Inter’s 2020/21 accounts cover a season when they won Serie A under Antonio Conte and also reached the Coppa Italia semi-finals, but were eliminated at the group stage in the Champions League. Figures significantly impacted by COVID. Some thoughts in the following thread #Inter

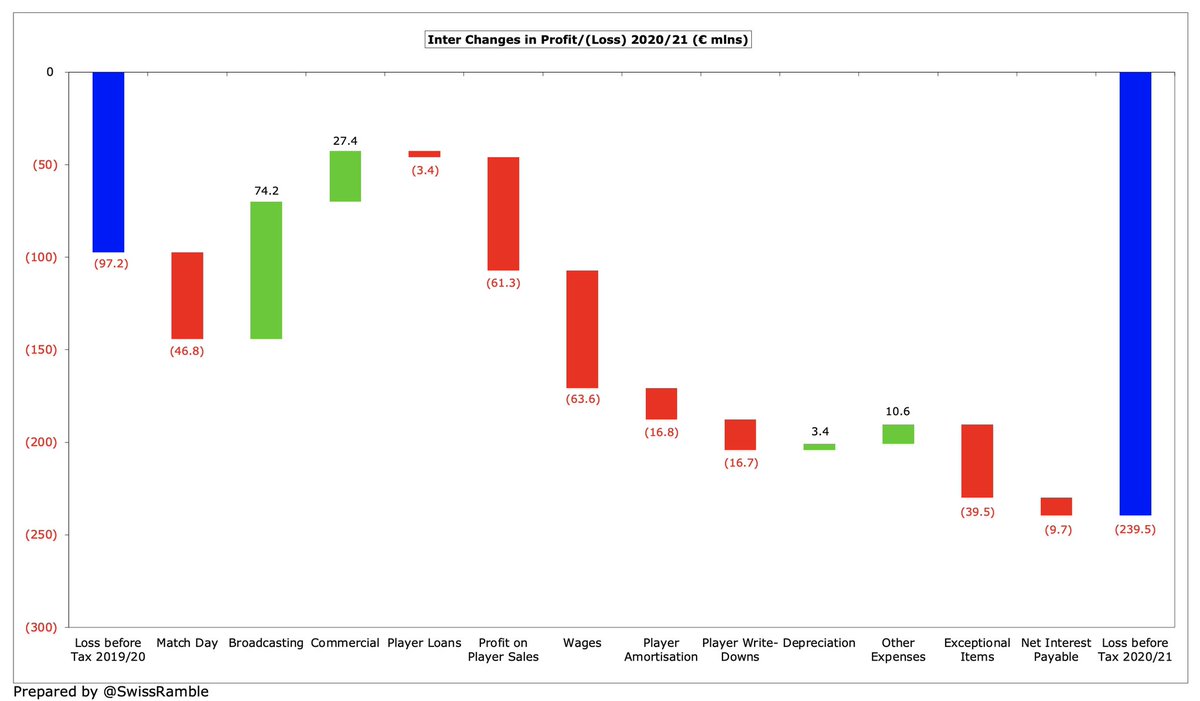

#Inter pre-tax loss widened from €97m to €239m (post-tax €246m), despite revenue increasing €51m (17%) to €354m, as profit on player sales fell €61m to just €246k. Operating expenses rose €123m, including large once-off charges, while net interest was up €10m to €35m.

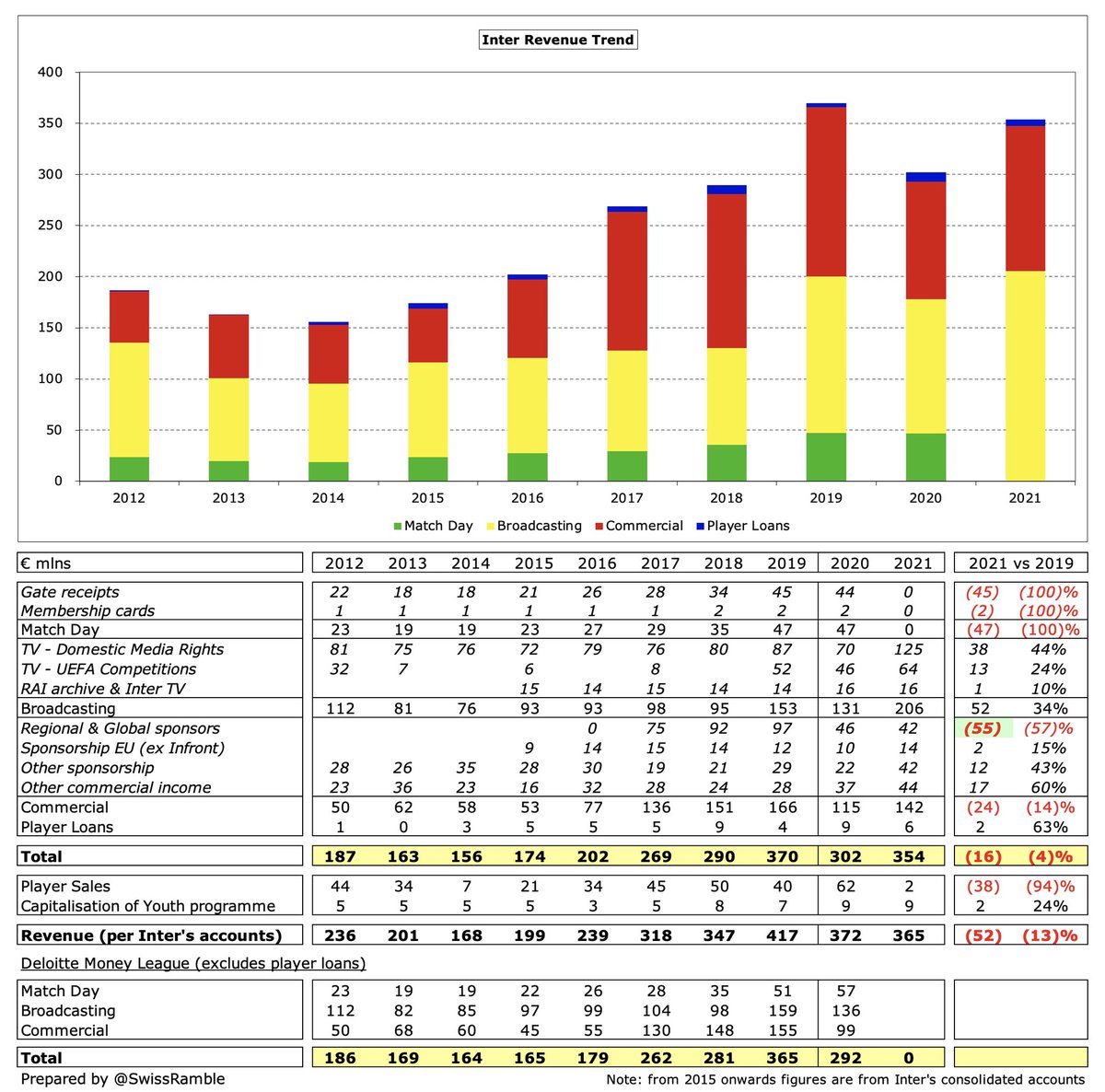

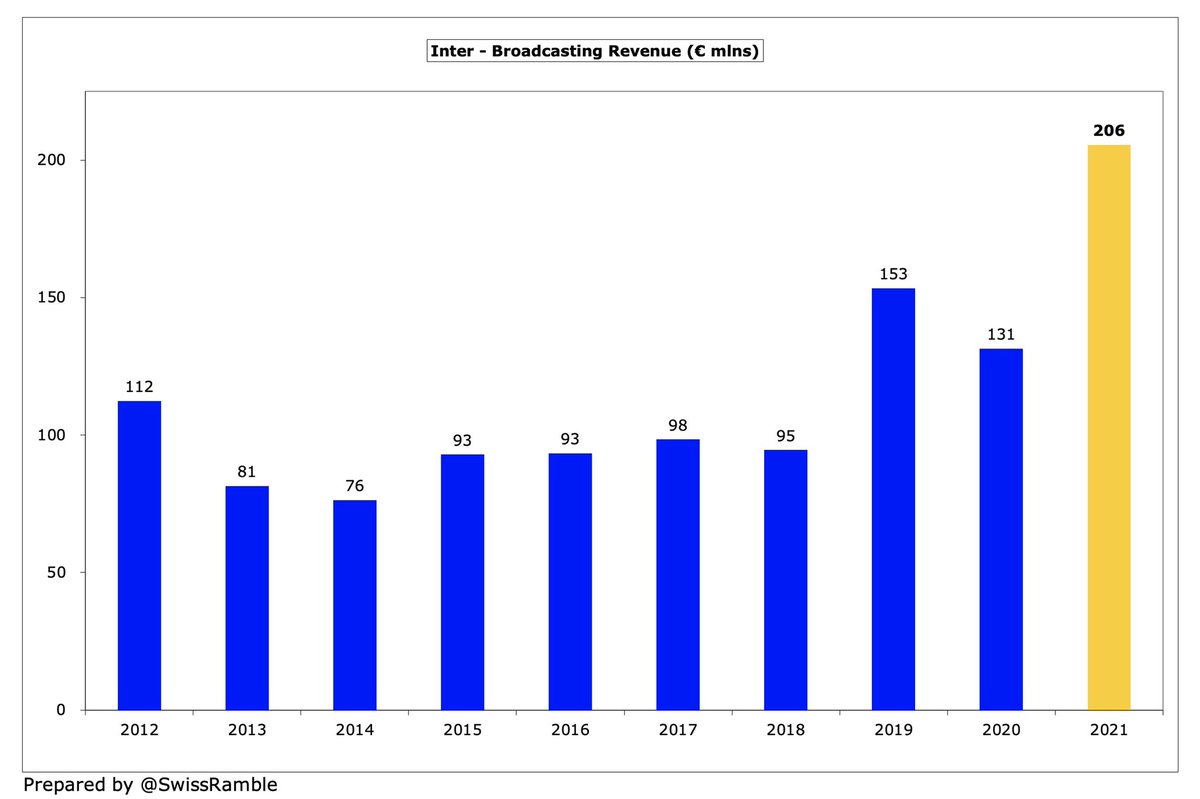

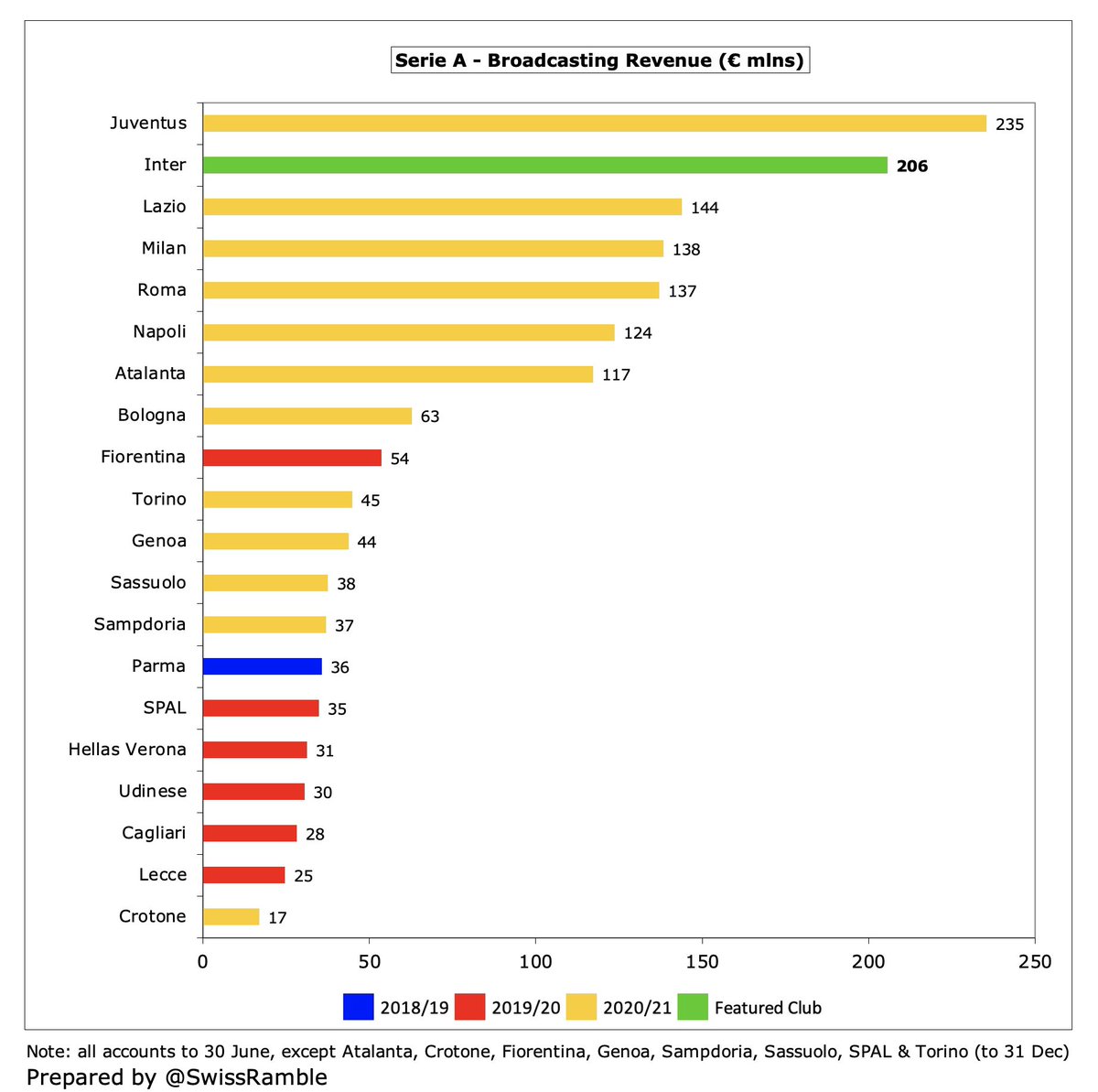

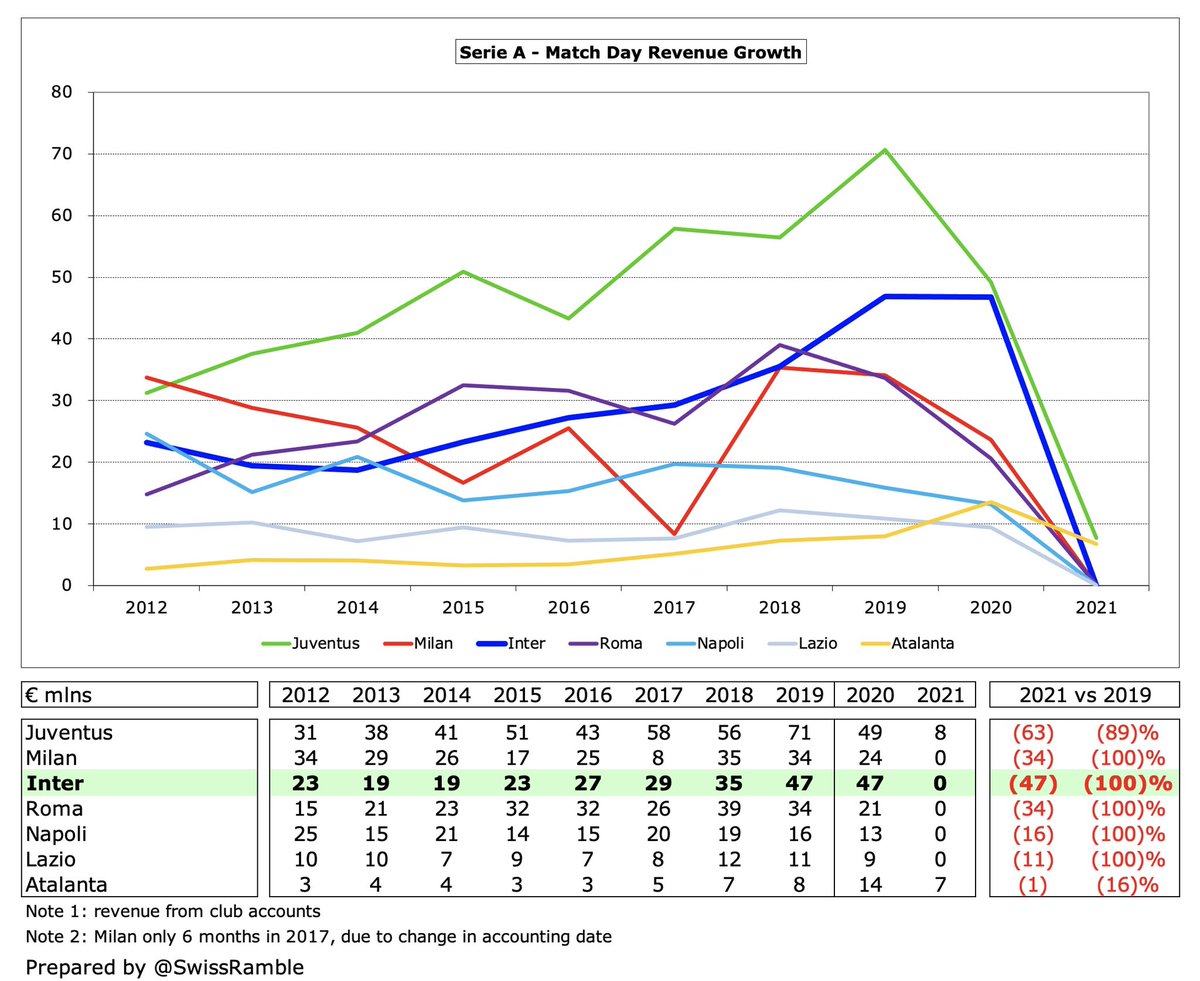

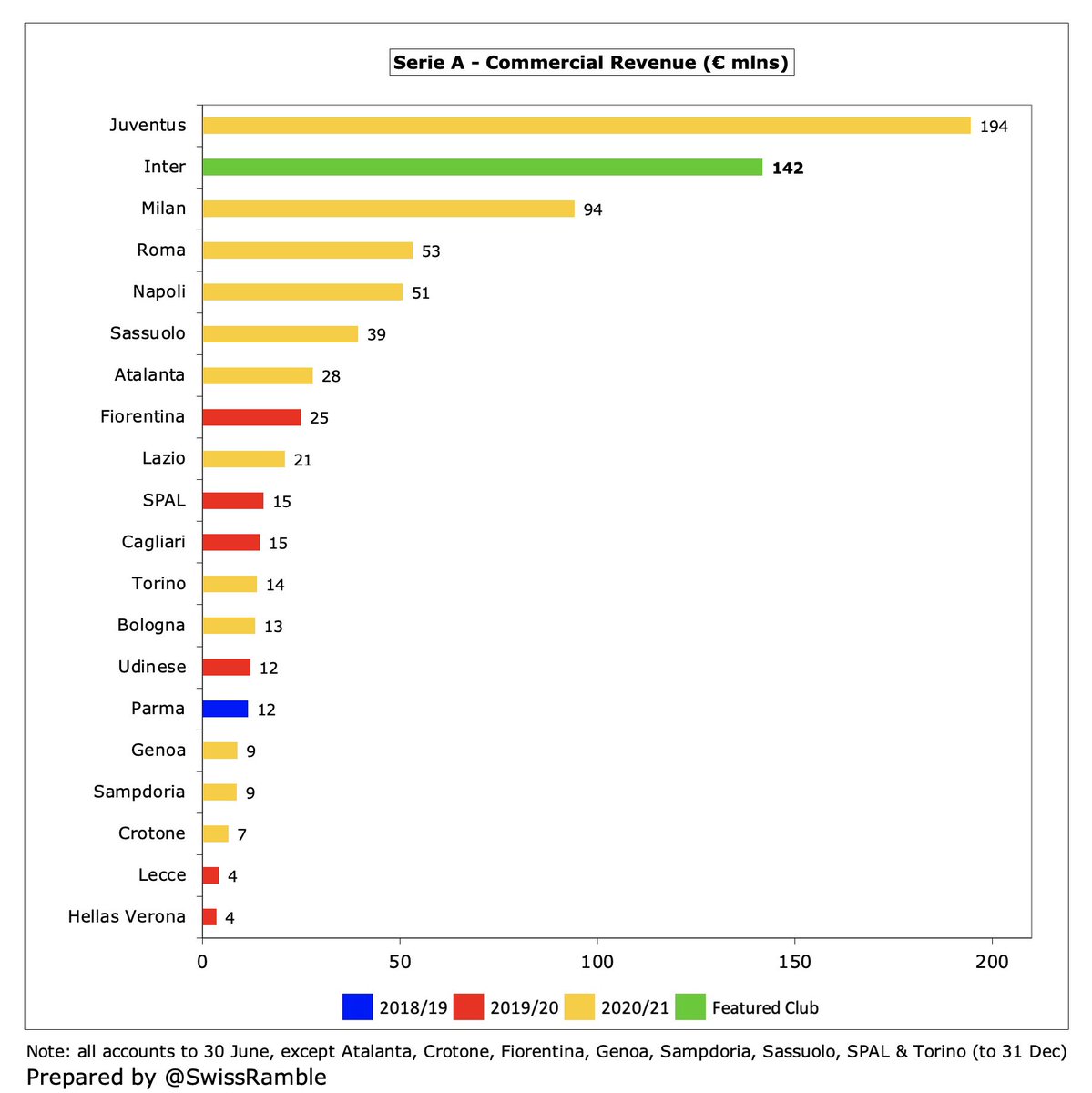

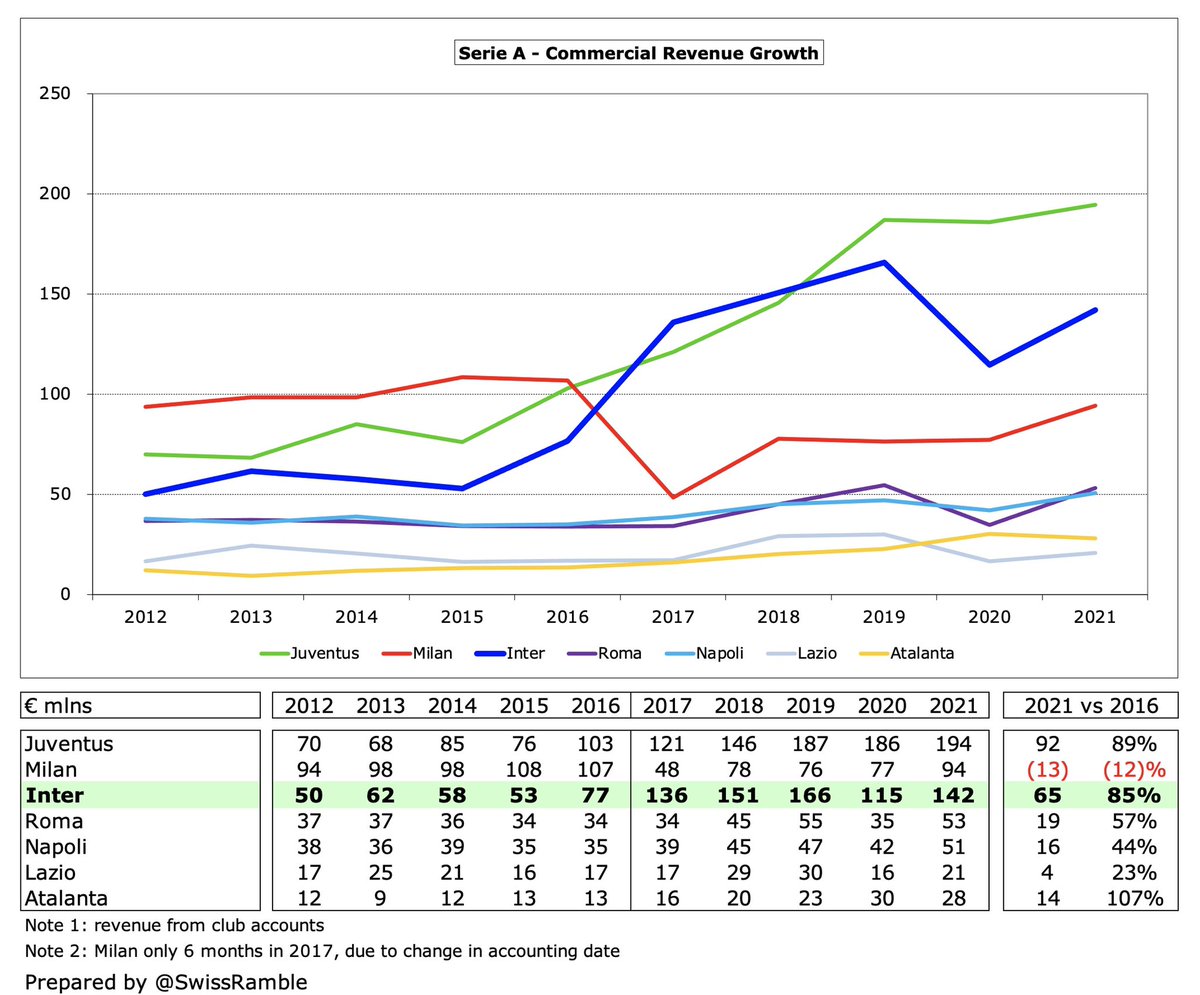

#Inter broadcasting income rose €74m (56%) from €132m to €206m, mainly revenue deferred from 2019/20 accounts, and commercial increased €27m (24%) from €115m to €142m. Compensated for COVID driven falls in match day, down €47m to zero, and player loans, down €3m to €6m.

As a technical aside, this international definition of #Inter €354m revenue is different to the one used in club accounts, which also includes €2m gain on player sales plus €9m capitalisation of youth programme, giving revenue of €365m, down €7m (2%) from prior year €372m.

