Trend System (TS) Update $BTC Midterm

Midterm: Bearish (3.5 out of 4 indicators)

- Support: 29.5k

- Bounce Resistance: 40.1K

- Trend resistance: 44.6K

- Mood: Small daily DCA and waiting for trend reversal for big investments.

Comments below

#BTC #Bitcoin

Midterm: Bearish (3.5 out of 4 indicators)

- Support: 29.5k

- Bounce Resistance: 40.1K

- Trend resistance: 44.6K

- Mood: Small daily DCA and waiting for trend reversal for big investments.

Comments below

#BTC #Bitcoin

We had a volatile day, as expected. Hope you stayed level headed and used the ribbon to identify short term resistances.

Bullish divergence and double momentum dot still active (until a blue dot appears), so the bounce chances are still alive.

Bullish divergence and double momentum dot still active (until a blue dot appears), so the bounce chances are still alive.

https://twitter.com/WalterCripto/status/1485462367420907520?s=20

My strategy is still the same:

1) Wait for the daily trend to flip bullish using out TS.

2) DCA a little every day using our MBI to detect when to intensify the buying.

3) Buying some alts that confirmed orange dot near strong support with tight SL and aggresive profit taking.

1) Wait for the daily trend to flip bullish using out TS.

2) DCA a little every day using our MBI to detect when to intensify the buying.

3) Buying some alts that confirmed orange dot near strong support with tight SL and aggresive profit taking.

Execute the 3 strategies require certain level of expertise, specially the third one, so don't try to do everything unless you have the experience/time.

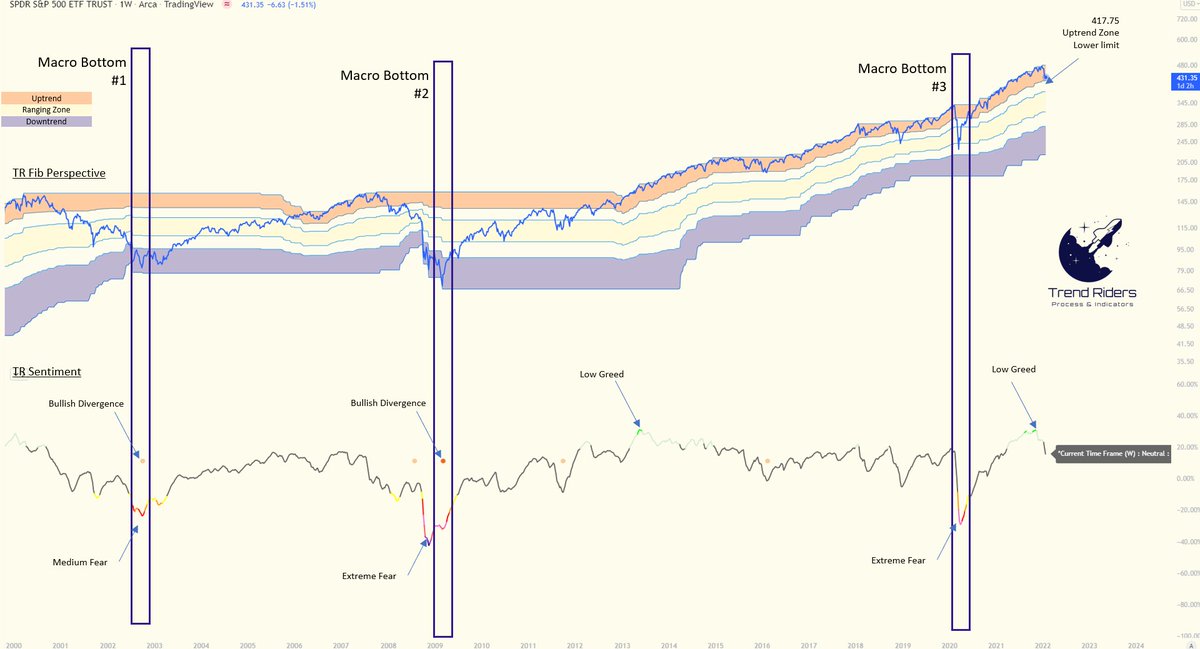

For a broader perspective of the market please check the thread below.

https://twitter.com/WalterCripto/status/1486412550283698177?s=20

Want to be consistently updated and access our custom indicators? Join our Patreon

- Newsletter

- Trend System (TS) Access and Indicators

- Max Bottom Identifier (MBI) Access

- Crypto tracker (Updated Trends of major coins)

patreon.com/Trendriders

- Newsletter

- Trend System (TS) Access and Indicators

- Max Bottom Identifier (MBI) Access

- Crypto tracker (Updated Trends of major coins)

patreon.com/Trendriders

• • •

Missing some Tweet in this thread? You can try to

force a refresh