Today's data: inflation! 📈

Average consumer prices in January 2022 were 5.1% higher than a year earlier. Highest since 1991. Excluding energy, prices were 4% higher. www150.statcan.gc.ca/n1/daily-quoti… #cdnecon

Average consumer prices in January 2022 were 5.1% higher than a year earlier. Highest since 1991. Excluding energy, prices were 4% higher. www150.statcan.gc.ca/n1/daily-quoti… #cdnecon

What's behind the accelerating inflation rate? This visual might help. It decomposes the change in inflation due to several important components. Energy prices and household depreciation account for most of the change.

What's homeowners' replace cost (i.e., depreciation)? I explain here: thehub.ca/2022-01-25/mak…

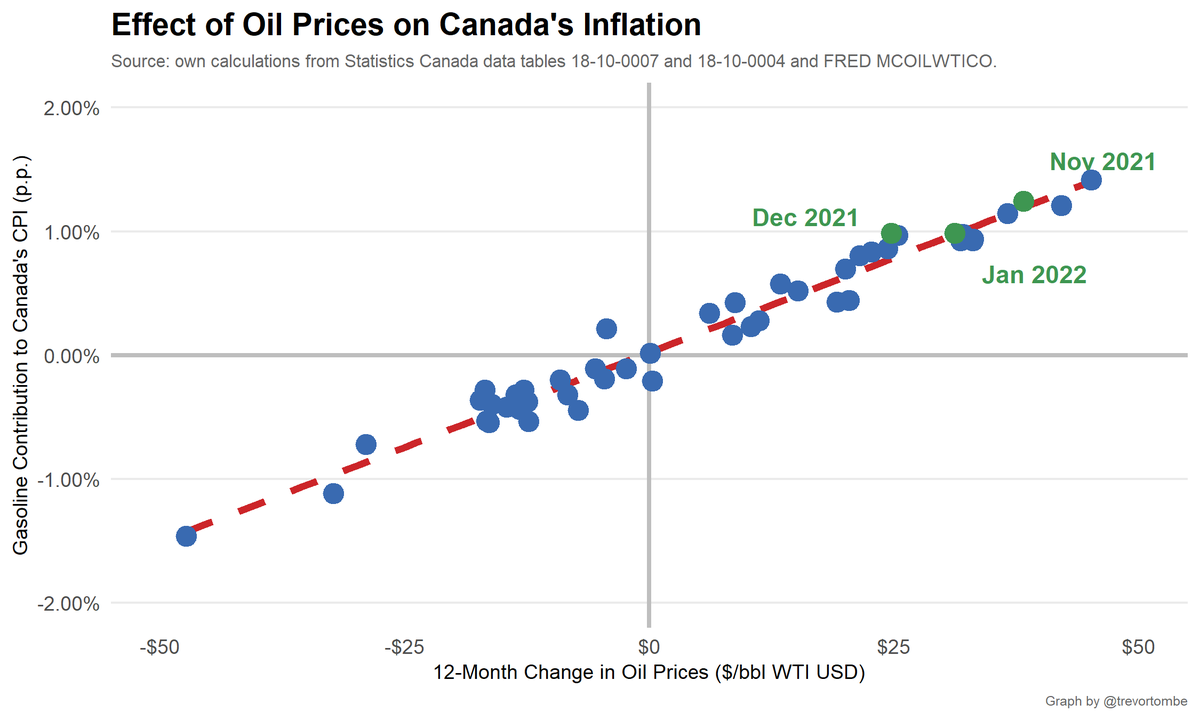

That piece also explains why energy is a large contributor to inflation. The strong link between global oil prices and the gasoline contribution to CPI remains the case in January. This is important context some politicos neglect.

• • •

Missing some Tweet in this thread? You can try to

force a refresh