1/ 🚨 MARKET UPDATE🚨 A thread... 👇

Below I will share my views of the market and my plan, are you in? Lets go...

#Bear markets are great opportunities to scoop coins at a significant discount. The right picks can change lives.

Don't fall into FUD! Start planning!

👇

Below I will share my views of the market and my plan, are you in? Lets go...

#Bear markets are great opportunities to scoop coins at a significant discount. The right picks can change lives.

Don't fall into FUD! Start planning!

👇

2/ This is my third bear market. Here is what I learned so far. Bitcoin first. 👇

#Bitcoin bottoms after 85% drop from ATH, #ETH at 95%. Will we see similar drops now? Possibly, but maybe not.

Below the #Bitcoin levels to watch as we drop.

#Bitcoin bottoms after 85% drop from ATH, #ETH at 95%. Will we see similar drops now? Possibly, but maybe not.

Below the #Bitcoin levels to watch as we drop.

3/ $30k for #BTC is almost certain. If that breaks (likely), then $20k is in play.

To me $20k is the most likely level where we will bottom after a 70% crash. Why?

Previous ATH and strong support levels. Moreover, institutions are here now, so a 85% drop is less likely. 👇

To me $20k is the most likely level where we will bottom after a 70% crash. Why?

Previous ATH and strong support levels. Moreover, institutions are here now, so a 85% drop is less likely. 👇

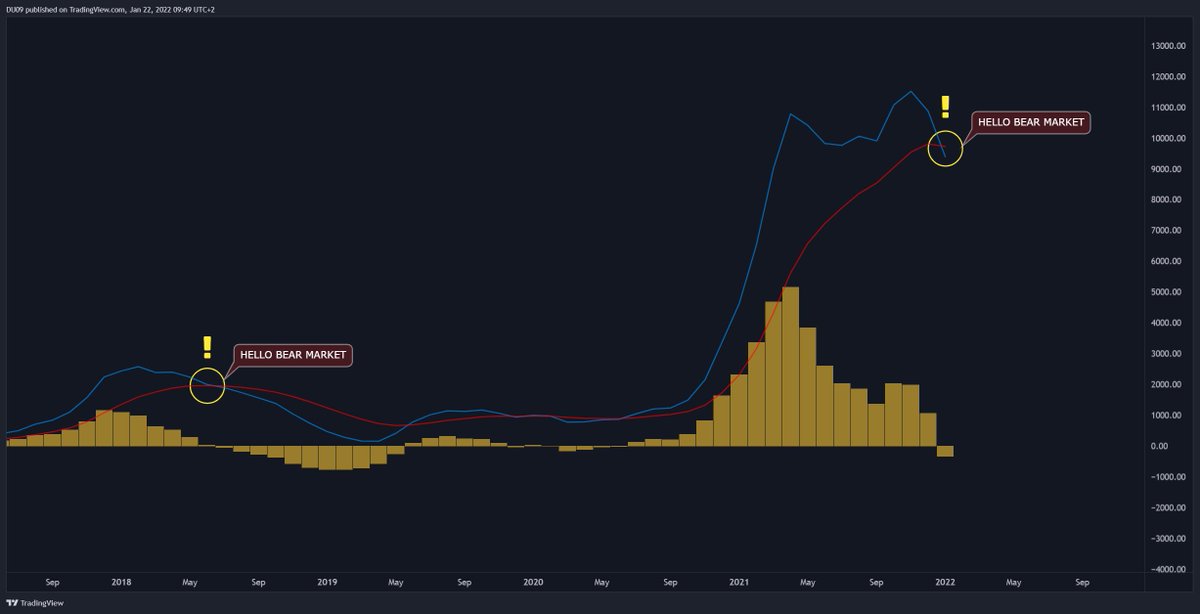

4/ If you think #BTC is not in a bear market, look at monthly MACD (pictured).

I will scale into #BTC as we move under $30k. WHY?

#Bitcoin can reach over $1 mil by 2030. Of course I am buying... 👇

I will scale into #BTC as we move under $30k. WHY?

#Bitcoin can reach over $1 mil by 2030. Of course I am buying... 👇

5/ Now #Ethereum and shitcoins (ETH pictured).

I am not interested in #ETH until it falls under $1k. After that I scale in. I'd be surprised if it stops at $1.4k (70% crash).

#ETH will easily go into 80% if BTC drops to $20k. 👇

I am not interested in #ETH until it falls under $1k. After that I scale in. I'd be surprised if it stops at $1.4k (70% crash).

#ETH will easily go into 80% if BTC drops to $20k. 👇

6/ What about my shiny #shitcoins? Expect a drop between 80-95%. That is when you buy.

Think #ADA at 30 cents, #Luna under $10, #SOL at $20. Do the math, see what makes sense.

Don't spend big early and don't fall for the FOMO relief rallies. 👇

Think #ADA at 30 cents, #Luna under $10, #SOL at $20. Do the math, see what makes sense.

Don't spend big early and don't fall for the FOMO relief rallies. 👇

7/ Keep powder for when there is blood on the streets.

What I will buy at a discount (in that order):

1. #BTC

2. #ETH

3. #Luna / #LQTY

4. #SAND

5. #CRV

6. #BNB/#FTX/#WOO/#KCS

7. #UNI/#1INCH

8. #GRT/#FLX/#LINK

9. 👇

No #ETH killers? No. #ETH will kill them instead.

What I will buy at a discount (in that order):

1. #BTC

2. #ETH

3. #Luna / #LQTY

4. #SAND

5. #CRV

6. #BNB/#FTX/#WOO/#KCS

7. #UNI/#1INCH

8. #GRT/#FLX/#LINK

9. 👇

No #ETH killers? No. #ETH will kill them instead.

8/ I will also get some high risk/high reward plays... depends what is hyped as we move into 2022.

Now start building your plan. What will you buy, when and start saving powder, particularly if $BTC falls under $30k.

It will feel like X-mas, but better. 👇

Now start building your plan. What will you buy, when and start saving powder, particularly if $BTC falls under $30k.

It will feel like X-mas, but better. 👇

9/ Good to also consider this picture for #BTC, but there are a few concerns:

1. Stock market crash incoming...

2. War in Ukraine...

If those materialize in 2022, I can't see how #BTC correction stops at 57%... 👇

1. Stock market crash incoming...

2. War in Ukraine...

If those materialize in 2022, I can't see how #BTC correction stops at 57%... 👇

10/ Don't focus so much on the bear market, but what it can offer you in the next cycle.

#Crypto adoption today is like the Internet in 1997. YOU ARE STILL EARLY!

Don't get sidetracked and ignore those joking about crypto... "look its crashing, told ya it's a ponzi". 👇

#Crypto adoption today is like the Internet in 1997. YOU ARE STILL EARLY!

Don't get sidetracked and ignore those joking about crypto... "look its crashing, told ya it's a ponzi". 👇

11/ If you play this smart, it can change your life. Focus on that. WORK HARDER, MORE and KEEP BUILDING. 🤩

Find gems and #HODL them as $1,000 invested in 2022 can be life changing later.

If you liked this thread, please share, retweet, follow & like. If you need guidance...👇

Find gems and #HODL them as $1,000 invested in 2022 can be life changing later.

If you liked this thread, please share, retweet, follow & like. If you need guidance...👇

12/ Join me on Discord:

bit.ly/3n2gng0

Bear markets are for buying, bull markets are for selling! Bear markets also build character and resilience, embrace them! 🥰

P.S. If you lost a lot, it's just money, don't forget what matters. Trust me I know. 🚀

bit.ly/3n2gng0

Bear markets are for buying, bull markets are for selling! Bear markets also build character and resilience, embrace them! 🥰

P.S. If you lost a lot, it's just money, don't forget what matters. Trust me I know. 🚀

13/ P.S.S. This is my opinion, the market will do what the market does. Prepare accordingly and do your research.

NFA.

NFA.

• • •

Missing some Tweet in this thread? You can try to

force a refresh