🏦 The SEC & #Bitcoin

🔎 @kylewaters_ and @natemaddrey searched millions of SEC filings for crypto-related terms looking for trends in investment interest and adoption.

Read the full report: coinmetrics.substack.com/p/state-of-the…

Thread 👇

🔎 @kylewaters_ and @natemaddrey searched millions of SEC filings for crypto-related terms looking for trends in investment interest and adoption.

Read the full report: coinmetrics.substack.com/p/state-of-the…

Thread 👇

We mined filings in the SEC’s EDGAR database for crypto-related terms, searching for signs of institutional interest.

📜 The first mention of #Bitcoin in an SEC filing occurred in 2011.

📈 Bitcoin has since been mentioned in 11,510 filings by over 2,000 unique filing entities.

📜 The first mention of #Bitcoin in an SEC filing occurred in 2011.

📈 Bitcoin has since been mentioned in 11,510 filings by over 2,000 unique filing entities.

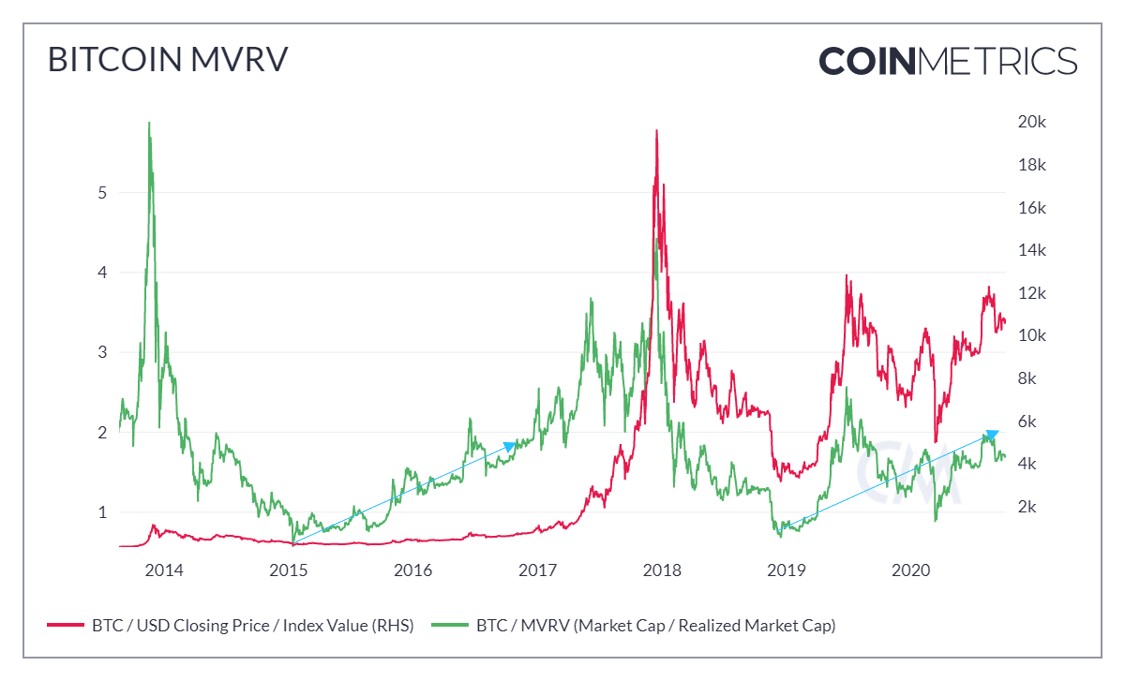

This chart shows the number of filings by month mentioning #Bitcoin plotted against $BTC's price.

The number of mentions closely tracks historical price cycles, noticeably accelerating while the price was rising in '17 and 20/21

The number of mentions closely tracks historical price cycles, noticeably accelerating while the price was rising in '17 and 20/21

Similarly, filings mentioning other crypto-related terms also increase when markets are up.

Check out the number of filings mentioning "ethereum" and “blockchain” by month below.

Both spiked significantly in 2018 and going into 2021.

⬇️

Check out the number of filings mentioning "ethereum" and “blockchain” by month below.

Both spiked significantly in 2018 and going into 2021.

⬇️

Another way to slice the data is by looking at # of unique entities that are filing, e.g. Bitcoin mining company Riot Blockchain (RIOT), asset-management companies like Grayscale, & companies such as Tesla (TSLA) or Microstrategy (MSTR) that hold BTC on their balance sheets.

Unique entities mentioning crypto terms have increased since 2020, reflecting a broader trend of crypto’s growing institutionalization and interest in #Bitcoin mining.

There are now over 40 publicly-traded Bitcoin mining companies on US and Canadian exchanges.

There are now over 40 publicly-traded Bitcoin mining companies on US and Canadian exchanges.

Going into 2021, the number of addresses holding high balances of BTC and ETH rose, aligning with anecdotal evidence that institutional interest was picking up then.

However, the trend seemingly broke during the second half of 2021 by this measure.

However, the trend seemingly broke during the second half of 2021 by this measure.

Fortunately, certain types of SEC filings can also be useful to measure institutional interest in crypto assets.

This chart shows 13F filings mentioning #Bitcoin which increased going into 2021 but dipped somewhat in Q2 and Q3 last year, aligning with the on-chain data.

This chart shows 13F filings mentioning #Bitcoin which increased going into 2021 but dipped somewhat in Q2 and Q3 last year, aligning with the on-chain data.

To date, a popular way institutions have gained exposure to BTC has been through trusts, such as Grayscale’s Bitcoin Trust (GBTC), the largest by net asset value (NAV) that currently holds around 643K BTC valued at ~$27B.

A similar trend from 2020 to 2021 is noticeable for #Ethereum, reflecting its growing interest with institutions.

However, there has yet to be any Ethereum ETF approved in the US, leaving trusts as the primary investment vehicle.

However, there has yet to be any Ethereum ETF approved in the US, leaving trusts as the primary investment vehicle.

The SEC filings can be a helpful way to measure crypto’s growing presence in the US economy.

While it will be useful to keep watching for new information in future filings, it’s worth noting that public blockchains can enable far more granular updates 😉

While it will be useful to keep watching for new information in future filings, it’s worth noting that public blockchains can enable far more granular updates 😉

Check out this week's State of the Network to dive further into @kylewaters_ and @natemaddrey's analysis of the SEC filings data plus a network update on $BTC and exchanges.

📰: coinmetrics.substack.com/p/state-of-the…

📰: coinmetrics.substack.com/p/state-of-the…

• • •

Missing some Tweet in this thread? You can try to

force a refresh