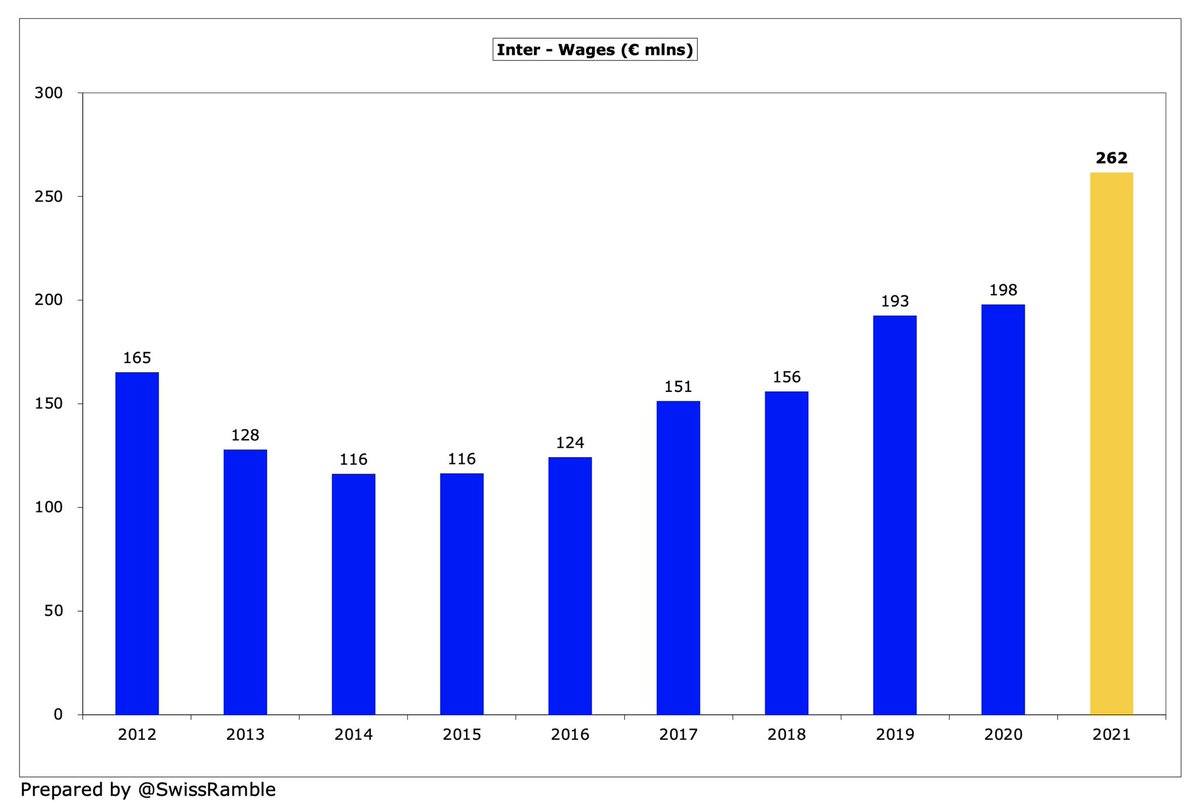

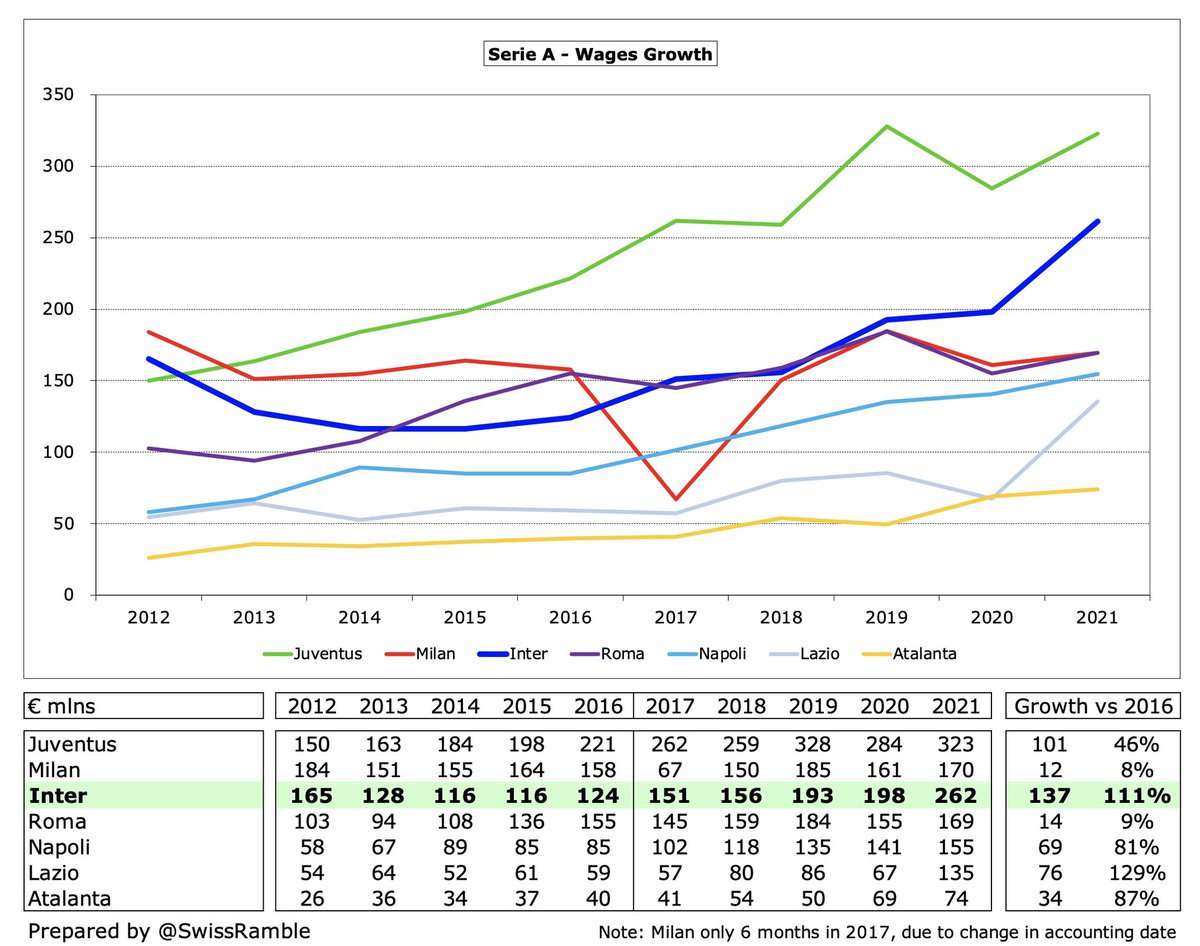

#Inter wages rose €64m (32%) from €198m to €262m, while player amortisation grew €17m (14%) to €137m plus €17m player write-downs, though other expenses fell €11m (13%) to €72m. Exceptional items increased €40m to €55m, while net interest payable was up €10m to €35m.

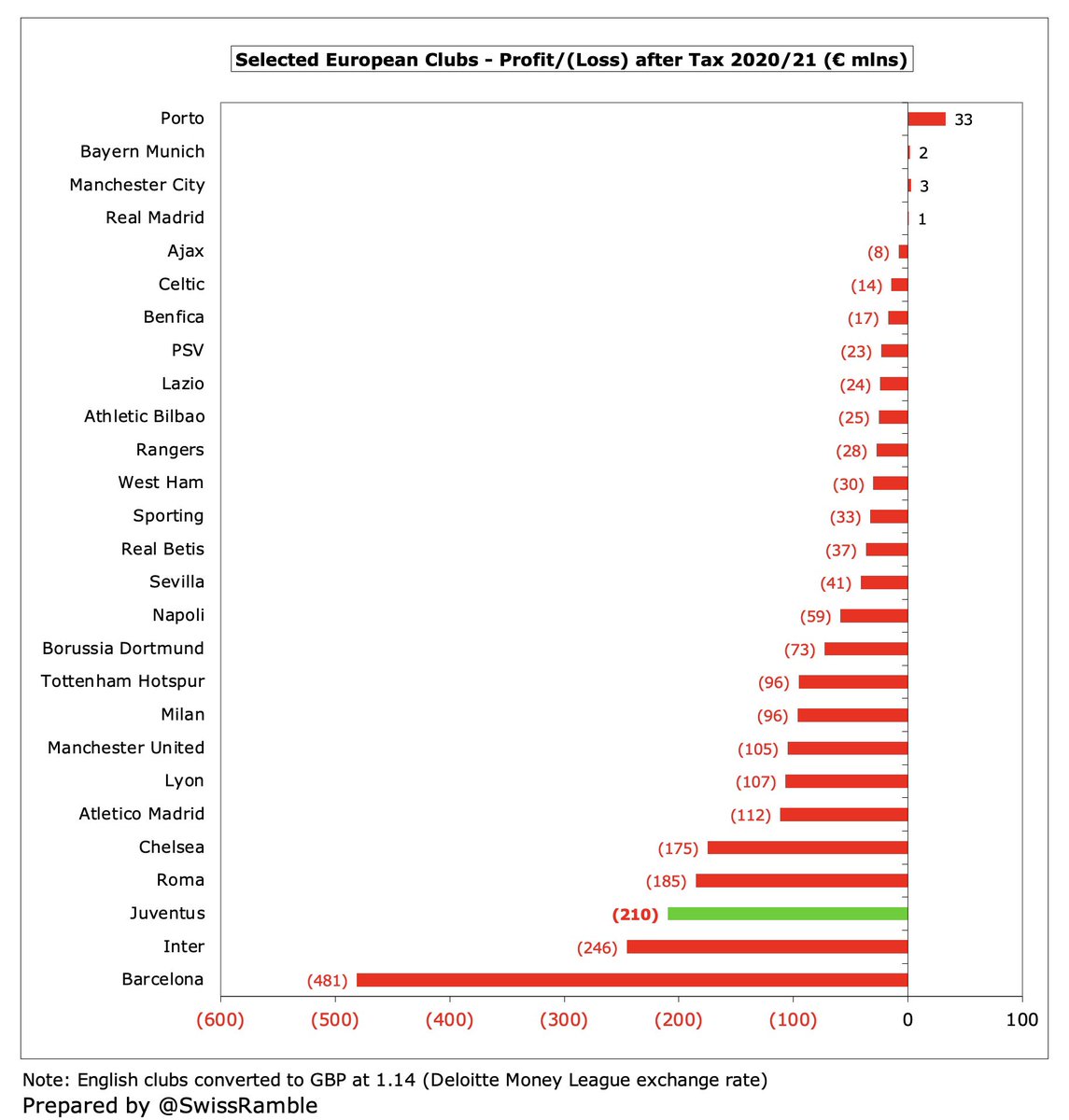

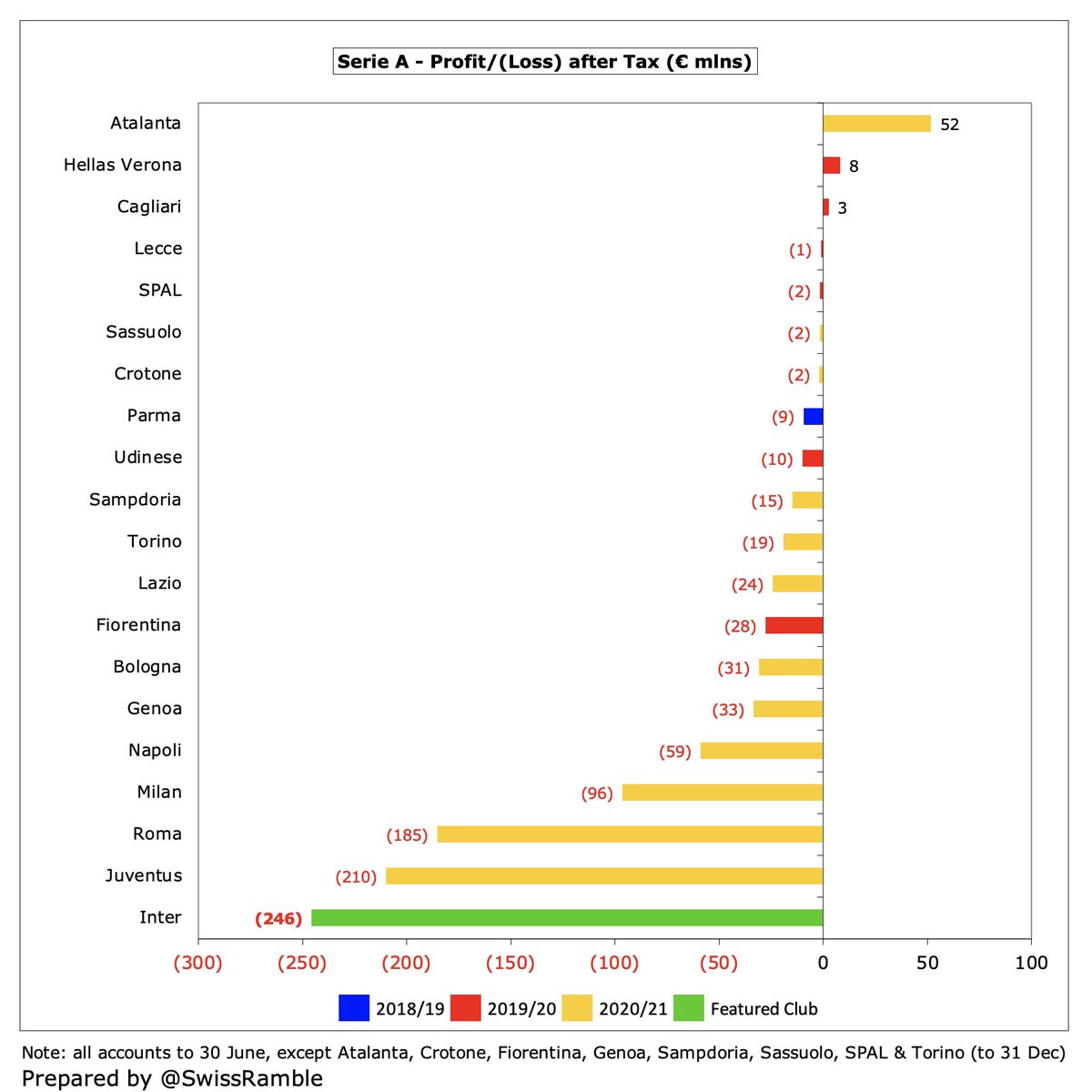

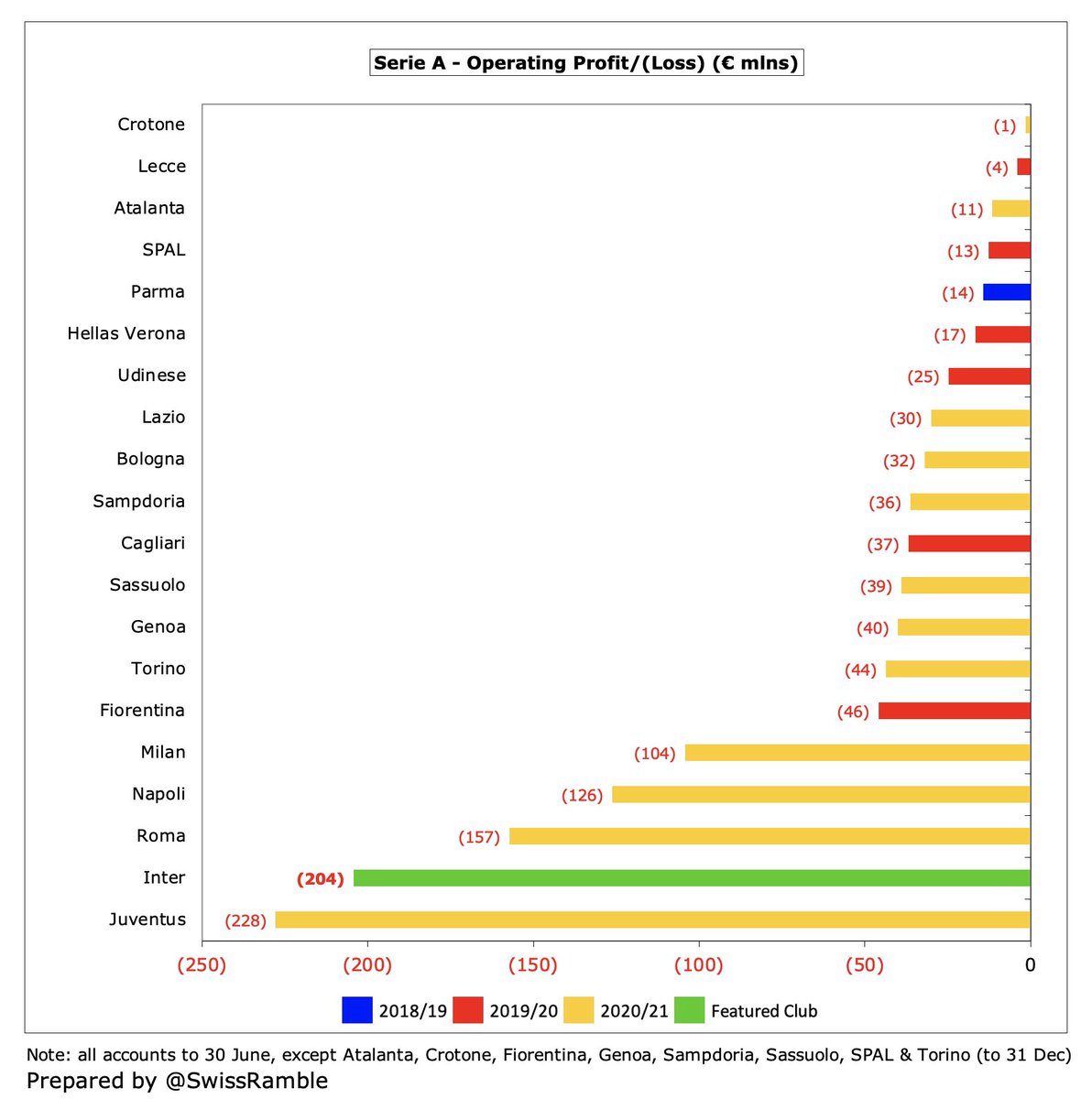

Unsurprisingly, #Inter €246m post-tax loss is the highest in Italy in 2020/21, comfortably ahead of by Juventus €210m, Roma €185m and Milan €96m. Atalanta €53m profit is impressive, though their December year-end does not reflect a full year of the pandemic.

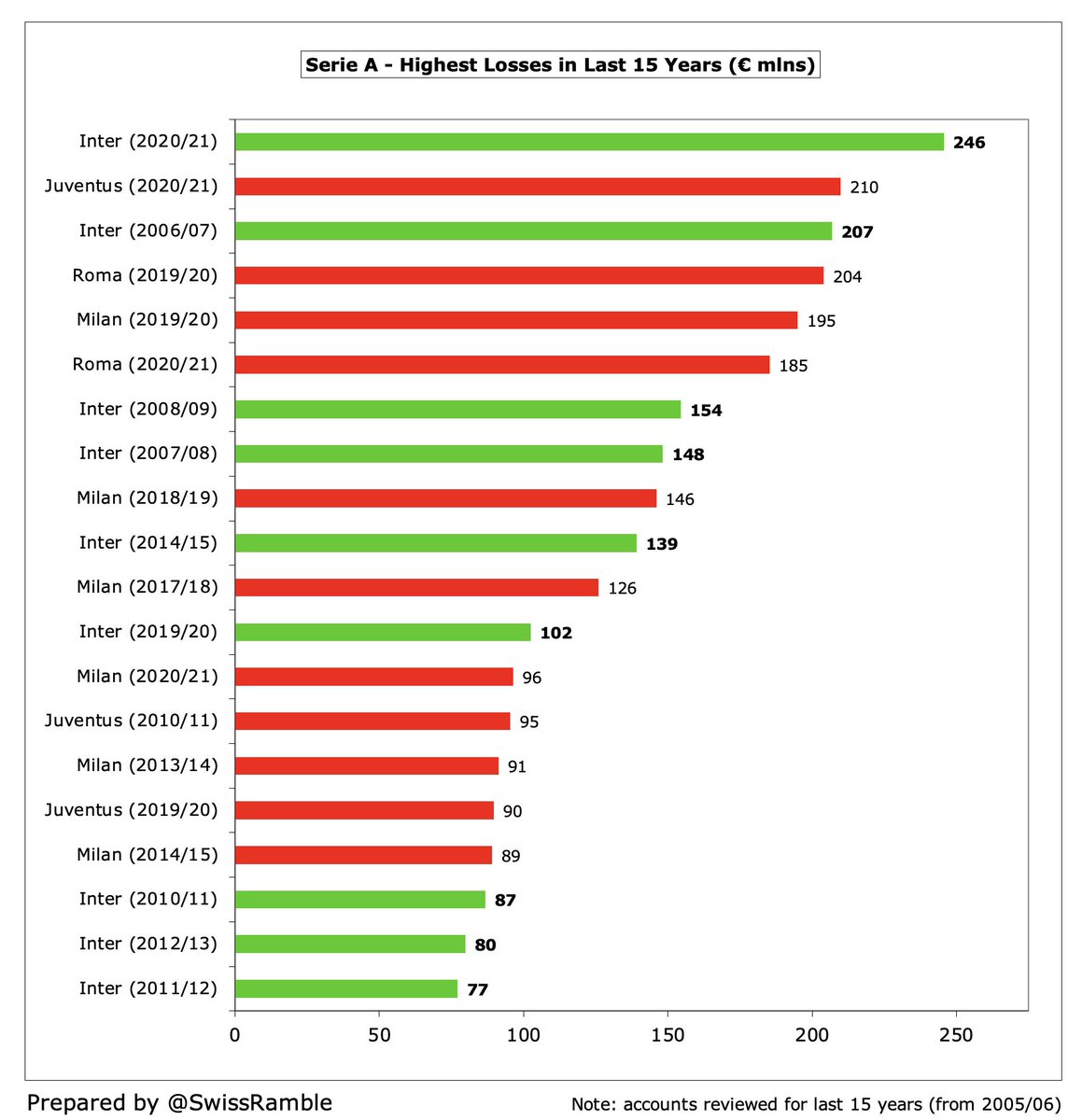

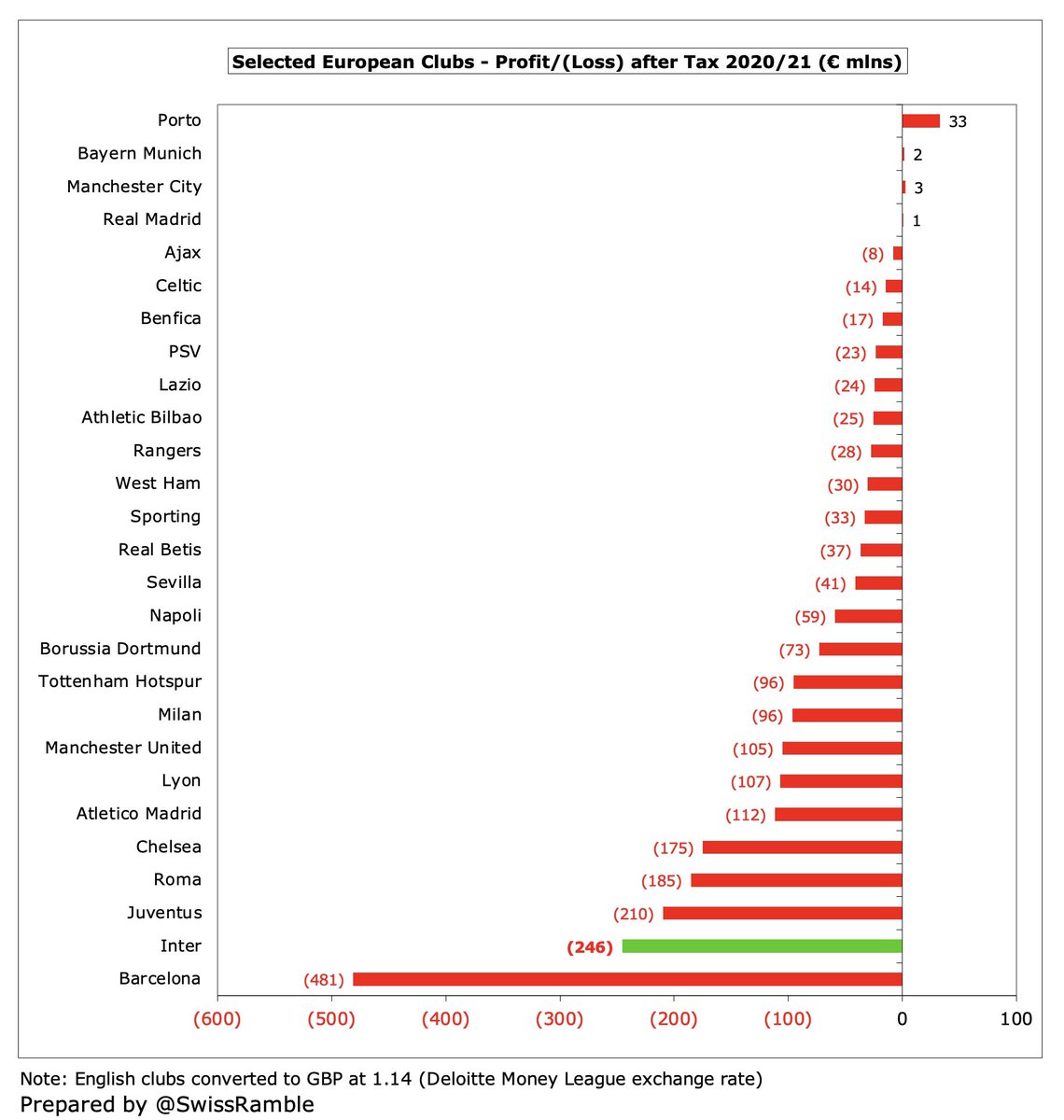

In fact, #Inter €246m loss is the highest ever registered in Italy, as COVID has exacerbated underlying financial issues. Only exceeded in Europe in 2020/21 by Barcelona’s horrific €481m loss. Worth noting that #Inter are responsible for nine of the 20 worst losses in Serie A.

