1./ Yesterday @TeamKujira posted about $aUST becoming available to bid on liquidated assets in the near future. I already shared it because I'm very excited about it, but why am I so excited?

A short thread on why this matters so much 🧵👇

A short thread on why this matters so much 🧵👇

https://twitter.com/TeamKujira/status/1480278091926753284?s=20

2./ Currently you have to deposit $UST in #ORCA to be able to buy discounted liquidated assets. It's interesting, but it does have opportunity costs.

Depositing $UST in @anchor_protocol gives you 19.5% APY. And you're not getting this once the $UST is deposited in #ORCA.

Depositing $UST in @anchor_protocol gives you 19.5% APY. And you're not getting this once the $UST is deposited in #ORCA.

3./ Once your bids in #ORCA won't get filled, you're missing out on the 19.5% APY @anchor_protocol would have given to you and you're not buying discounted, liquidated assets either.

4./ Therefore making $aUST available is a game changer. It's now becoming possible to bid on liquidated assets while your $UST is still earning interest. 15% instead of 19.5%, but that's still amazing.

Check this tweet to see what this could mean:

Check this tweet to see what this could mean:

https://twitter.com/lejimmy/status/1480367964289384449?s=20

5./ But that's not the only benefit. Because people will be able to use $aUST the revenue of @TeamKujira is expected go x30! 🤯

And all of this is being payed out to $KUJI stakers.

And all of this is being payed out to $KUJI stakers.

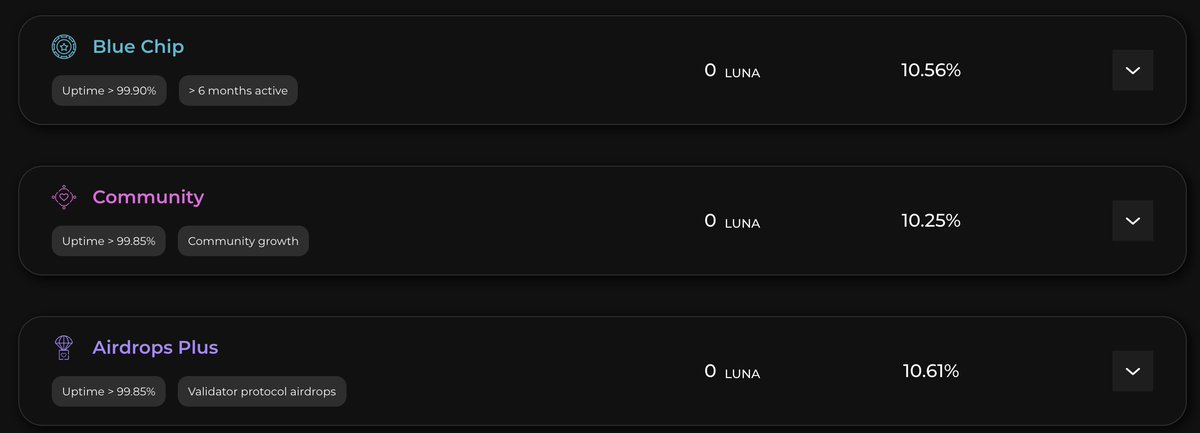

6./ Currently, the single asset staking APR for $KUJI is already 20% without this revenue. Imagine this to go x30. People will ape into $KUJI to profit from such an APR, which will make the price explode 💥

7./ I'm not finished.

We all know that it's just a matter of time before @anchor_protocol will offer more collateral options. More collateral options means more bAssets to get liquidated.

We all know that it's just a matter of time before @anchor_protocol will offer more collateral options. More collateral options means more bAssets to get liquidated.

8./ Currently it's only possible to buy discounted $bLUNA or $bETH, but what if $bATOM, $bSOL or other assets become available?

More fees will be collected by @TeamKujira so more revenue is being payed out to stakers.

More fees will be collected by @TeamKujira so more revenue is being payed out to stakers.

9./ I'm very happy with my $KUJI bag. @TeamKujira is doing great work and I expect we're just at the beginning.

Buying discounted assets while earning yield on your stables is a masterpiece 🧑🎨

Don't sleep on $KUJI, anon 🔥

Buying discounted assets while earning yield on your stables is a masterpiece 🧑🎨

Don't sleep on $KUJI, anon 🔥

• • •

Missing some Tweet in this thread? You can try to

force a refresh