#AfricaTech #Reflections: Where we might go from here?

2021 gave us many reasons to celebrate. More startups. More money. More deals. More global and local investors. Feels like the stage is set. But is it? And even if yes, what can we expect?

Few pre-weekend thoughts - long 🧵👇

2021 gave us many reasons to celebrate. More startups. More money. More deals. More global and local investors. Feels like the stage is set. But is it? And even if yes, what can we expect?

Few pre-weekend thoughts - long 🧵👇

1/ Reading this great piece from @fcollective – was a good reminder of value creation and the fact it is measured over time and not just on the first fundraising rounds.

link.medium.com/FjwZPlQvYmb

link.medium.com/FjwZPlQvYmb

2/ A giant drop in public markets tech multiples across the board + eye-watering pre-seed & seed valuations – are a reason to stop & think.

Is this a sustainable track and the best way to embark in '22 onwards?

Or are there frameworks to help #AfricaTech grow healthier & better?

Is this a sustainable track and the best way to embark in '22 onwards?

Or are there frameworks to help #AfricaTech grow healthier & better?

3/ So I tried to look around.

First – we're early. Very early. Good to celebrate our $5b raised (including debt), 100s of deals & several unicorns, but maturity wise > Early. A few years behind India & LATAM, and more behind US/EU/Israel in terms of exit options breadth and depth

First – we're early. Very early. Good to celebrate our $5b raised (including debt), 100s of deals & several unicorns, but maturity wise > Early. A few years behind India & LATAM, and more behind US/EU/Israel in terms of exit options breadth and depth

4/ Both India and LATAM had very strong ‘exit’ years in 2021. Well above 2020, and almost all years before. Both different in nature, but some interesting potential lessons about what might happen in the years to come.

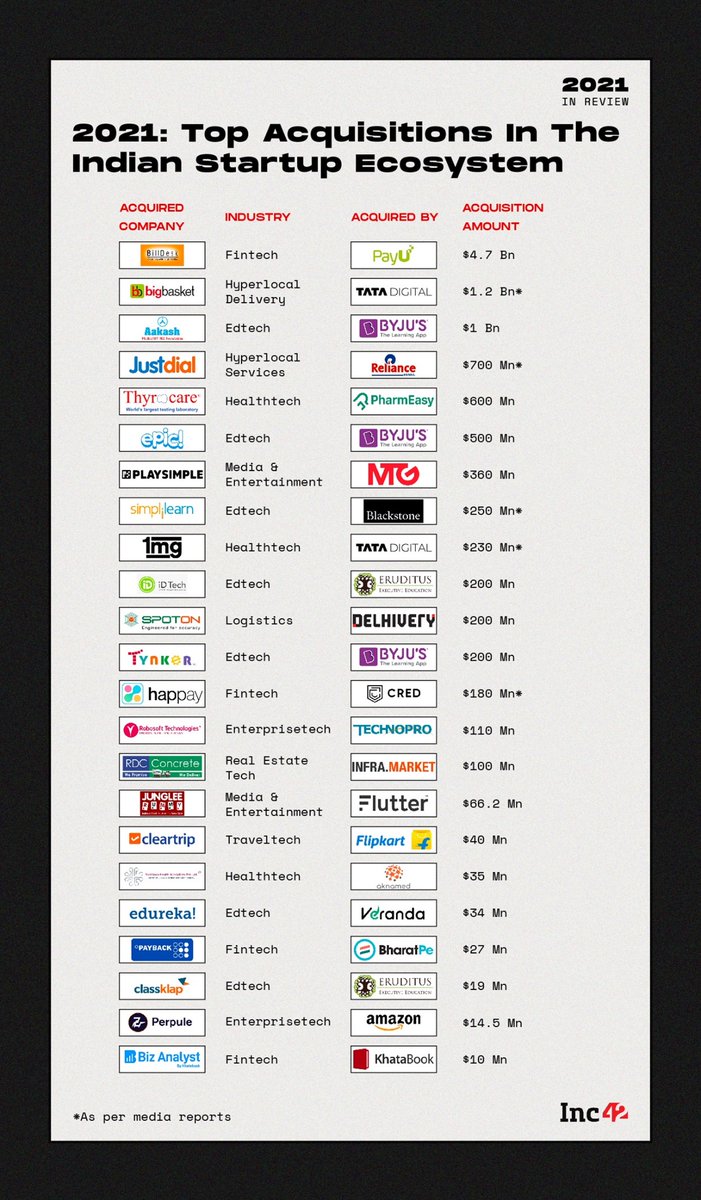

5/ India saw exits valued at circa $40b, though over a third of it was in a few very large IT companies takeovers, which are less relevant. Yet, excluding the almost $9b deal in IT, the average exit was at about $100m, with clear majority being strategic of financial M&As.

6/ A striking data point in the Indian context, is that +90% of the largest tech exits were to larger local players. #Consolidation in market, by players who know the its dynamics, and cater for similar client base.

7/ In terms of spaces, the most active acquirers were in #EdTech (several large deals) and online retail or food brands (dozens of small deals). Other spaces saw 1-3 large deals at best. It is worth noting that a few of the largest IPOs were made in the local Stock

8/ Excanhge which saw some new tech business models for the first time. Success remains very mixed for those 11 listings, raising an average amount of $670m. This is a depth African stock markets are clearly lacking.

9/ LATAM saw a somewhat different dynamic. While some of the largest exits were also in the IT services (less pure tech) space, about half of the buyers were local and the other were mainly US based, and some from Europe/UK.

10/ @Okta, @Etsy, @Blockchian.com, @Uber were among the noteable buyers. Largest sectors included #identity, #eCommerce and retail/food.

Very few IPOs, mostly in the US stock markets (including @nubank), as local ones aren’t tech savvy and lack depth as well.

#SoWhat?

Very few IPOs, mostly in the US stock markets (including @nubank), as local ones aren’t tech savvy and lack depth as well.

#SoWhat?

11/ Of course Africa my carve itself a different future, and more so, the future at large can be very different for everyone than the passages above.

12/ Yet, we are suffering a few limiting factors: underdeveloped local stock exchanges will mean less IPOs as these will need to compete in the US and London.

13/ Outside few verticals most companies are targeting African consumers and businesses, they may suffer slightly lower margins built into their models and might not always be a fit for US buyers (which aren’t yet making big expansion moves into any of the developing markets).

14/ In turn, they might be a fit for the very few local buyers and those who will grow to be the consolidators, as well as the large relevant players in India/Asia/LATAM which have more aligned business models and margin structures.

15/ These could be phenomenal, but may also entail lower multiples (which any case are noted in all growth tech markets globally in recent months).

16/ Looking at the exit landscape in India&LATAM pre '21, there may be a few potential years with most exits being in the tens & low hundreds of $m. Tying back to the starting point of @fcollective's piece, majority of exits will be smaller than anticipated, many by a long mile

17/ While investors (us included) may be able to overcome by being part of the very few large ones, for most founders there is a more binary outcome. And probability of it being smaller than some assume based on *fundraising valuations* maybe very misguiding.

18/ Let’s all make sure we are taking the right amount of $$ at the right time, and focus on building value. Happy customers that stick and recommend. Revenues turning to profits. And a distinctive advantage over competitors: much lower cost base or much better value proposition

19/ If those can be explained easily and be clear and distinctive, we’re on the right passage to create value. In turn, maybe be acquired as a market leader, be bought for the cash flow, or better but much more rare – be able to go public and grow value with time.

20/ Exit really the only goal in life, but systematically, only good exits (for early and later investors as well as founders) will secure more money invested, more global attention, more local role models and more #value built for #Africa.

end/ Time will tell and fascinating year(s) ahead.

Kindly comment and share if you found interesting, and happy for alternative or additional views to keep developing mine.

#AfricaTech #AfricaVC

Kindly comment and share if you found interesting, and happy for alternative or additional views to keep developing mine.

#AfricaTech #AfricaVC

• • •

Missing some Tweet in this thread? You can try to

force a refresh