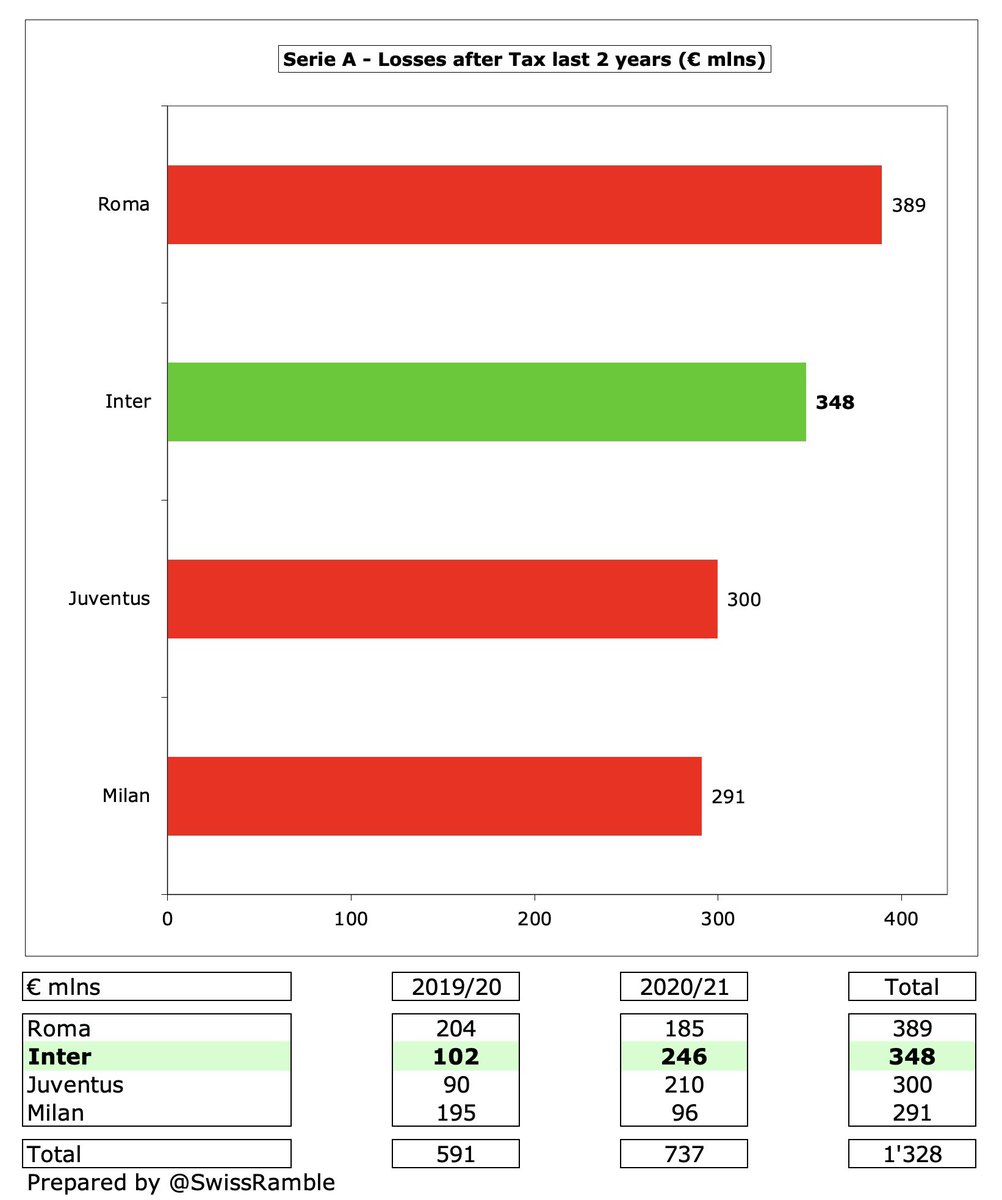

In fact, the big four Italian clubs have lost a staggering €1.3 bln in the last 2 seasons (€591m in 2019/20 and €737m in 2020/21). #Inter were second worst in this period with their €348m deficit only surpassed by Roma €389m, but higher than Juventus €300m and Milan €291m.

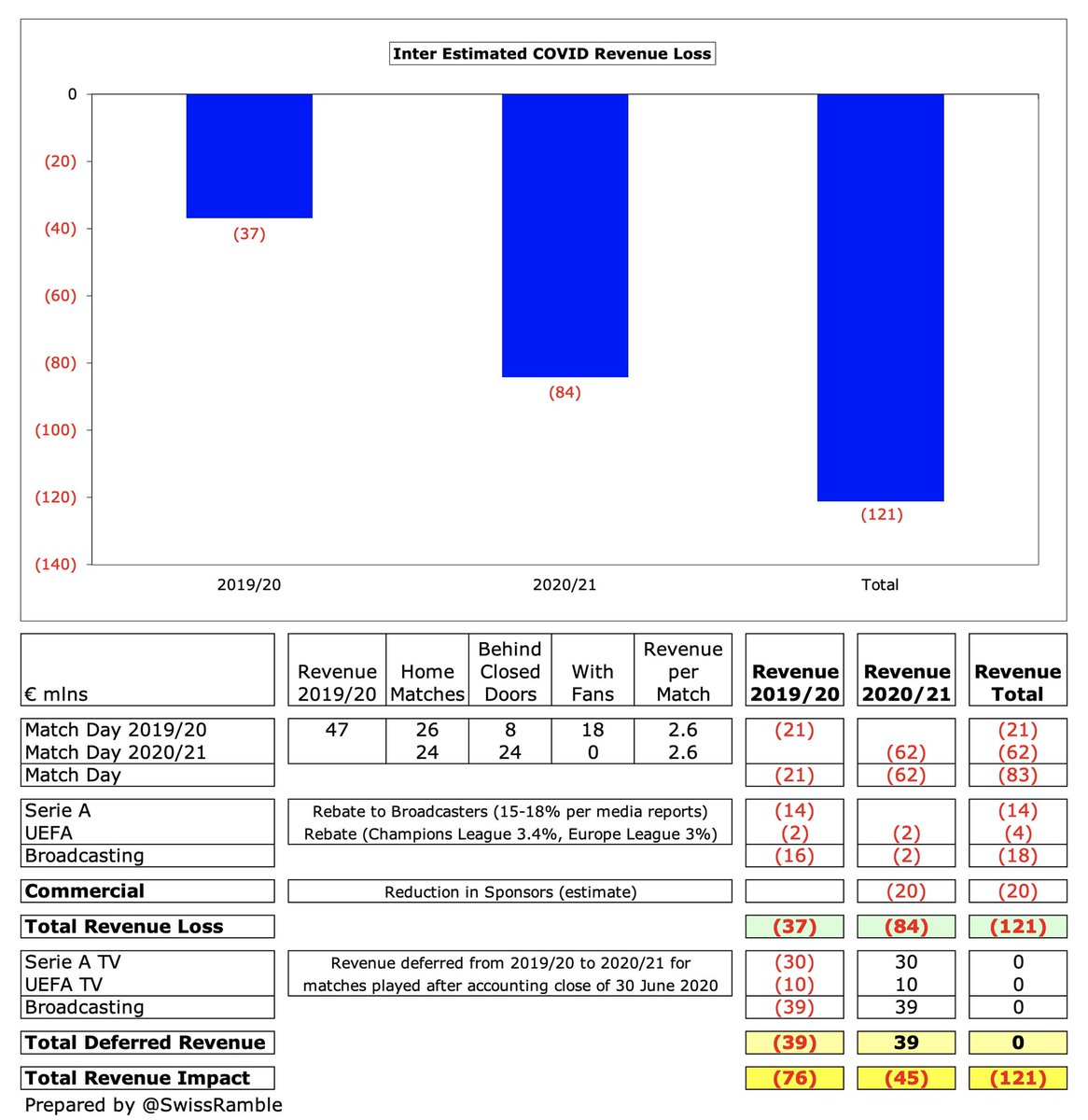

I estimate total #Inter COVID revenue loss as €121m (€37m in 2020 & €84m in 2021), split between match day €83m, commercial €20m and broadcasting €18m. However, 2021 figures benefit from €39m revenue deferred from 2020 for 13 games played after 30th June accounting close.

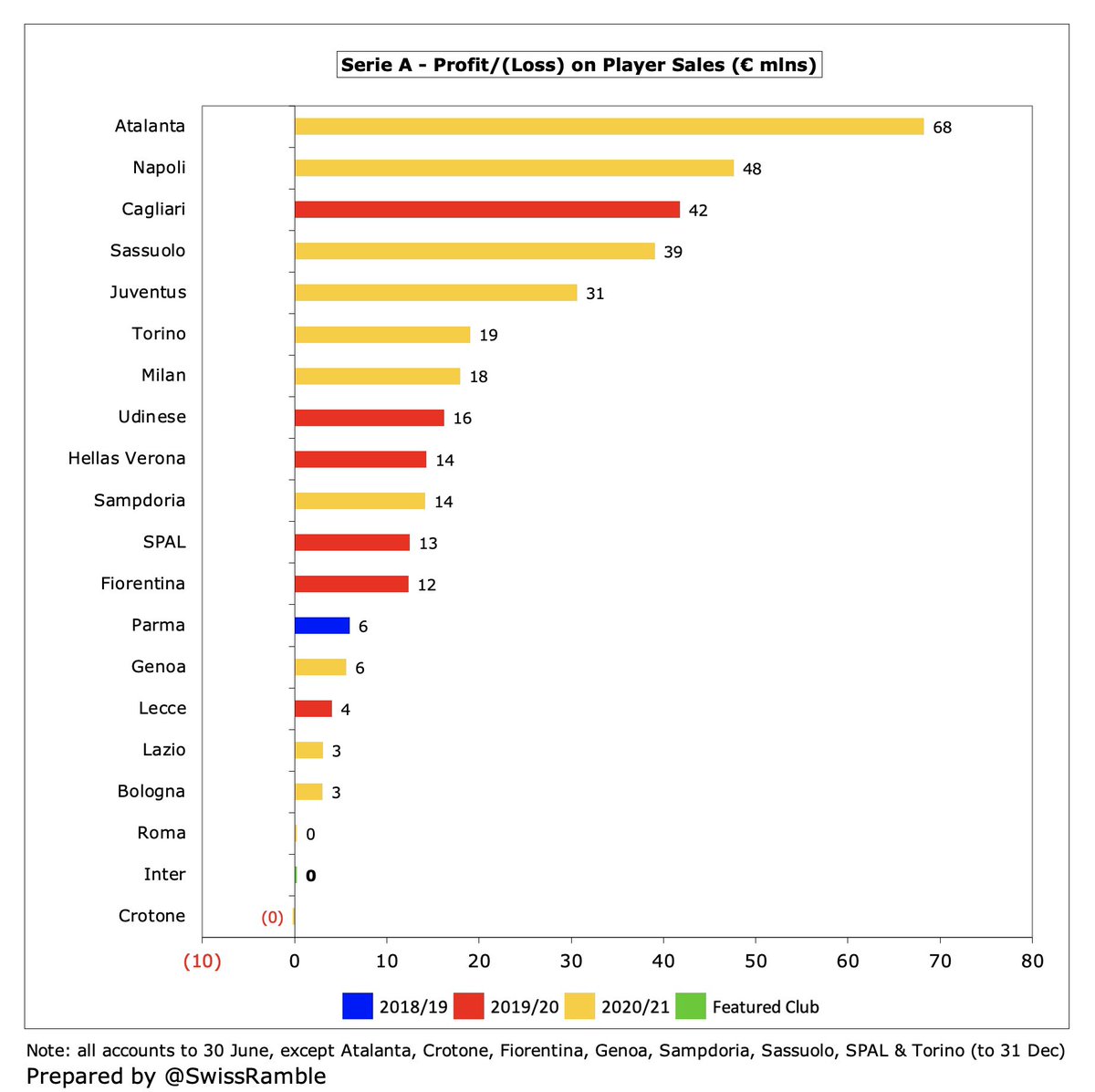

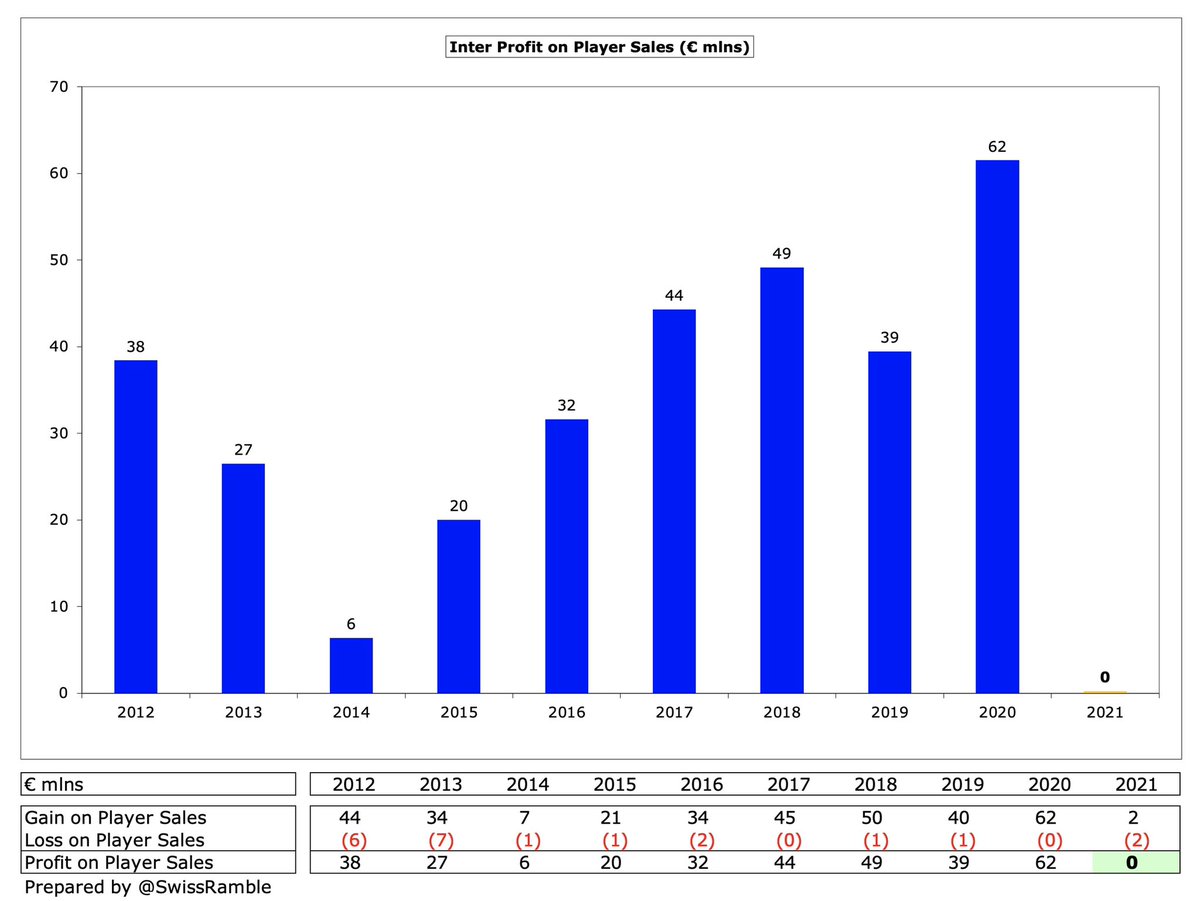

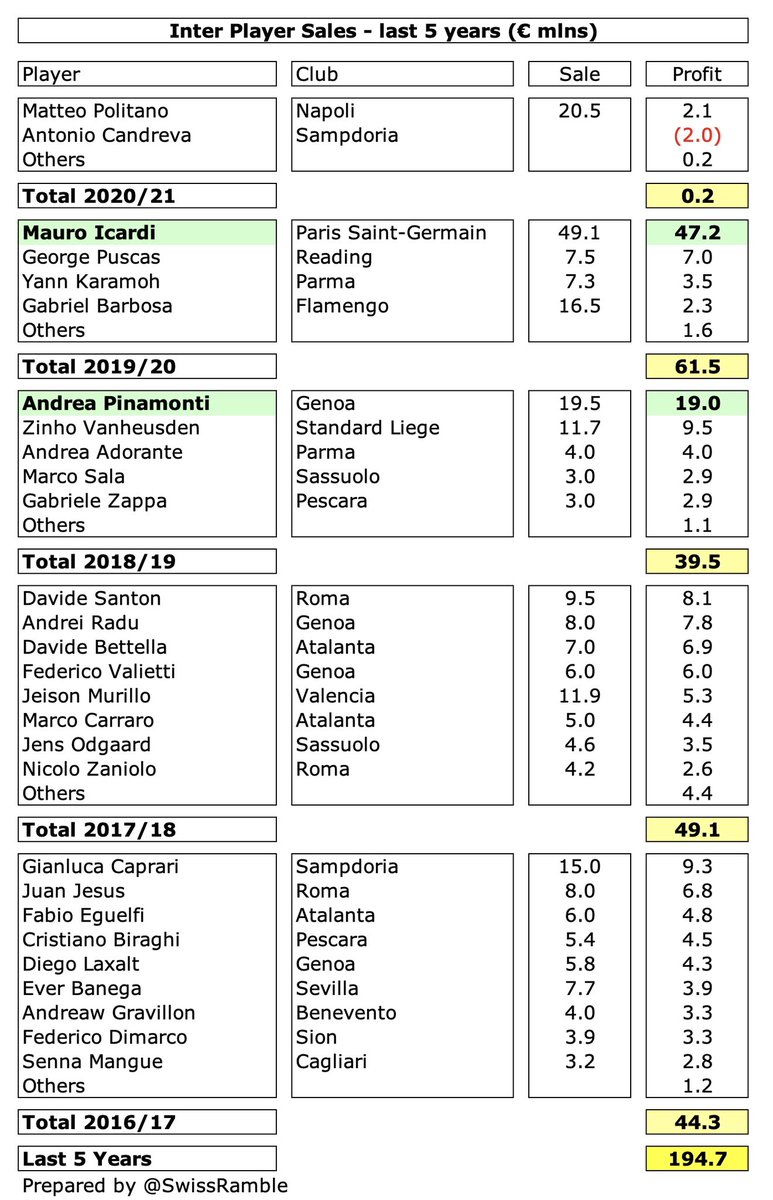

#Inter profit on player sales slumped from €68m to just €246k, as €2m gain from Politano to Napoli was offset by losses (mainly Candreva to Sampdoria). Transfer market deflated due to COVID, but good sales still made by Atalanta €68m and Napoli €48m.

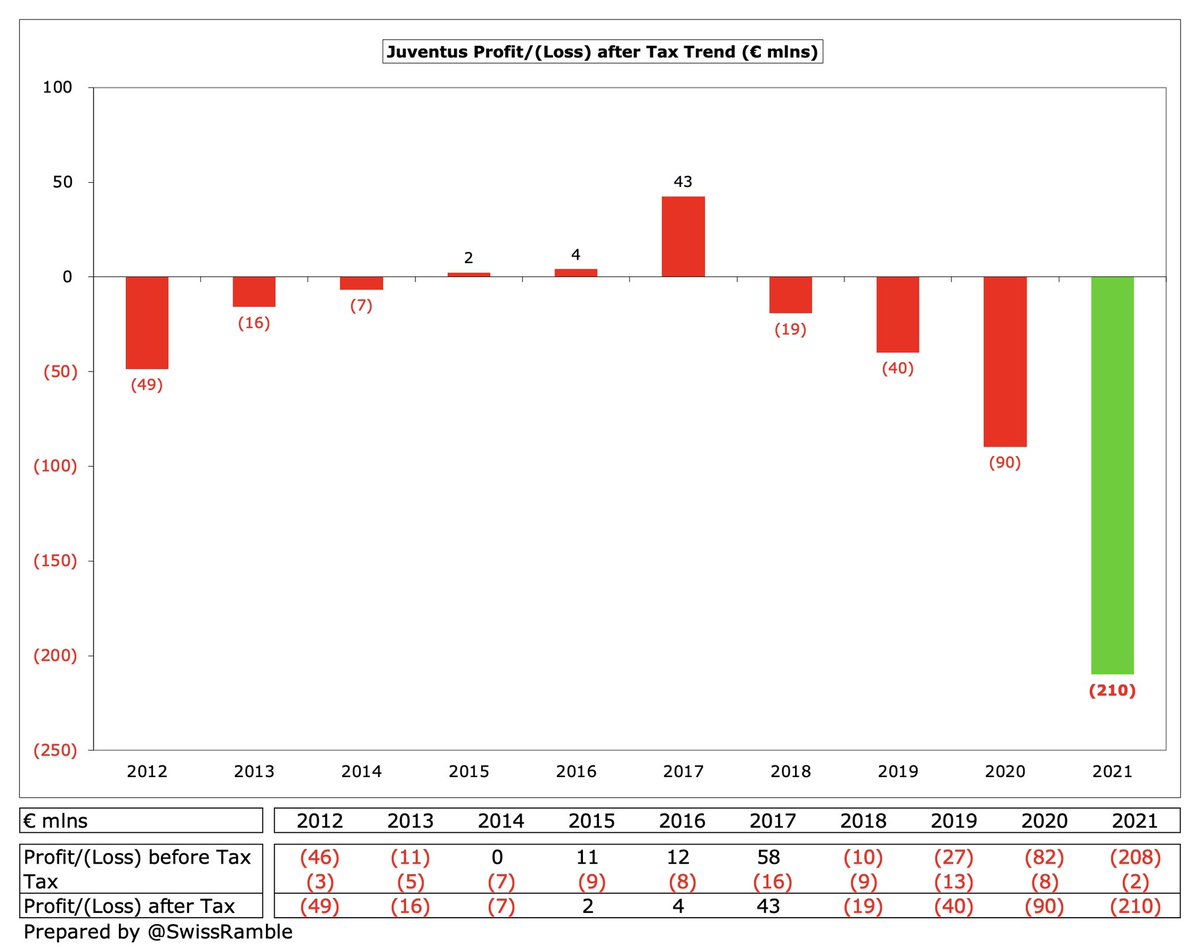

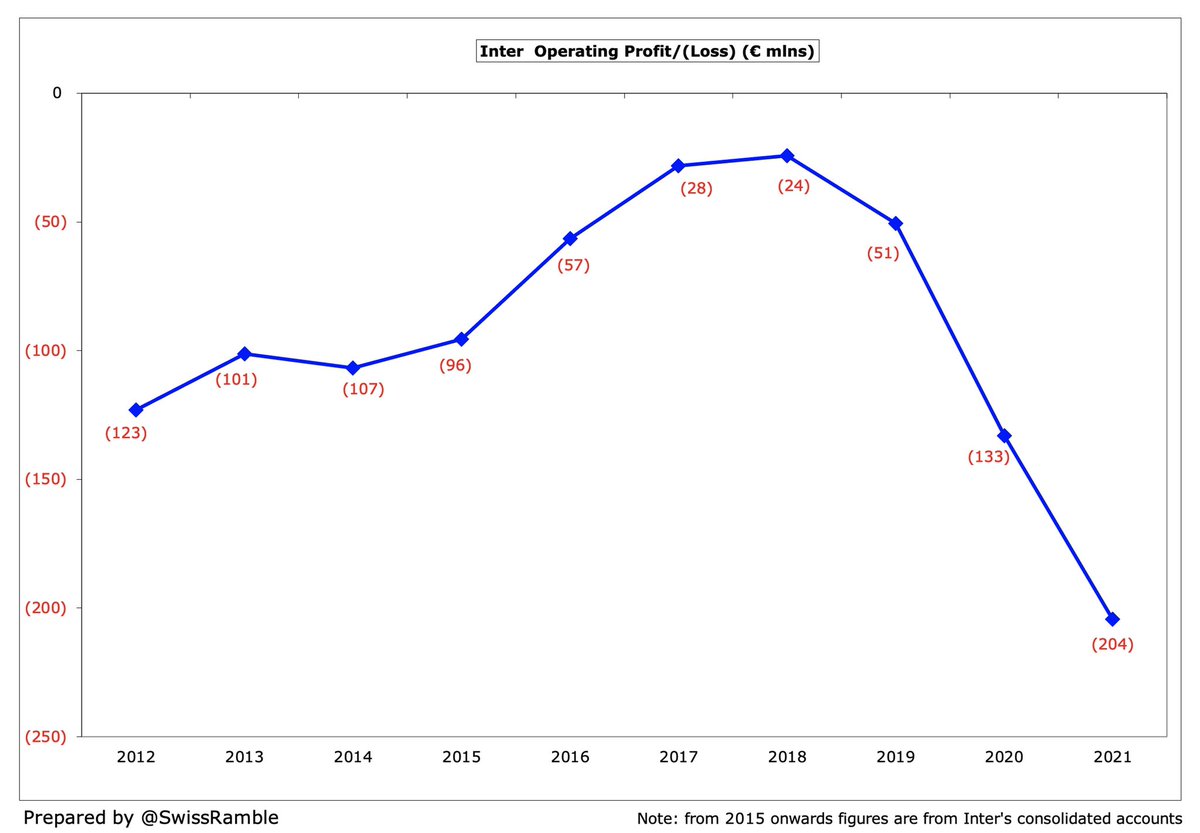

#Inter have lost an amazing €724m in the last 10 years (pre-tax), including €403m in the 5 years under Suning’s control. They have only reported a profit once in that period (€33m in 2014). The club expects another loss in 2021/22, though “significantly reduced”.

