#btcusd: Should we expect another leg up this year?

I think not:

1. If the stock market is like an avg 2nd year presidential year, it will move sideways.

#btc is moved by similar mechanisms/confounders and is unlikely to behave very differently.

I think not:

1. If the stock market is like an avg 2nd year presidential year, it will move sideways.

#btc is moved by similar mechanisms/confounders and is unlikely to behave very differently.

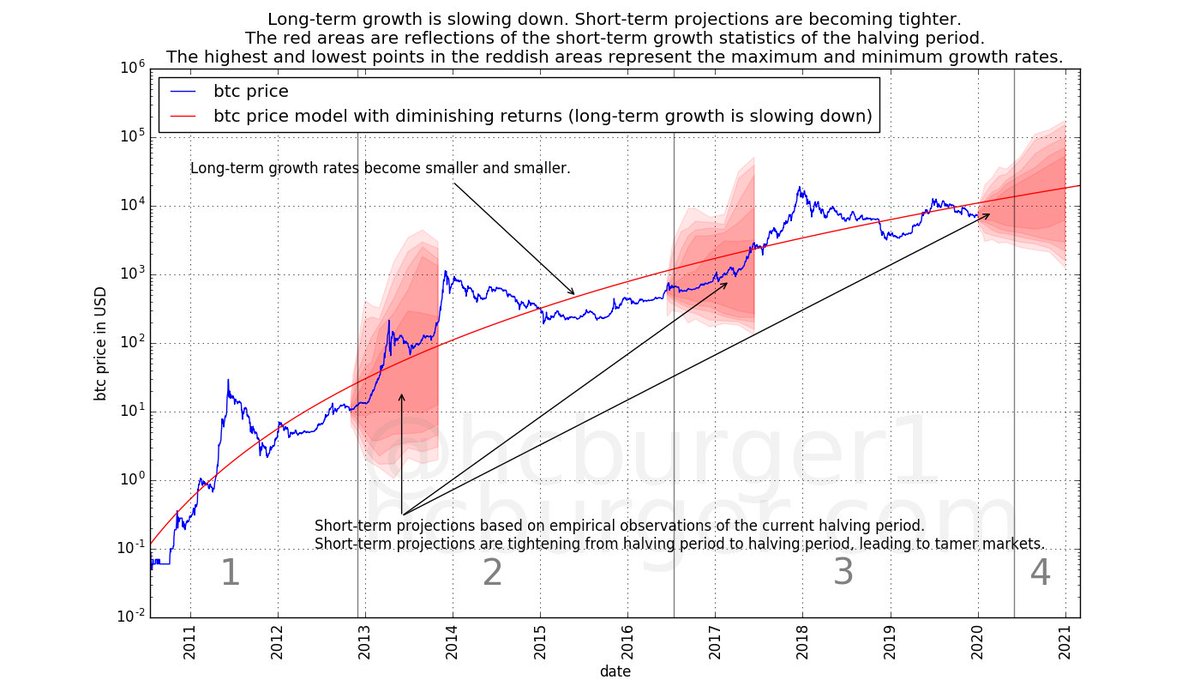

2. #btc just came out of a bull market.

The logical next thing to happen is a bear market, not another bull market.

However: This bull market was weaker than previous ones, which weakly suggests the bear market might also be weaker.

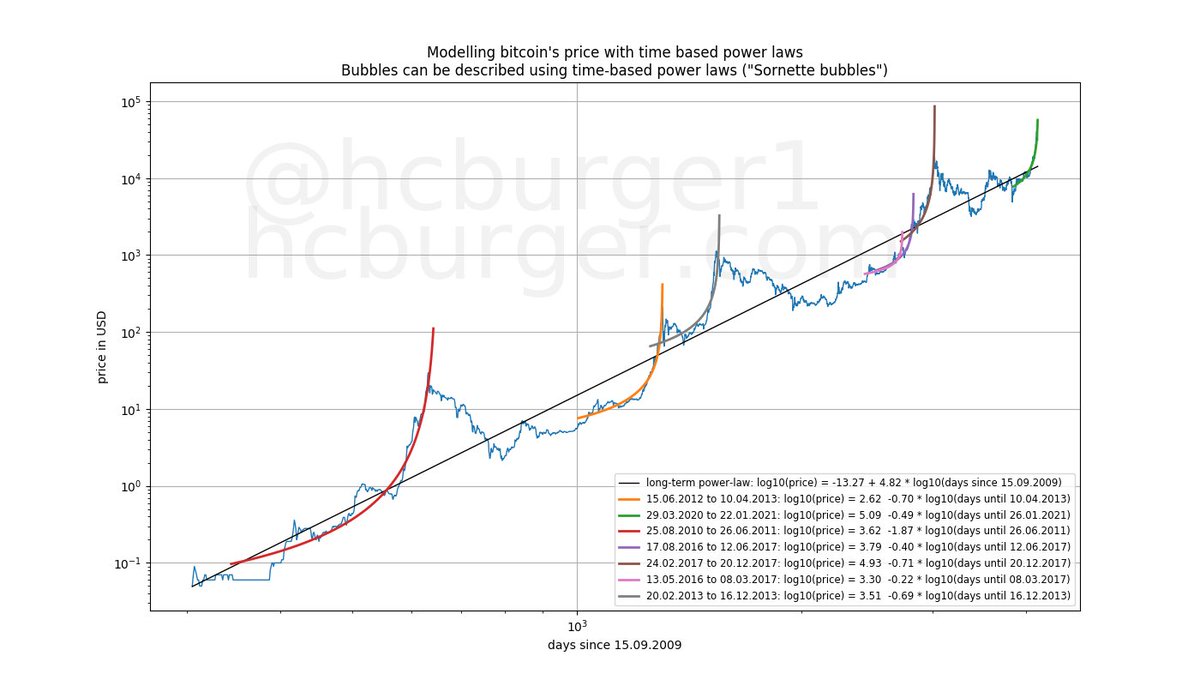

hcburger.com/blog/powerlaw

The logical next thing to happen is a bear market, not another bull market.

However: This bull market was weaker than previous ones, which weakly suggests the bear market might also be weaker.

hcburger.com/blog/powerlaw

There seems to be a lot of hope that another leg up might be happening anytime soon, but this seems to be based mostly on wishful thinking (as far as I can tell).

Another move down or prolonged sideways movement is more likely than a strong move up.

Another move down or prolonged sideways movement is more likely than a strong move up.

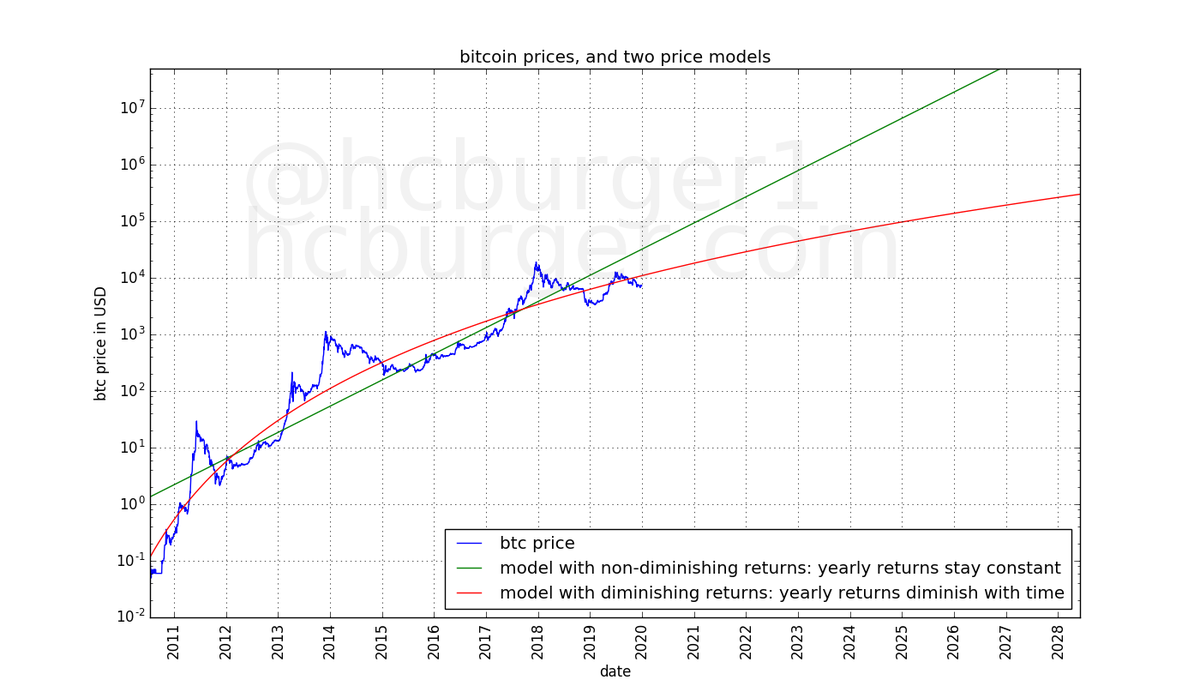

Predictions/narratives/models based on exponential (i.e. non-diminishing) growth will continue to fare very poorly.

Sideways or downwards movement is compatible with DIMINISHING returns, which HAS fared very well.

Sideways or downwards movement is compatible with DIMINISHING returns, which HAS fared very well.

The popular S2F model is not likely to fare well by end of year, as predicted (in Feb 2020):

hcburger.com/blog/s2fdecomp…

hcburger.com/blog/s2fdecomp…

https://twitter.com/s2fmultiple/status/1486213648791998465?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh