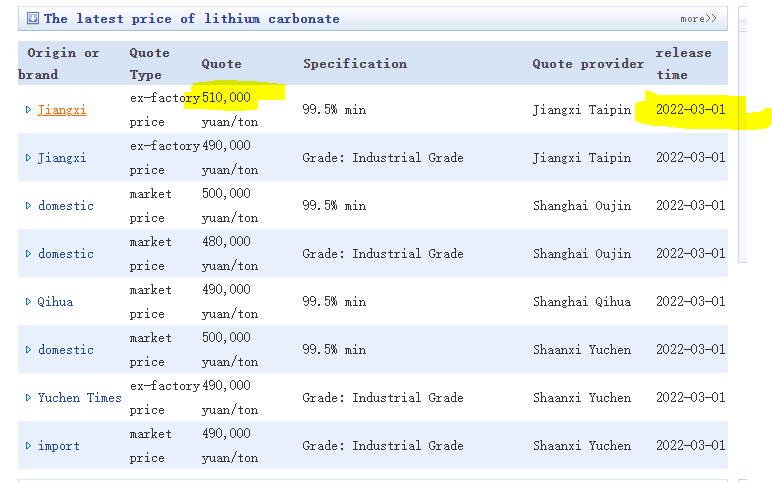

#lithium carbonate breaks $510k yuan/ton which is $80k USD - almost a $10k increase in the last fortnight. A small thread on why this matters below for #electricvehicles and #lithium #mining stocks. Happy punting all.

#Spot #lithium traded as above is usually representative of tiny volumes at different districts in China. Could probably spend a whole thread describing lithium prices in different areas but that'd be a waste of time. Take away point is the volume is tiny but it's a trend.

The head price you see here is representative of what traders/chemical producers are getting for product sold typically to #cathode #producers who use the chemicals to create lithium batteries.

In regards to battery price and #EV #electric #vehicle demand, this is not a good thing. Price rises like this, that are so rapid quickly deteriorate the margin that economies of scale benefit well developed #EV manafacturers, for which there is few, given its a new industry.

This means that #EV #electricvehicle #prices will remain stable or increase, hindering demand to some degree. I say "some degree" as car price is not always the main factor in a #EV buyer purchase decision - often it's charging station availability etc.

None the less it has an effect on the industry. #lithium #miners however, reap the benefits of this two ways. Miners have contracts with offtake partners who convert raw materials and sell them for a price. The higher the head price (as trending by the initial pic) the greater...

The margin for #raw #materials producers. Spodumene (Raw material) produced by pure-play $PLS.ax gets converted into #lithium chemicals. The higher the chem price the higher the margin #spodumene miners can gather as there is room for miners to negotiate pricing $PLS.ax

Other companies such as $AKE.ax directly benefit from the head grade prices as they aim to produce #lithium #chemicals such as #carbonate itself - the specification and quality is what matters in this example which determines success.

Other companies are trying to go the other route $PLS.ax $MIN.ax $IGO.ax and develop JV's to create #lithium hydroxide from their spodumene feedstock on-shore or overseas to capture the upside to chemical pricing.

The general #lithium price trend follows the head grade as I have posted and prices will continue to rise both for chemicals #carbonate and #hydroxide and #spodumene itself, creating some really profitable companies.

But as always, these sharp increases lead to whipsaw, volatile markets as what goes up must come down, and quality stocks will survive. I have said it before and I will again, I think there will be early M&A in the cycle as cashed up producers will take out struggling projects

Who underestimate the difficulty in building a lithium chemical plant. Inflation, labor costs, and skilled shortages worldwide is NOT bringing on the supply that people think was going to come.

To end my ramblings I think #graphite is going to mimmick exactly the run #lithium has had for price transperency (rather, lack of) reasons. $BKT.ax is my pick.

• • •

Missing some Tweet in this thread? You can try to

force a refresh