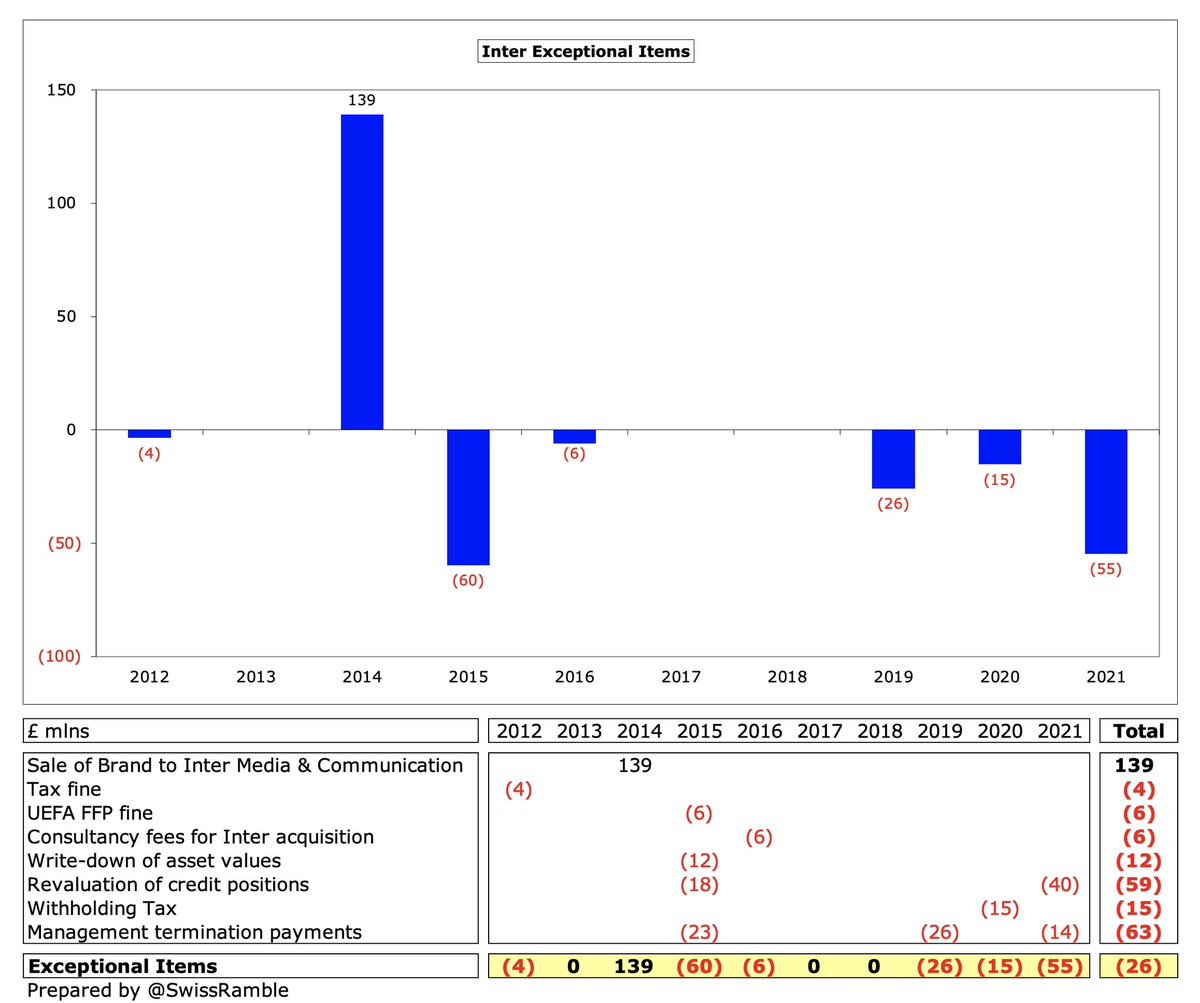

#Inter €33m profit in 2014 would also have been a massive loss without €139m from selling the brand to Inter Media & Communications. There were €55m exceptional charges in 2020, comprising €40m to write-off amounts owed by Chinese sponsors and €14m for Conte’s severance pay.

Like many clubs, #Inter have become increasingly reliant on player sales, averaging €49m in the four years up to 2020, but no profits in 2021. This season will be a different story following the big money sales of Romelu Lukaku to #CFC €113m and Achraf Hakimi to PSG €67m.

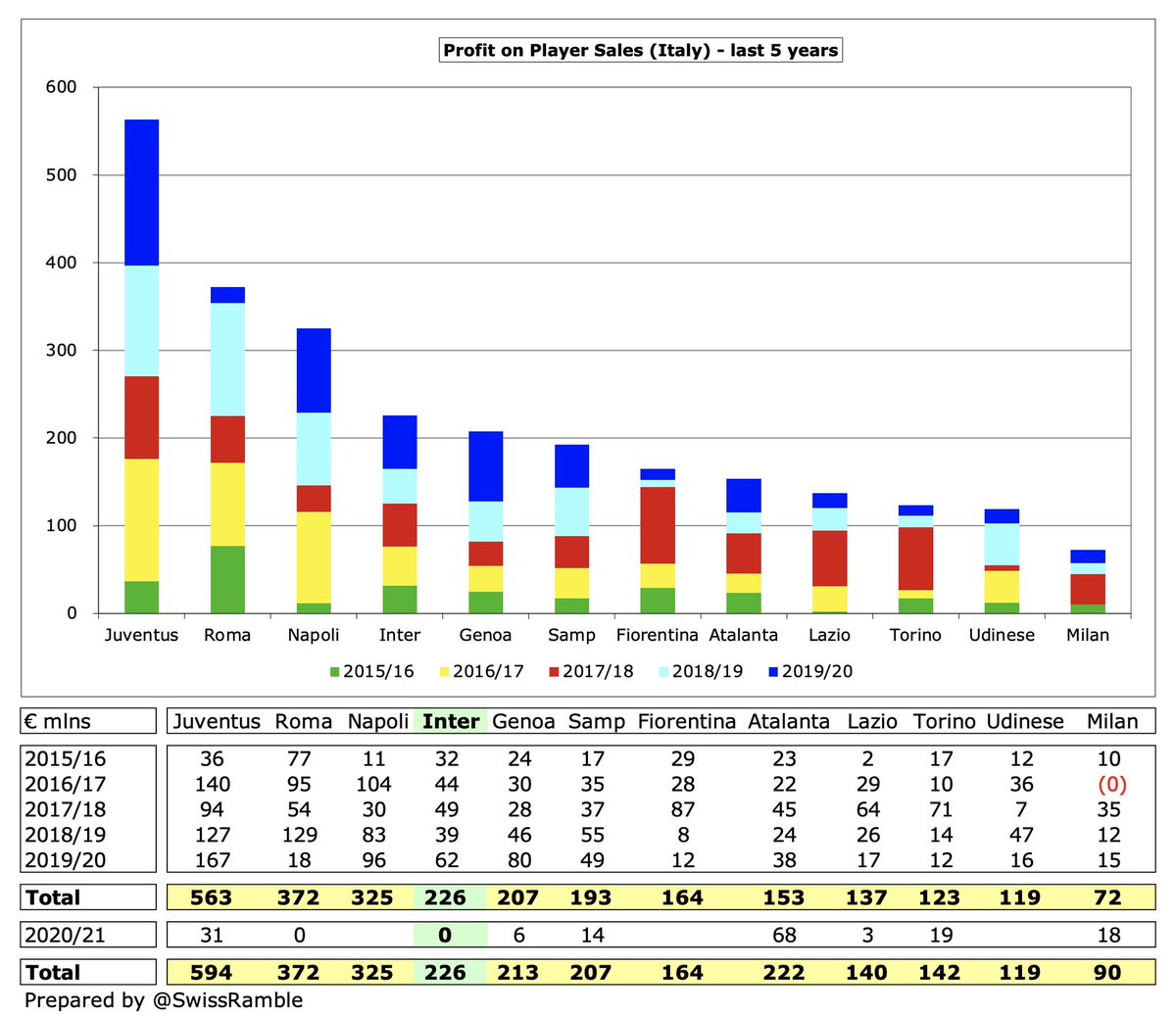

#Inter player trading was an area that needed to improve, as they have lagged behind: in 5 years to 2020 their €226m profit was far below Juve €563m, Roma €372m & Napoli €325m. In fact, only 2 players sold for a profit above €10m since 2017: Icardi €47m & Pinamonti €19m.

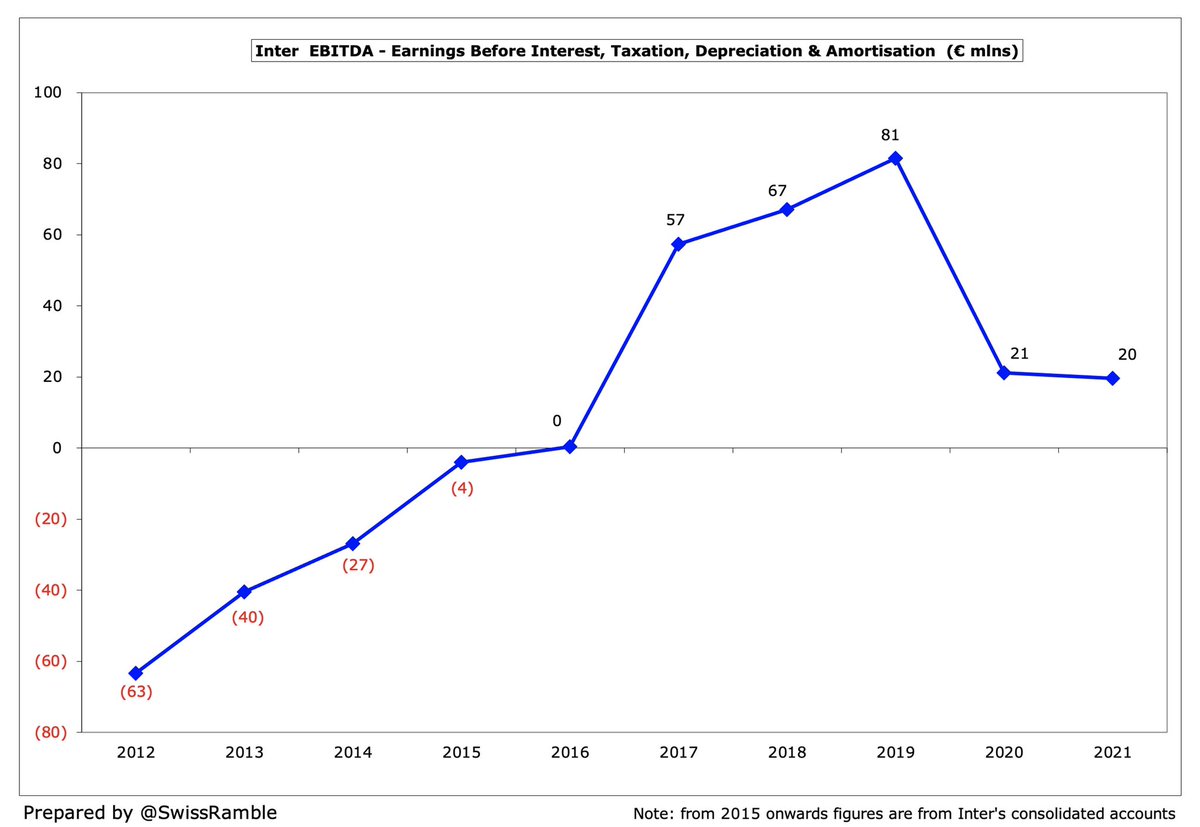

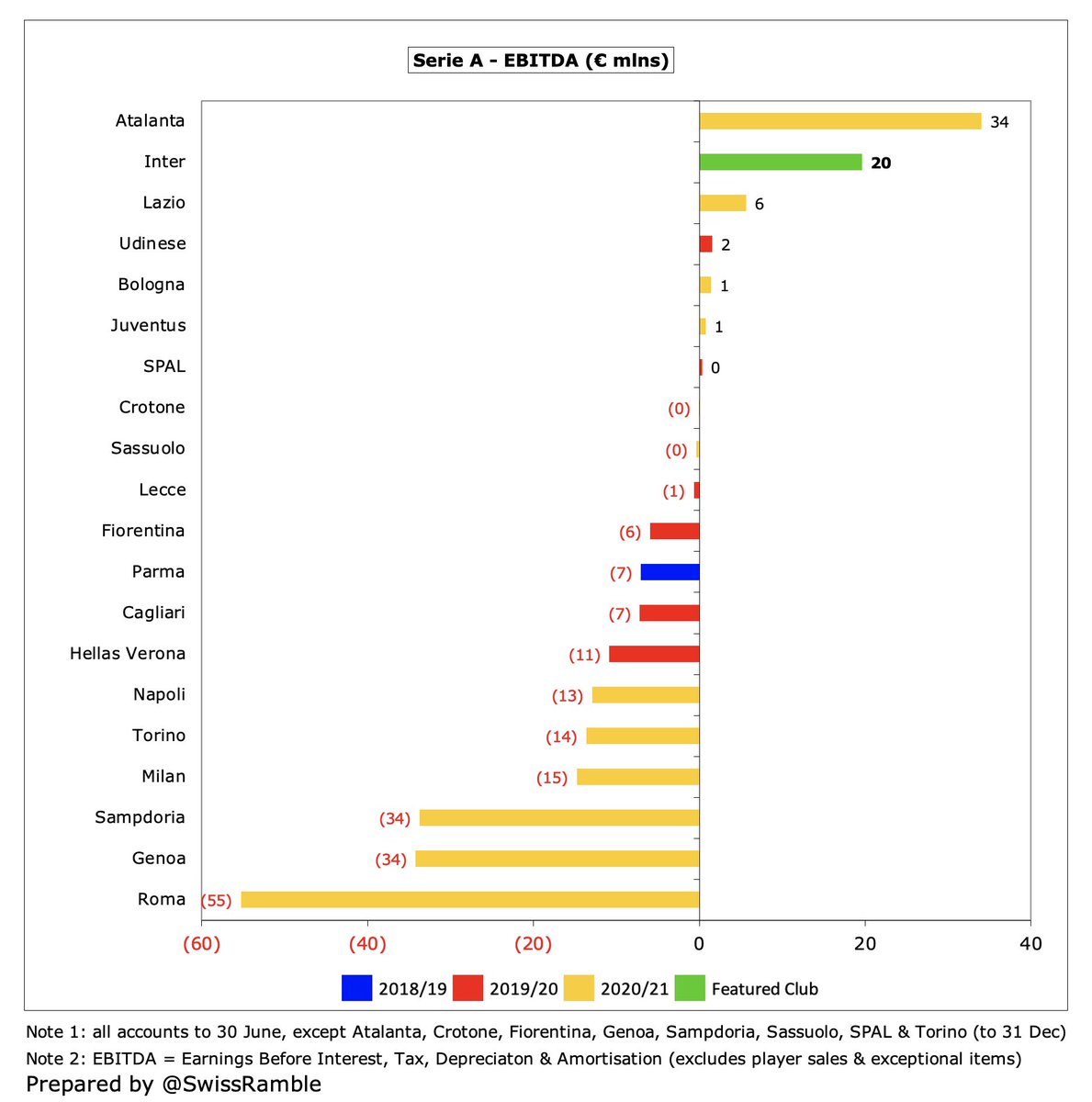

#Inter EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered a proxy for underlying profitability, as it excludes once-off items like player sales and exceptional items, fell slightly to €20m, though one of the best in Italy, only behind Atalanta €34m.

However, #Inter operating loss (including exceptional items and write-downs) increased from €133m to €204m, continuing the steep decline from €24m in 2018. Five Italian clubs are above €100m, though the Nerazzurri are only “beaten” by Juventus €228m.

#Inter revenue has only dropped €16m (4%) from pre-pandemic €370m to €354m, despite reductions in match day and commercial (fall in Chinese sponsorships), thanks to broadcasting (mainly deferred income). By club’s definition, revenue is down €52m (13%) from €417m to €365m.

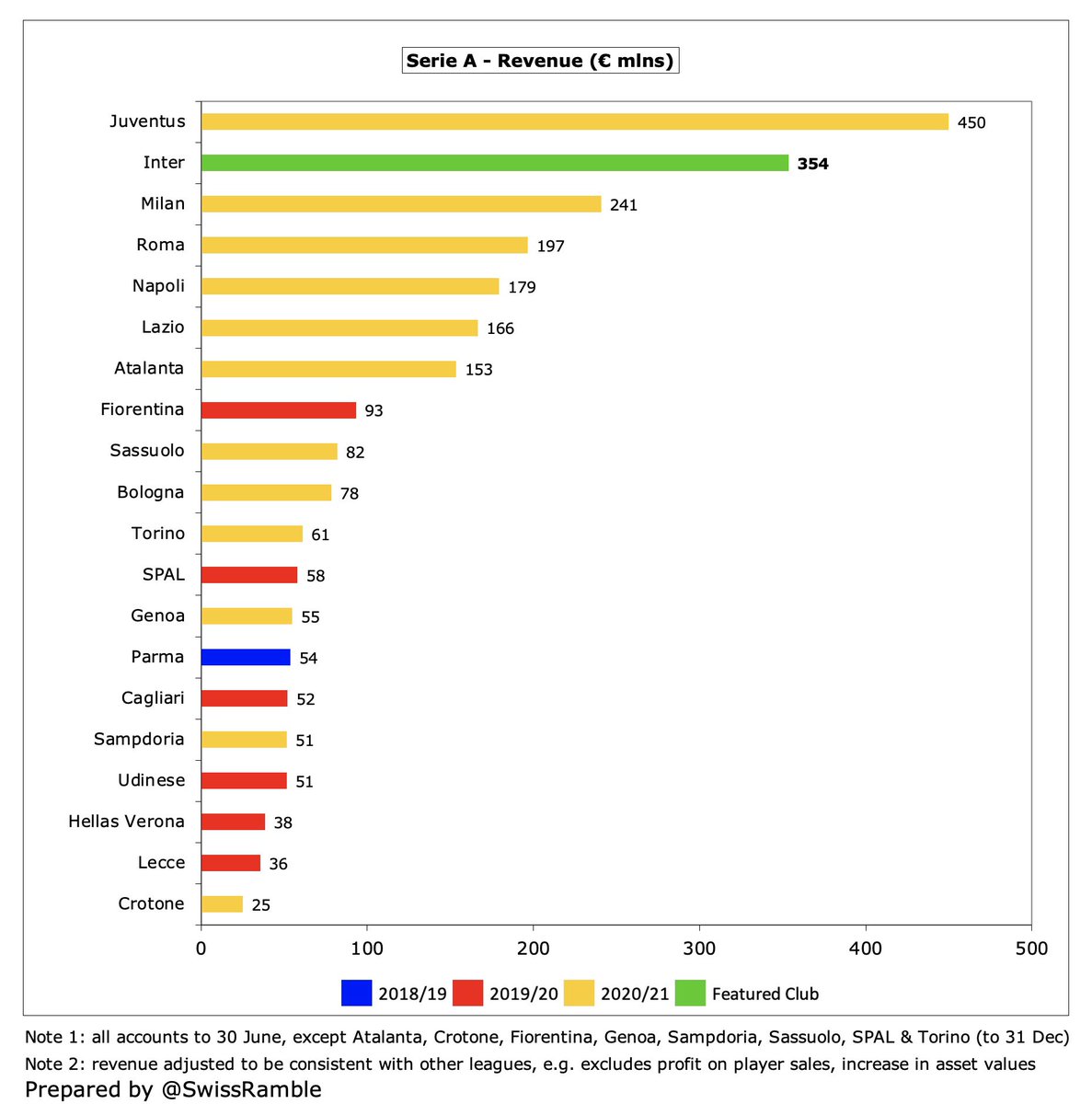

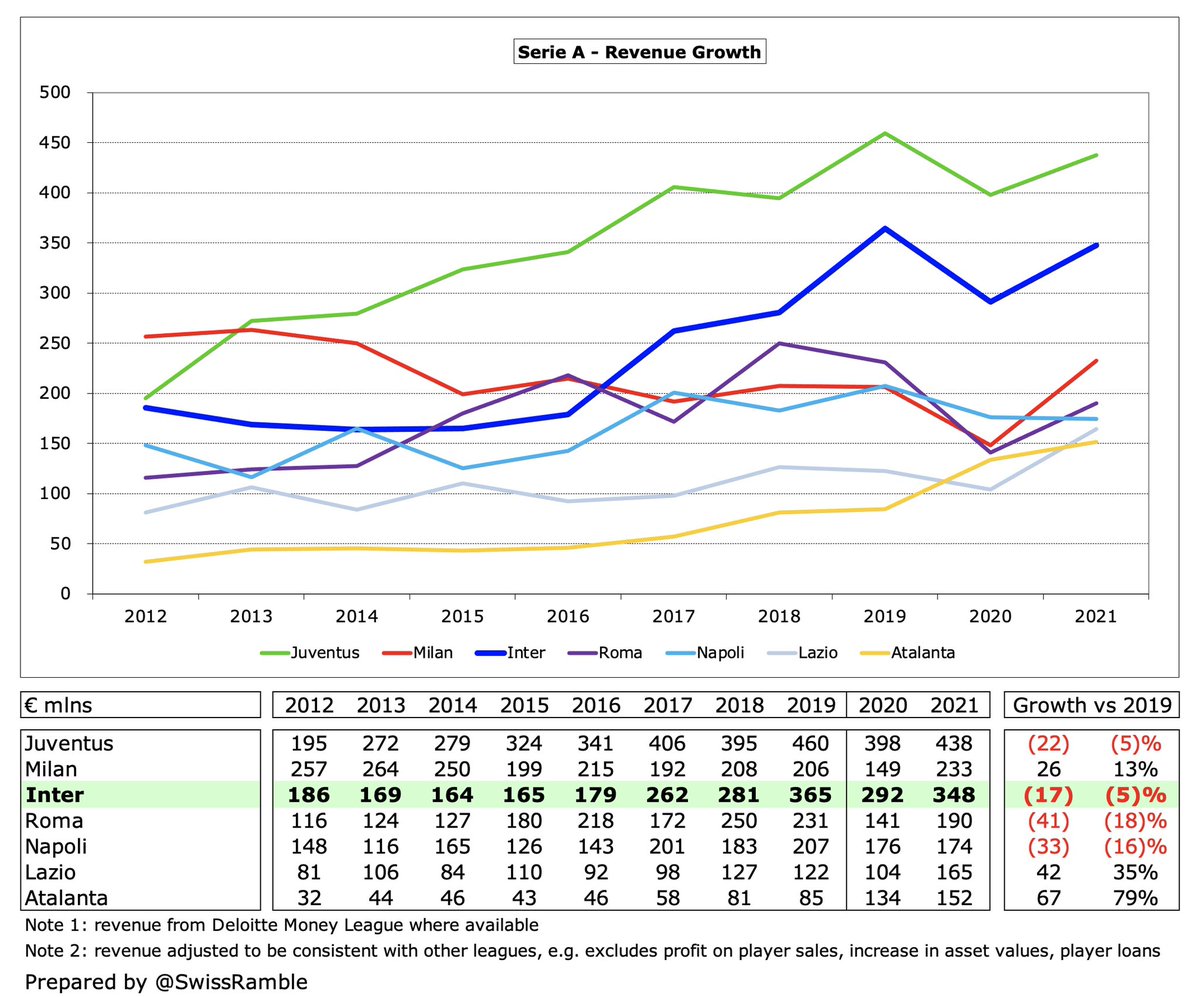

Despite the decrease, #Inter €354m revenue remains second highest in Italy, though still around €100m less than Juventus €450m. On the other hand, there is also clear water between Inter and the other challengers: Milan €241m, Roma €197m and Napoli €179m.

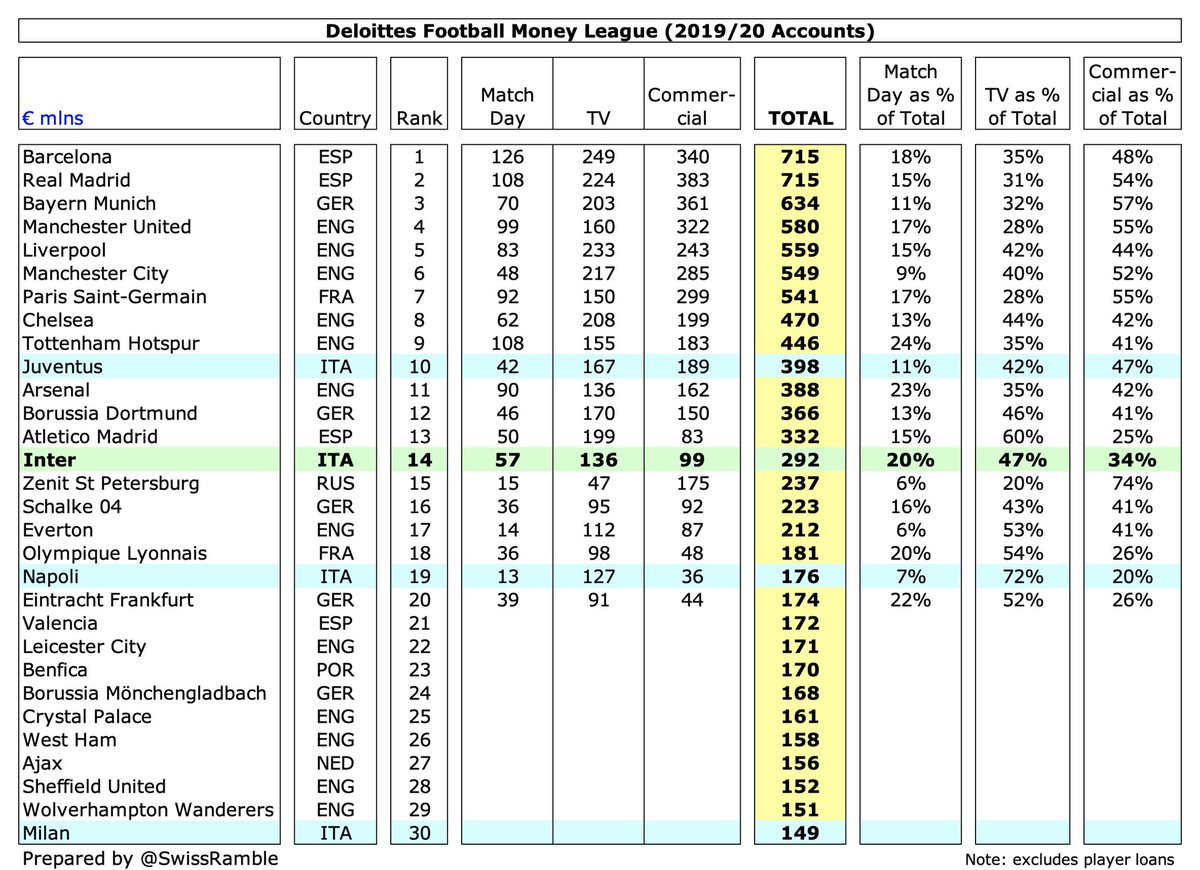

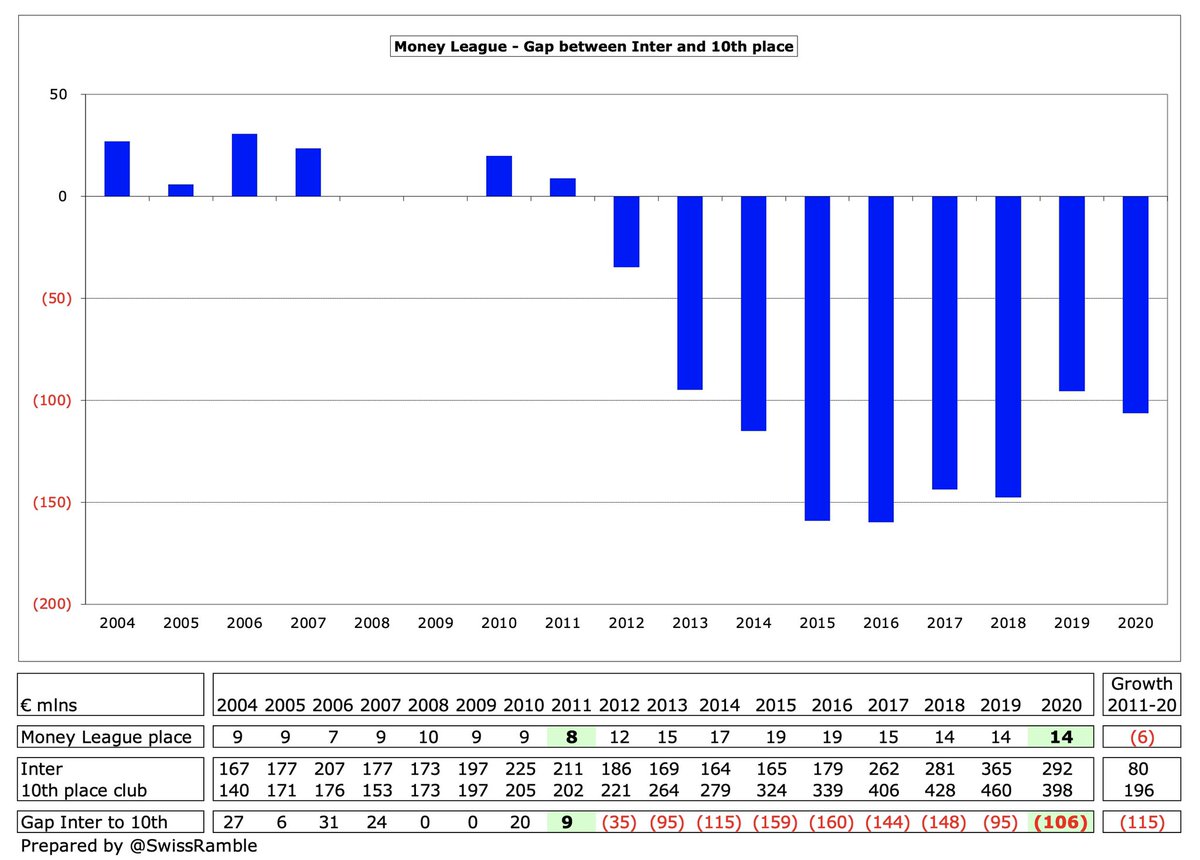

Based on 2019/20 accounts, #Inter were 14th in the Deloitte Money League, which ranks clubs worldwide by revenue. In 2011 they were as high as 8th generating €9m more revenue than the 10th placed club, but are now €106m lower.

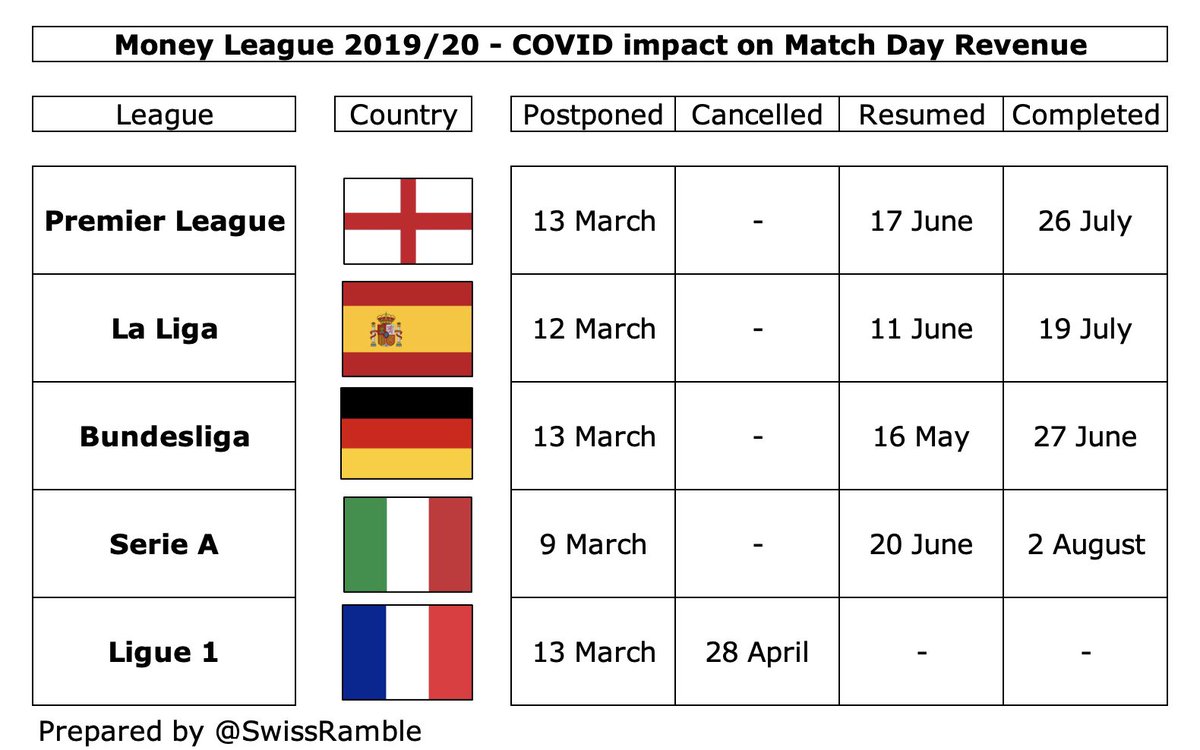

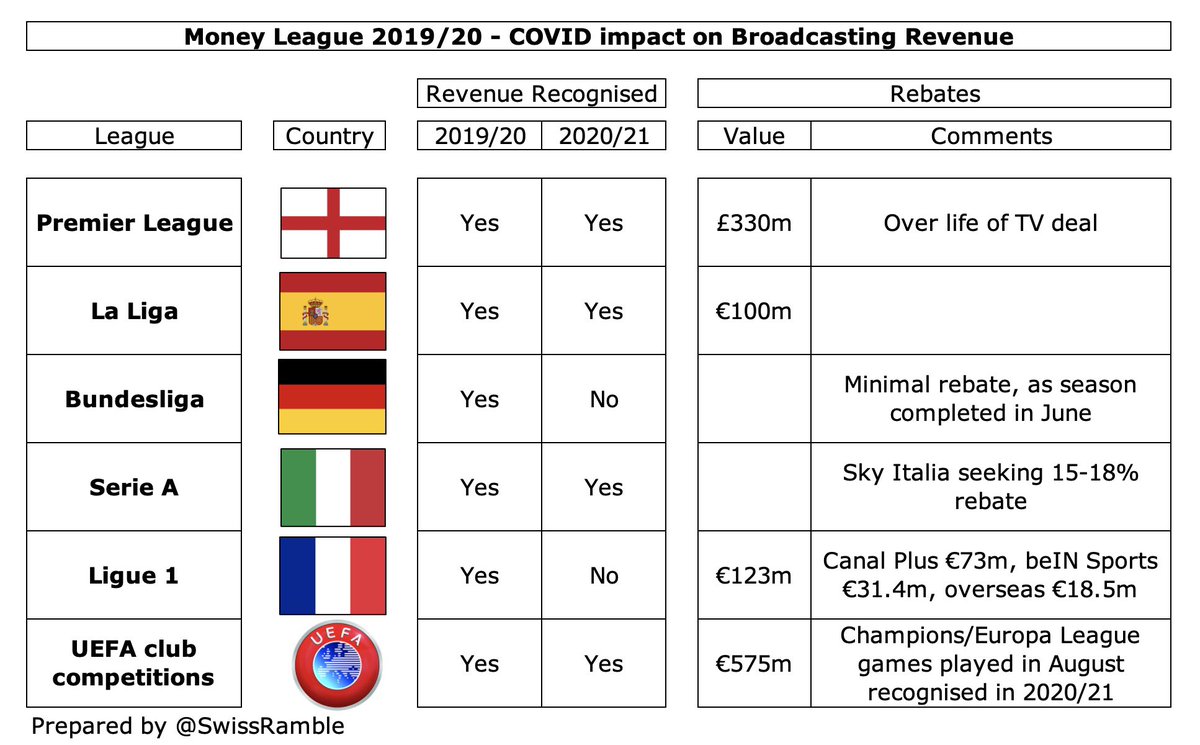

Money League comparisons are a bit misleading though, due to different responses to COVID, e.g. Bundesliga managed to complete its season by end-June, so could recognise a full season’s revenue in 2019/20, while Premier League, Serie A and La Liga extended to July and August.

#Inter broadcasting revenue shot up €75m (56%) from €131m to €206m, benefiting from money deferred from 2019/20 for games played after June accounting close. Domestic TV rose €55m to €125m and UEFA money up €18m to €64m. Also includes RAI archive €10m and Inter TV €5m.

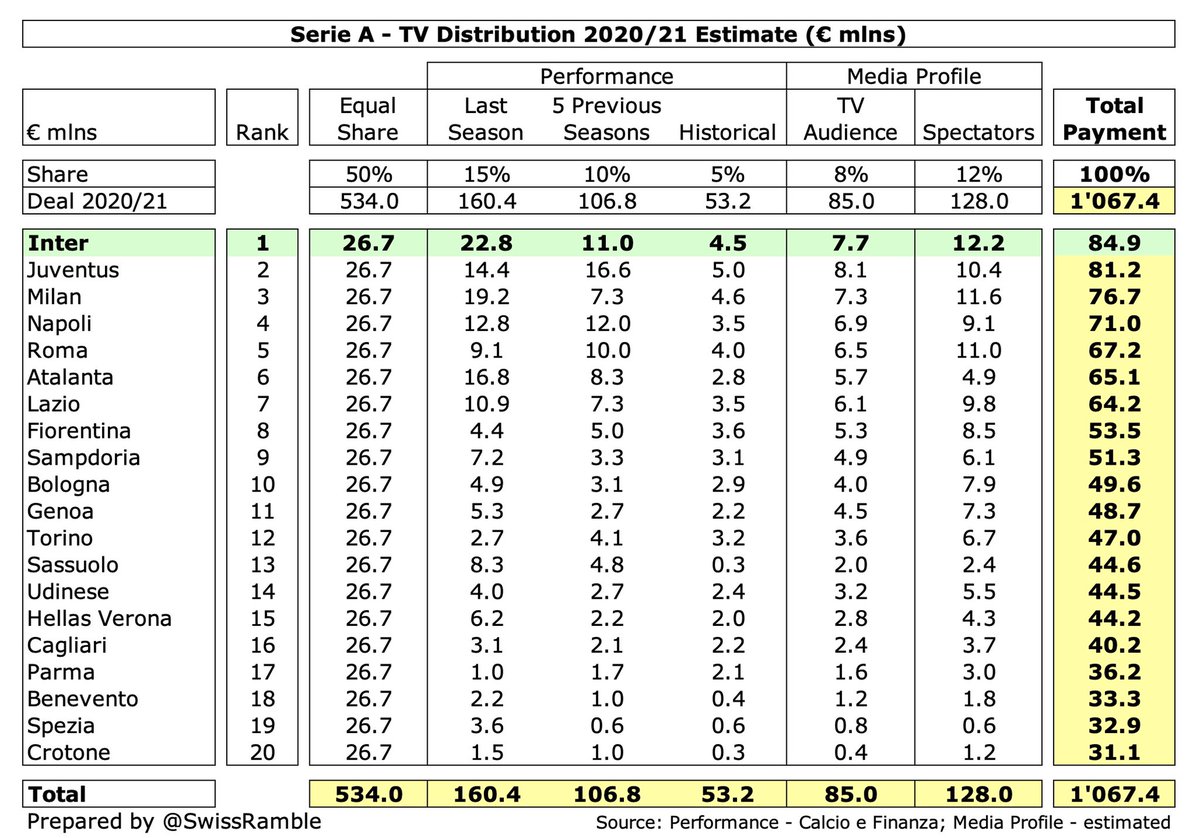

Per my model #Inter received €85m TV money from Serie A in 2020/21: 50% equal share; 30% performance (15% last season, 10% last 5 years, 5% historical); 20% media profile (8% TV audience, 12% fans). Also have to add income deferred from 2019/20 for games played in July & August.

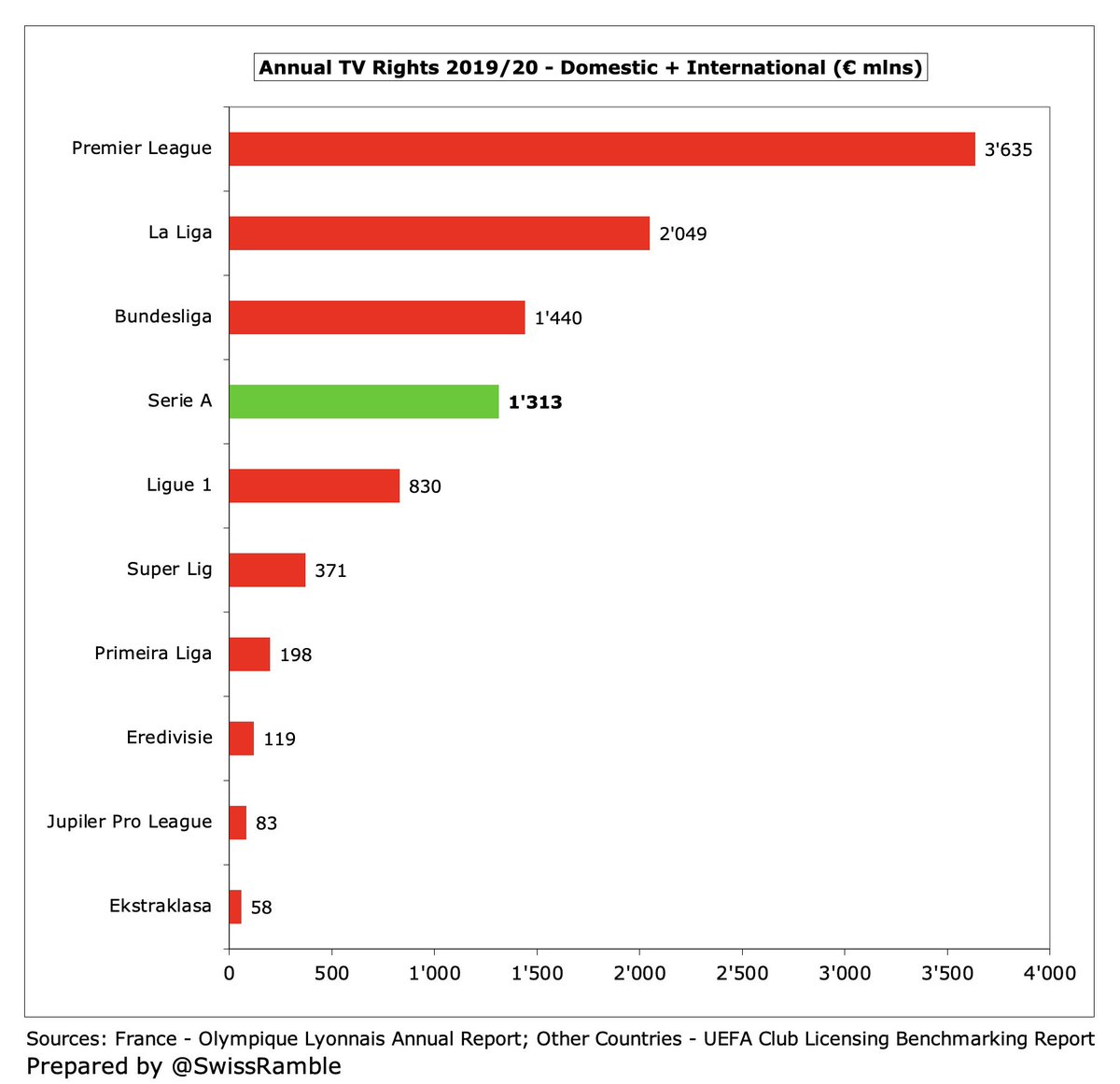

It is imperative that #Inter qualify for Europe to boost broadcasting income, as TV rights in Serie A are relatively low. England €3.6 bln and Spain €2.0 bln saw big increases in 2019, while Italy was unchanged at €1.3 bln. In fact, the new 2021-24 deal will be lower.

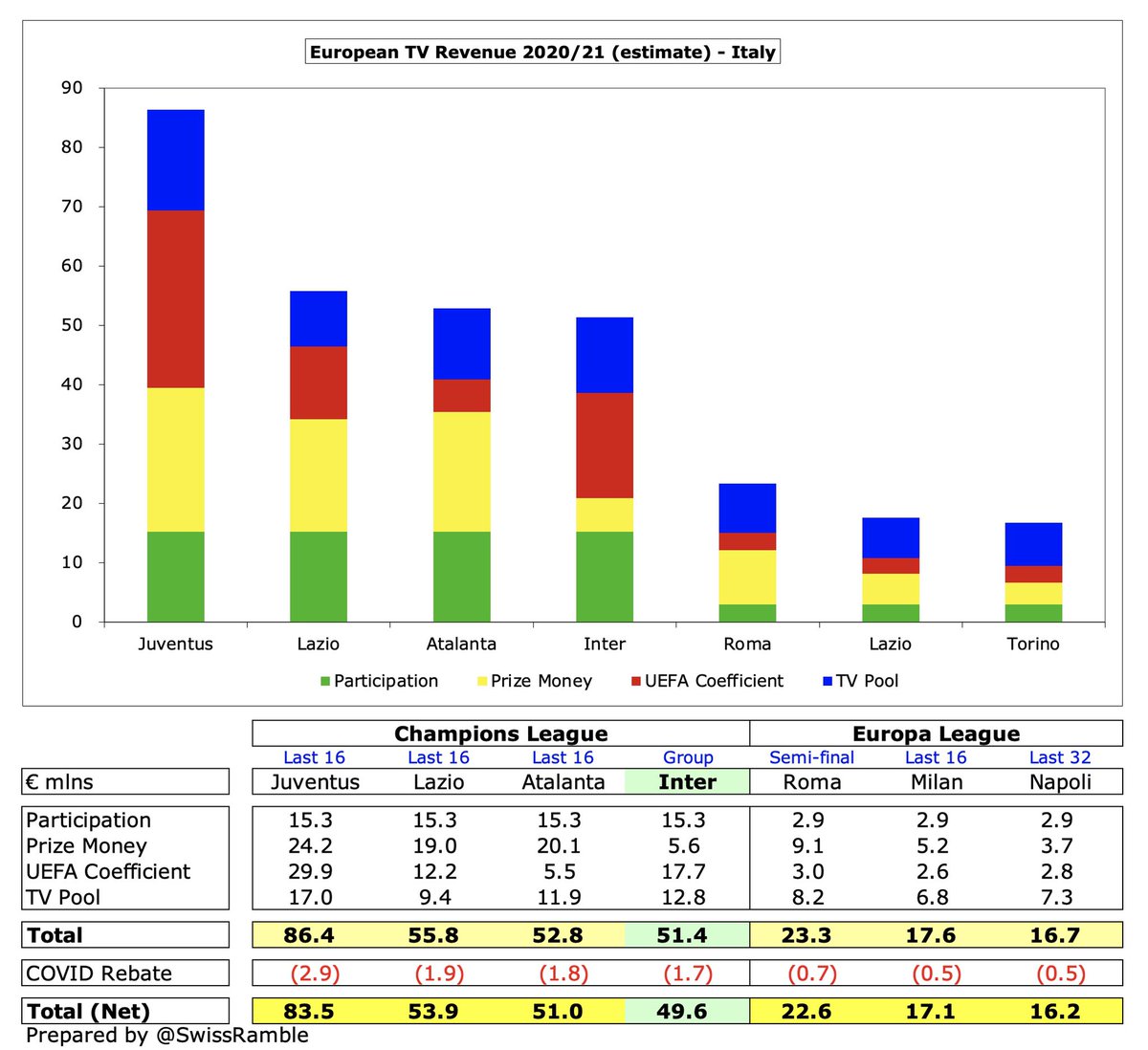

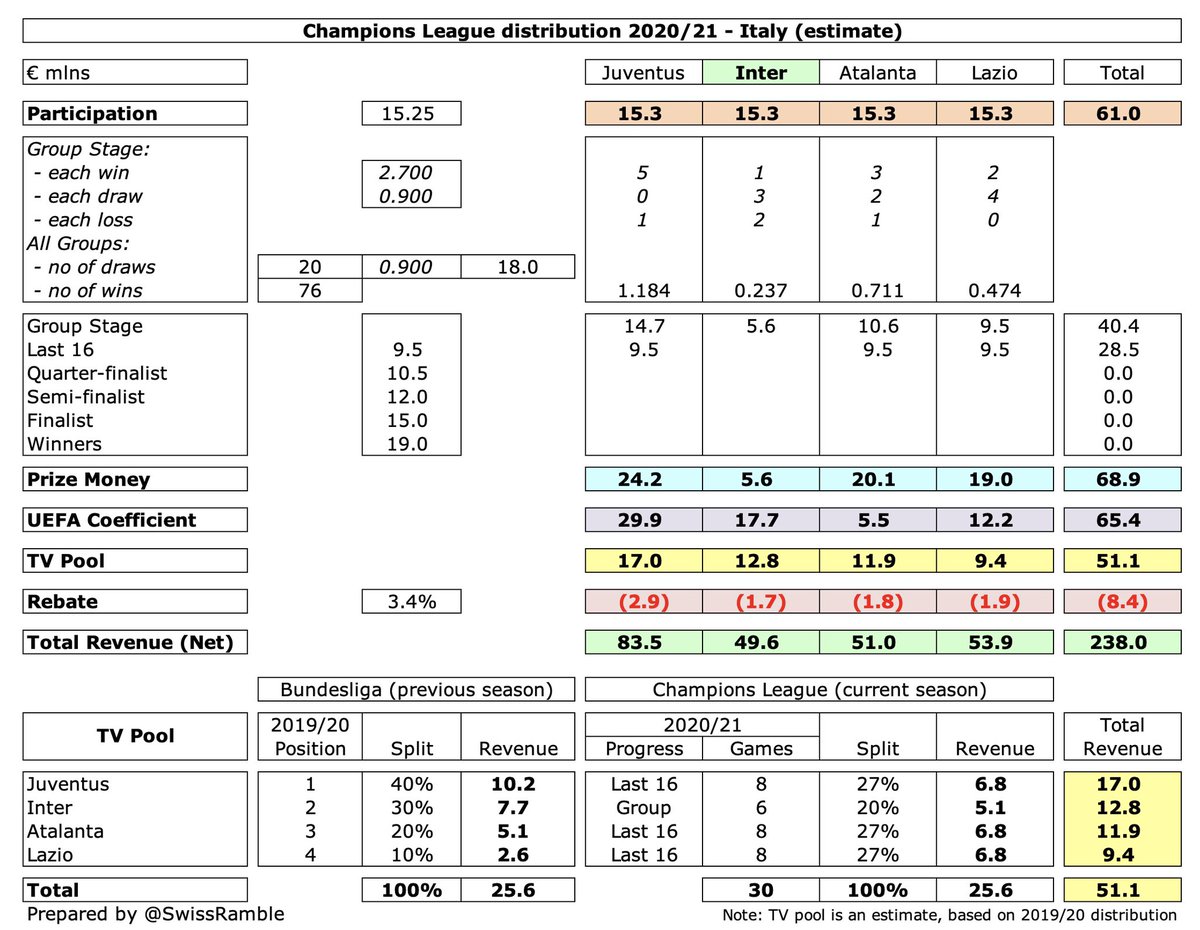

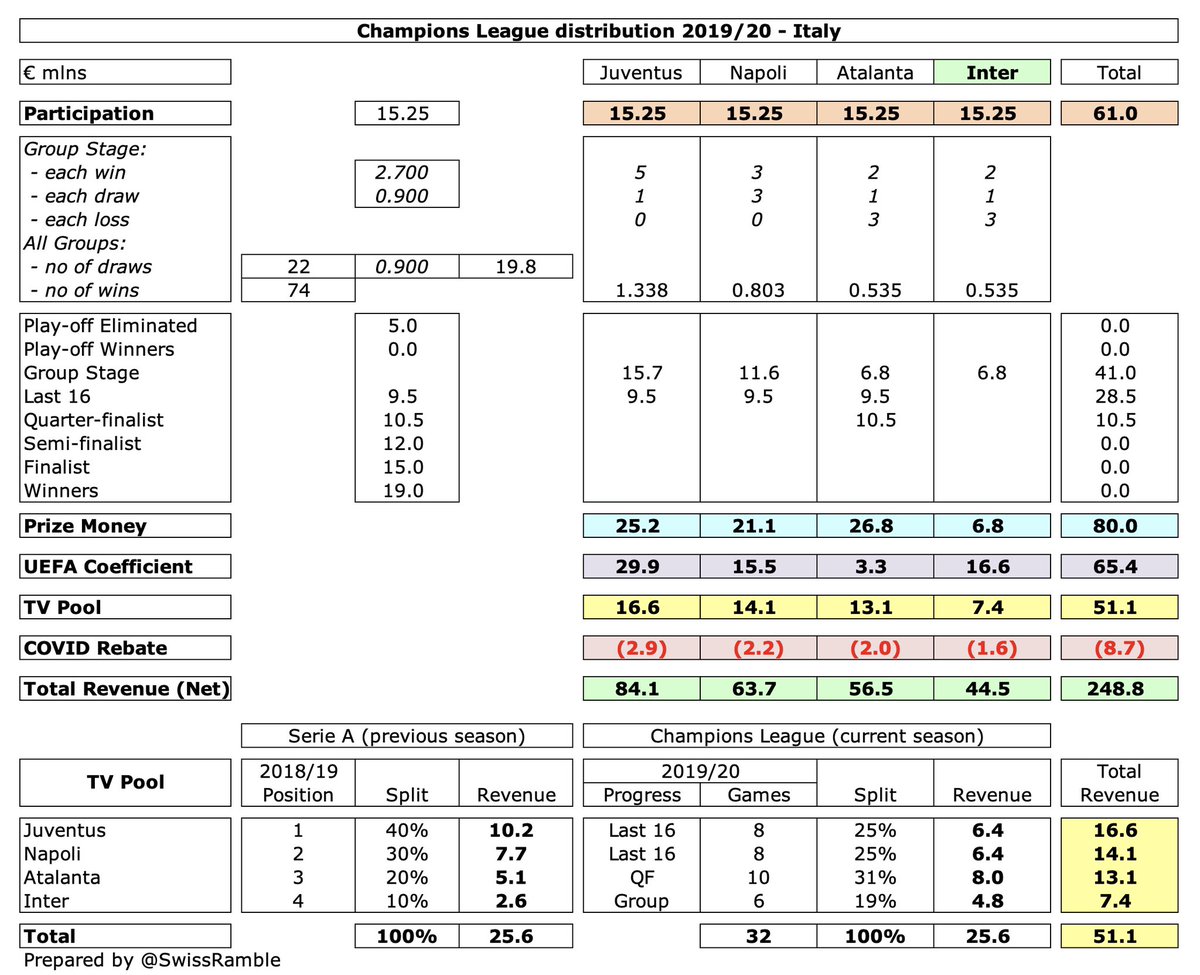

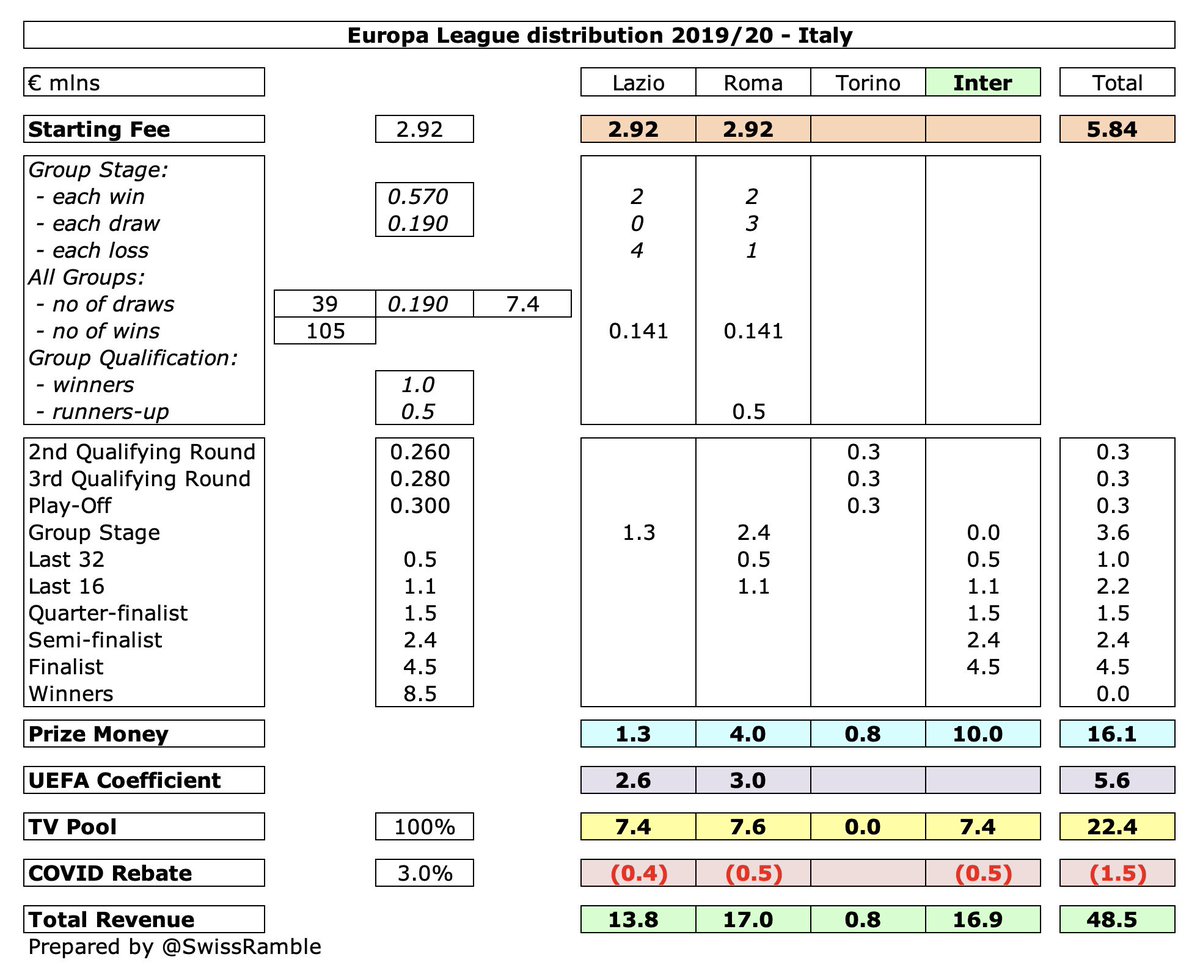

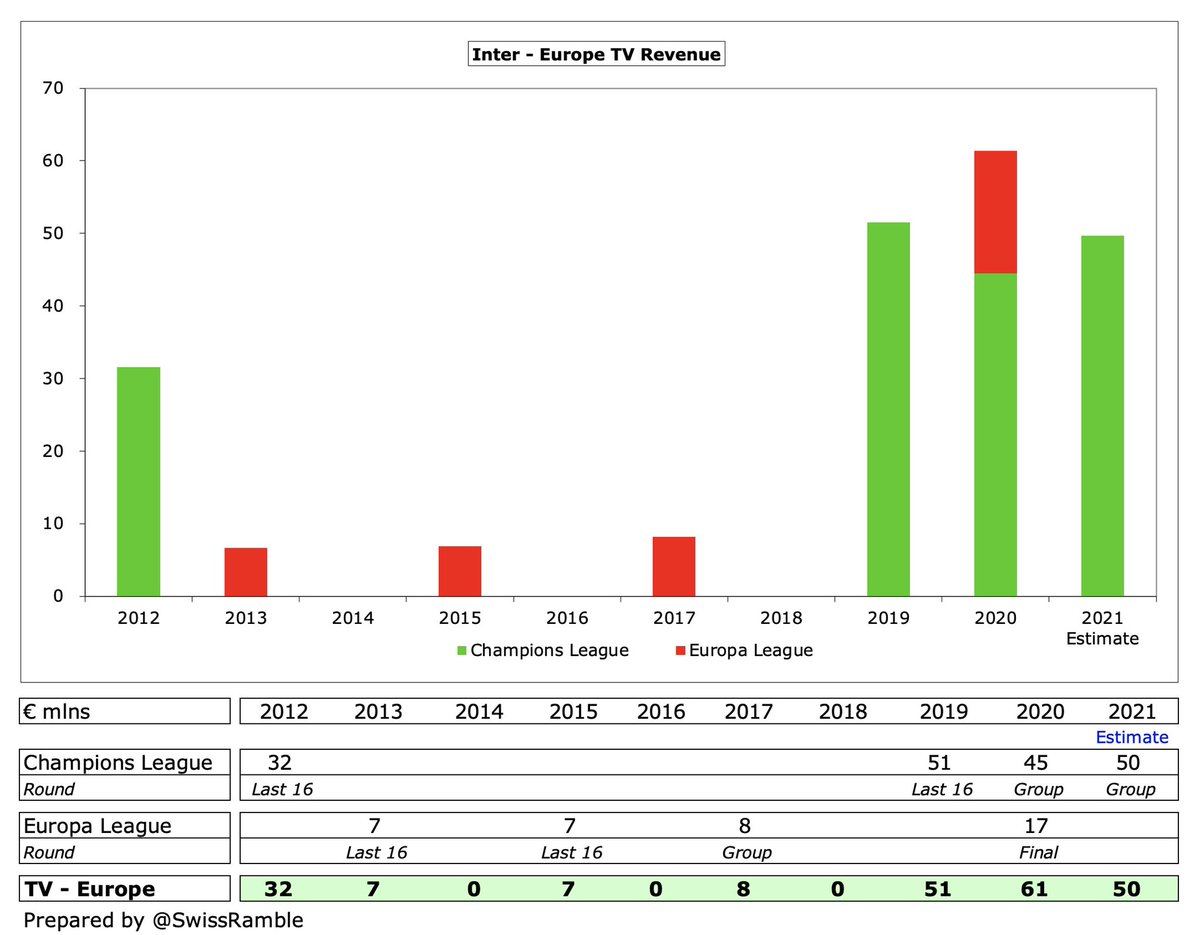

#Inter earned around €50m from the Champions League, even though they did not get out of the group. This was less than prior season’s €61m: €44m after finishing 3rd in Champions League group plus €17m for reaching Europa League final, though some money deferred to 20/21.

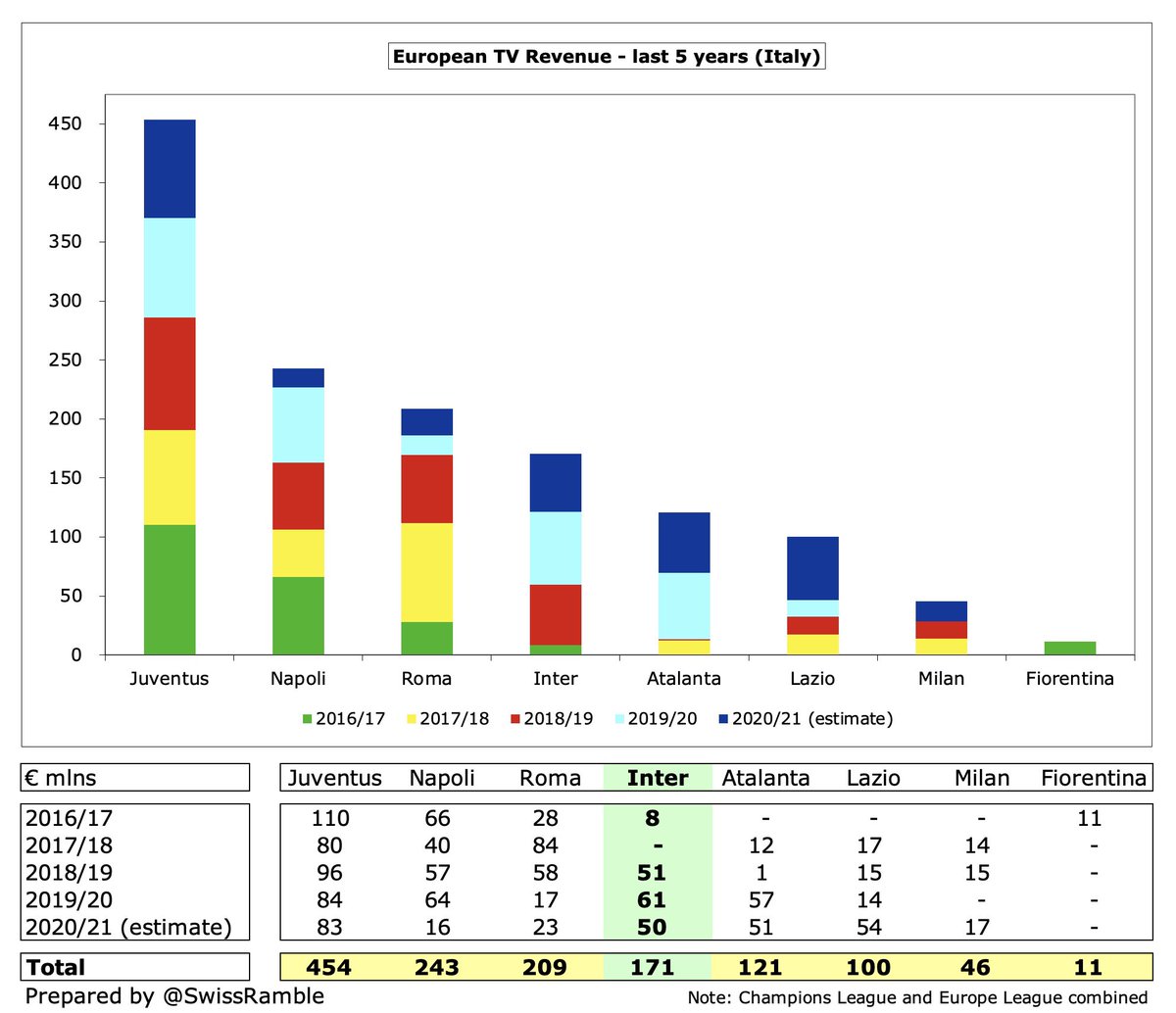

#Inter have received €171m from Europe in last 5 years, almost all from 2019 to 2021. This is miles below Juventus €454m and also less than Napoli €243m and Roma €209m, but way ahead of Milan €46m. This also has an impact on the UEFA coefficient ranking.

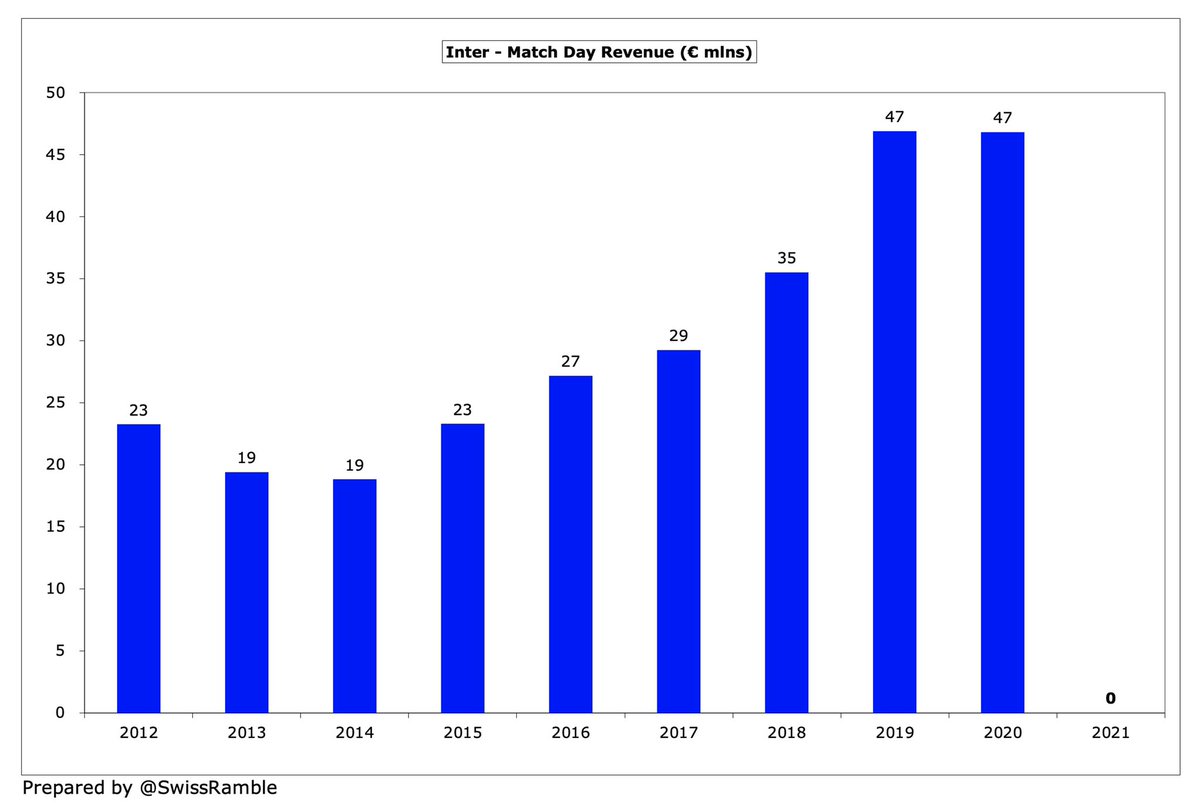

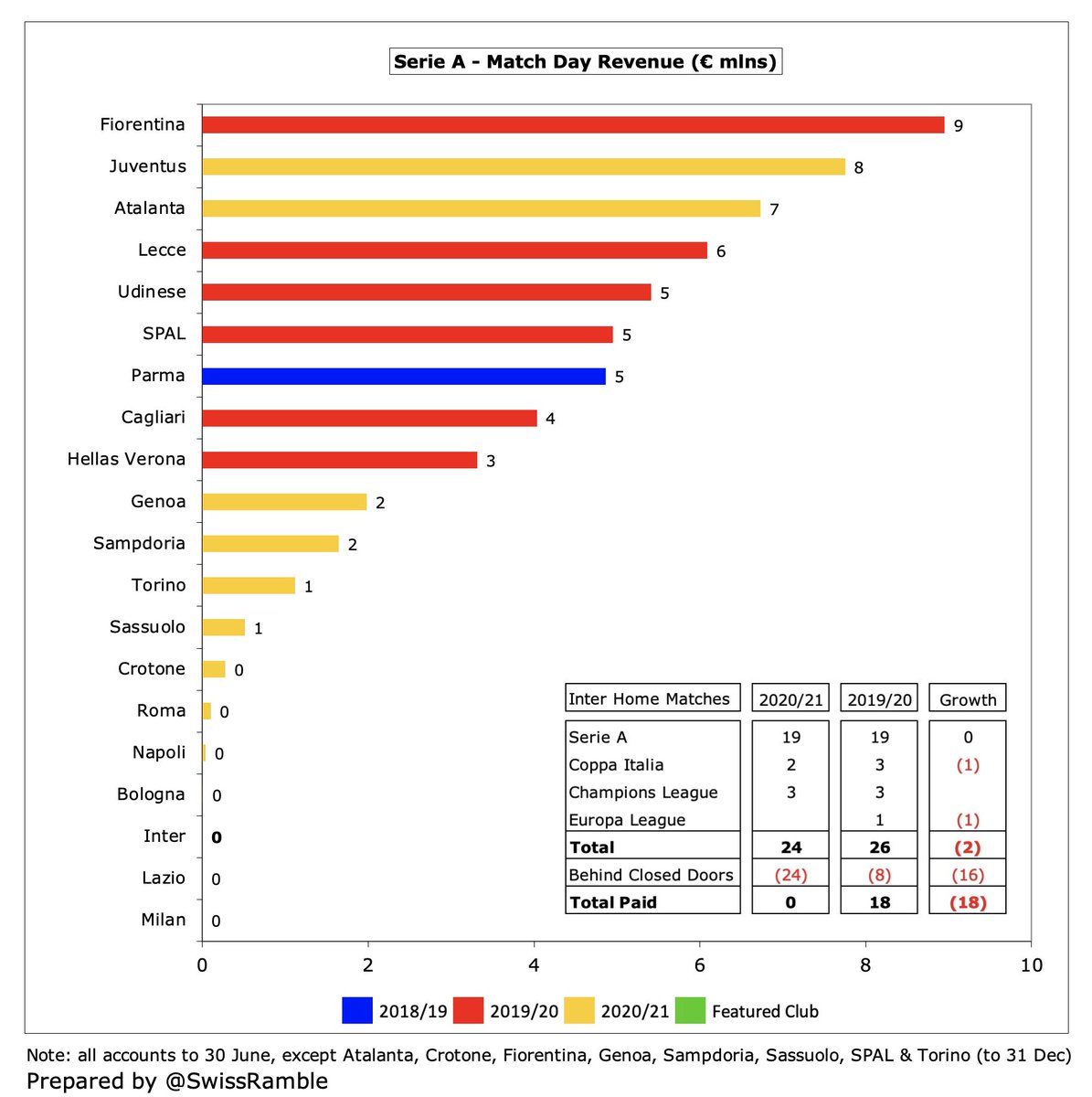

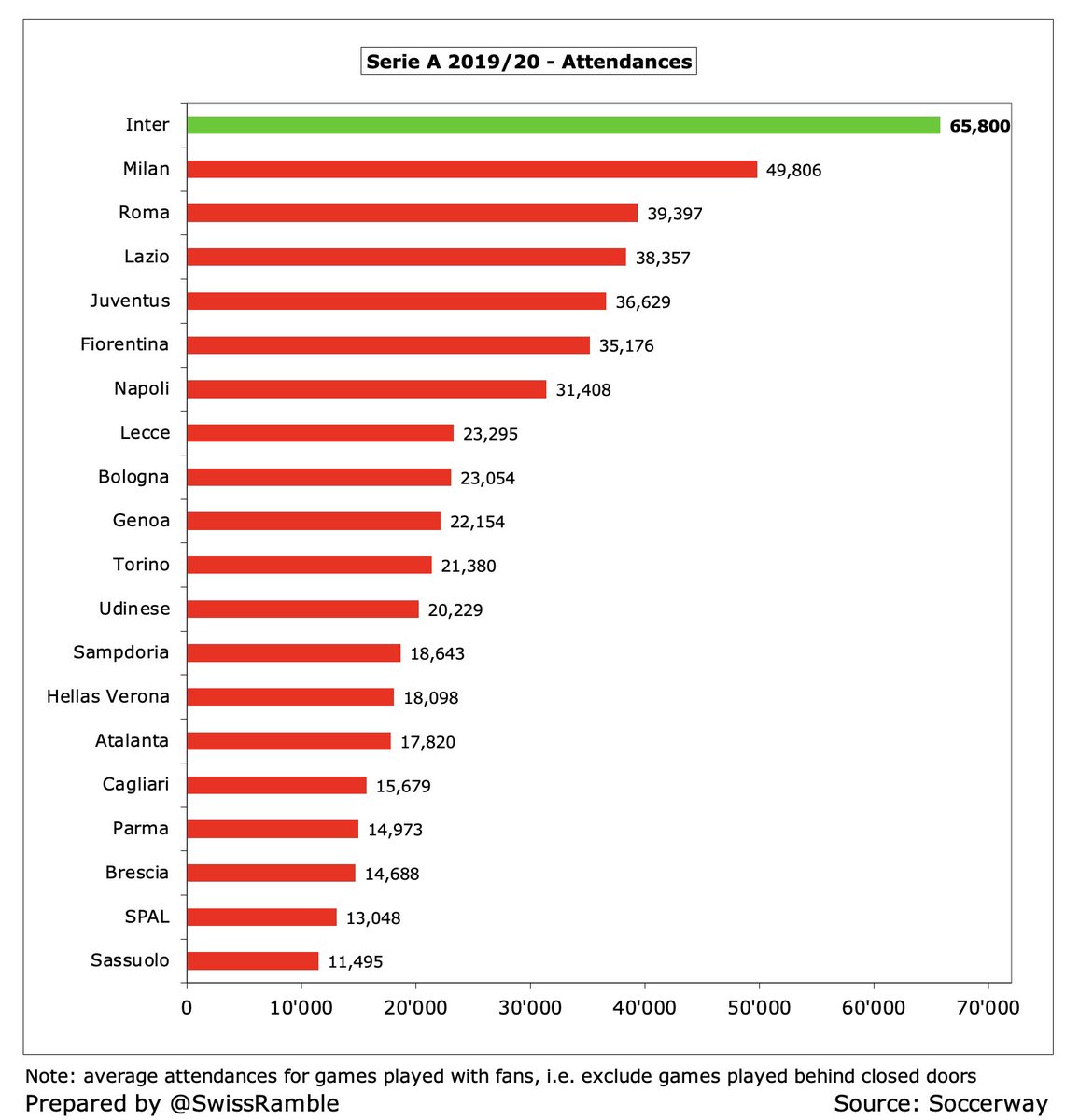

#Inter match day income fell from €47m to zero, as all home games were played behind closed doors. Before the pandemic struck, this was 2nd highest in Italy, though well below Juventus €71m (new stadium). Potential shown in 2019/20 with €7.9m receipts from Barcelona CL game.

#Inter had the highest attendance in Italy of around 66,000 pre-COVID, so they will be happy that fans have returned to stadiums this season for this “essential revenue stream”. Capacity had been increased to 75%, before Omicron reduction to 5,000, though hope for 100% soon.

The #Inter and Milan joint project to build a new stadium has been approved. Inter chief executive Alessandro Antonello said this was needed “to compete on an equal footing with the most important European clubs”, as can be clearly seen by 2019/20 match day income.

#Inter commercial revenue rose €27m (24%) from €115m to €142m, including some revenue deferred from 2019/20 accounts. Had surged from €77m in 2016 to €166m in 2019 thanks to Regional (Chinese) sponsorships, though some of these have been terminated early.

#Inter €142m commercial income is still the second highest in Italy, albeit a fair way below Juve’s €194m. Their growth in this important revenue stream in the last 5 years has only been outpaced by the Bianconeri, but leaves them well ahead of Milan, Roma and Napoli.

#Inter replaced long-standing €11m Pirelli shirt sponsorship in 2021/22 with Socios €16m, but will move to current sleeve sponsor DigitalBits in 2022/23 in 4-year €85m deal. Looking to extend Nike kit deal, though for twice existing €12.5m. Also have Lenovo back-of-shirt deal

#Inter income from player loans income decreased from €9m to €6m, mainly Lazaro to Borussia Mönchengladbach and Dalbert to Rennes. This can be an important revenue stream for some Italian clubs, including other income from player management.

#Inter wage bill rose by €64m (32%) from €198m to €262m, mainly due to pro-rating of wages paid for March to June 2020 until August 2020. Also included increases in coaches’ salaries €9m and bonuses €5m. Even on a normalised basis, wages up significantly from €124m in 2016.

In fact, #Inter have the highest wages growth in Italy in the last 5 years, as their €137m increase has outpaced Juventus €101m. In comparison, Milan and Roma only grew by €12m and €14m respectively in the same period.

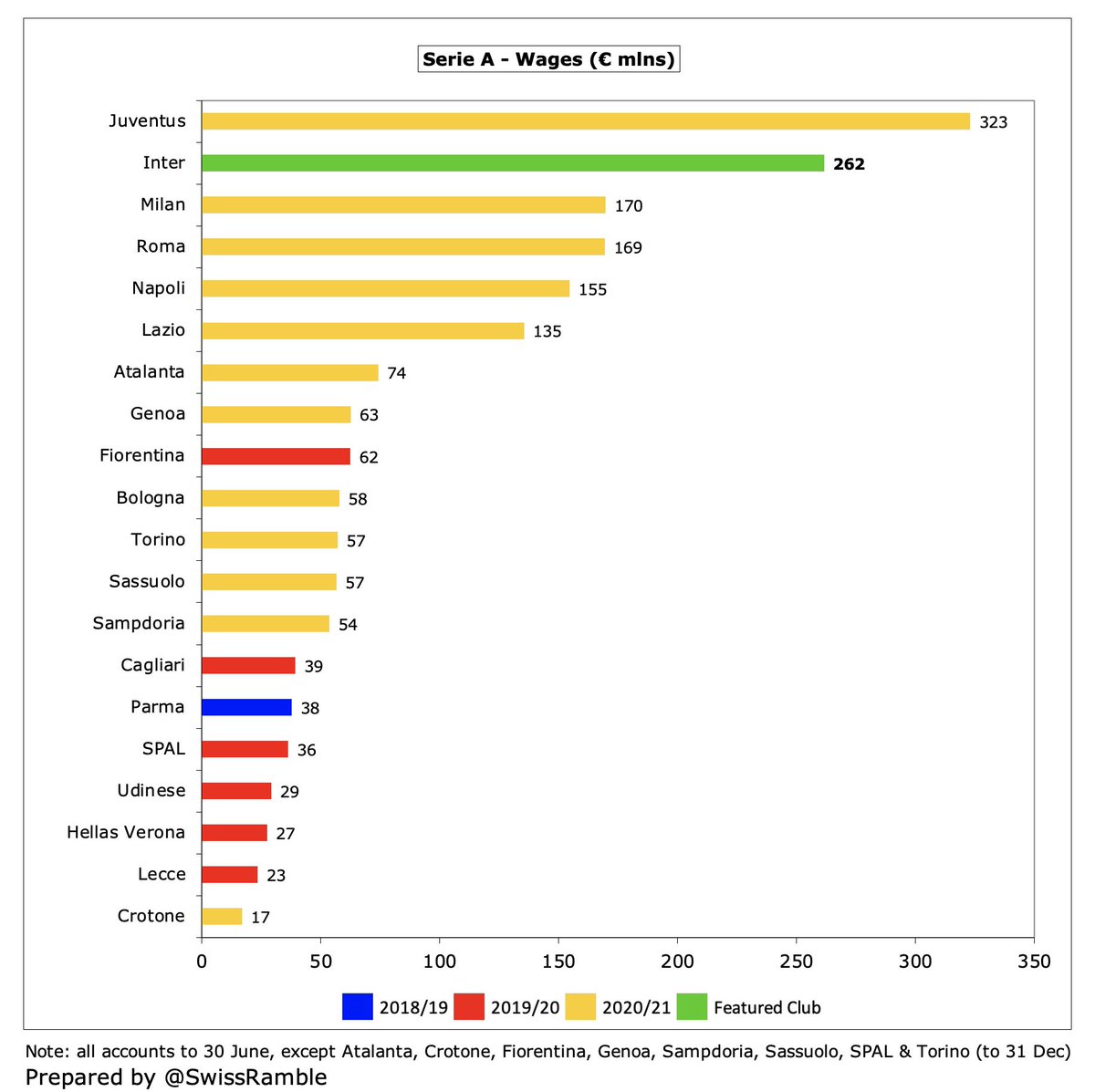

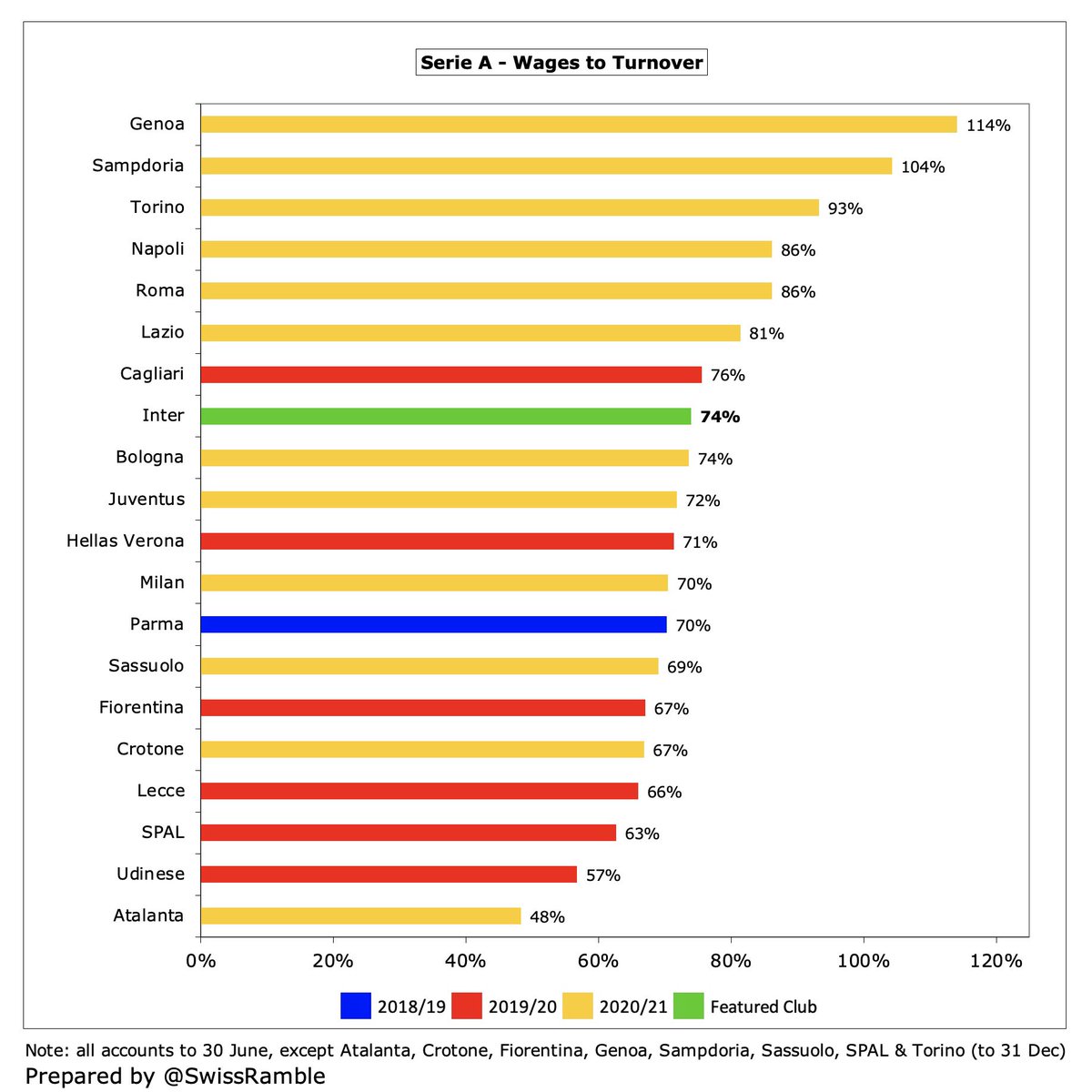

As a result, #Inter €262m wage bill is now clearly the second highest in Italy, only behind Juventus €323m, but around €100m ahead of Milan €170m, Roma €169m and Napoli €155m. However, the club is looking to cut wages to be more sustainable, so some players released.

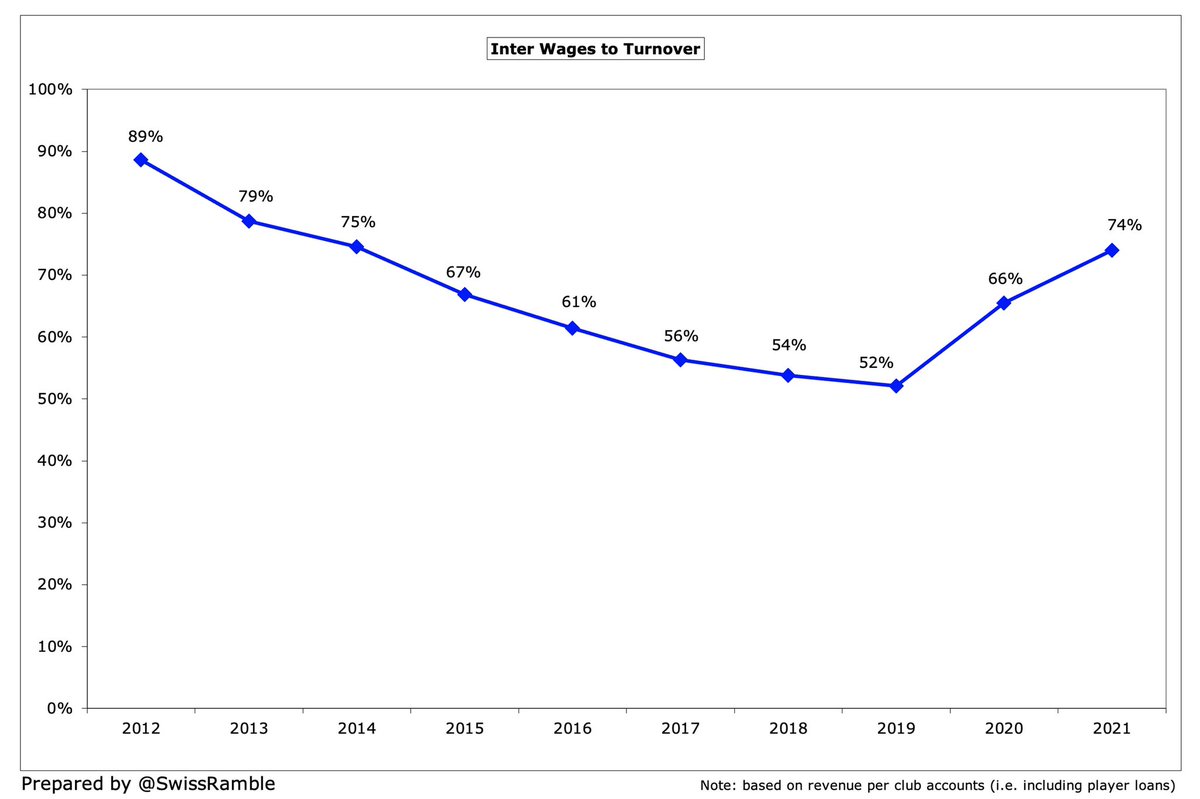

#Inter wages to turnover ratio increased from 66% to 74%, though this was inflated by salaries deferred from 2019/20 and the lack of match day revenue. Around the same level as Juventus 72% and Milan 70%, though better than Roma and Napoli (both 86%).

#Inter player amortisation, the annual cost of writing-off transfer fees, rose by €17m (14%) from €120m to €137m, so up €52m in just 2 years. Now 2nd highest in Italy, far below Juventus €177m, though twice Milan €66m. Also €17m player write-downs (Nainggolan & Joao Mario)

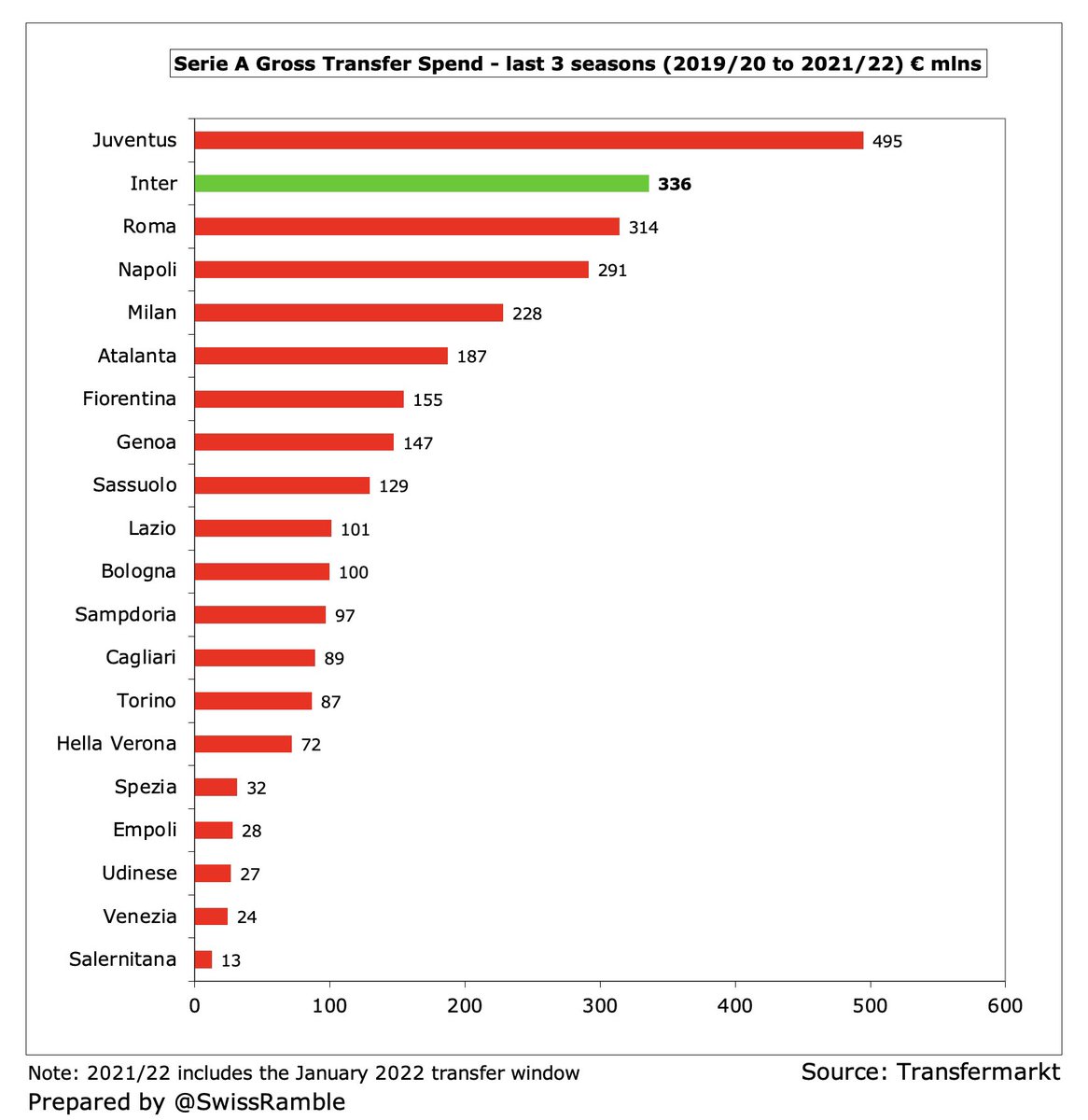

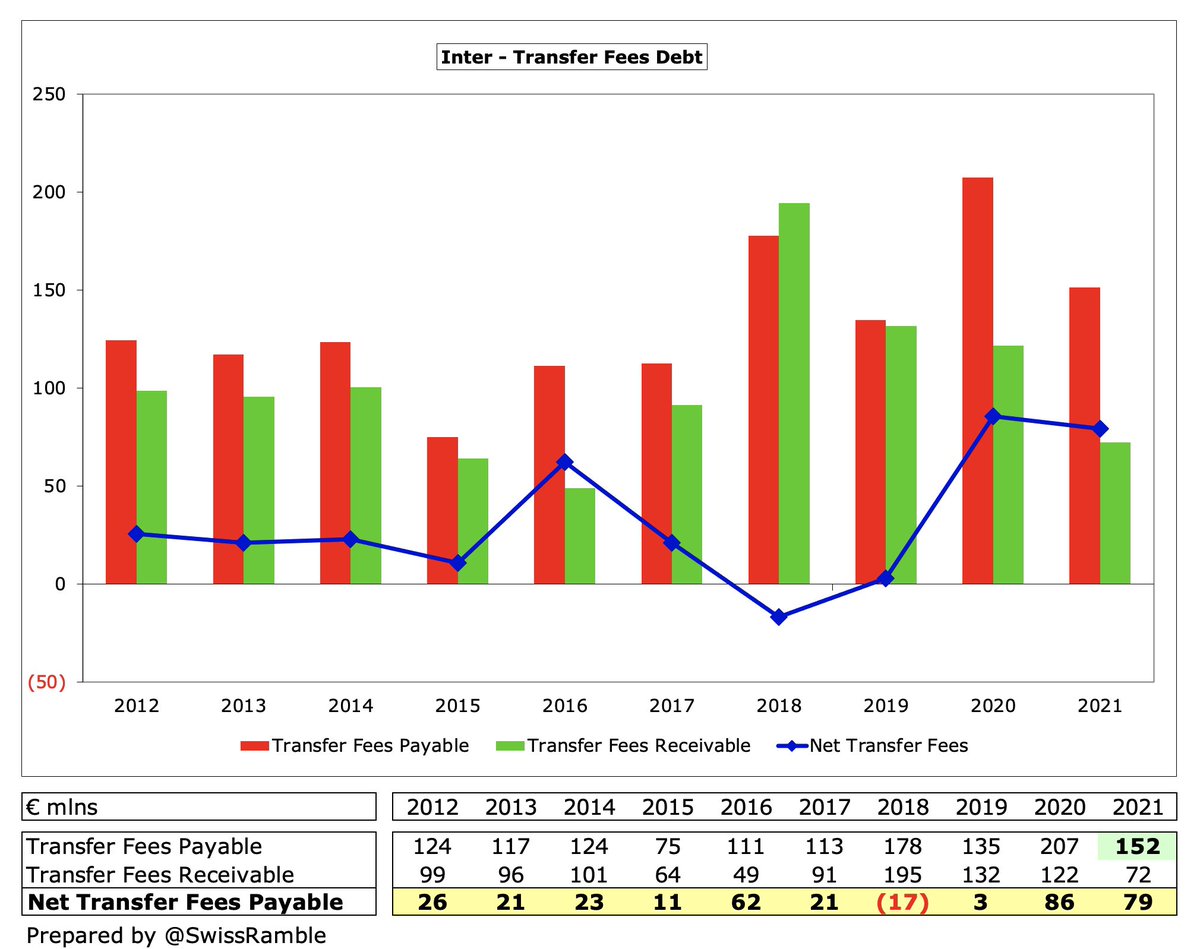

#Inter have really ramped up expenditure in the transfer market, splashing out €779m in the last 5 years, much more than €458m in the preceding 5-year period. Spent €99m in 2020/21, when largest purchases were Stefano Sensi (Sassuolo) €28m and Andrea Pinamonti (Genoa) €21m.

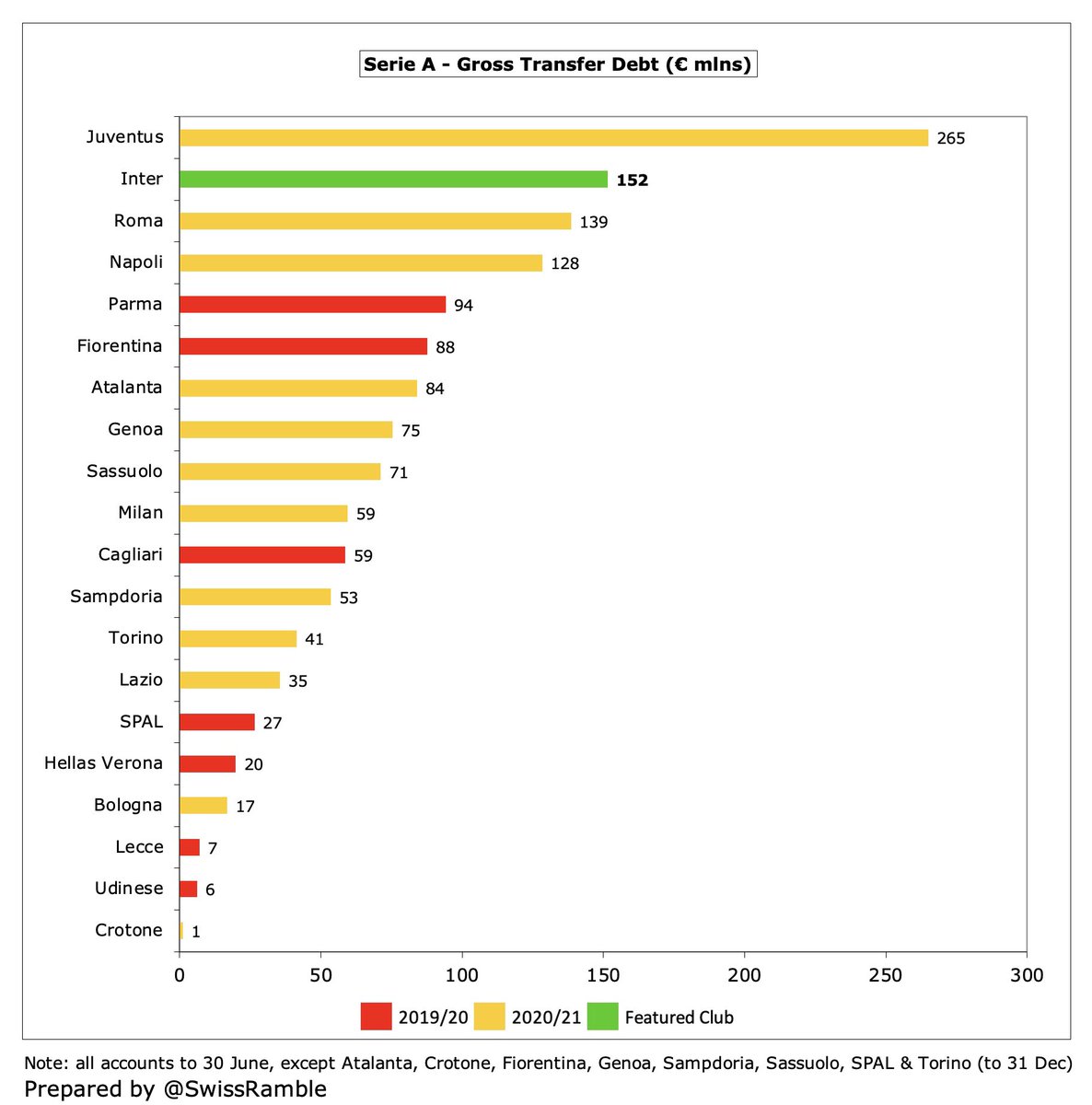

Including the recent transfer window, #Inter has the second highest gross transfer spend in Serie A, only surpassed by Juventus. However, it’s a very different story for net spend, as the lucrative sales of Lukaku and Hakimi mean that Inter actually had €16m net sales.

