I have been criticizing the forecasts of S2F model since 2019, but I don't agree with this article. It arrives at some correct conclusions based on wrong arguments.

Let me elaborate.👇

bitcoinmagazine.com/markets/why-bi…

Let me elaborate.👇

bitcoinmagazine.com/markets/why-bi…

The article claims that the S2F model is a tautology, and therefore totally nonsensical: "In layman’s terms PlanB is essentially asserting that “Stock is a function of Stock.”"

But is S2F really a tautology?

But is S2F really a tautology?

Simply writing down the mathematical expression and re-arranging a bit shows us that this is NOT the case. S2F is NOT a tautology. It does NOT state that stock is a function of stock.

The article makes an ad hominem, stating that @100trillionUSD blocks all those who point out a problem with his model.

Well, I (together with @InTheLoopBTC) have been pointing out problems since 2019 but have not been blocked. In personal communications, PlanB was very friendly.

Well, I (together with @InTheLoopBTC) have been pointing out problems since 2019 but have not been blocked. In personal communications, PlanB was very friendly.

Yes, I do strongly believe that the S2F model is wrong and that its forecasts will prove too bullish.

But there are right and wrong reasons to say that the model is wrong. Some wrong reasons: stating that

- S2F is a tautology (it's not)

- PlanB is not nice (mere ad hominem).

But there are right and wrong reasons to say that the model is wrong. Some wrong reasons: stating that

- S2F is a tautology (it's not)

- PlanB is not nice (mere ad hominem).

Another incorrect reason is the lack of co-integration between the S2F variable and price. The concept of co-integration is just not that useful.

Judea Pearl (@yudapearl), the de-facto inventor of causal statistics didn't even know of the concept:

Judea Pearl (@yudapearl), the de-facto inventor of causal statistics didn't even know of the concept:

https://twitter.com/ercwl/status/1250537274053451776?s=20

Other reasons I believe are too weak to rule out S2F:

- the model doesn't include demand

- S2F is not a good measure of scarcity

- scarcity cannot create demand.

There is some truth in these statements. But S2F is a mere model, so it's ok if it's imperfect.

- the model doesn't include demand

- S2F is not a good measure of scarcity

- scarcity cannot create demand.

There is some truth in these statements. But S2F is a mere model, so it's ok if it's imperfect.

Good reasons to be skeptical of the S2F model:

1. The paucity of data points. The S2F variable stays the same within a halving period, so the data points tend to cluster. We have 3 datapoints + the very early history of btc.

~3 datapoints it not much!

1. The paucity of data points. The S2F variable stays the same within a halving period, so the data points tend to cluster. We have 3 datapoints + the very early history of btc.

~3 datapoints it not much!

https://twitter.com/100trillionUSD/status/1478701553800335363?s=20

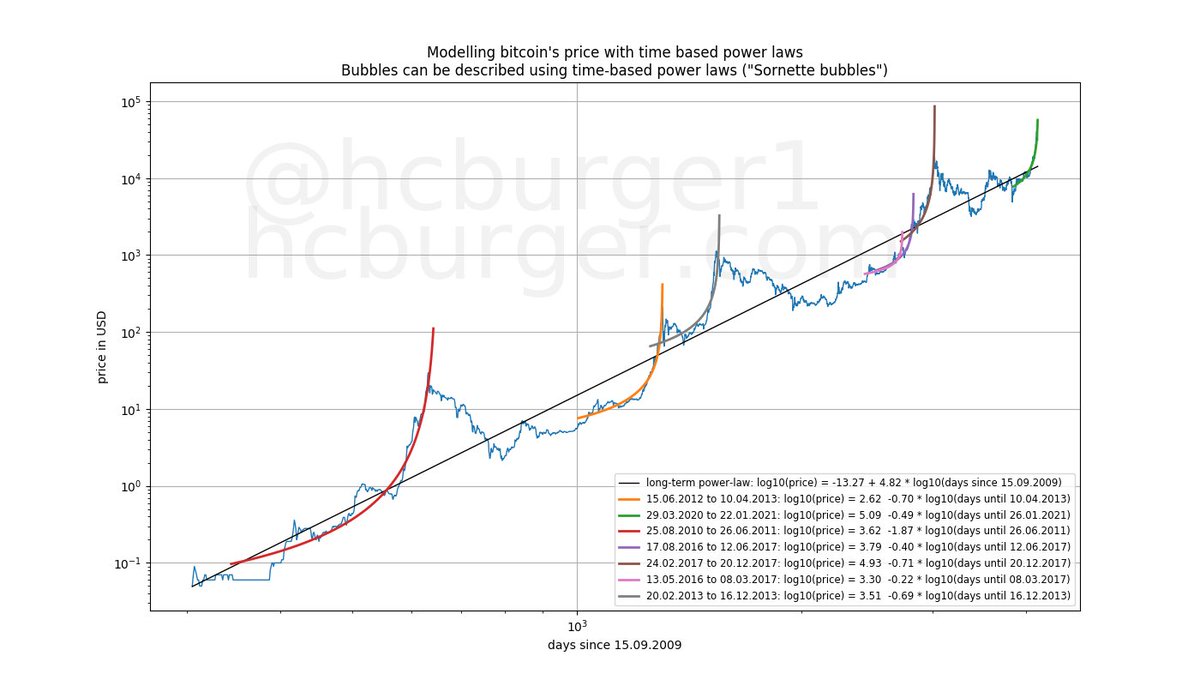

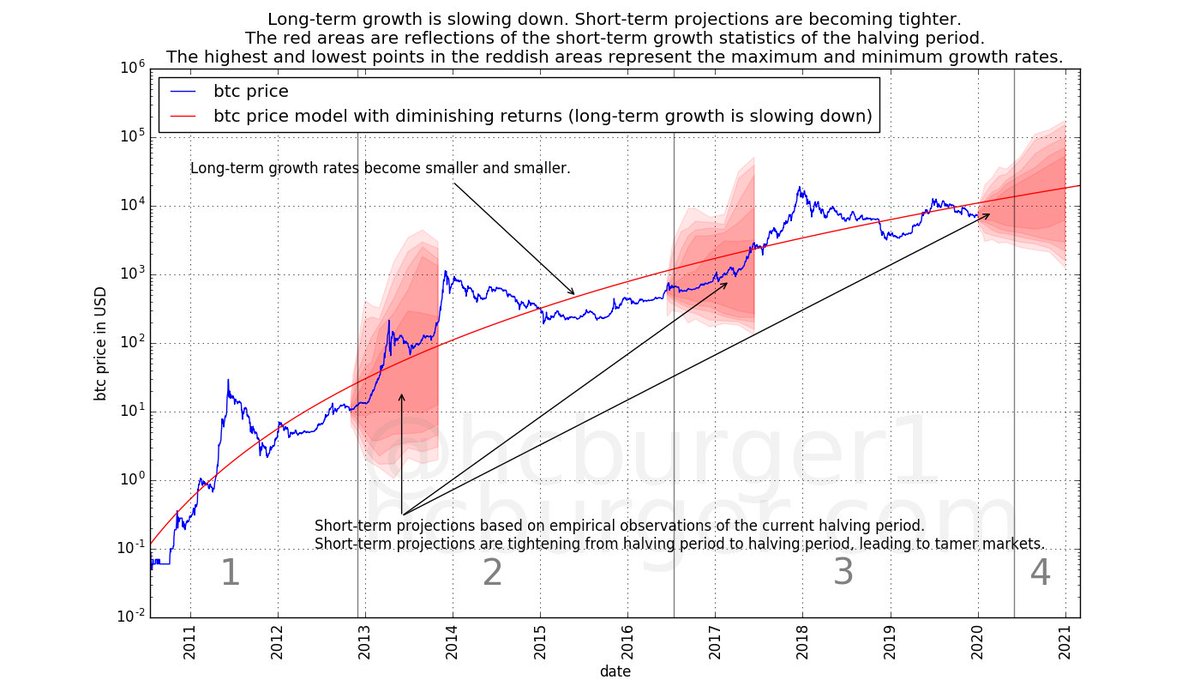

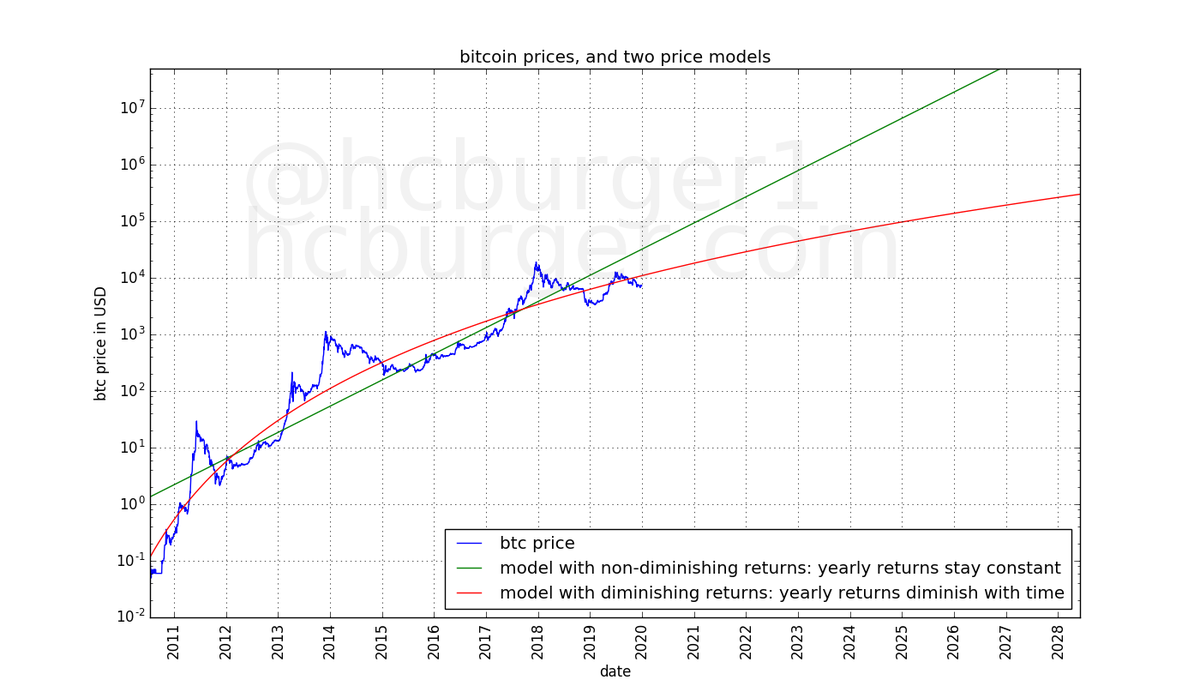

2. We have strong empirical evidence pointing toward DIMNISHING returns, yet the S2F model predicts NON-DIMINISHING returns.

There is good EMPIRICAL reason to be skeptical of the S2F model. @InTheLoopBTC and I have written about this:

medium.com/quantodian-pub…

There is good EMPIRICAL reason to be skeptical of the S2F model. @InTheLoopBTC and I have written about this:

medium.com/quantodian-pub…

I have written another article which empirically demonstrates that bitcoin has diminishing returns. S2F predicts exponential growth (NON-diminishing returns).

But #btcusd grows slower than exponential.

medium.com/quantodian-pub…

But #btcusd grows slower than exponential.

medium.com/quantodian-pub…

I wrote the above article in December 2019 and already predicted that the S2F model would prove too bullish because of the conflict between: a) empirically observed diminishing returns and b) non-diminishing returns forecast by S2F:

Another empirical demonstration:

The "S2F multiple" is dropping (as predicted by diminishing returns). Since 2015, the multiple has been mostly negative.

The "S2F multiple" is dropping (as predicted by diminishing returns). Since 2015, the multiple has been mostly negative.

https://twitter.com/s2fmultiple/status/1486576036644995074?s=20

The S2F model has received a lot of attention. My (strong) opinion is that it is wrong and too bullish. It's a bad model. But it's almost equally bad to dismiss the model for incorrect reasons.

• • •

Missing some Tweet in this thread? You can try to

force a refresh