How did I save from my spending??? 🧵

I used some FinTech apps and credit cards and saved good amounts from my spending

A small thread on the Top Apps I liked & Savings.

Feel free to RT 🙏🙏

NOTE - I use my credit cards as debit cards & pay instantly

#Finance #Shopping

I used some FinTech apps and credit cards and saved good amounts from my spending

A small thread on the Top Apps I liked & Savings.

Feel free to RT 🙏🙏

NOTE - I use my credit cards as debit cards & pay instantly

#Finance #Shopping

1 - CRED

Cred has been my companion for all the credit card payments for the past 4 years

Got around 1% cashback just by paying credit card bills

New users can sign up now below & get Rs.250 instant cashback on the first payment of min Rs.100

Sign up

app.cred.club/spQx/f5925dc3

Cred has been my companion for all the credit card payments for the past 4 years

Got around 1% cashback just by paying credit card bills

New users can sign up now below & get Rs.250 instant cashback on the first payment of min Rs.100

Sign up

app.cred.club/spQx/f5925dc3

2 - Amazon + ICICI Card

I have been using this with Amazon Prime account for all my purchases.

With 5% cashback + special offers on Amazon (FLAT 50 on 500 using UPI, etc.) the savings over last 2 years were amazing 👏

#Amazon

I have been using this with Amazon Prime account for all my purchases.

With 5% cashback + special offers on Amazon (FLAT 50 on 500 using UPI, etc.) the savings over last 2 years were amazing 👏

#Amazon

3 - Slice Card

Only 1 month since I started, the experience has been so far very rewarding.

Special offers & extra cashback on online shopping and points for insurance spends

Signup using below link to get 300 cashback

Code - GROOT328568

links.sliceit.com/invite?rc=GROO…

#saving

Only 1 month since I started, the experience has been so far very rewarding.

Special offers & extra cashback on online shopping and points for insurance spends

Signup using below link to get 300 cashback

Code - GROOT328568

links.sliceit.com/invite?rc=GROO…

#saving

4 - Paytm

Used Paytm for 80% of my UPI transactions and bill payments

Although not great, it has been decent till date

Used Paytm for 80% of my UPI transactions and bill payments

Although not great, it has been decent till date

5 - Key credit cards without annual fee

American Express Gold Charge & Credit Card - Basic cards with high rewarding value (Amex stopped issuing new cards in India now)

Citi Indian Oil card - Best for fuel spends in Tier 1 cities

#creditcard

American Express Gold Charge & Credit Card - Basic cards with high rewarding value (Amex stopped issuing new cards in India now)

Citi Indian Oil card - Best for fuel spends in Tier 1 cities

#creditcard

6 - TimesPrime for Subscriptions (OTT and more)

One stop solution for most of my subscription needs

Zee5, SonyLiv, Pharmeasy, ETPrime, Audible, Mubi, Discovery+ etc.

Get 300 off using below link-

timesprime.onelink.me/6hfI/ebab9c1a?…

One stop solution for most of my subscription needs

Zee5, SonyLiv, Pharmeasy, ETPrime, Audible, Mubi, Discovery+ etc.

Get 300 off using below link-

timesprime.onelink.me/6hfI/ebab9c1a?…

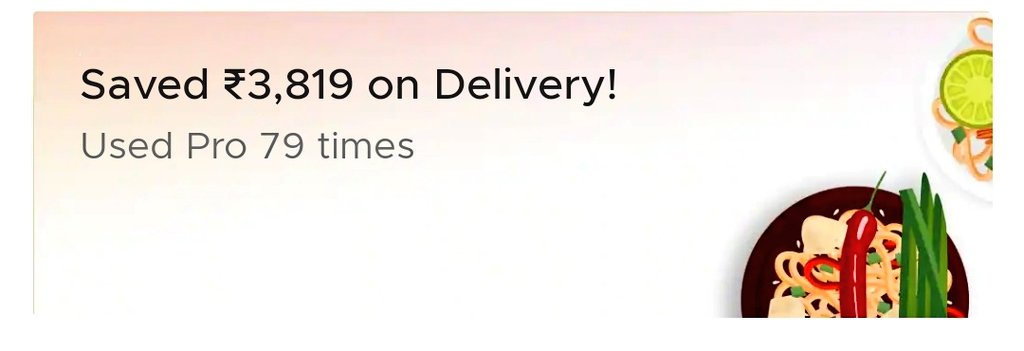

7 - Zomato Pro Plus

Zomato Pro Plus and Slice Card mentioned above is a very powerful combination for savings 🔊🔊

Pro Plus saves on special discounts + Free delivery

30-60% off with slice card is super helpful

Slice link - links.sliceit.com/invite?rc=GROO…

Swiggy one is okay okay.

Zomato Pro Plus and Slice Card mentioned above is a very powerful combination for savings 🔊🔊

Pro Plus saves on special discounts + Free delivery

30-60% off with slice card is super helpful

Slice link - links.sliceit.com/invite?rc=GROO…

Swiggy one is okay okay.

Finally, last 2 things

I don't spend just because there is an offer. When I spend, I find the best possible offer

I don't sign up for all cards; I do my research and get the cards/subscriptions of my use only

Spending extra for cashback doesn't make sense to me.

I don't spend just because there is an offer. When I spend, I find the best possible offer

I don't sign up for all cards; I do my research and get the cards/subscriptions of my use only

Spending extra for cashback doesn't make sense to me.

8. PharmEasy plus for medicines

I got this subscription from Timesprime mentioned above, 18% flat discount + 5% cashback on all medicine orders

New users-

Use code- 1xkib, and get EXTRA 5% OFF on your first order peasy.in/SmpsuT

I got this subscription from Timesprime mentioned above, 18% flat discount + 5% cashback on all medicine orders

New users-

Use code- 1xkib, and get EXTRA 5% OFF on your first order peasy.in/SmpsuT

• • •

Missing some Tweet in this thread? You can try to

force a refresh