After Rafael Benitez was sacked by Everton, the Spaniard released a statement, claiming that his task had been made harder by the “financial situation”, so here’s a quick look at the club’s challenges (in advance of the publication of the 2020/21 accounts) #EFC

#EFC have reported losses 5 times in the last 6 seasons up to 2019/20 with another hefty deficit anticipated in 2020/21, as almost all games were played behind closed doors. In fact, the losses in the last 2 seasons (£140m & £112m) are both in the top 7 ever recorded in England.

It is worth noting that the #EFC bottom line has been adversely impacted by the high managerial turnover since Farhad Moshiri arrived. Even before Rafa’s departure #EFC have paid out £32m in compensation and severance pay in the last 5 years.

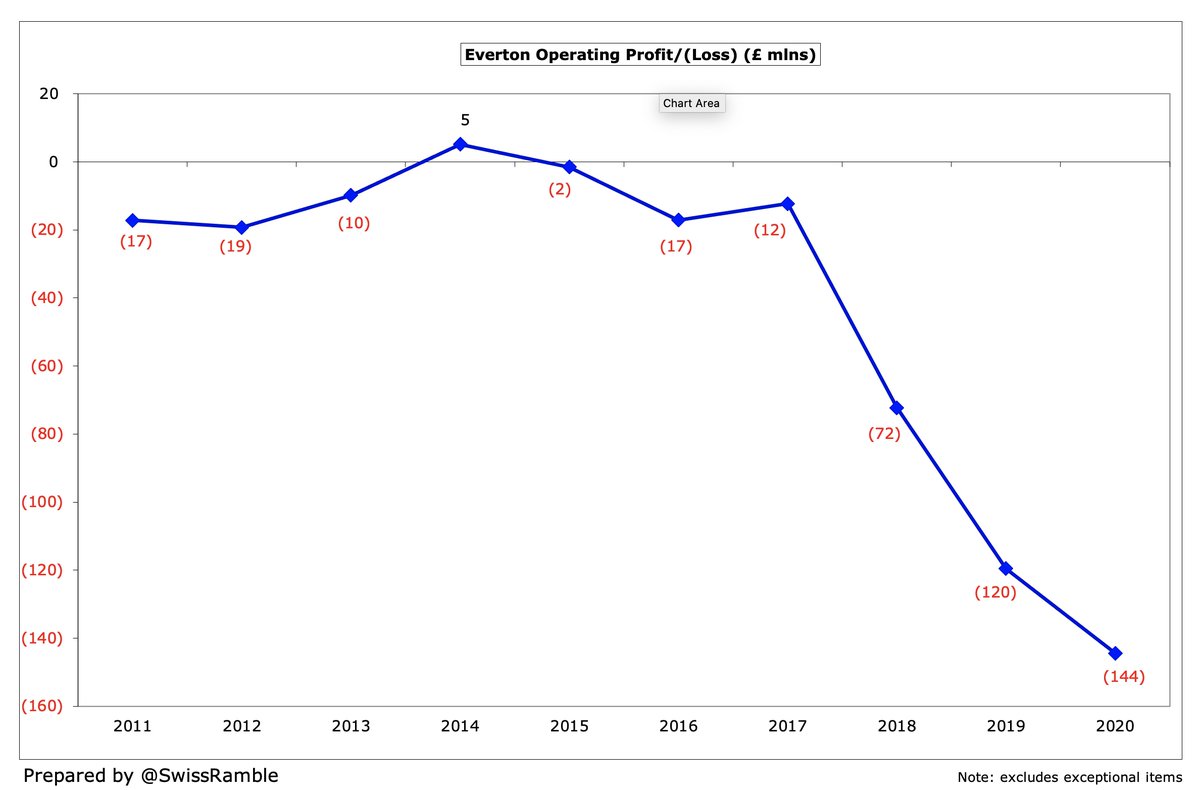

At an operating level (i.e. excluding player sales & exceptional items), #EFC loss has shot up from £12m to £144m in just 3 years. In fairness, few clubs post operating profits, but Everton’s loss is the second highest in the last 2 seasons, only surpassed by #CFC £159m.

The #EFC wage bill has virtually doubled since 2016 from £84m to £165m. In the same period, revenue has only increased by around 50%, so the wages to turnover ratio has worsened from 61% to 89%.

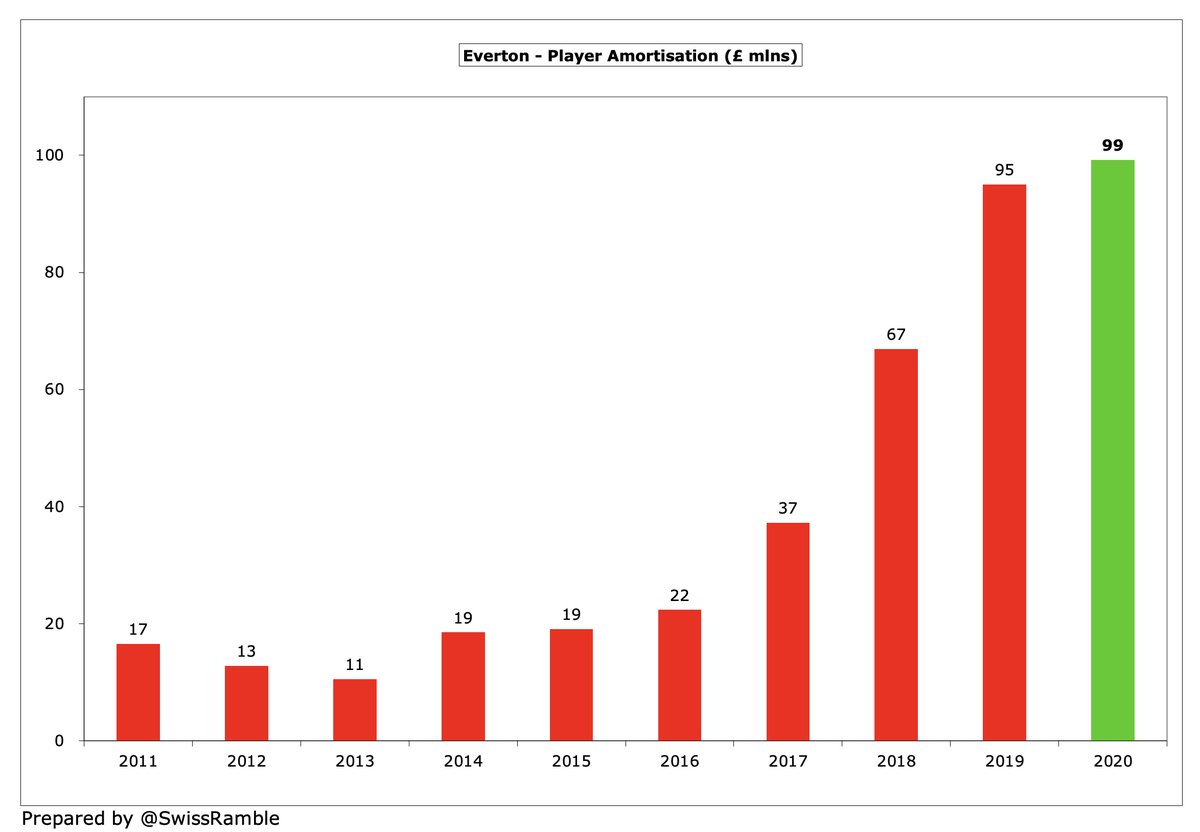

Since Moshiri’s arrival, #EFC have spent big in the transfer market (until last summer). In the 4 seasons up to 2020, they splashed out a chunky £566m gross spend (£294m net), which resulted in player amortisation more than quadrupling from £22m to £99m.

