Today we will speak about @kava_platform and how to get 70% APY on your stables.

🧵

🧵

1/ @kava_platform is working on a kava chain which has around 500M$ of TVL and it is a part of @cosmos eco system. Recently @kava_platform joined #IBCGang which will allow crosschain transfers, but let's come back to the topic.

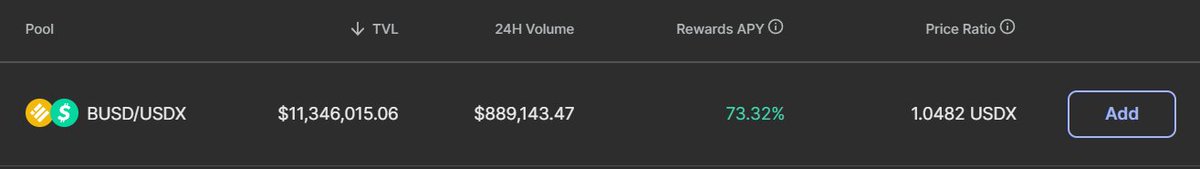

2/ Go to app.kava.io/swap/pools and add liquidity to the BUSD/USDX liquidity pool for 70% APY. APY depends on the price of rewards which are paid in $SWP token and total value locked. I have started farming with 140% APY last year.

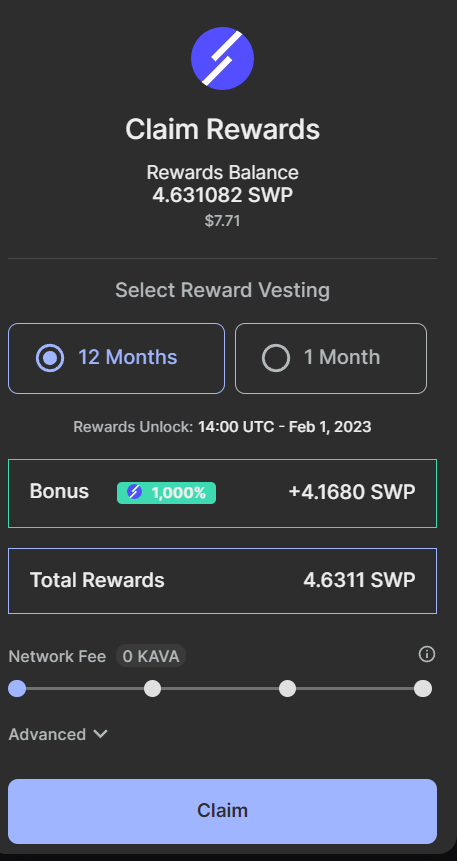

3/ Few important things to note! To get the highest APY you need to vest your rewards for 12 months when claiming. You can withdraw your rewards to the wallet but they will be still locked. Another option is to lock your rewards only for 1 month, but you won't get bonus rewards.

4/ As I have already mentioned and you can see on the screenshot above you can choose network fee yourself. Even with 0 fee transactions are quite fast, don't worry.

5/ So it is up to you and your investing strategy to vest your rewards for 12 months (365-380 days to be correct) or to vest them for a month and reinvest after.

6/ But what is $USDX and how to get it? It is #Kava native stable coin which you can buy on CEX @AscendEX_Global or directly on app.kava.io/swap/trade

I used @binance CEX to send $KAVA or $BUSD to the wallet (I'll explain futher) and swapped it for USDX in the app.

I used @binance CEX to send $KAVA or $BUSD to the wallet (I'll explain futher) and swapped it for USDX in the app.

7/ @kava_platform can not be used with MetaMask so in order to access it you need to use @keplrwallet which is perfect option if you are using different chains on @cosmos network, @TrustWallet - great mobile wallet, @Ledger or @IBCwallet.

8/ After that just provide BUSD/USDX liquidity at

app.kava.io/swap/liquidity and deposit to the pool.

app.kava.io/swap/liquidity and deposit to the pool.

9/ There is another option to have a decent APY on your stables by lending #USDX for 32% APY. 32% seems not to much, but you can leverage #USDX by borrowing $USDX against it for less than 1% interest. This is a looping strategy where you can get 76% APY just in 5 loops.

10/ Do you think that I'll leave you with just 76% APY on your stables with 12 months vested rewards? You would unfollow me immediately.

11/ When lending your #USDX you are getting rewards in $KAVA and $HARD tokens. As you remember they are vested but you can withdraw them to your wallet. Despite they are locked you can delegate your #KAVA tokens to the validator for another 33% APR while they are locked.

12/ Another reason to split your assets into LP and lending is to diversify your rewards into different tokens. So you won't be exposed only to a single farm token.

13/ But for delegating your $KAVA you will need some gas ($KAVA) in the wallet to approve the transaction, except you are using mobile app of @IBCwallet and it is not connected to your @Ledger wallet.

14/ What are the cons? #USDX is not the safest stable coin, during high volatility it tends to depeg more than #USDC, #USDT, #BUSD and other well known stables. To get the highest APY you need to vest rewards for 12 months (you are not gaining liquid capital for the first year..

15/ ..but you will be receiving rewards for another 12 months after you remove your funds from @kava_platform). APY is based on a current price of $KAVA, $SWP and $HARD tokens. Basically they can go to 0 and you will just waste time, they can stay at a same price and you'll..

16/ ..get 70% APY or it can go up in price and you'll get a higher APY, nobody knows. Personally I see a potential in @kava_platform especially after integrating #IBC. Plenty new assets will be available on a platform such as #ATOM, #LUNA, #UST, #AKT.

17/ It will bring more volume on the platform and further integrate to the @cosmos eco system. I am vesting the rewards for 12 months (only rewards are vested, you are free to withdraw your funds at any moment).

18/ I am not gaining anything for the first year but it is something like set and forget. Expected APY outweights the cons for me personally. And as everywhere I am investing only as much as I can afford to lose.

19/ Hope I didn't forget to mention anything. I only described stable coins farming opportunities on @kava_platform but you can check more degen farms with higher APY if it's up to your risk tollerance.

20/ Before I started to write threads myself I never understood why everyone is asking for likes, subs or sharing. But I can clearly see it now. Just as an appreciation of my work I will be very happy for the feedback. Thank you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh