Brentford’s 2020/21 financial results covered a “momentous” season when they were promoted to the Premier League following victory in the Championship play-off final and also reached the Carabao Cup semi-final. Some thoughts in the following thread #BrentfordFC

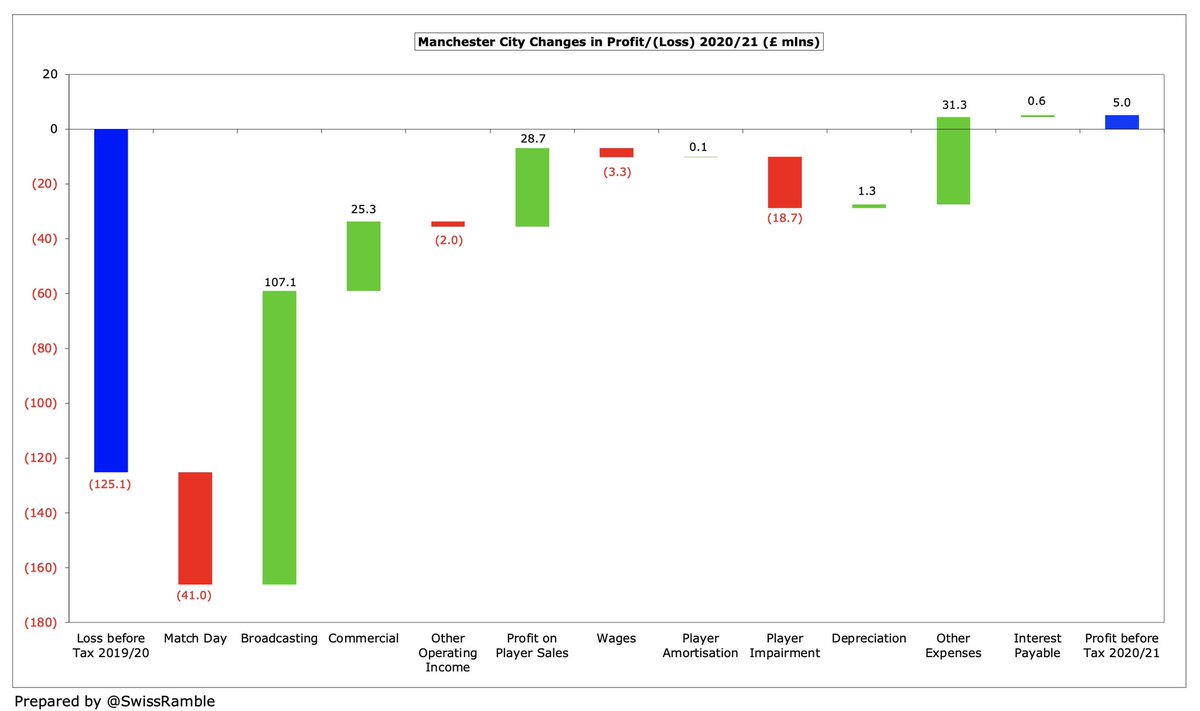

#BrentfordFC pre-tax loss slightly improved from £9.1m to £8.5m (£2.4m after tax), as profit from player sales rose £19m to £44m and revenue grew £1.4m (10%) from £13.9m to a club record £15.3m. Largely offset by operating expenses, up £22m (46%), including £12m promotion bonus.

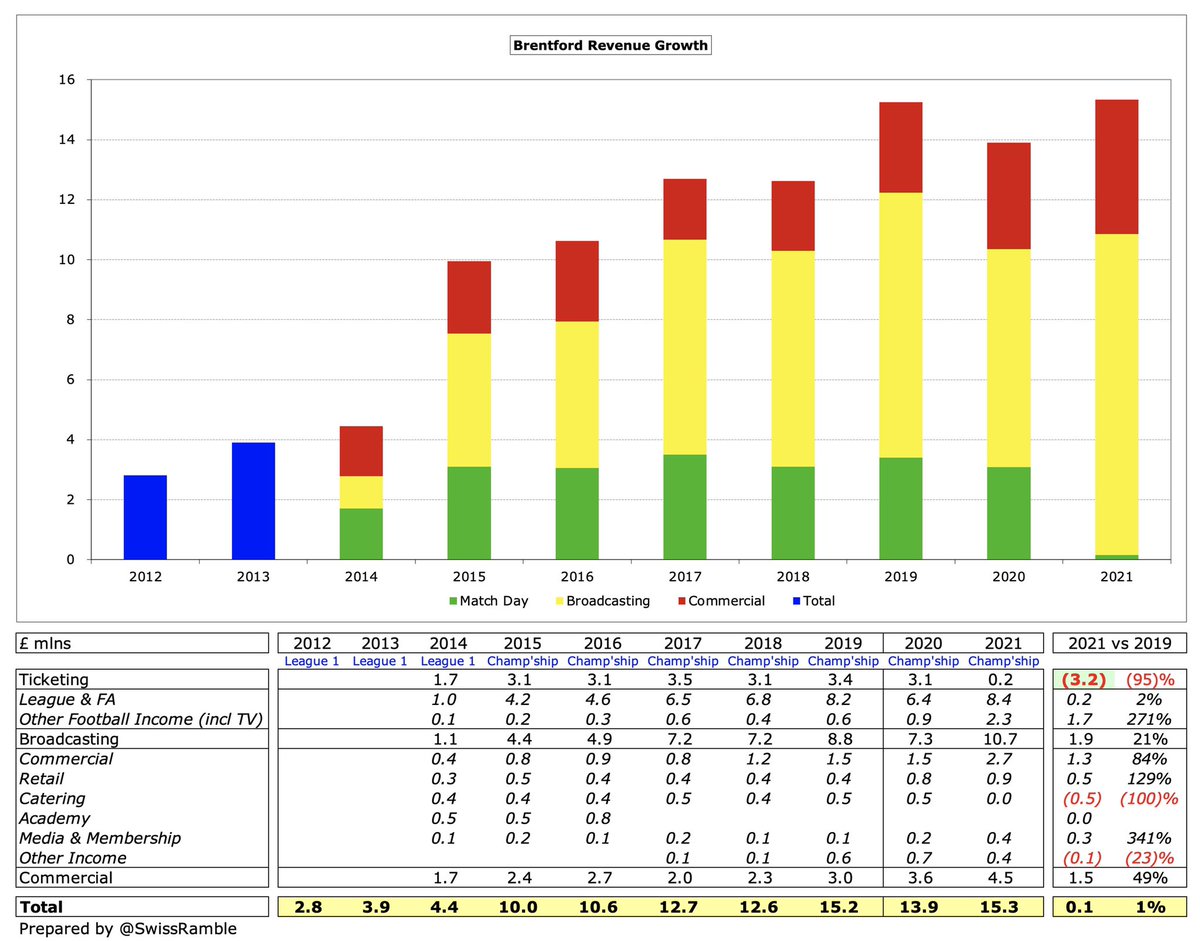

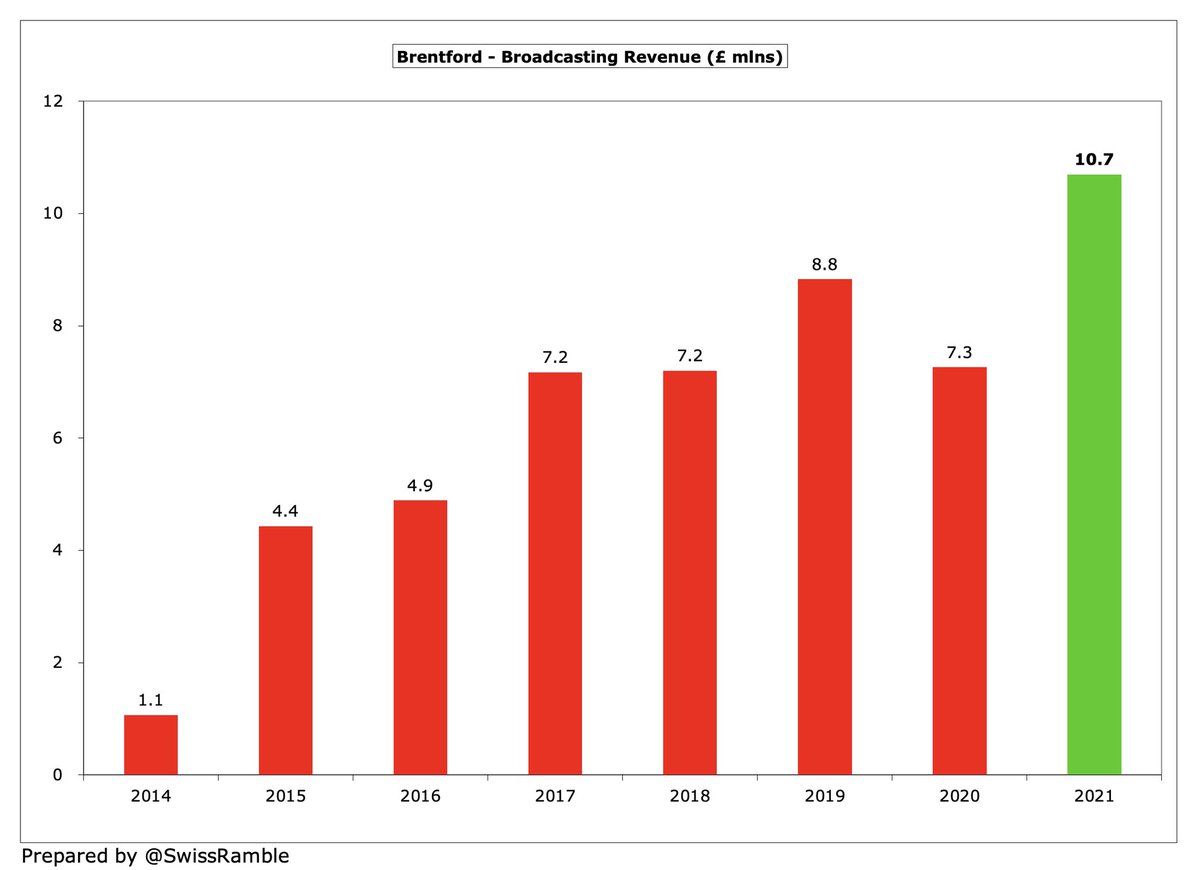

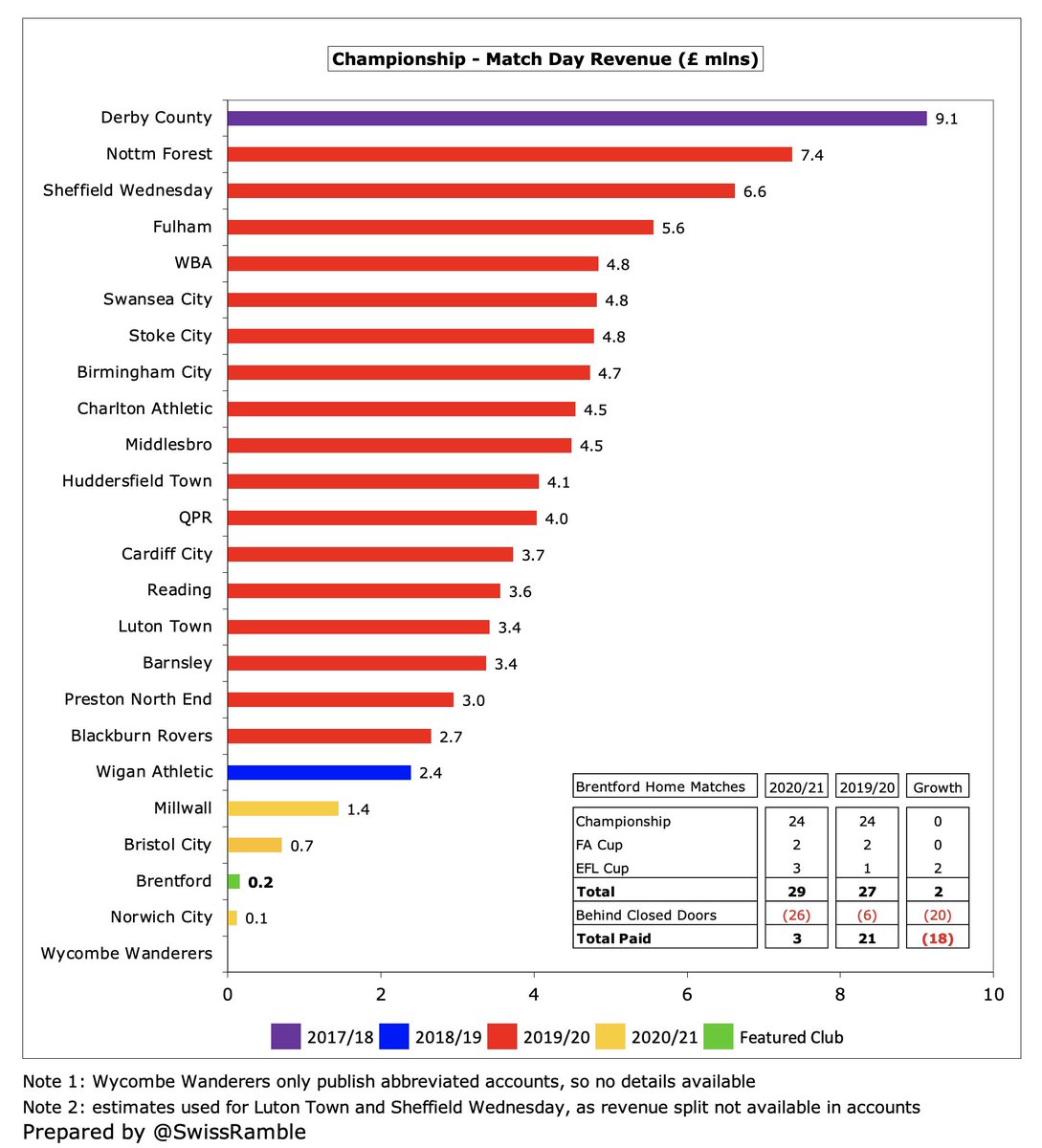

#BrentfordFC revenue increase was driven by broadcasting, up £3.4m (47%) from £7.3m to £10.7m, partly due to deferred TV money from 2019/20, with commercial also up £0.9m (26%) to £4.5m, which offset COVID driven reduction in match day, down £2.9m (95%) to just £155k.

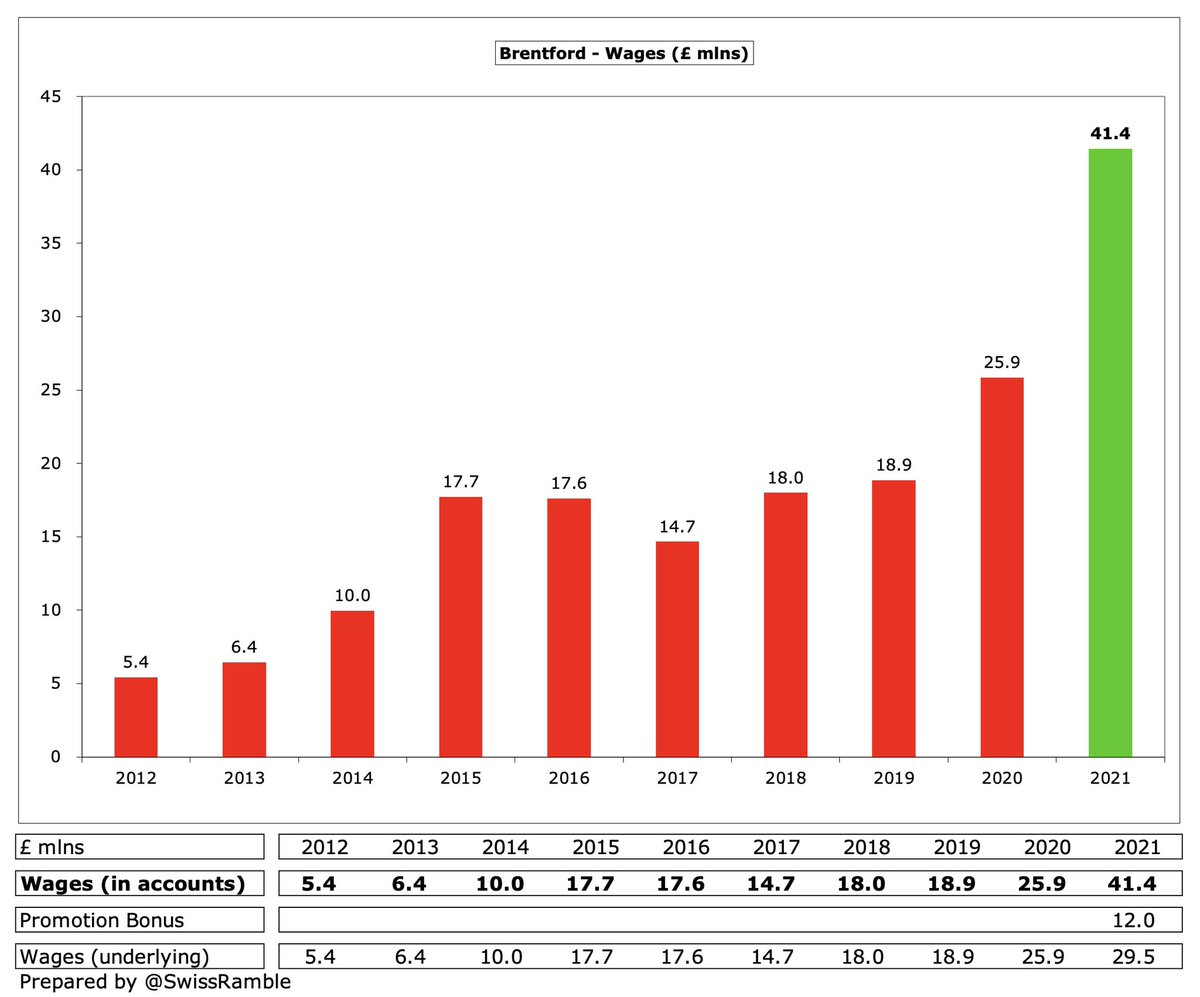

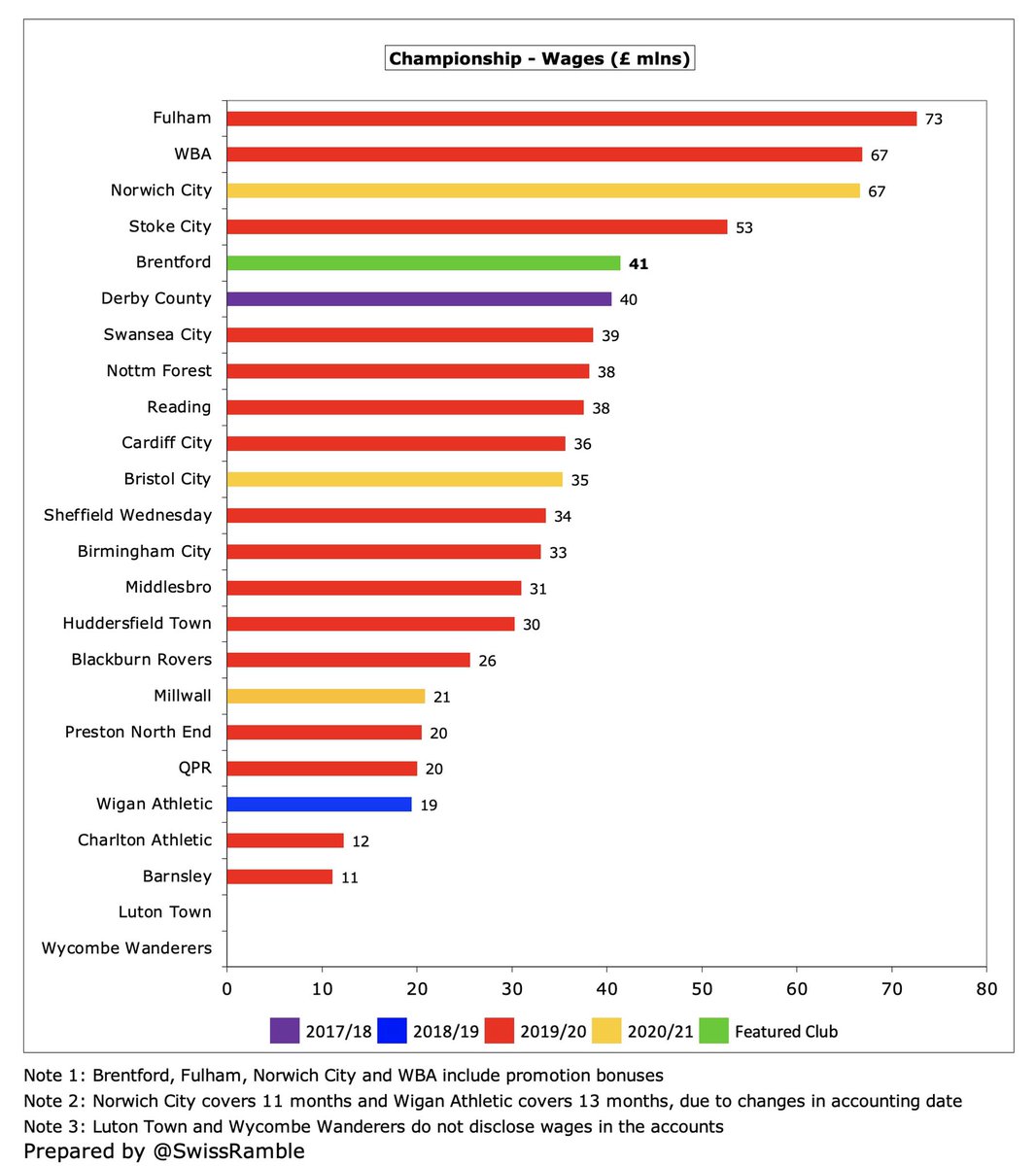

#BrentfordFC wage bill rose £15m (60%) from £26m to £41m, including £12m promotion bonus, while player amortisation increased £1.9m (16%) to £13.3m and other expenses grew £2.6m (23%) to £13.7m. Depreciation up £2.3m to £2.8m, due to new stadium. Other income grew £1.8m to £2.9m.

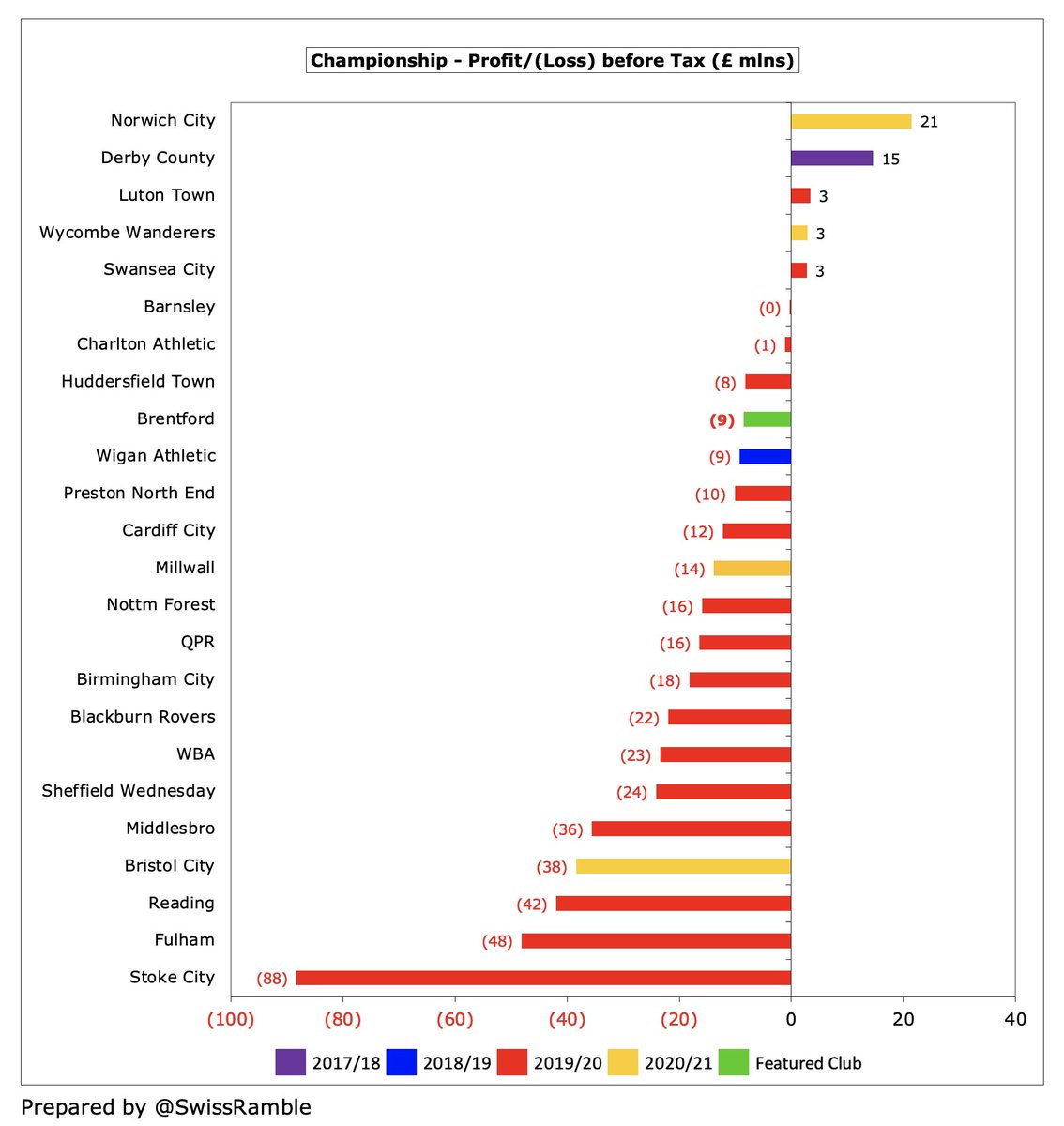

#BrentfordFC £8.5m loss is actually one of the better results in the Championship. Even before the full effects of the pandemic were felt in the 20/21season, many clubs lost more than £20m. In fact, the Bees would have posted a £3.5m profit without the £12m promotion bonus.

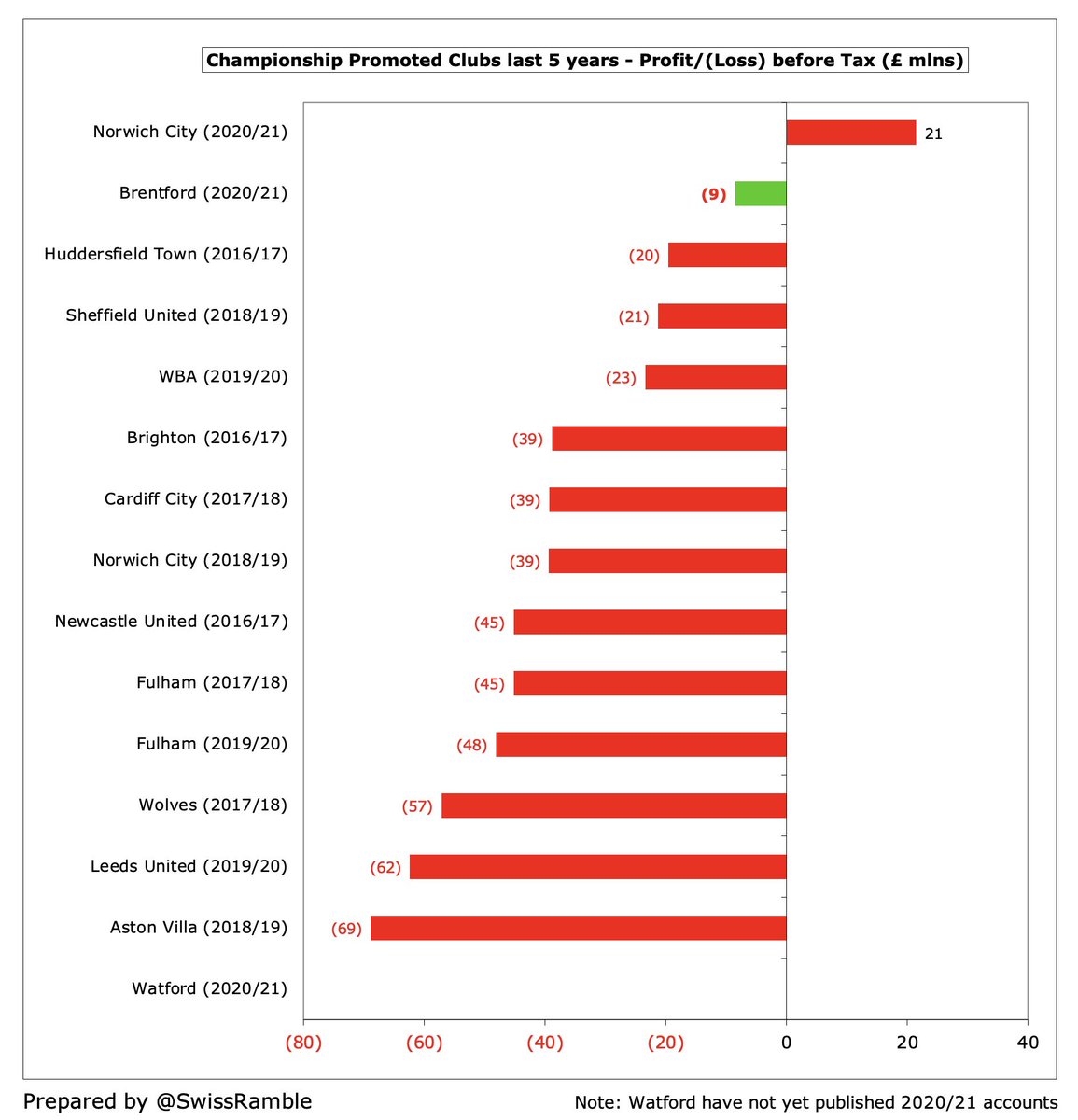

Most clubs promoted from the Championship have massive losses, as they really “go for it” in pursuit of the Premier League’s promised land, but #BrentfordFC £8.5m loss is one of the smallest, e.g. in the last 5 years 9 clubs lost between £39m and £69m as the price of success.

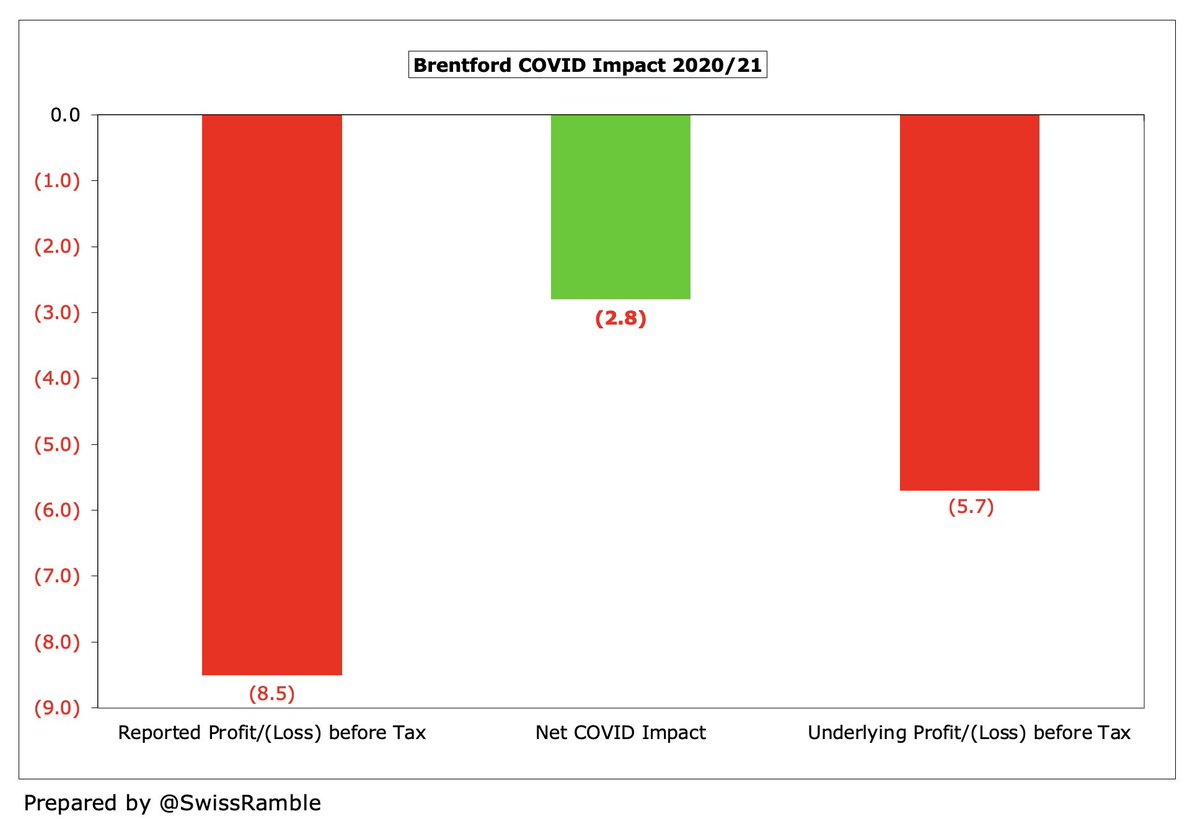

Furthermore, #BrentfordFC also faced “significant challenges” as a result of COVID with the negative financial impact being £2.8m in 2020/21 (prior year £1.0m), due to lost match day revenue with games played without fans, offset by lower operational costs and grant income.

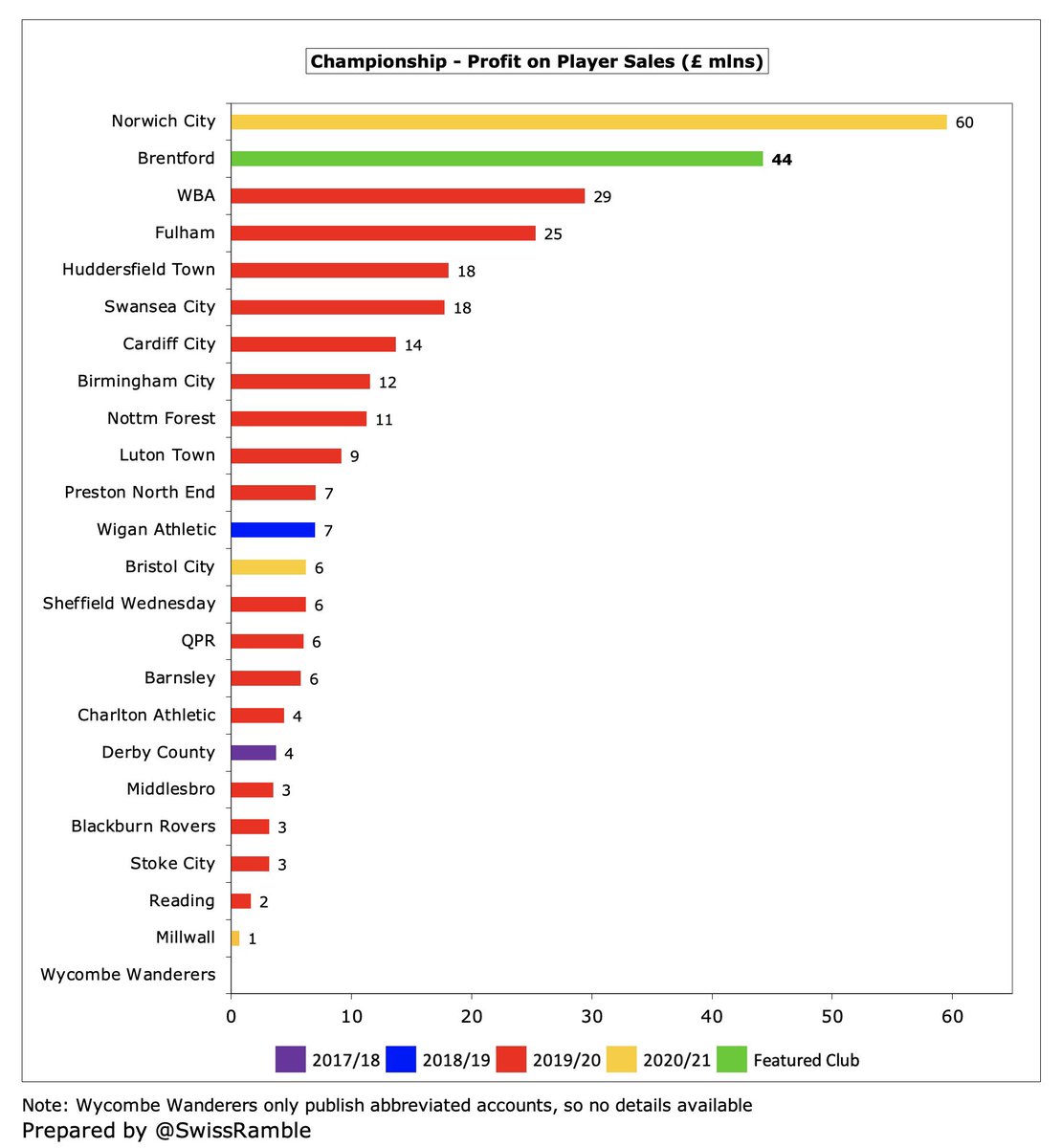

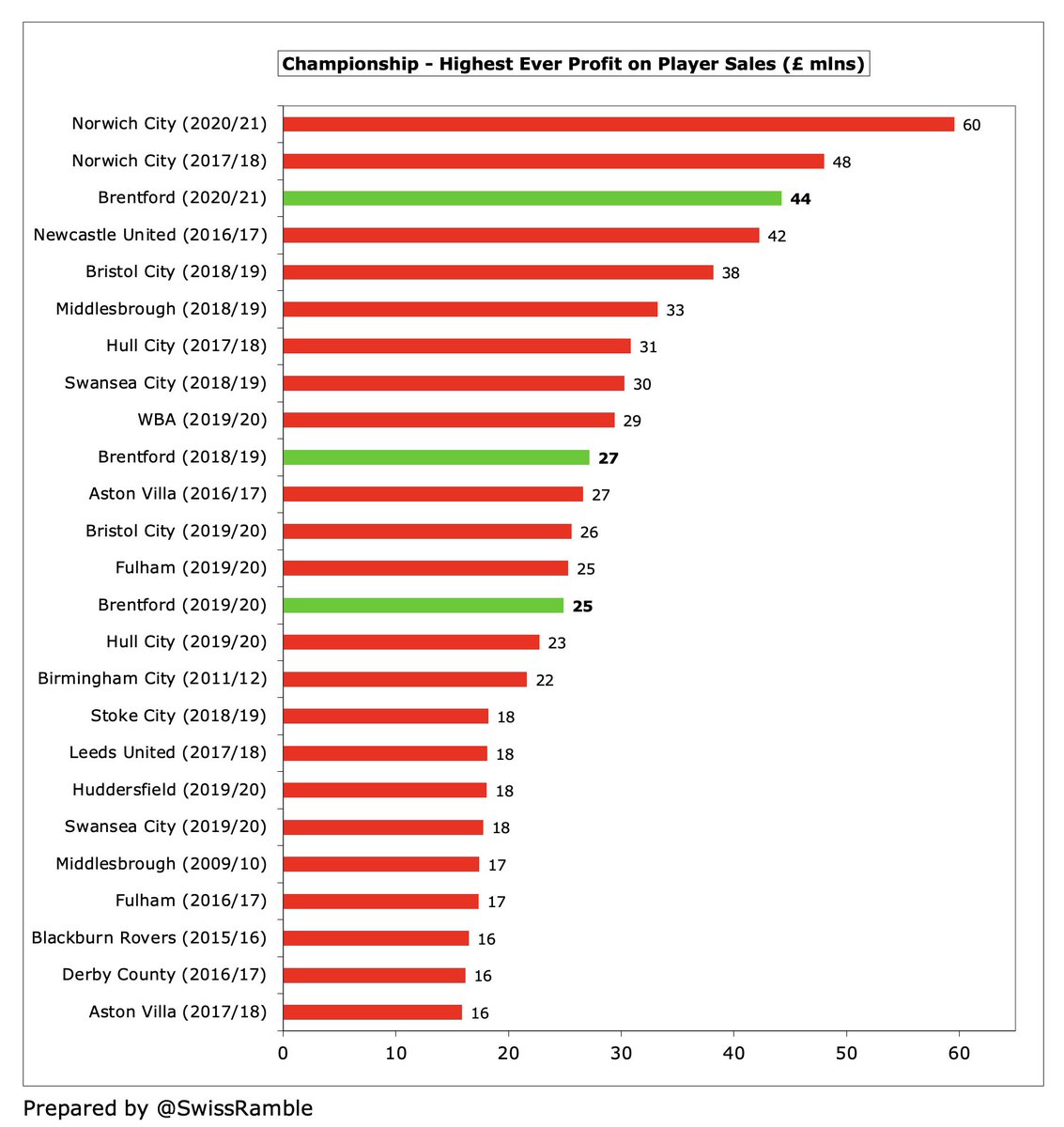

#BrentfordFC financials boosted by £44m profit on player sales, mainly Ollie Watkins to #AVFC and Said Benrahma to #WHUFC, £19m higher than prior year’s £25m. Second highest in the Championship to date, only behind #NCFC £60m. Almost three times as much as club’s £15m revenue.

#BrentfordFC have only made an overall profit once in the last 10 years: £24m in 2019, boosted by £14m from the land sale. However, they have managed to keep the magnitude of their losses relatively small, which is no mean feat, given their low turnover.

#BrentfordFC chairman Cliff Crown noted that “the club has been heavily reliant on successful player trading”, as evidenced by an impressive £139m profit from player sales in the last 6 seasons (including £96m in the last 3 years alone).

According to Transfermarkt, #BrentfordFC have sold players costing £22m for an amazing £174m in the last 6 years, thereby adding £152m of value via good recruitment and development. In fact, 2020/21 saw the club’s record sales with Watkins and Benrahma.

#BrentfordFC have made 3 of the top 14 profits from player sales in the Championship, though 2021/22 is unlikely to include big money, as “the club has not needed to sell any players”, thanks to the financial benefits anticipated after promotion to the lucrative top flight.

To date, #BrentfordFC have needed good player trading profits to offset large operating losses, which have widened from £17m to £53m in the last 2 years. In fairness, almost every Championship club posts substantial operating losses with half of them being above £30m.

#BrentfordFC have managed to slightly increase their revenue by 1% in the last 2 years, despite the impact of the pandemic, which has reduced match day income by £3.2m (95%), as this has been offset by growth in broadcasting, up £1.9m (21%), and commercial, up £1.5m (49%).

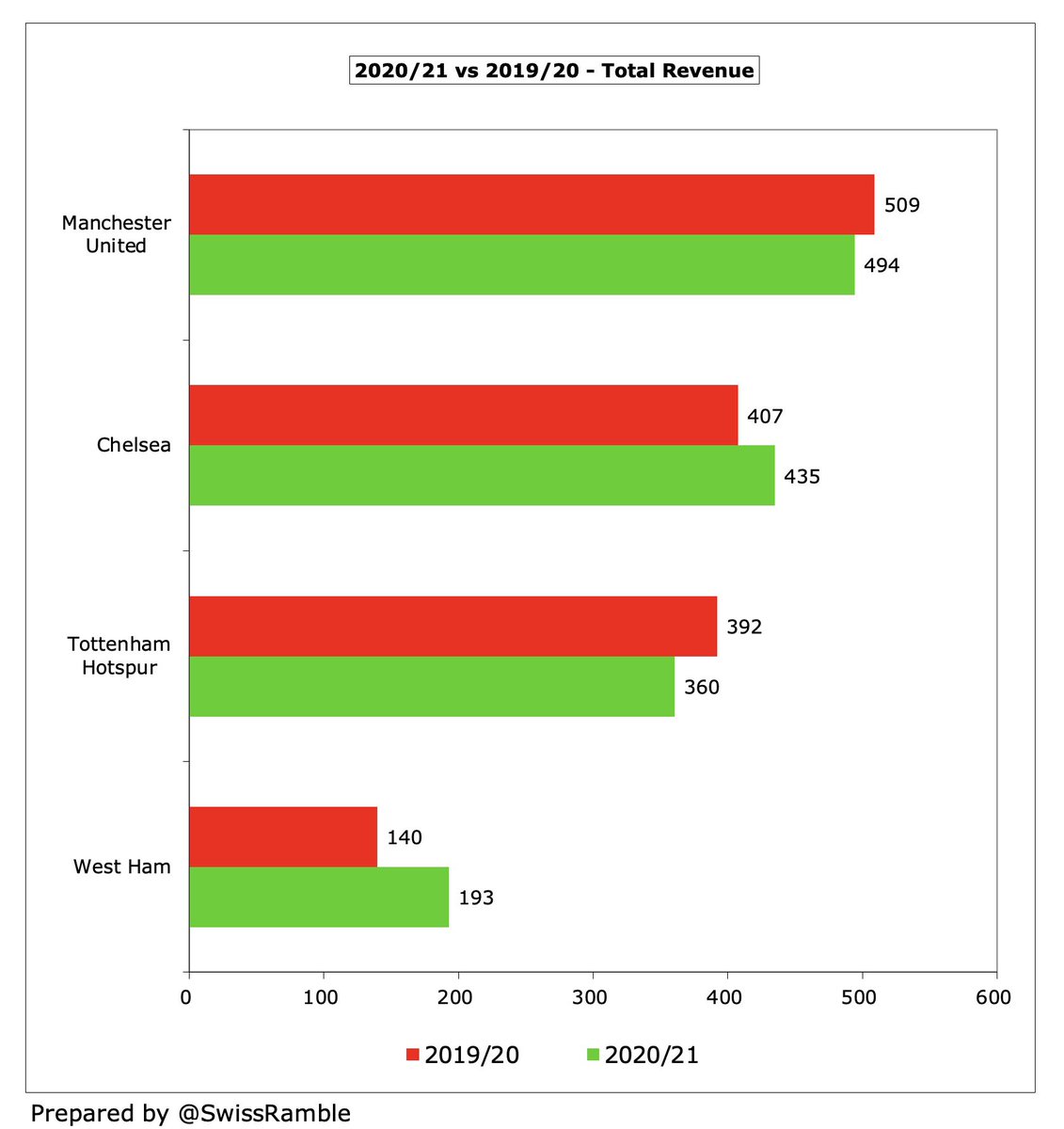

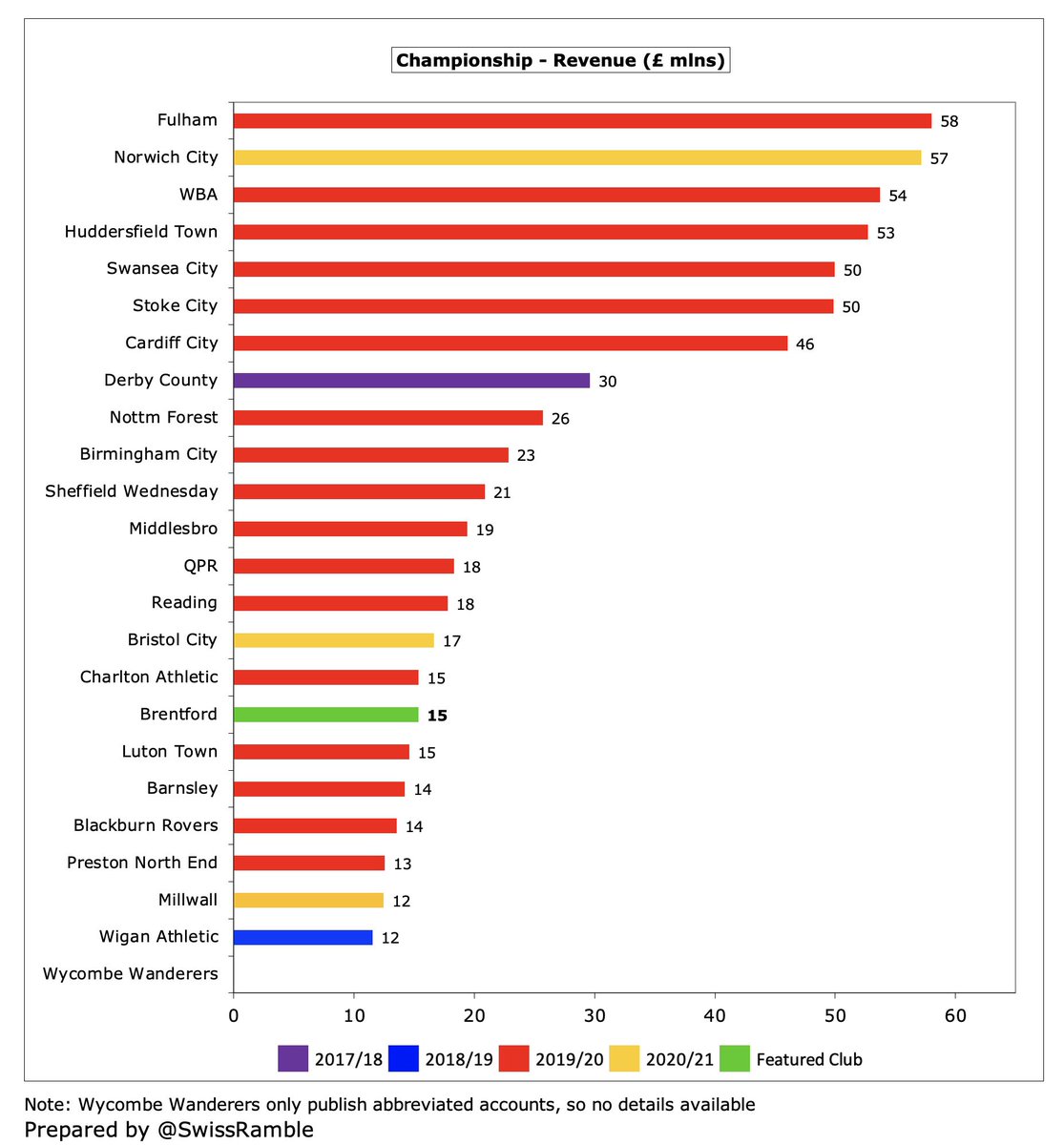

#BrentfordFC ability to punch above their weight is amply demonstrated by the fact that their £15m revenue was comfortably in the bottom half of the Championship, only around a quarter of clubs benefiting from parachute payments, e.g. #NCFC £57m in 2020/21.

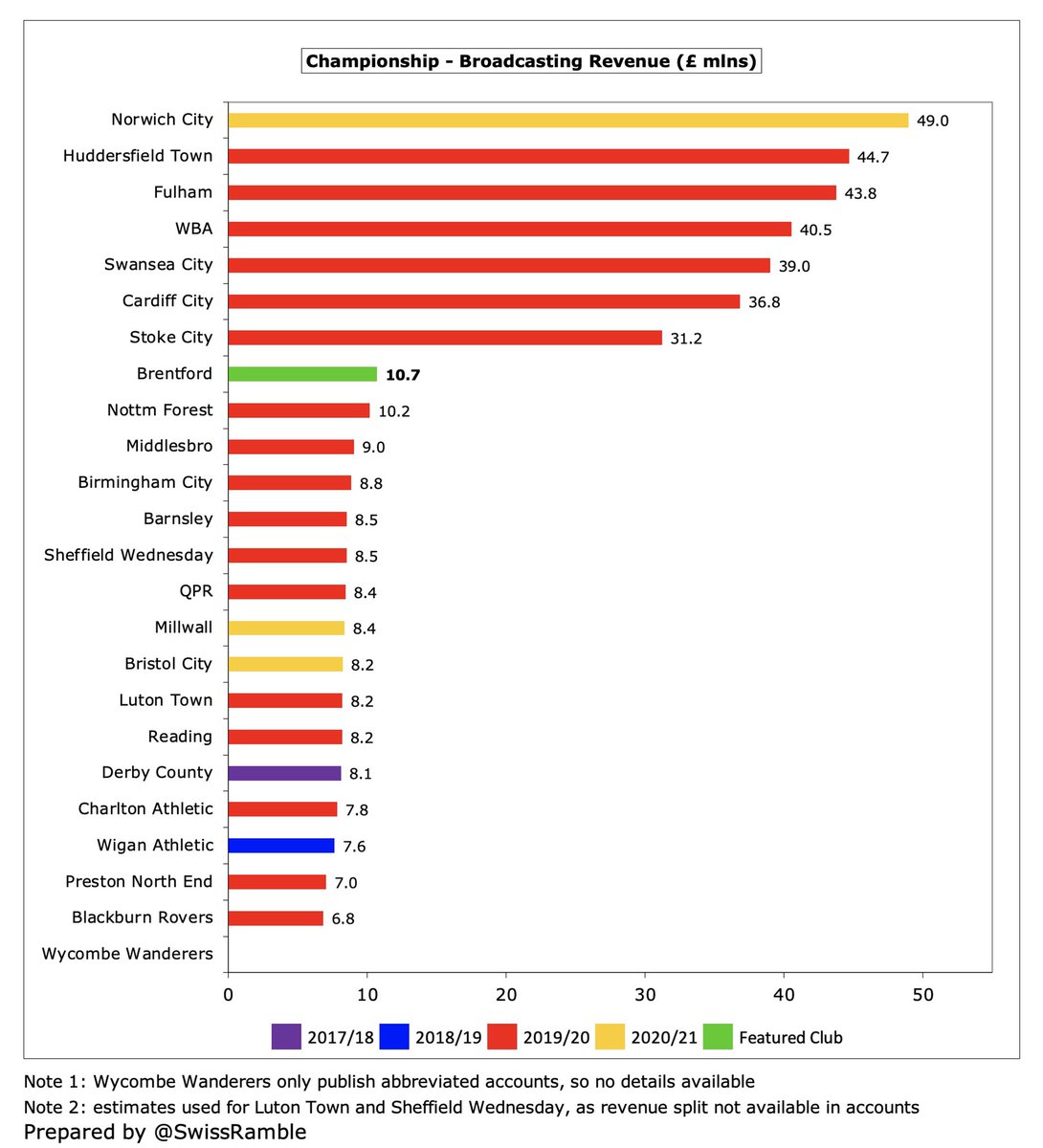

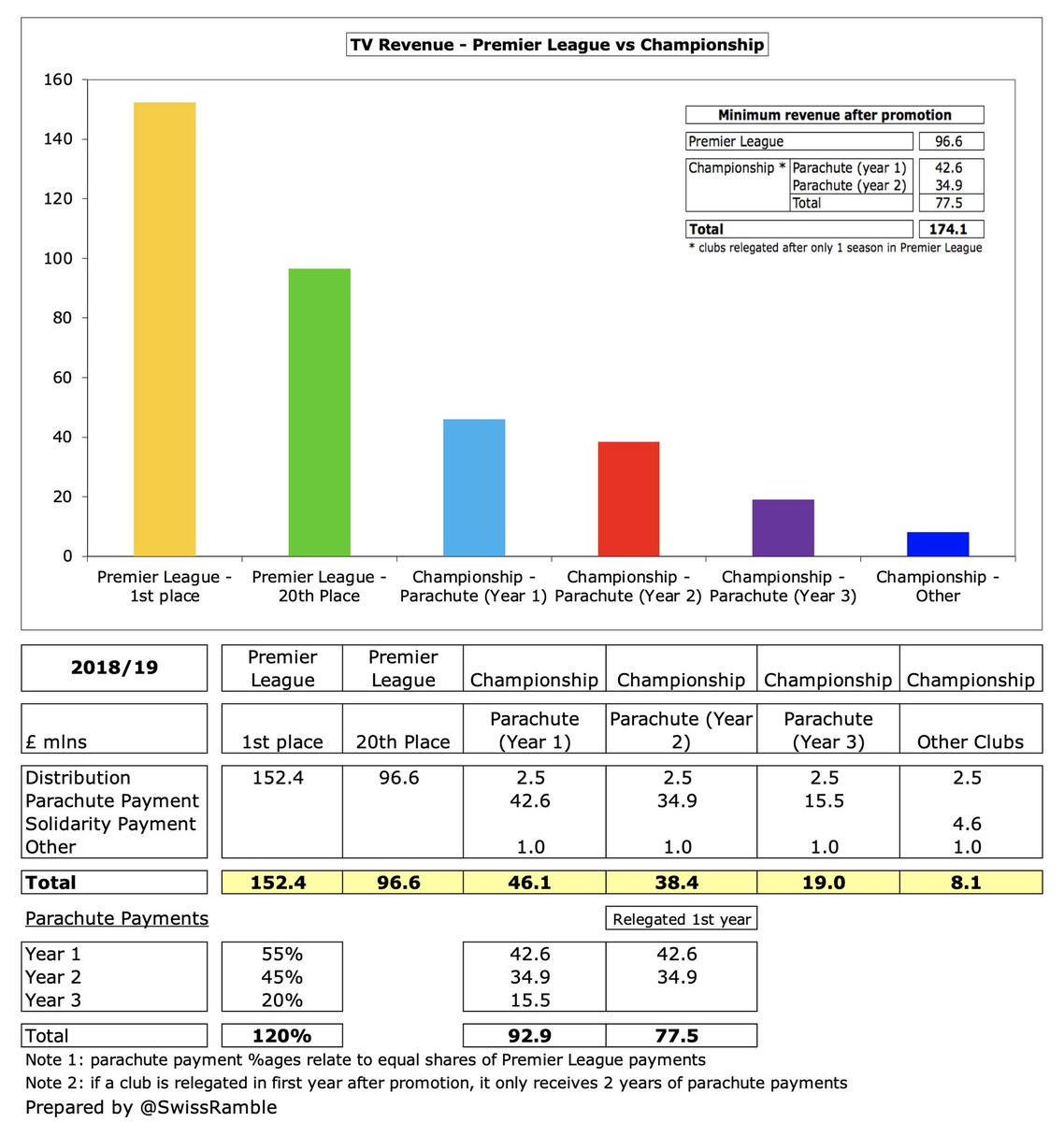

As #BrentfordFC chairman Cliff Crown said, “The final table bore testimony to the difficulty of competing with clubs relegated from the Premier League with recently relegated Norwich and Watford booking the top two spots.” In 2019/20 a relegated club received £42m in year one.

To emphasise #BrentfordFC outperformance, their £15m revenue in 2020/21 is the lowest for any Championship club that secured promotion in the last 5 years. Six of those promoted clubs enjoyed revenue over £50m, while three more were above £30m (i.e. twice as much as the Bees).

#BrentfordFC broadcasting income rose £3.4m (47%) from £7.3m to £10.7m, as revenue for games played after 30th June 2019/20 accounting close was deferred, plus more live games. Most Championship clubs earn £7-9m, but there is a massive gap to clubs with parachute payments.

Crown stated, “Promotion to the Premier League completely transforms the financial outlook for the club.” TV money for #BrentfordFC current 14th place was worth £108m in 2018/19 (new deal is even higher). If they stay up, they would get 3 years parachutes (£93m) after relegation.

#BrentfordFC match day income fell £2.9m (95%) to just £155k, as all home games were played behind closed doors (except three with severely restricted capacity). Forecast for the current Premier League season with the new stadium is around £10m.

#BrentfordFC average attendance was up to 11,696 (for games played with fans) in their last season at Griffin Park in 2019/20, but is around 17,000 at the new (higher capacity) Community Stadium which opened in September 2020. Over 11,000 premium and season tickets sold.

#BrentfordFC commercial income rose £0.9m (26%) to £4.5m, as partners stood by the club during the pandemic. New club record, but still on the low side (bottom half of Championship). However, the new stadium will help, so this should further rise to around £10m in the top flight.

#BrentfordFC had a new shirt sponsor in 2020/20 with Utilita, since replaced in 2021/22 by a 2-year deal with Hollywoodbets. They also have a new 2-year sleeve sponsor with SafetyCulture. The kit supplier deal with Umbro has been extended to the 2024/25 season.

#BrentfordFC other operating income increased from £1.0m to £2.9m, mainly player loans £1.7m, other income £0.6m, government coronavirus job retention scheme £0.4m and rents £0.1m. #HTAFC sizeable £6.3m n 2019/20 included £5.7m from player loans.

#BrentfordFC wage bill increased £15m (60%) from £26m to £41m, though that included a £12m promotion bonus. Even if that once-off payment is excluded, wages were up £4m (14%), which means that they have doubled in last 4 years.

Despite the increase, #BrentfordFC £41m wage bill was still a fair way below clubs that benefited from parachute payments, whose wages are generally around the £70m level. Without the £12m promotion bonus, the Bees would have been in the bottom half of the Championship.

The wages to turnover ratio worsened from 186% to 270%, the highest to date in the Championship. Even if £12m promotion bonus were excluded, this metric would have been 192%, though most Championship clubs are well above 100% and #BrentfordFC model relies more on player sales.

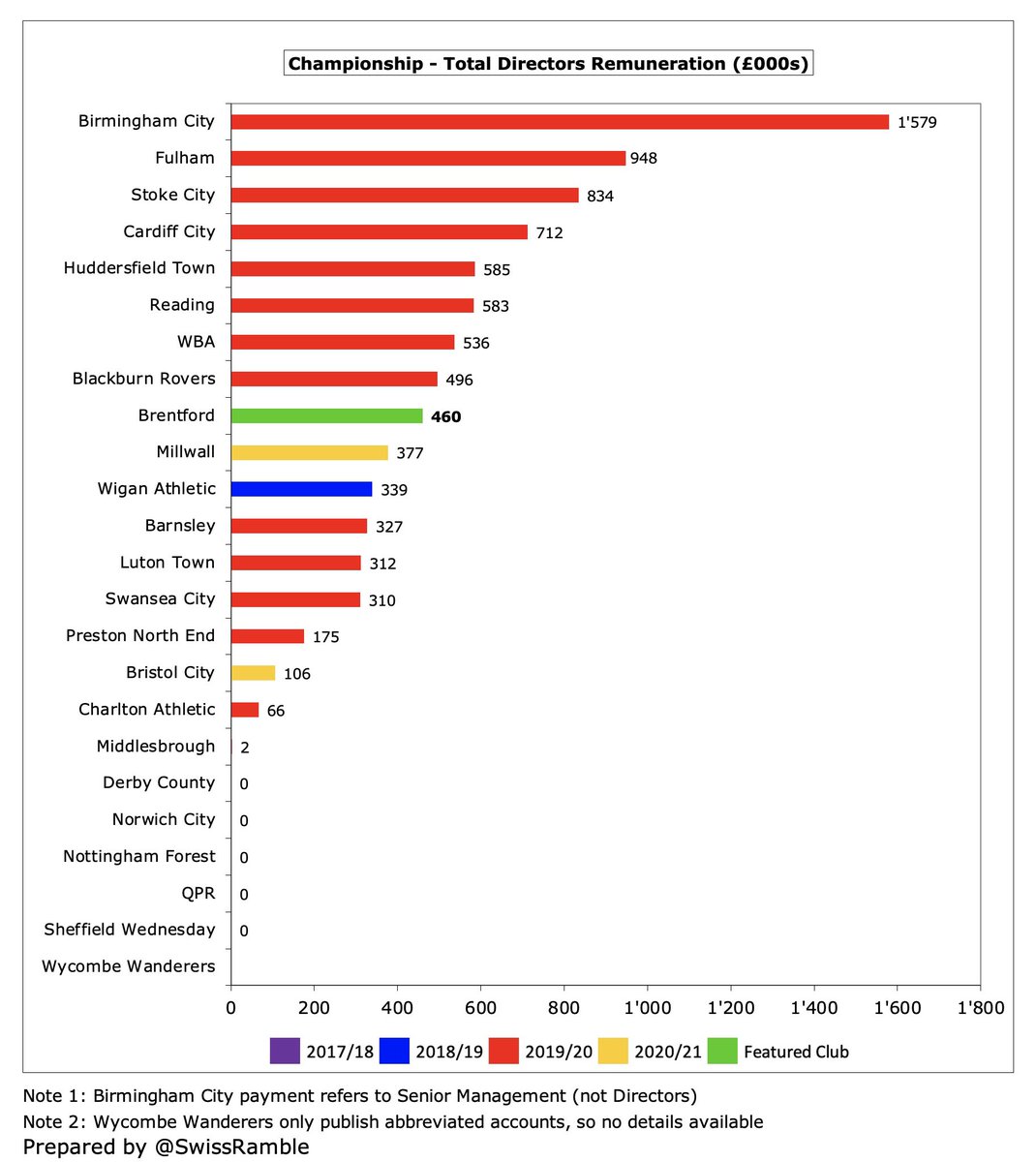

#BrentfordFC total directors remuneration rose 58% from £291k to £460k, though this was still a lot less than the likes of Birmingham City £1.6m, Fulham £948k, Stoke City £834k and Cardiff City £712k. Included payments to Smartodds, owner Matthew Benham’s company.

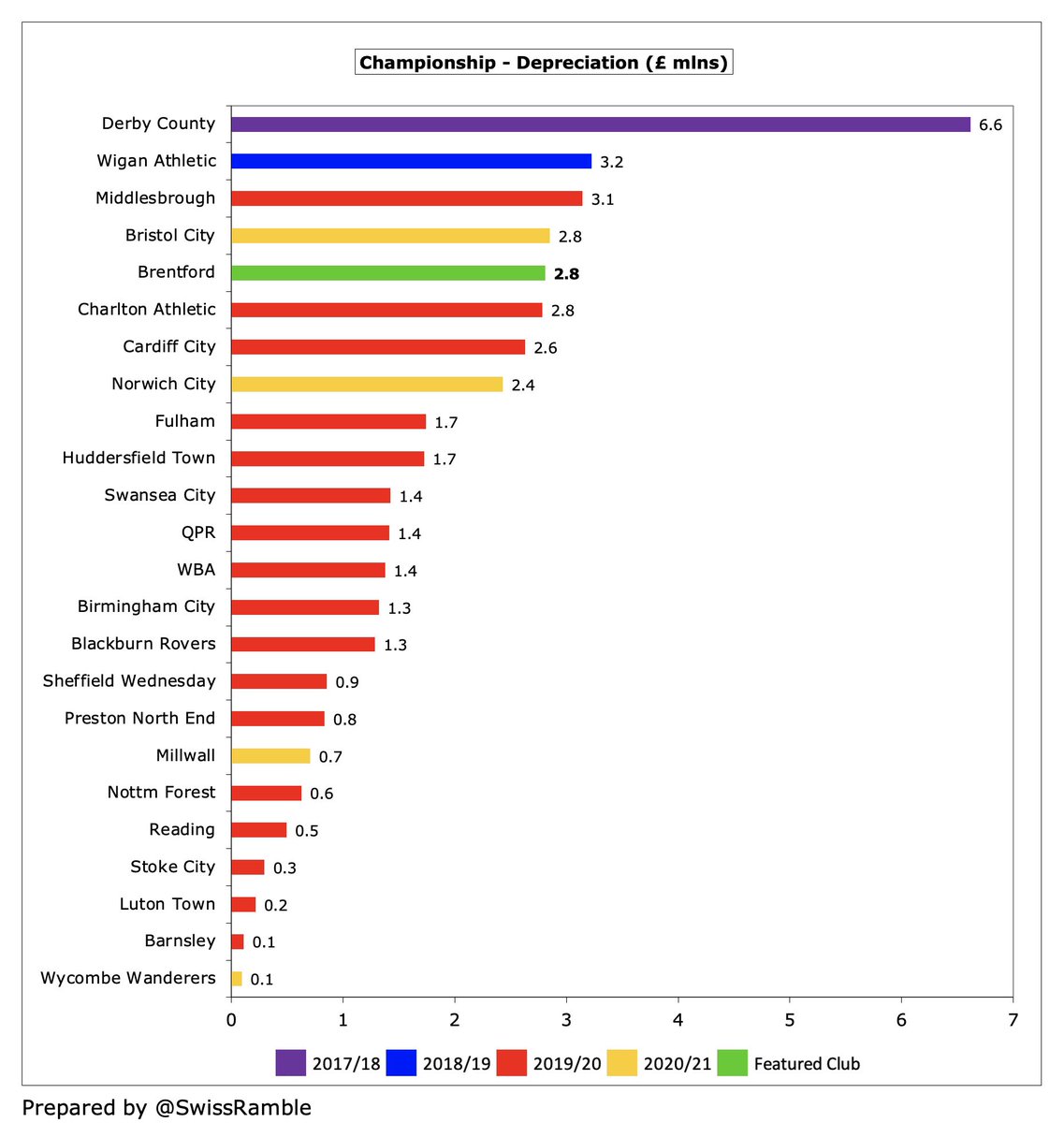

#BrentfordFC depreciation increased from £0.5m to £2.8m after the new stadium opened. This is not a huge amount (and is a non-cash expense), but it was quite high for the Championship, around the same level as Bristol City.

#BrentfordFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, rose £1.8m (16%) from £11.5m to £13.3m, so has doubled in just 2 years. Towards the upper end of the Championship, but miles below the really big spenders.

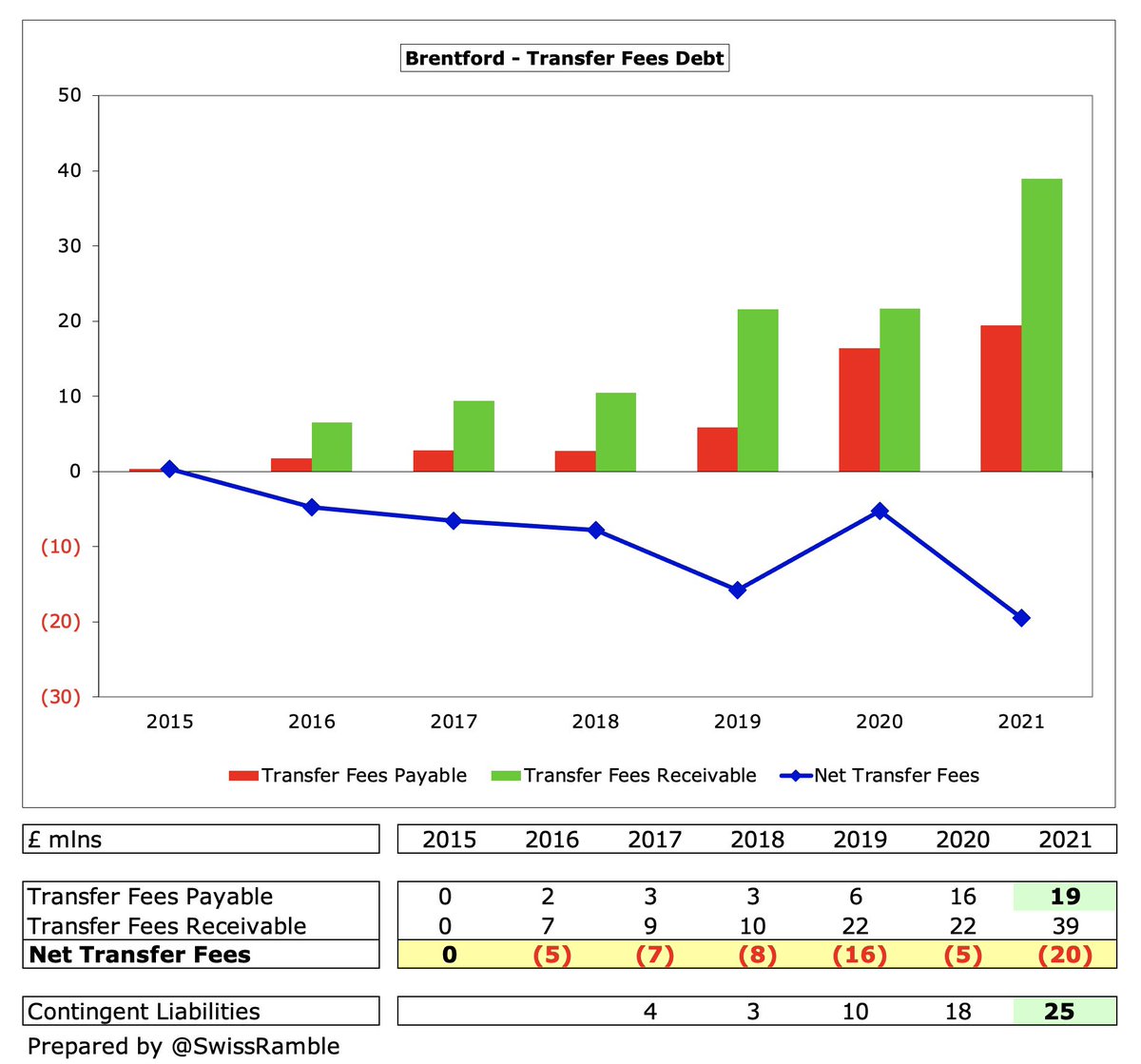

#BrentfordFC spent £22m on players in 2020/21, including Ivan Toney from #PUFC, Vitaly Janelt from Bochum, Mads Bistrup from RB Leipzig, Saman Ghoddos from Amiens and Charlie Goode from #NTFC. Around the same as another promoted club #NCFC.

For many years #BrentfordFC spent little on player recruitment, but have splashed out £53m in the last 2 seasons. However, £75m player sales meant £22m net sales. After promotion bought Kristoffer Ajer from Celtic, Frank Onyeka from Midtjylland and Yoane Wisser from Lorient.

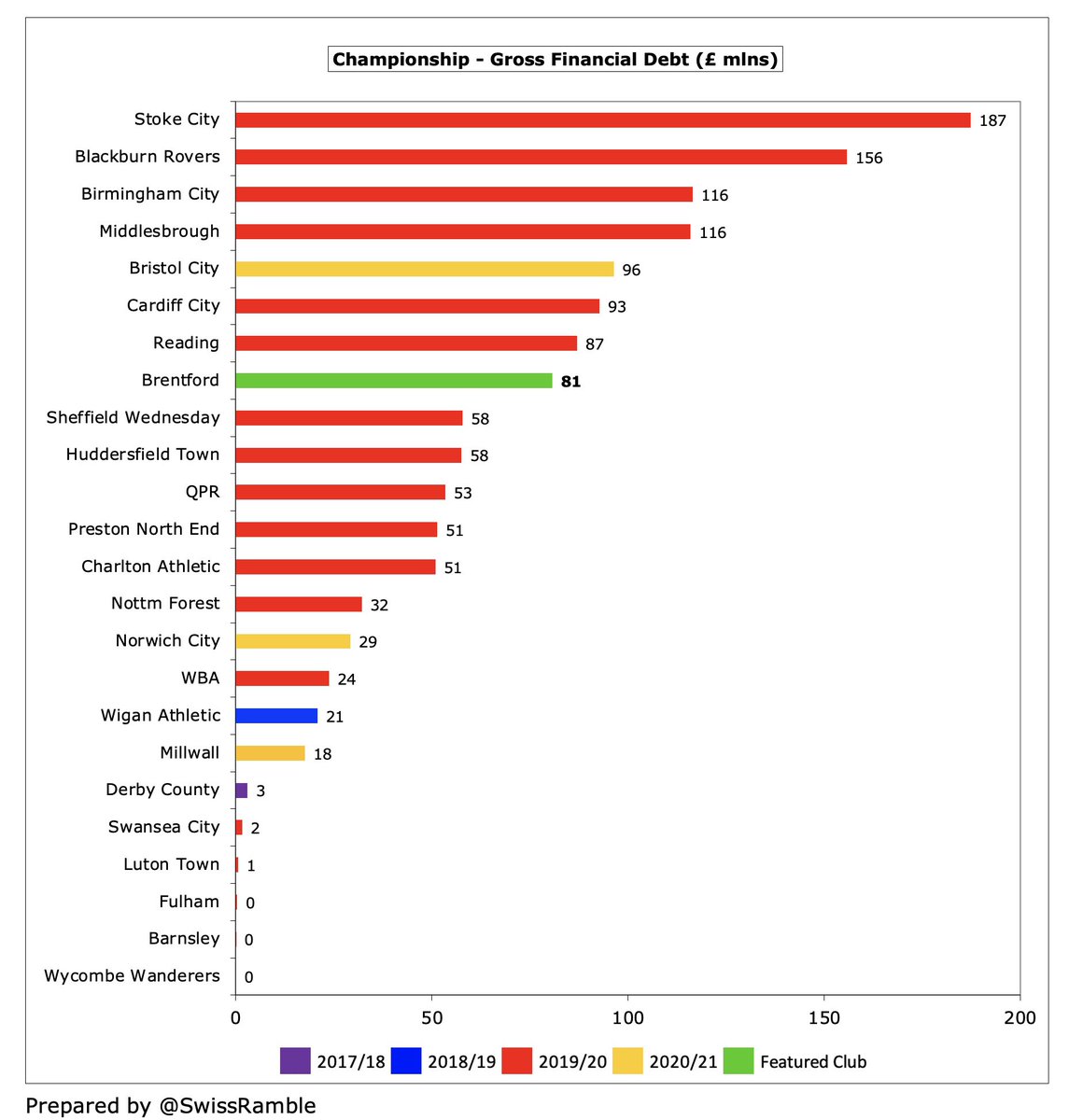

#BrentfordFC gross debt rose £7m from £74m to £81m, with £61m from owner Matthew Benham. Also had £8m EFL loan and £6m liabilities for cash advances on player sales (both repaid post year-end), £5m from FC Midtjylland (Benham’s other club) and £1m from Bees United.

#BrentfordFC £81m debt is quite large for a club of their size, though a long way below the likes of Stoke City £187m and Blackburn Rovers £156m. The club has also taken out a £20m overdraft facility with Barclays “to fund any monthly cash shortfalls in the 21/22 season”.

However, most of BrentfordFC debt is of the “soft” variety, having been provided interest-free by the owner. As a result, #BrentfordFC only had to pay £0.5m interest (excluding the unwinding of discount on player creditors).

#BrentfordFC outstanding payments on transfer fees increased from £16m to £19m. Quite high for the Championship, but the amount owed to the Bees by other clubs is £39m, so they have £20m net receivables. Also contingent liabilities (based on appearances and promotion) of £25m.

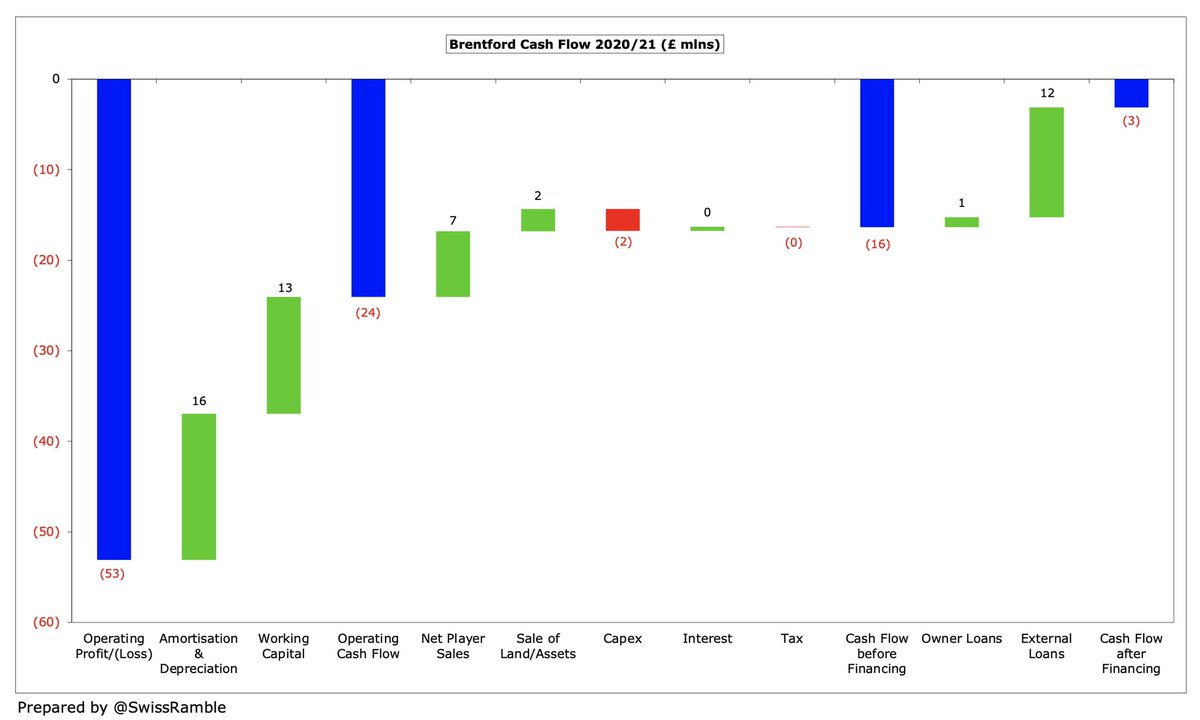

#BrentfordFC £53m operating loss improved to £24m negative cash flow by adding back £16m amortisation/depreciation and £13m working capital movements, then spent £2m on capex. Funded by £7m player trading (sales £38m, purchases £31m) and £13m loans (owner £1m, external £12m).

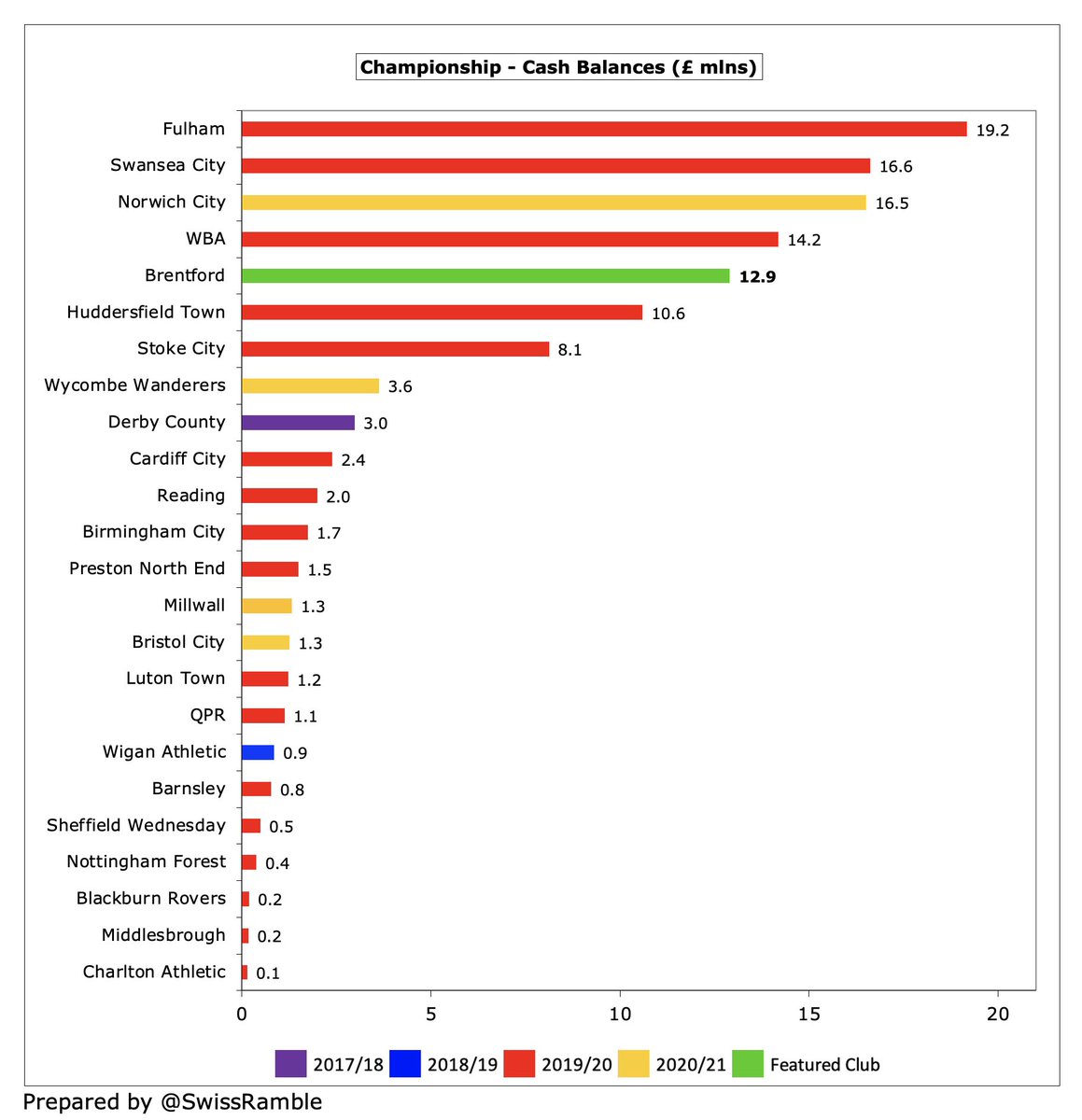

As a consequence, #BrentfordFC cash balance fell £3m to £13m. One of the highest in the Championship, though included £5m restricted cash (which can only be utilized for the settlement of Capital Court tribunal decision linked to the stadium development).

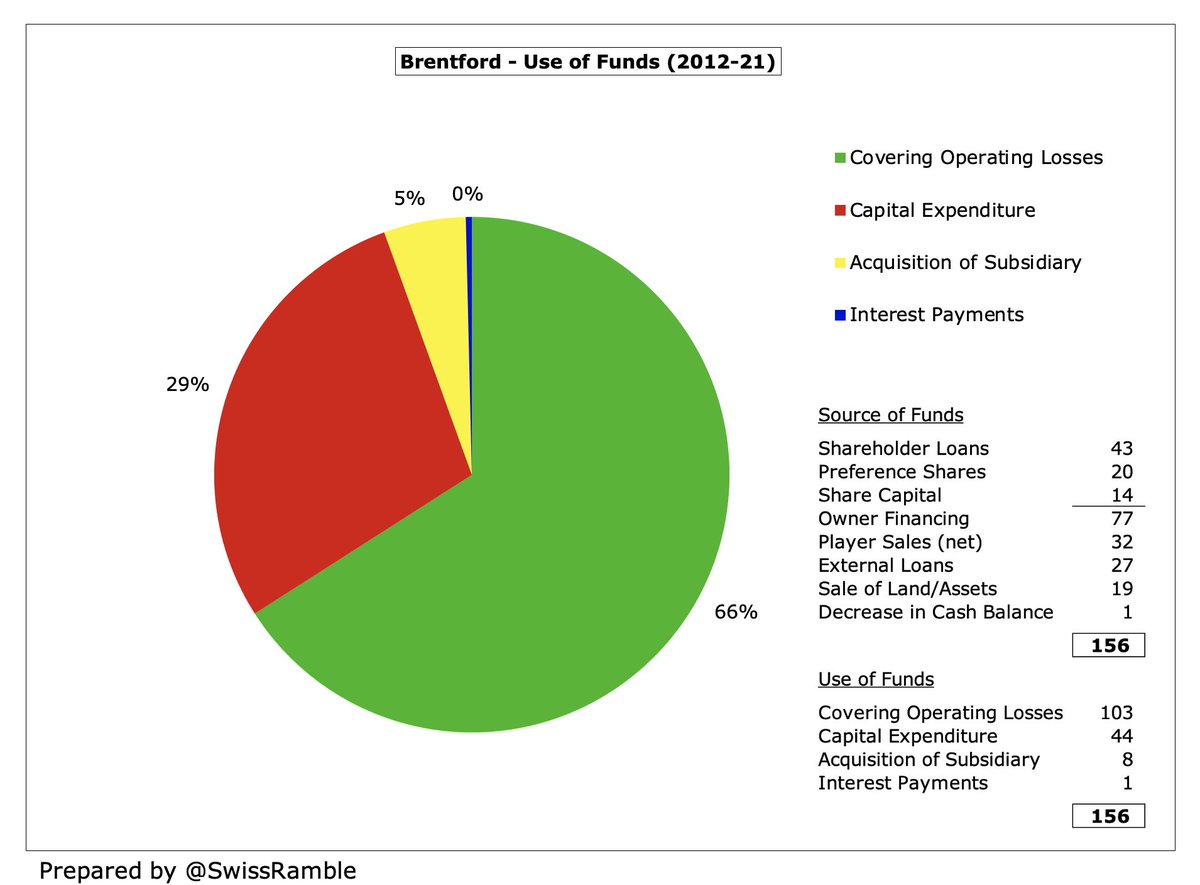

Since 2012 #BrentfordFC major source of funds has been money put in by Benham, boosted by player sales and the land disposal. Largely used to cover £103m operating losses with £44m spent on infrastructure investment (stadium & training ground) and £8m on acquiring a subsidiary.

Matthew Benham’s commitment to #BrentfordFC now stands at £104m, comprising £66m loans and £38m share capital. Includes £22m specifically in relation to new stadium. Little wonder that Crown thanked the owner for his “unwavering commitment to the club”.

Unfortunately, the poor finances in the Championship mean that many clubs rely on funding from their owners. In the 10 years up to 2020, Benham provided a chunky £80m to #BrentfordFC, but that was far below the likes of Fulham £315m, QPR £285m and Stoke City £185m.

#BrentfordFC had no problems with Financial Fair Play (FFP), as they were well within the FFP limit for the 3-year monitoring period, even before deducting allowable expense for academy, community, infrastructure, promotion bonus and COVID impact.

#BrentfordFC did extremely well to be promoted with their revenue among the lowest in the Championship, largely by operating a smart strategy based on player trading, though still required funding from their owner. The Premier League will bring “vastly increased revenue streams”.

• • •

Missing some Tweet in this thread? You can try to

force a refresh