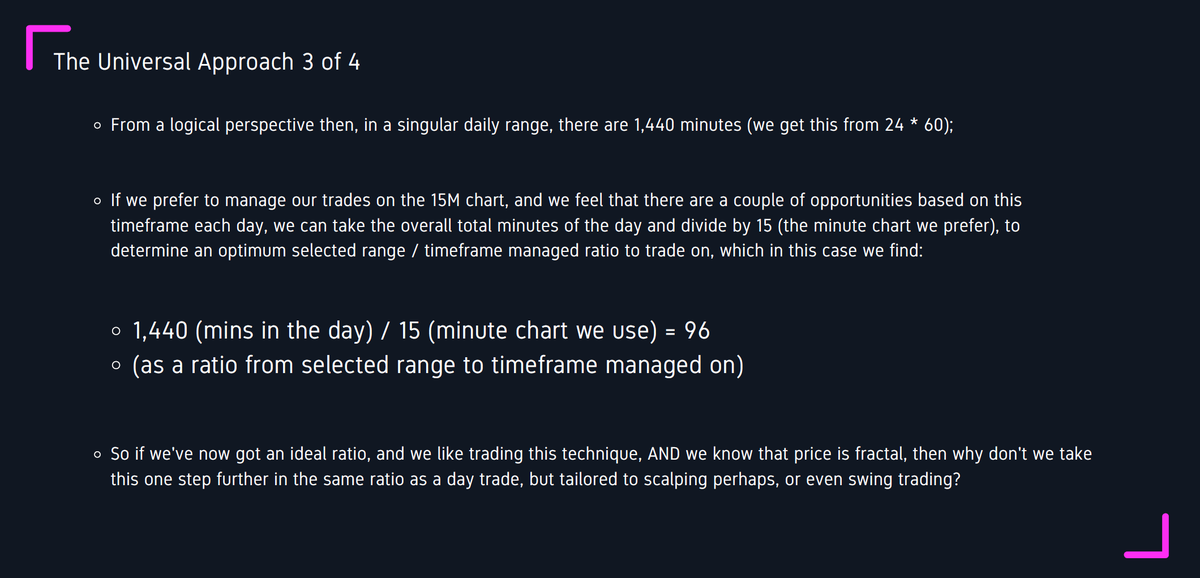

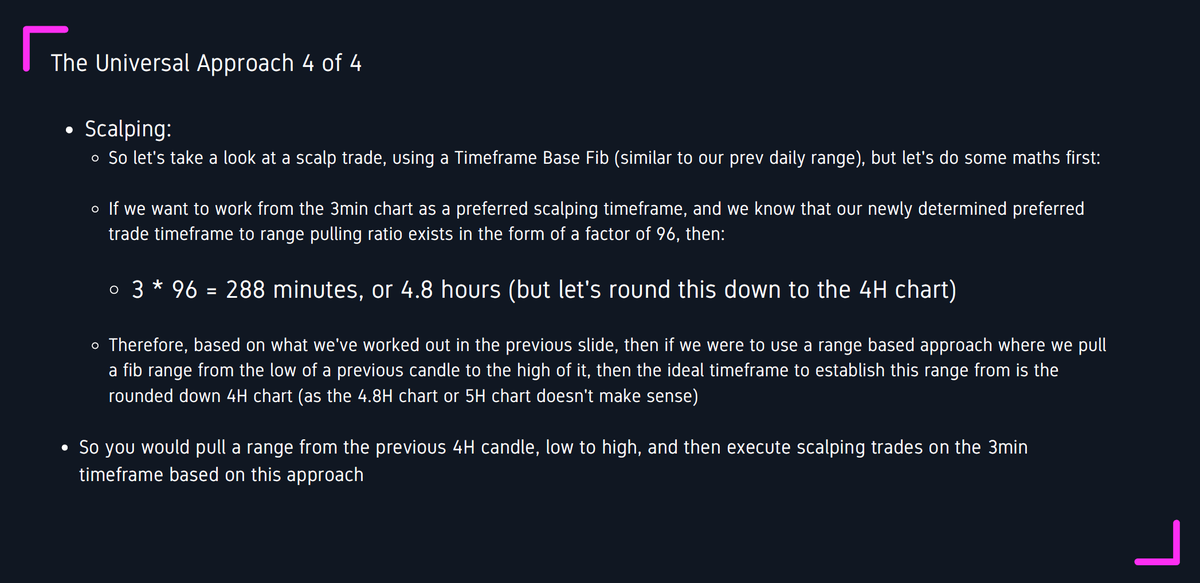

As price is fractal in nature, if we work out a ratio of TF used to establish a range, to TF used to manage a trade, we get 96 (1,440 mins in a day / 15mins)

Using this logic, we can then trade a range on any timeframe based on this ratio, from scalping to swing trading

Using this logic, we can then trade a range on any timeframe based on this ratio, from scalping to swing trading

You can essentially use exactly the same technique (that we are learning), on a ratio'd timeframe of established range to a timeframe that you manage your trade on, that suits your style or the PA that is presenting

(ie daytrading set up not presenting, but scalping looks good)

(ie daytrading set up not presenting, but scalping looks good)

So it's a bit of a head scratcher at the start, but when you delve into it, the technique we're learning truly affords you the opportunity to use it whether you are scalping, day trading, swing trading, or even position trading.

We'll learn more about this soon with eg's

🤝🍻

We'll learn more about this soon with eg's

🤝🍻

• • •

Missing some Tweet in this thread? You can try to

force a refresh