CBDC's in Cross Border Payments - World Bank

So I read this 46-page document

I found some interesting pieces of information so this thread will dive into some of my thoughts

I also found some errors the @WorldBank needs to fix in regards to $XRP

#XRP $XLM #XRPCommunity #XRPL

So I read this 46-page document

I found some interesting pieces of information so this thread will dive into some of my thoughts

I also found some errors the @WorldBank needs to fix in regards to $XRP

#XRP $XLM #XRPCommunity #XRPL

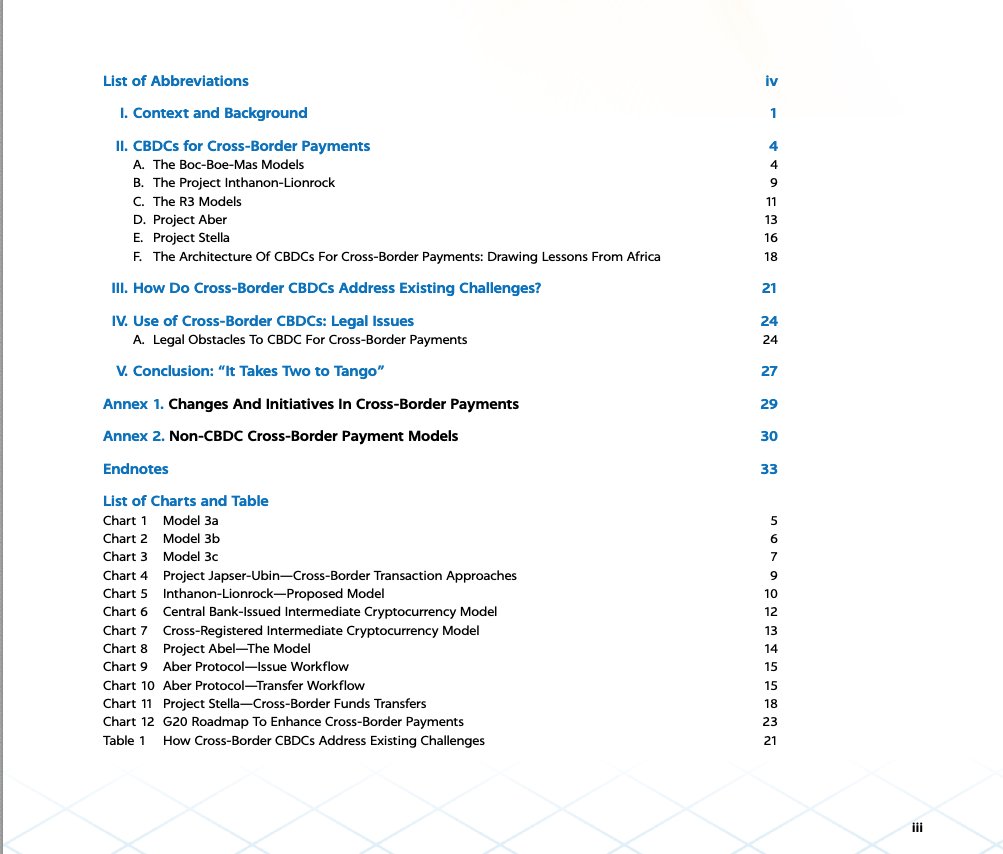

First of all, thank you to the writers that created this

There was a lot of great information on CBDC's and possible structures that the infrastructure could be built on.

But I am not going to cover the CBDC stuff in this thread.

#Project #Ubin #Stella #Jasper #R3

There was a lot of great information on CBDC's and possible structures that the infrastructure could be built on.

But I am not going to cover the CBDC stuff in this thread.

#Project #Ubin #Stella #Jasper #R3

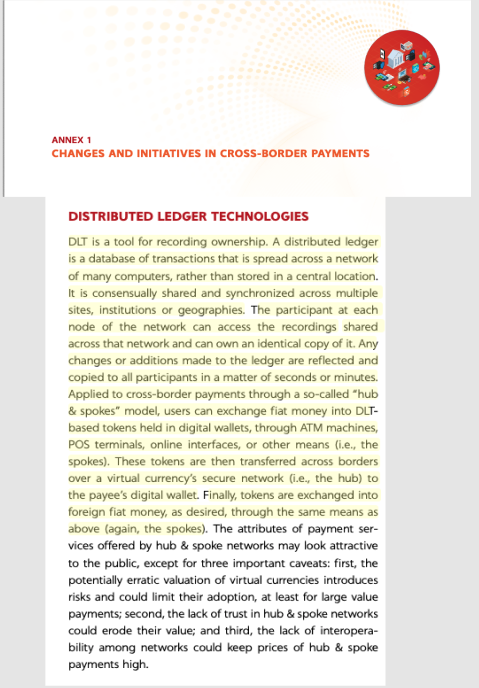

Great description for beginners of what Distributed Ledger Technology is.

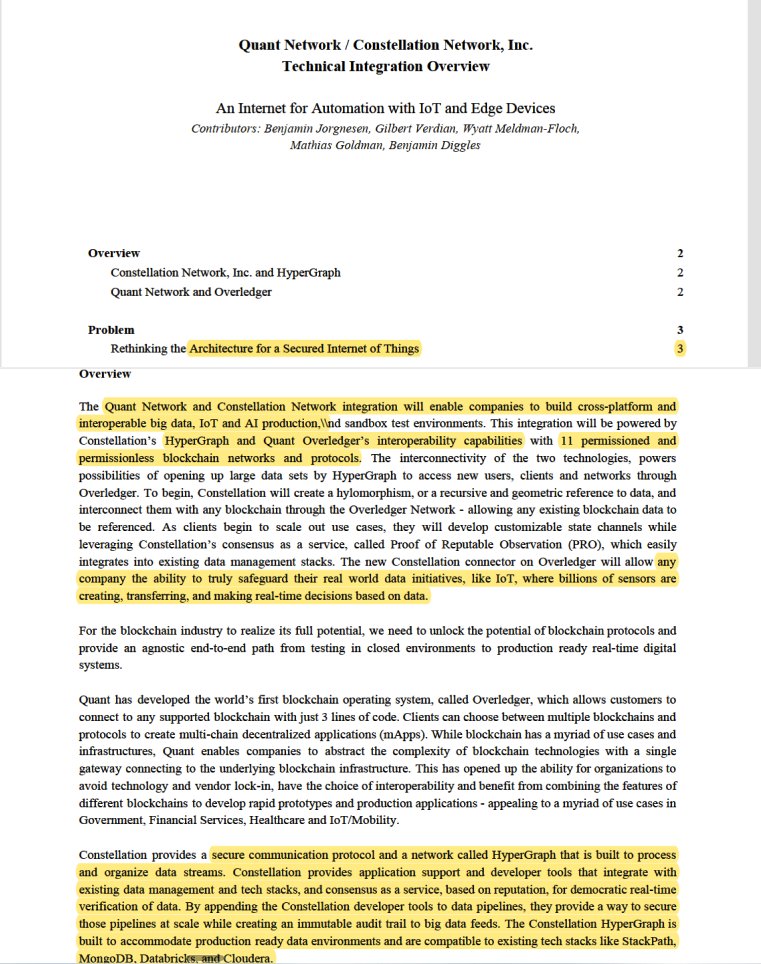

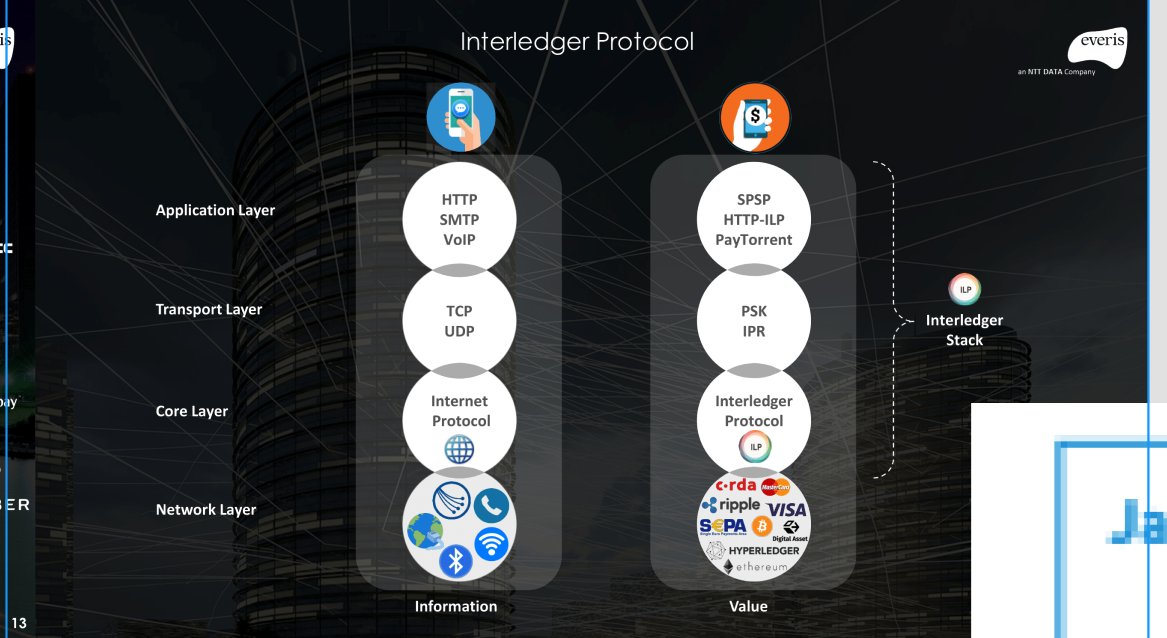

World bank mentions lack of interoperability but there are two great solutions for that:

1. @quant_network - #Overledger Solution

2. @Interledger - Interledger Protocol ILP

#DLT #Blockchain

World bank mentions lack of interoperability but there are two great solutions for that:

1. @quant_network - #Overledger Solution

2. @Interledger - Interledger Protocol ILP

#DLT #Blockchain

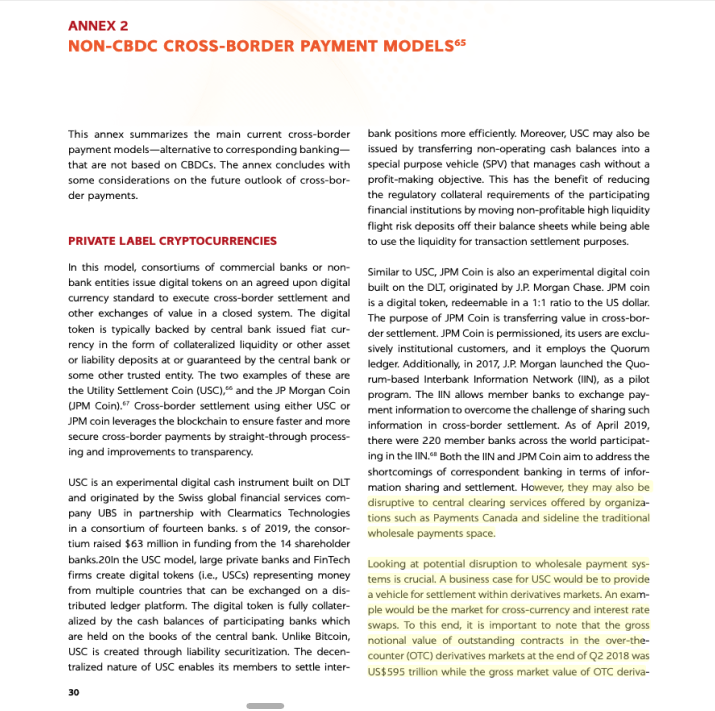

Non-CBDC Cross Border Payment Models

This is where the mentions of $XRP & $XLM are👇

#Fintech #RegTech #Banking #Payments #Openbanking #BankTransfers #DLT

This is where the mentions of $XRP & $XLM are👇

#Fintech #RegTech #Banking #Payments #Openbanking #BankTransfers #DLT

@WorldBank puts $XRP & $XLM under the category of stablecoins and calls them "Digital Currencies" (Cough Not Securities @SECGov)