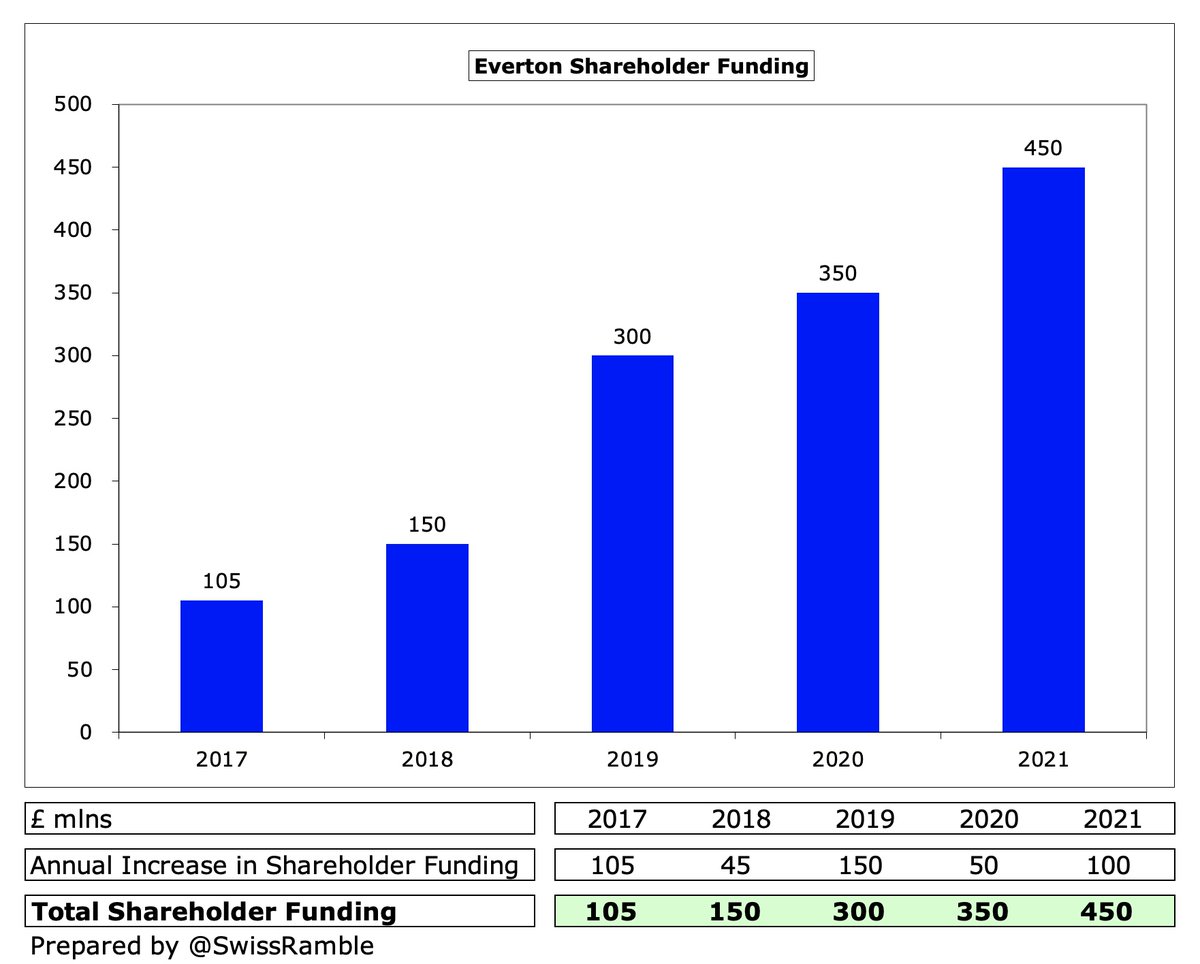

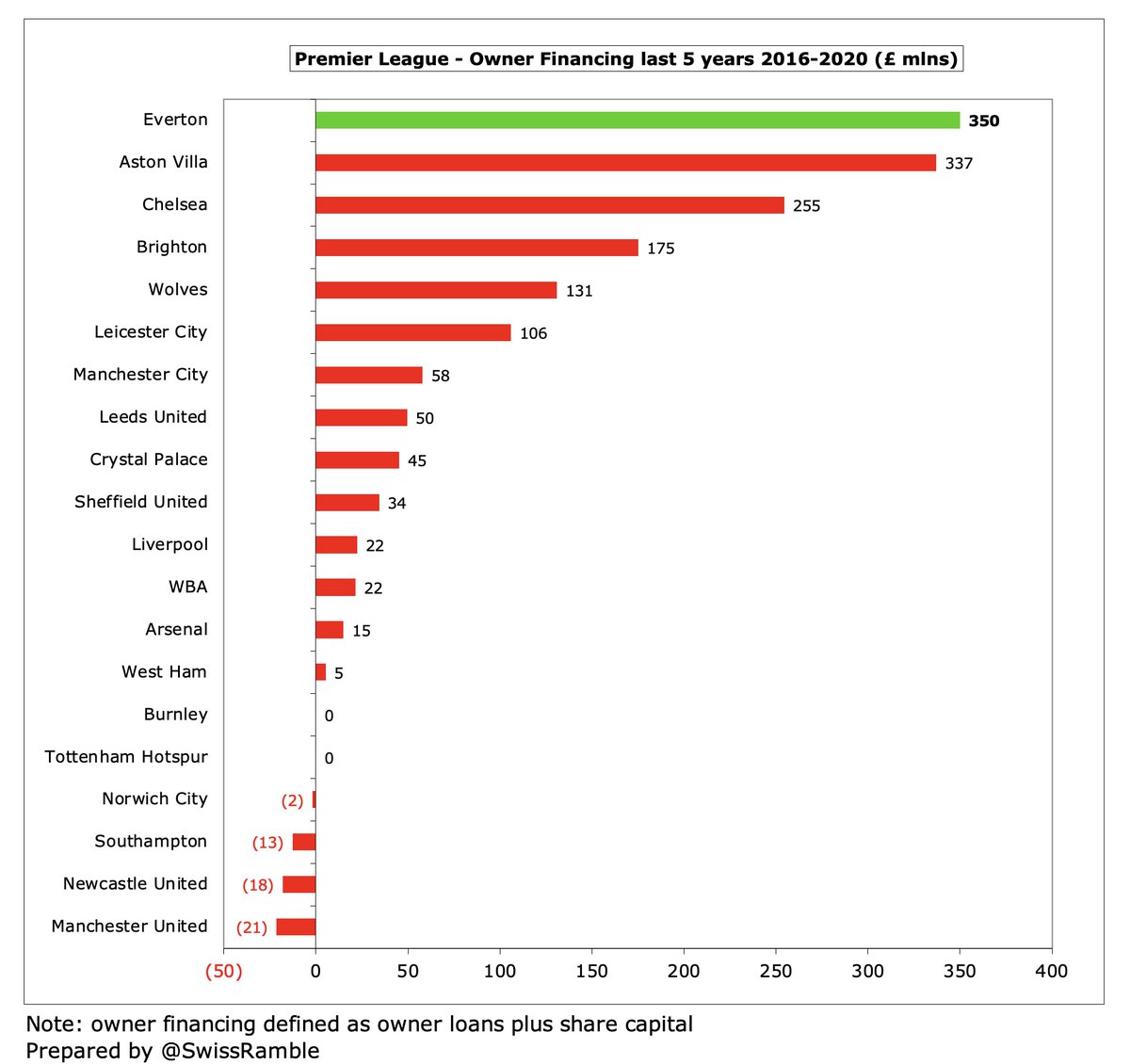

This profligate approach has been essentially funded by Moshiri. Including £100m capital injections and loans in 2020/21, I reckon this now adds up to a hefty £450m. In fact, in the five years up to 2020, #EFC £350m owner funding was the highest in the Premier League.

However, Benitez’s biggest problem was probably linked to the PL’s Profitability & Sustainability rules (aka FFP). My estimate is that #EFC were way over target even after allowable deductions (including stadium costs), though were much closer after excluding COVID impact.

Given that the 2020/21 figures are likely to be even worse, #EFC have a tough challenge to be compliant with FFP regulations. This is almost certainly the reason why they spent less than £2m in the summer (on Demarai Gray) before the recent panic buys of Mykolenko and Patterson.

There is no doubt that #EFC owners have put a lot of money into the club. The problem is that they have not spent it very well. Whatever people think of Benitez’s managerial abilities, he seems to have a point when he talks about the difficult “financial situation”.

• • •

Missing some Tweet in this thread? You can try to

force a refresh