1./ Imagine staking your $LUNA at @staderlabs, receive $LUNAx and use it as collateral on @mirror_protocol 🔥🤯

You can now vote on this proposal:

mirrorprotocol.app/#/gov/poll/225

But why is it important? Why should you actually care?

A thread 🧵👇

You can now vote on this proposal:

mirrorprotocol.app/#/gov/poll/225

But why is it important? Why should you actually care?

A thread 🧵👇

2./ As we all know, it's possible to use a delta neutral strategy on @mirror_protocol. This basically means that you have the same upside as downside. So no matter which way the price is moving, the value of you're holdings stay (almost) the same.

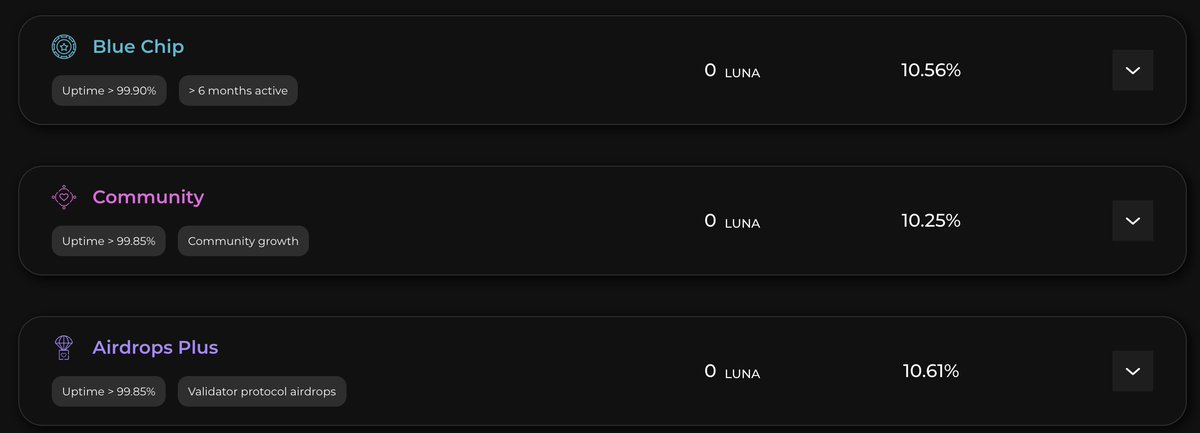

3./ But why is it interesting? Why should I care if my values stay the same? Well, both your short as your long position will give you rewards. See the picture below for some examples

4./ So by opening a delta-neutral position, you are at almost no risk for price movements but you do farm rewards. Amazing, isn't it?

5./ But why do you need $LUNAx? For opening a short position collateral is needed. As you can see below you now have the choice between $UST, $aUST and $LUNA. You can't stake $LUNA and use it as collateral at the same time at the moment. But $LUNAx might be added.

6./ And there is a big difference between using $LUNA and $LUNAx as collateral.

Once you choose to liquid stake your $LUNA at @staderlabs you receive $LUNAx in return. $LUNAx is basically the right to reclaim your original deposited $LUNA.

Once you choose to liquid stake your $LUNA at @staderlabs you receive $LUNAx in return. $LUNAx is basically the right to reclaim your original deposited $LUNA.

7./ You're now staking your $LUNA, so you are receiving #airdrops and yield, but you have a liquid token in return at the same time; $LUNAx. When it would be possible to use this as collateral you're able to receive staking rewards and use it as collateral at the same time!

8./ That's what I call capital efficiency! Not having to choose between either of the two but choosing both at the same time.

In my opinion this opens a new strategy on the #Terra network, which I always like.

In my opinion this opens a new strategy on the #Terra network, which I always like.

9./ Please note that using $LUNA or $LUNAx as collateral is a way higher risk than using $UST or $aUST. If you don't understand this, please do your own research on how short positions and collateral work before starting with this.

10./ If you want to know more about the delta neutral strategy, there are a lot of excellent video's about it available on youtube. I recommend to watch these before starting.

11./ For now, I think it's time for the $MIR governance stakers to let your voice be heard:

mirrorprotocol.app/#/gov/poll/225

@staderlabs is bringing staking to the next level. Very excited about everything else they're building for us!

🔥🔥

mirrorprotocol.app/#/gov/poll/225

@staderlabs is bringing staking to the next level. Very excited about everything else they're building for us!

🔥🔥

• • •

Missing some Tweet in this thread? You can try to

force a refresh