Stable coins because of instant settlemnt

#XRP - Cross-border Interbanking payments / micropayments / CBDC-Federated Sidechains

#XLM - Retail payments

Stable coins because of instant settlemnt

#XRP - Cross-border Interbanking payments / micropayments / CBDC-Federated Sidechains

#XLM - Retail payments

I point out the terms "Digital Currency" because there is a huge difference between a "Security" and a "Digital Asset / Currency"

Example: Japan clarified XRP is a Digital Asset not a security

Japan = Winning in regulatory clarity

USA = Unorganized and failing because of @secgov

Example: Japan clarified XRP is a Digital Asset not a security

Japan = Winning in regulatory clarity

USA = Unorganized and failing because of @secgov

@WorldBank Makes a huge outdated mistake.

dev.to/ripplexdev/deb…

There are currently 150 Validator Nodes / 900 Nodes in total

Ripple only controls 5 / 39 nodes on the default UNL

Roughly 5% of Total Nodes.

@HammerToe We got some myth-busting to do with the world bank. #XRP

dev.to/ripplexdev/deb…

There are currently 150 Validator Nodes / 900 Nodes in total

Ripple only controls 5 / 39 nodes on the default UNL

Roughly 5% of Total Nodes.

@HammerToe We got some myth-busting to do with the world bank. #XRP

I highlighted "XRP acts as a Bridge Currency" so I can show you these diagrams for your visualization and also tell the @SECgov there is no such thing as a "Bridge Security" that can source liquidity across the globe whenever necessary. 🤣

#XRP $XRP #ILP #fintech #banking

#XRP $XRP #ILP #fintech #banking

Their mentions of $XLM

•Mentions XLMs Barclays Africa & Deloitte Pilot

•Boasts cheap txn fees

•XLM acts as retail bridge currency between global jurisdictions

•SDEX is borderless & not subject to jurisdictional controls or frictions

(@worldbank Wrong XRP is decentralized)

•Mentions XLMs Barclays Africa & Deloitte Pilot

•Boasts cheap txn fees

•XLM acts as retail bridge currency between global jurisdictions

•SDEX is borderless & not subject to jurisdictional controls or frictions

(@worldbank Wrong XRP is decentralized)

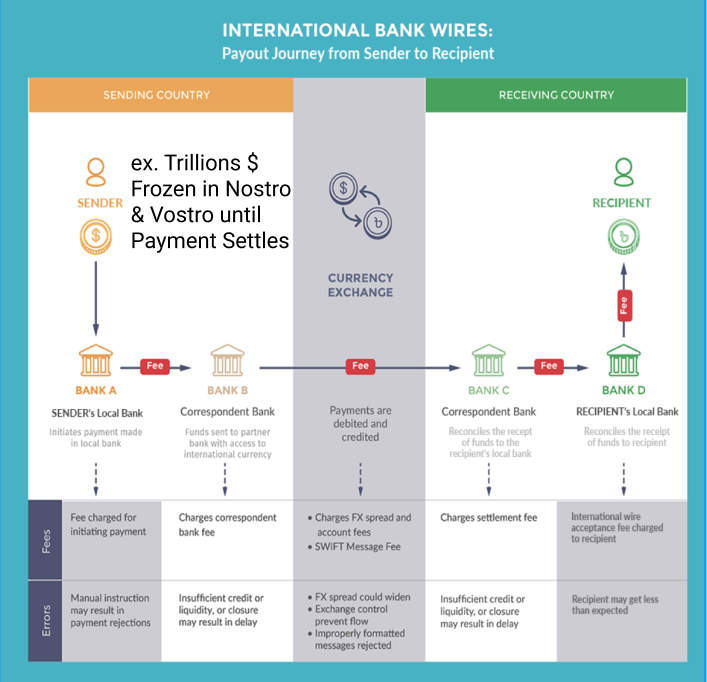

Cross border payments are broken with correspondent banking.

•Slow

•Expensive

•No end to end tracking

•Fragmented payment systems worldwide

•Nostro/Vostro Account Trapped Liquidity

Some diagrams below

(Note XRP is almost the same as the XRP comparison chart)

#XRP #XLM

•Slow

•Expensive

•No end to end tracking

•Fragmented payment systems worldwide

•Nostro/Vostro Account Trapped Liquidity

Some diagrams below

(Note XRP is almost the same as the XRP comparison chart)

#XRP #XLM

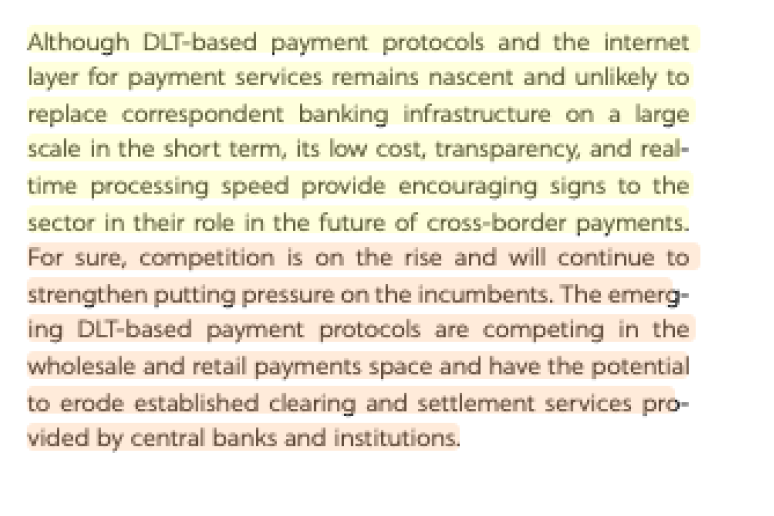

@worldbank "Expansion of DLT-based payment protocols appear to be yielding promising results"

"emerging trend that blockchain is here to stay"🌱🚀

"Internet layer for payment services" - example from my mindmap of ILP as layer

"emerging trend that blockchain is here to stay"🌱🚀

"Internet layer for payment services" - example from my mindmap of ILP as layer

Short term to replace correspondent banking infrastructure no.

But long term DLT based payment protocols are competing in the wholesale and retail payment space which can erode established clearing and settlement services provided by central banks and Institutions

But long term DLT based payment protocols are competing in the wholesale and retail payment space which can erode established clearing and settlement services provided by central banks and Institutions

Potential disruption to wholesale payment systems is crucial. USC could provide a "vehicle for settlement" within the derivatives markets

(I can think of a better solution 😉)

Outstanding contracts in the OTC derivatives markets at the end of Q2 2018 was US 595 Trillion $

(I can think of a better solution 😉)

Outstanding contracts in the OTC derivatives markets at the end of Q2 2018 was US 595 Trillion $

Well Citizens,

I hope you enjoyed my regulated crypto summary.

If you found some things interesting RT the first tweet.

If you are apart of the #XRPCommunity and think the @worldbank should make a correction to this document (RT, Tag them, and let's get their attention)💪

I hope you enjoyed my regulated crypto summary.

If you found some things interesting RT the first tweet.

If you are apart of the #XRPCommunity and think the @worldbank should make a correction to this document (RT, Tag them, and let's get their attention)💪

openknowledge.worldbank.org/handle/10986/3…

If you are interested in reading the full copy.

Here is the download link!

Stay educated Citizens and always keep learning!

-Citizen of the Future

If you are interested in reading the full copy.

Here is the download link!

Stay educated Citizens and always keep learning!

-Citizen of the Future

• • •

Missing some Tweet in this thread? You can try to

force a refresh