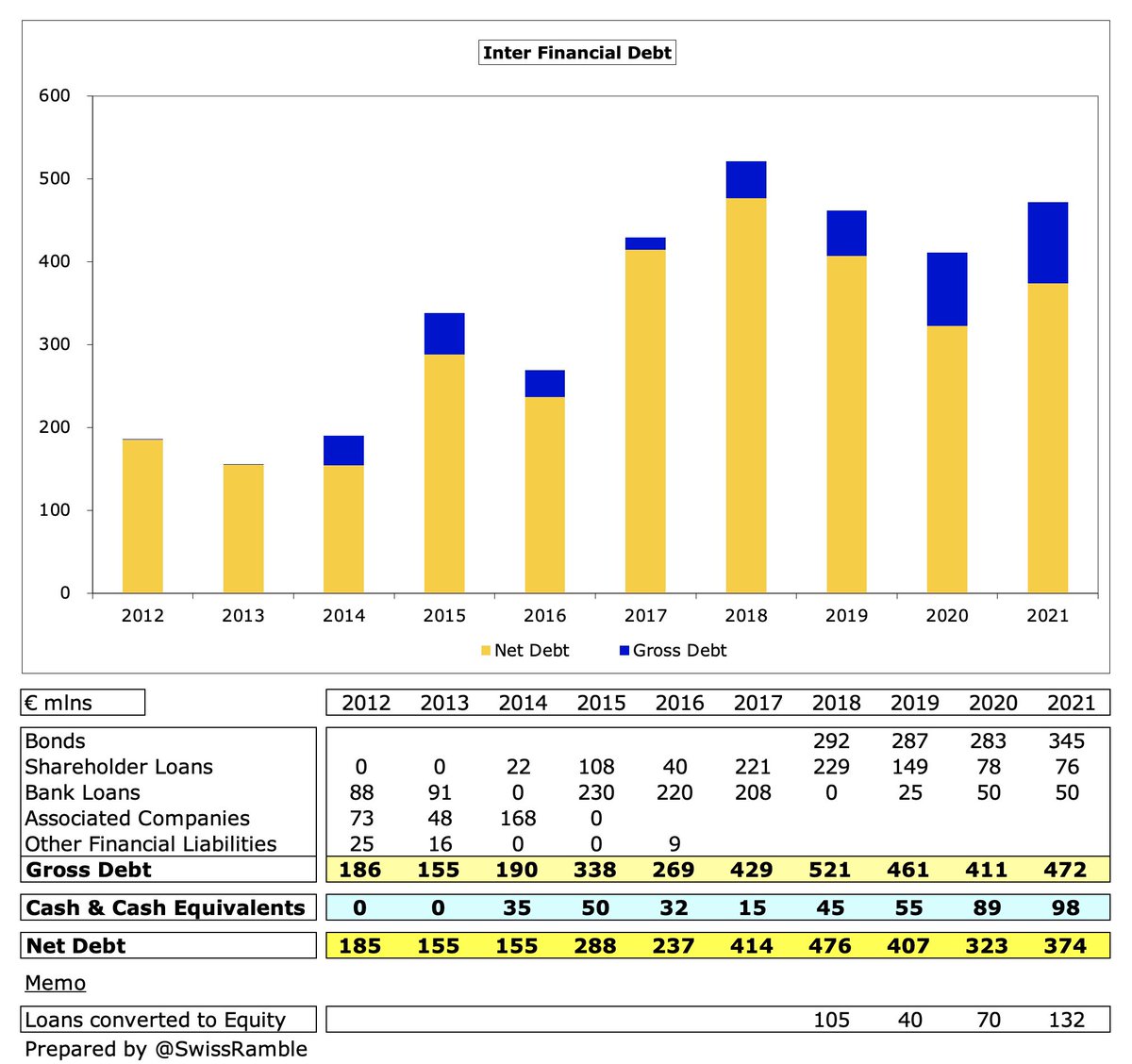

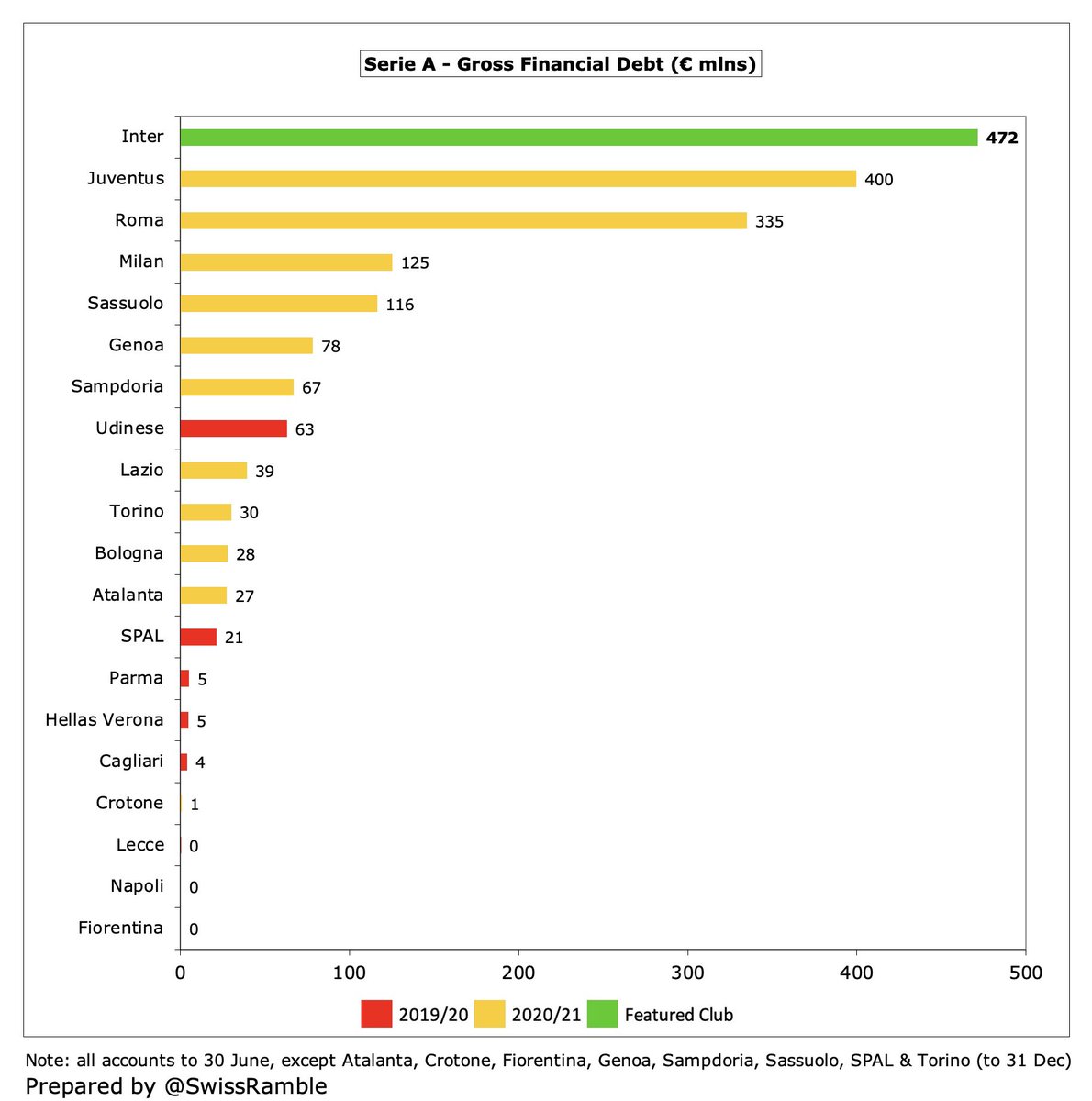

#Inter gross debt rose €61m from €411m to €472m, compromising €345m bonds, €76m shareholder loans and €50m bank loans. Debt up €203m in 5 years, but would have been even higher without Suning converting €347m debt into reserves (including €132m in 2020/21).

Nevertheless #Inter €472m gross debt is highest in Italy, above Juventus €400m (partly new stadium), Roma €335m & Milan €125m. Recent new €415m offering replaced bonds & credit facility, extending maturity from 2022 to 2027, but increased interest rate from 4.875% to 6.75%.

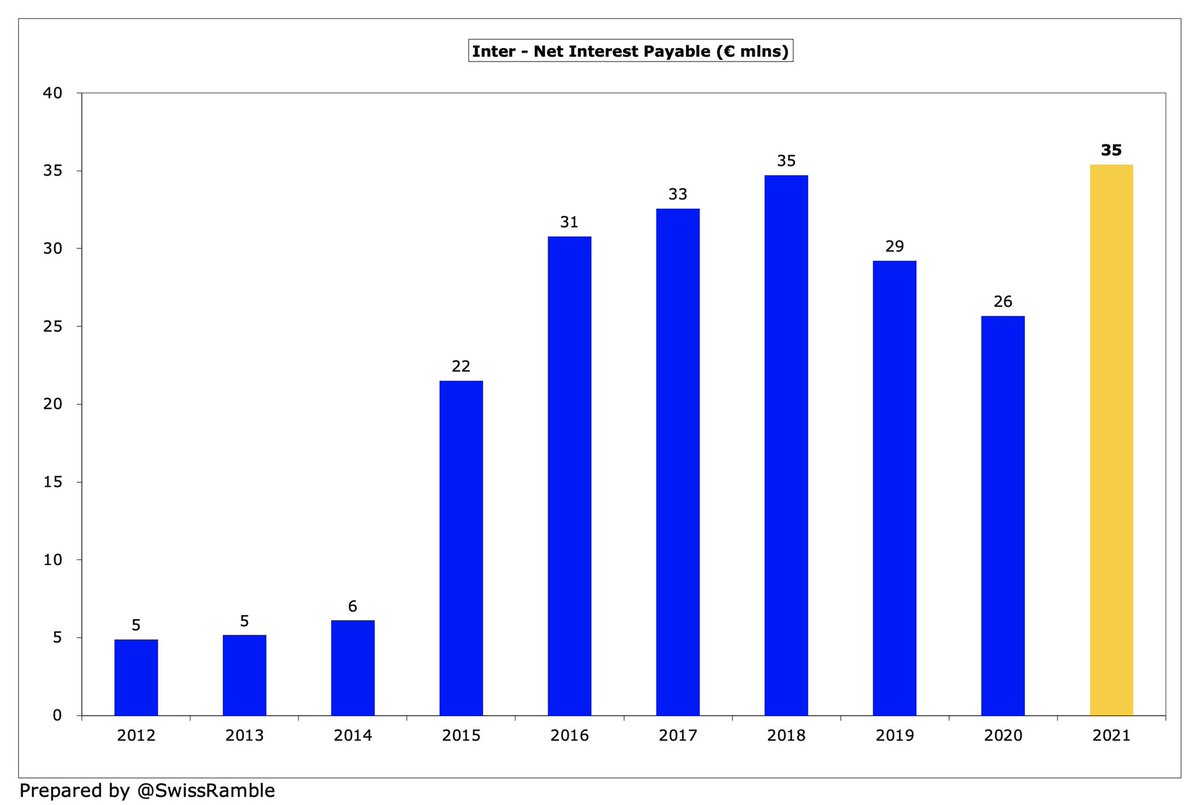

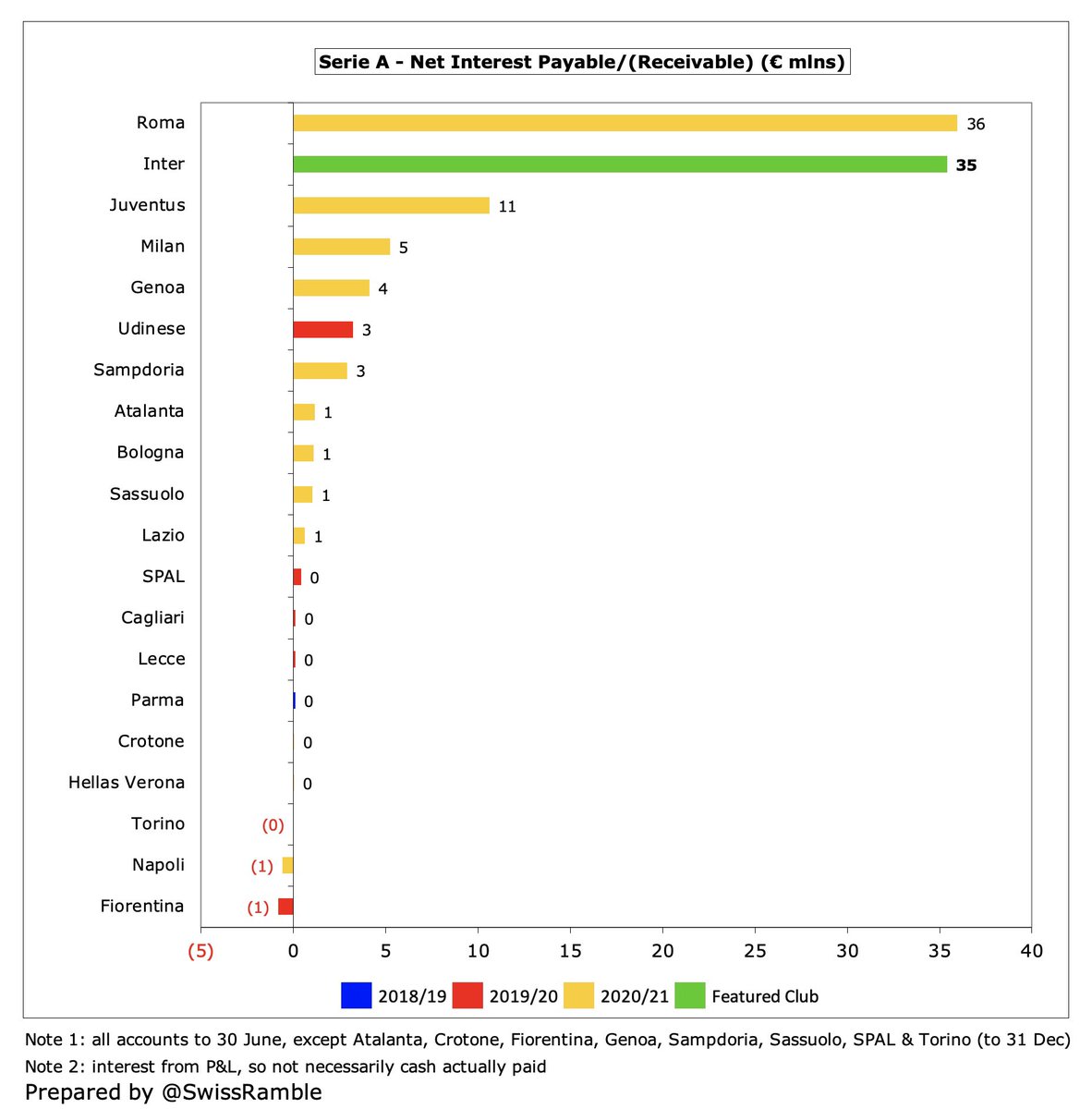

The hefty debt comes at a price, as #Inter net interest payable increased from €26m to €35m, mainly €22m on bonds, €6m on payables and €5m on shareholder loans (8%). Second highest in Italy, just behind Roma €36m, but much higher than Juventus €11m and Milan €5m.

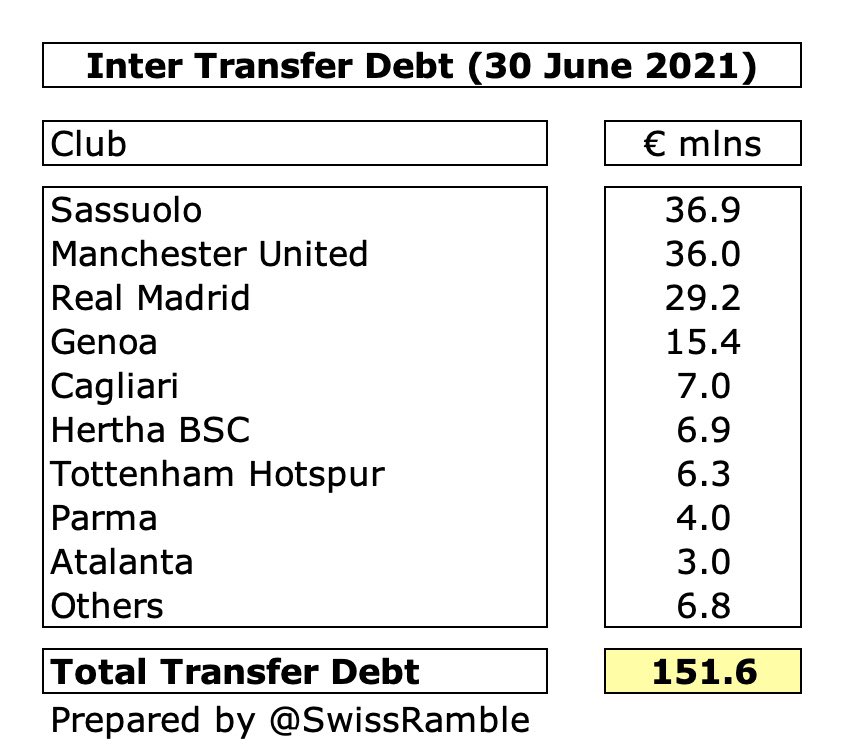

#Inter managed to reduce gross transfer debt from €207m to €152m, though this is still second highest in Italy, only below Juventus €265m. Largest amounts owed to Sassuolo €37m, #MUFC €36m and Real Madrid €29m. They are owed €72m by other clubs, so net payable is €79m.

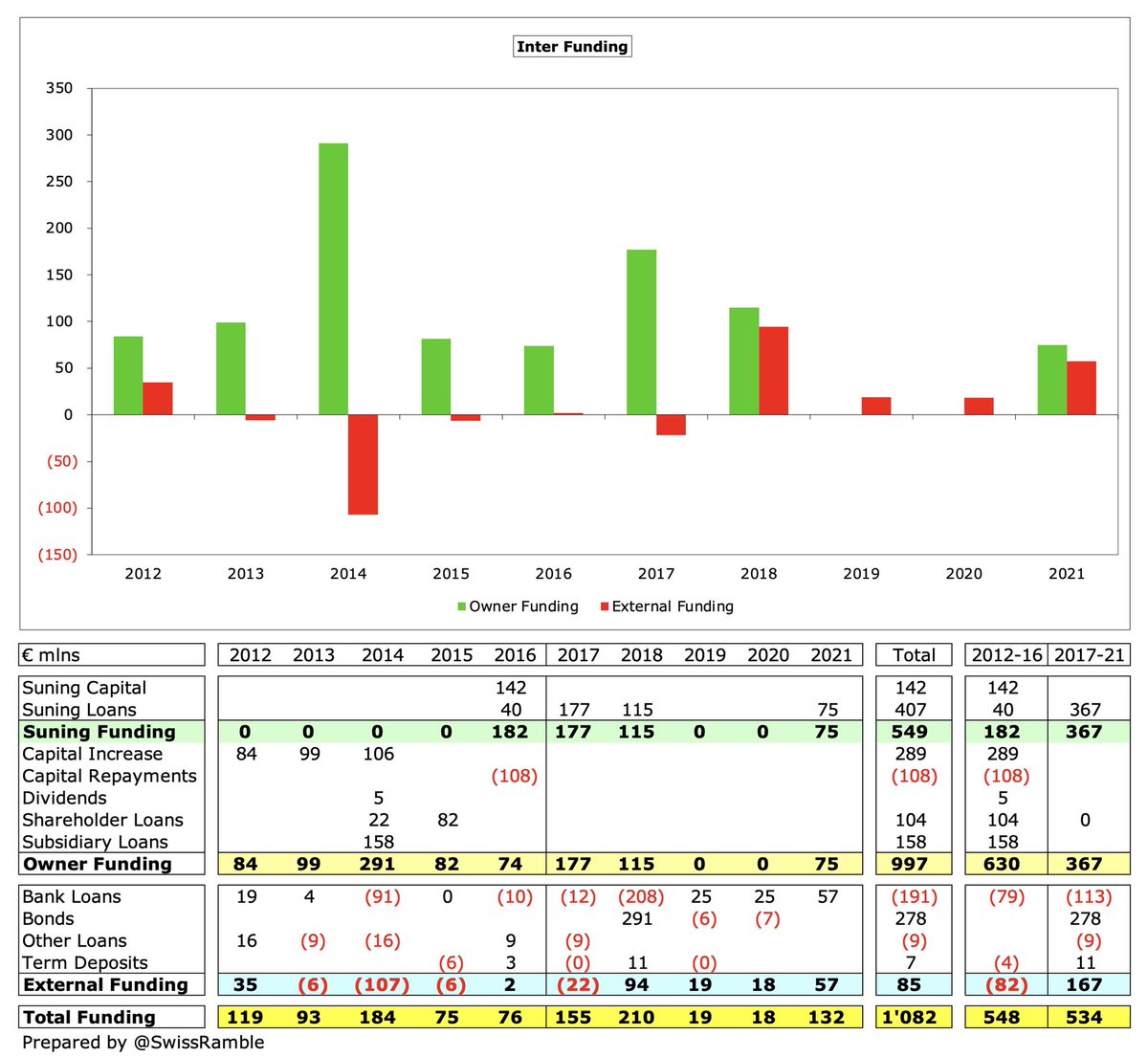

Suning provided #Inter with €75m loan in 2020/21, taking their total funding to €549m. The club has required €1.1 bln financing in the last decade, almost entirely from various owners, though increasingly the trend is to tap into external markets.

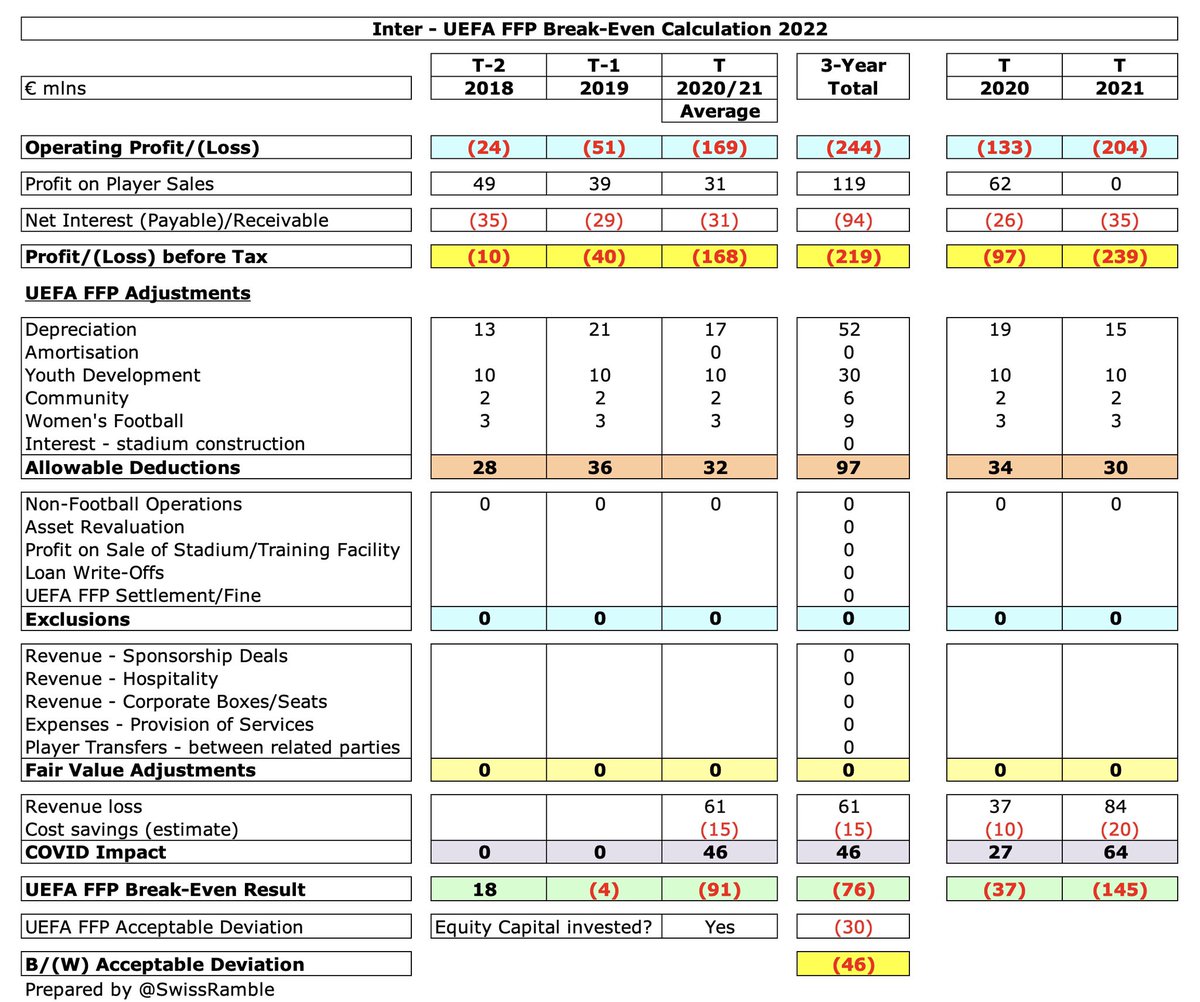

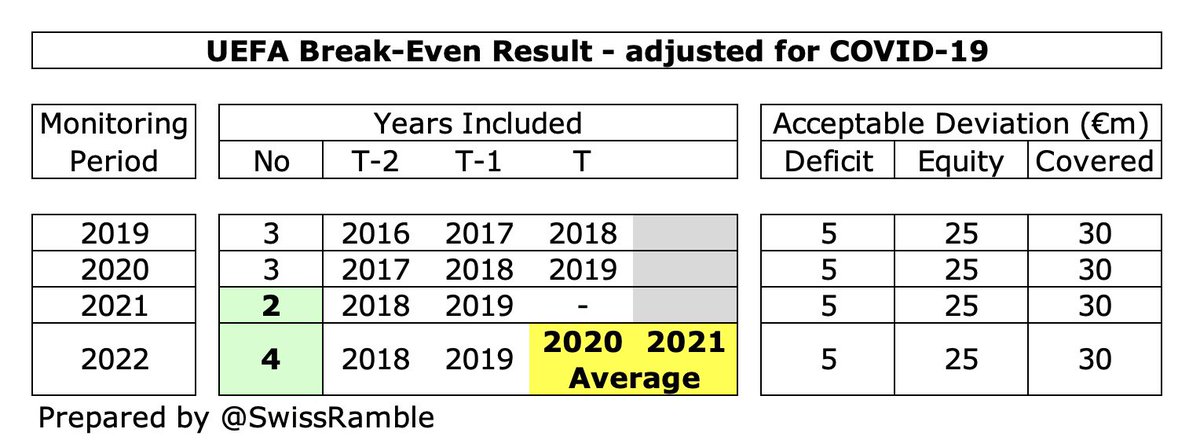

#Inter failed UEFA Financial Fair Play regulations in 2015. Despite a relaxation of FFP rules (adjusting for COVID losses and combining 2020 and 2021 seasons), club said it “is not yet in a position to formulate expectations regarding the assessment” due to their large losses.

#Inter increased their equity via a €212m revaluation (the Inter brand €163m and the historical library €48m), though this did not impact the profit and loss account. The club noted that the brand was revalued by independent experts.

While #Inter have had more success on the pitch, their finances have clearly come under pressure. Significant operational losses have required substantial funding by their owners, but Suning are reported to be struggling with their own financial issues.

#Inter sporting director Beppe Marotta warned, “Serie A is at risk of insolvency. It is a system at the edge of the abyss.” For the Nerazzurri, he added, “We have set ourselves the goal of combining a cost reduction policy together with maintaining sporting competitiveness.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh